Despite the loosening of cryptocurrency regulations in the US over the past year, most cryptocurrencies experienced a sharp decline in value during President Donald Trump's first year back in office.

Initially, many expected a positive shift in the crypto market, but ultimately it resulted in more investors losing money than making big gains. The biggest beneficiary of the increased attention on cryptocurrencies in traditional finance was none other than President Trump.

Optimism about crypto in Washington

The crypto community entered January 2025 with high expectations as Trump prepared to return to the White House.

During his campaign, he called himself the "Bitcoin president" and pledged to make America the world's crypto hub. These statements made the crypto community very optimistic, especially after Trump unveiled his own meme coin just two days before his inauguration.

To some extent, Mr. Trump has also kept this promise.

Donald Trump speaks at the Bitcoin Conference 2024, just before his re-election. Source: NY Times

Donald Trump speaks at the Bitcoin Conference 2024, just before his re-election. Source: NY TimesAlmost immediately afterward, Trump appointed a “crypto chief” and designated a crypto-friendly SEC chairman . At the same time, he signed into law the Genius Act , the first federal law to partially regulate the crypto industry.

To some extent, expectations were quite modest right from the start.

After years of criticizing the SEC under Gensler's leadership for its "regulation through punishment" approach, many in the industry were hoping for some change, however small.

Mr. Trump has consistently shown strong support for the crypto sector. Speaking at the World Economic Forum in Davos this week, he reiterated his support and mentioned his expectation of the possibility of passing the Clarity Act in the near future.

However, even as Trump highlighted his achievements, the crypto market continued its downward trend, with coin prices plummeting.

Crypto prices fall despite progress on regulation.

When XEM the price performance of major cryptocurrencies, BeInCrypto found that all major assets have recorded losses over the past year. At the time of writing, Bitcoin's price has fallen 13.4% since January, while Ethereum has also dropped nearly 9%.

Bitcoin price performance since January 2025. Source: CoinGecko .

Bitcoin price performance since January 2025. Source: CoinGecko .Other altcoins fell even more sharply.

Ripple's XRP dropped by as much as 39%, Solana 's SOL lost around 50%, and Cardano 's ADA evaporated by 63%.

These figures suggest that, despite positive policy changes in the crypto industry in 2025, larger macroeconomic factors will continue to hold back market performance.

Similar to the stock market, Trump's tariff policies have significantly impacted expectations for stable market growth. Despite several important reforms, crypto is still primarily XEM as a speculative product. When the market experiences significant volatility, crypto is often the first sector to be affected.

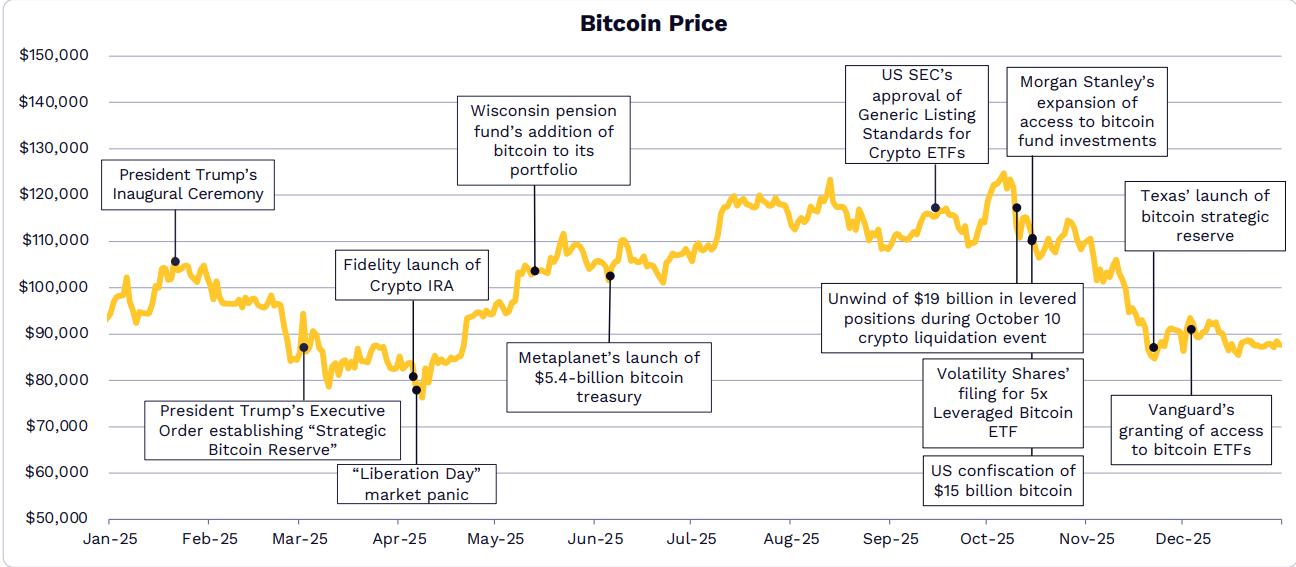

After President Trump announced tariffs on Liberation Day last April, the price of Bitcoin plummeted to $76,300 – its lowest level since November 2024. Then, on October 10th, the US government announced retaliatory tariffs of 100% on Chinese goods, causing Bitcoin's price to drop by 8%–10% in a single trading session . Billions of dollars were liquidated from the crypto market.

The Bitcoin chart shows significant volatility around the time Mr. Trump announced his tax policy. Source: ARK Invest

The Bitcoin chart shows significant volatility around the time Mr. Trump announced his tax policy. Source: ARK InvestHowever, tariffs are not the only factor causing this volatility.

Other pressures, such as concerns about the Fed's independence and escalating geopolitical tensions, are also adding to market instability .

Many people remain unsure whether the Trump administration will continue to maintain its current "course of action." If it does, some small investors may have to reconsider the balance between policy support and the greater macroeconomic risks.

However, not everyone suffered losses.

The Trump family, particularly Mr. Trump and his family members, have become major beneficiaries of the booming growth of this sector.

President's profits amid a sharp market downturn.

Trump's investment portfolio has diversified considerably over the past year, with a significant portion shifting to cryptocurrency-related activities.

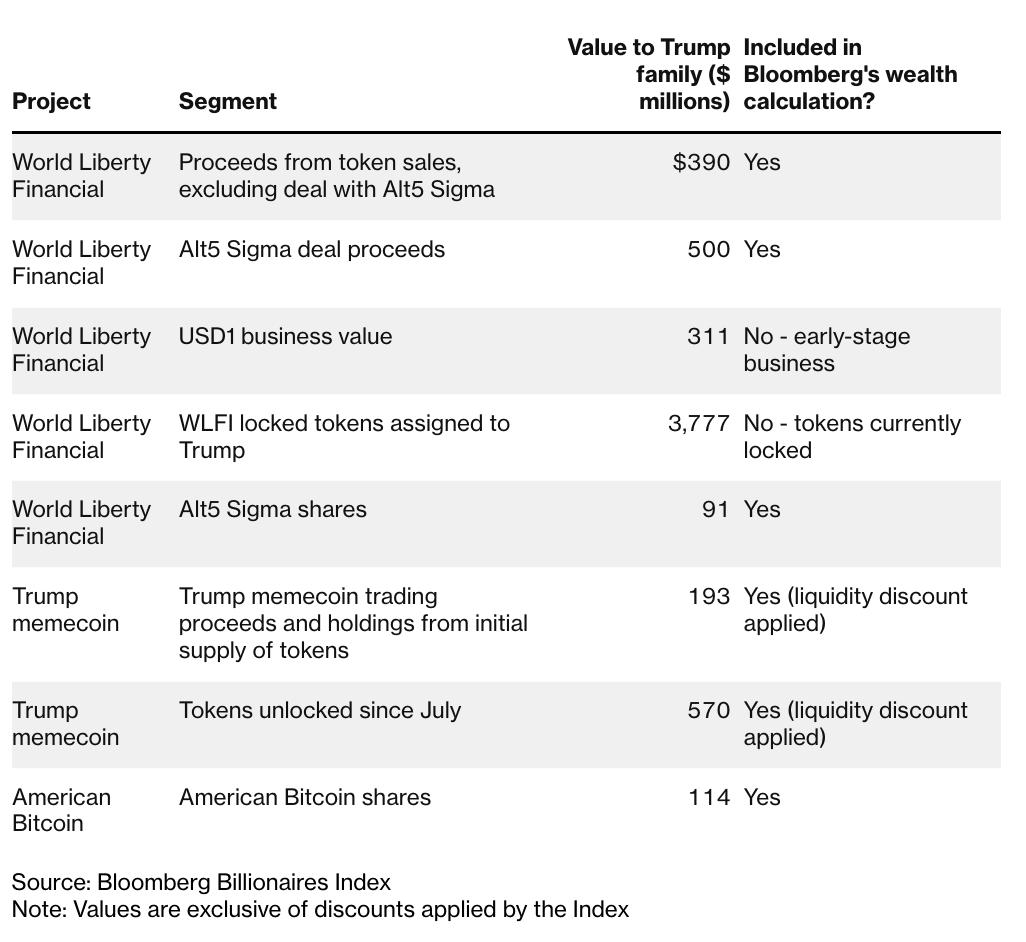

These activities range from a memecoin named after Trump to the decentralized finance platform World Liberty Financial . Many members of his family are also involved, either individually or in collaboration with each other, in cryptocurrency projects.

While the value of cryptocurrencies decreased, Trump's personal wealth grew in the opposite direction .

According to the latest analysis from Bloomberg, the Trump family has earned approximately $1.4 billion from cryptocurrency-related activities. Currently, digital assets account for more than 20% of the family's total assets.

The Trump family's cryptocurrency assets. Source: Bloomberg .

The Trump family's cryptocurrency assets. Source: Bloomberg .These activities have attracted a lot of attention.

The Trump administration frequently faced questions about potential conflicts of interest , even as he continued to pursue these projects.

As interest grows and retail investors suffer losses, the size of Trump's cryptocurrency portfolio now stands out compared to many other traders who have seen their portfolios plummet over the past year.