This article is machine translated

Show original

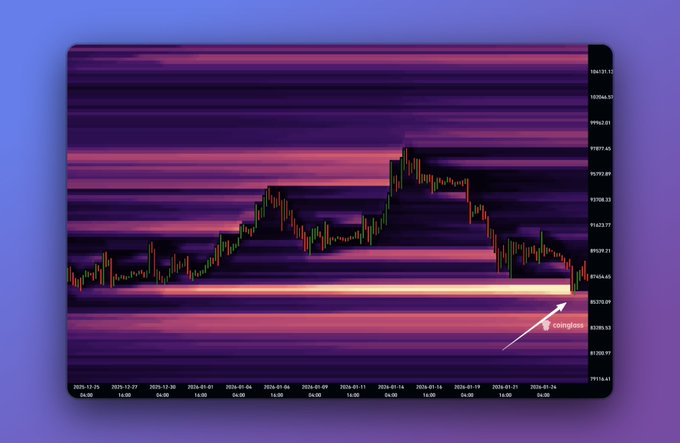

Yesterday's sharp drop was quite coincidental; it precisely cleared out the concentrated bullish liquidity accumulated over the past two months, without any miscalculation, before the subsequent rebound...

This really feels deliberate... Currently, bullish liquidity is still relatively concentrated around the price, but considering the largest liquidity area has already been cleared, I expect the price to rebound back to the previous trading range in the short term, above 88k...

Then we'll see which side's liquidity increases disproportionately. At present, the futures market can at best be considered to have bottomed out, since the short-selling liquidity above is somewhat reduced.

The ideal scenario is that the price maintains a period of consolidation, short-selling liquidity begins to accumulate above, then the price breaks through the descending wedge, quickly rebounding to 91.8k to capture short-selling liquidity...

If short sellers start adding to their positions, there's hope for a further rebound; otherwise, it will likely continue to oscillate at the lower end of the range until the weekend...

Crypto_Painter

@CryptoPainter

01-26

昨天看到这个小型震荡结构被破坏之后,就不敢再看反弹了,毕竟但是现货溢价掉的厉害,结构还破位了...

不过今天一看貌似有点转机,首先是现货溢价开始回升,同时价格行为并没有延续带量下跌的节奏,反倒是后续反弹带量,虽然目前延续空头结构,但我总觉得这里无法创造“大跌”的行情。

后续的思路: x.com/CryptoPainter/…

Short sellers did not increase their positions, and OI did not grow.

That probably won't go up.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content