Over the past eight years, Bitcoin has underperformed silver. When this statement began circulating among traders, a revaluation of silver's worth had already begun.

On January 27, silver prices surged by as much as 16% during trading, hitting a record high of $117.73 per ounce. Its market capitalization increase over the past 12 months is already twice that of Bitcoin's total market capitalization.

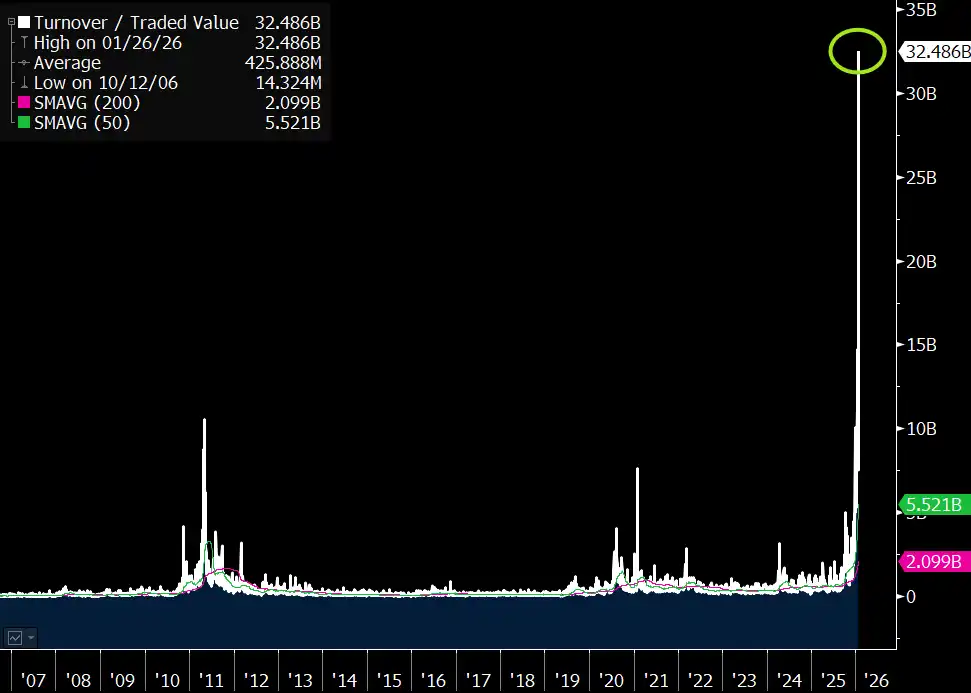

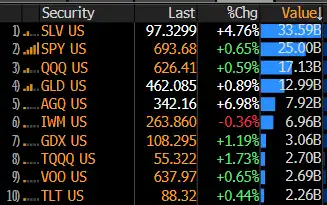

On that day, the world's largest silver ETF, iShares Silver Trust (SLV), saw a trading volume of $32 billion, 15 times its daily average, and even exceeding the combined trading volume of the S&P 500 ETF (SPY), NVDA, and Tesla (TSLA), making it the world's most traded security.

The trading volume of the Silver ETF (2024111120230) reached 32B yesterday.

Silver, an ancient precious metal, has been dormant at the bottom for nearly a decade. Why has it suddenly become a market favorite? The sentiment-driven speculation in the precious metals sector alone seems rather weak.

In fact, silver's narrative is shifting from "the poor man's gold" to "a necessity for industrial growth," and its fundamentals are undergoing a profound structural reshaping. Whether from the perspective of industrial demand, monetary attributes, institutional trends, or ETF inflows, silver seems to be ushering in its "Bitcoin moment."

Explosion of industrial demand

One of the key reasons for the rise in silver prices is an ongoing and irreversible industrial revolution.

The development of emerging industries such as photovoltaics, new energy vehicles, and AI has led to an unprecedentedly steep demand curve for silver due to technological iteration and market expansion.

Photovoltaics

The photovoltaic industry's demand for silver exploded in 2022. Prior to that, the photovoltaic industry widely used PERC cell technology, and silver consumption was relatively stable. However, as the industry transitioned to higher-efficiency cell technologies, the demand for silver paste surged.

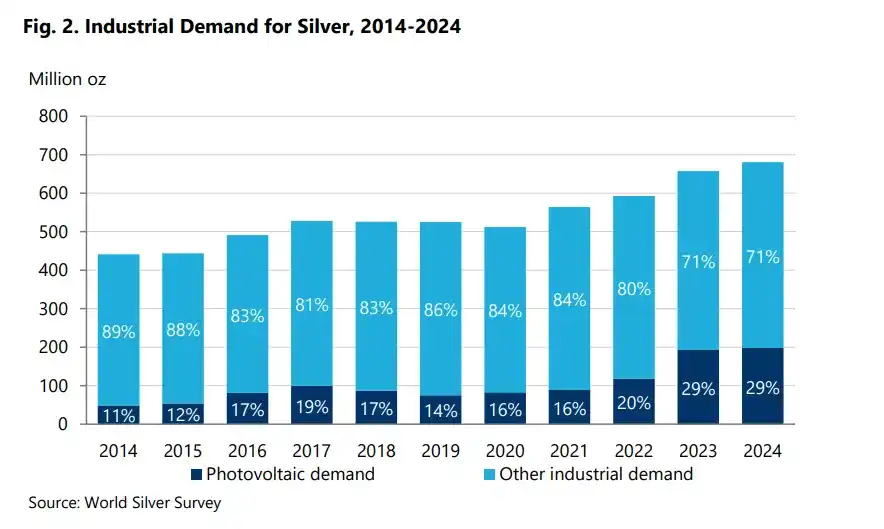

Furthermore, conductive silver paste is a core material for photovoltaic cells, and there is currently no alternative. In 2024, global silver consumption for photovoltaics reached 6,147 tons, accounting for nearly 30% of the total global silver demand, a scale comparable to the total global demand for silver jewelry.

Industrial demand for silver (dark blue represents photovoltaic demand, light blue represents other industrial demand) | Source: World Silver Institute survey

According to data from the China Photovoltaic Industry Association (CPIA), silver paste now accounts for 53% of the non-silicon cost of photovoltaic cells, transforming from an "auxiliary material" into a "main material" as important as silicon.

Solar cell companies are not indifferent to the surge in silver prices, which has jumped from $25 to $115. Leading companies like LONGi Green Energy have explicitly stated in their financial reports that the increase in silver paste costs has severely squeezed profits. However, the reality is that until a mature alternative (such as electroplated copper) is commercialized on a large scale, they can only passively accept the situation.

New energy vehicles

Electric vehicles are another major consumer of batteries. After 2020, the global penetration rate of new energy vehicles also crossed the critical point, jumping from 3% in 2019 to 21% in 2024.

The amount of silver used in each pure electric vehicle is two to three times that of a traditional gasoline vehicle. Taking BYD as an example, according to analysis, a typical EV battery pack (100 kWh capacity, about 200 cells) requires about 1 kilogram of silver per vehicle.

Based on BYD's projected sales of 4.3 million vehicles by 2025, this single company's silver demand could reach 4,300 tons. Furthermore, BYD's ongoing development of silver-based solid-state battery technology may further increase its silver usage in the future.

AI Data Center

The explosive growth of AI data centers has also added new possibilities to the demand for silver. According to data from the World Silver Institute, AI-related silver demand is expected to surge by 30% in 2025, with annual usage exceeding 1,000 tons.

Although accounting for only 3%-6% of global silver demand, AI servers have become the fastest-growing segment in silver demand, with an annual growth rate of over 50%. A single NVIDIA H100 server contains 1.2 kg of silver, far exceeding the approximately 0.5 kg used in traditional servers.

Supply rigidity

Furthermore, the current supply of silver is struggling to keep pace with demand. Globally, approximately 70% of silver is a byproduct of mining metals such as copper, lead, and zinc, meaning that silver supply is "rigid" and cannot be increased rapidly in response to price fluctuations.

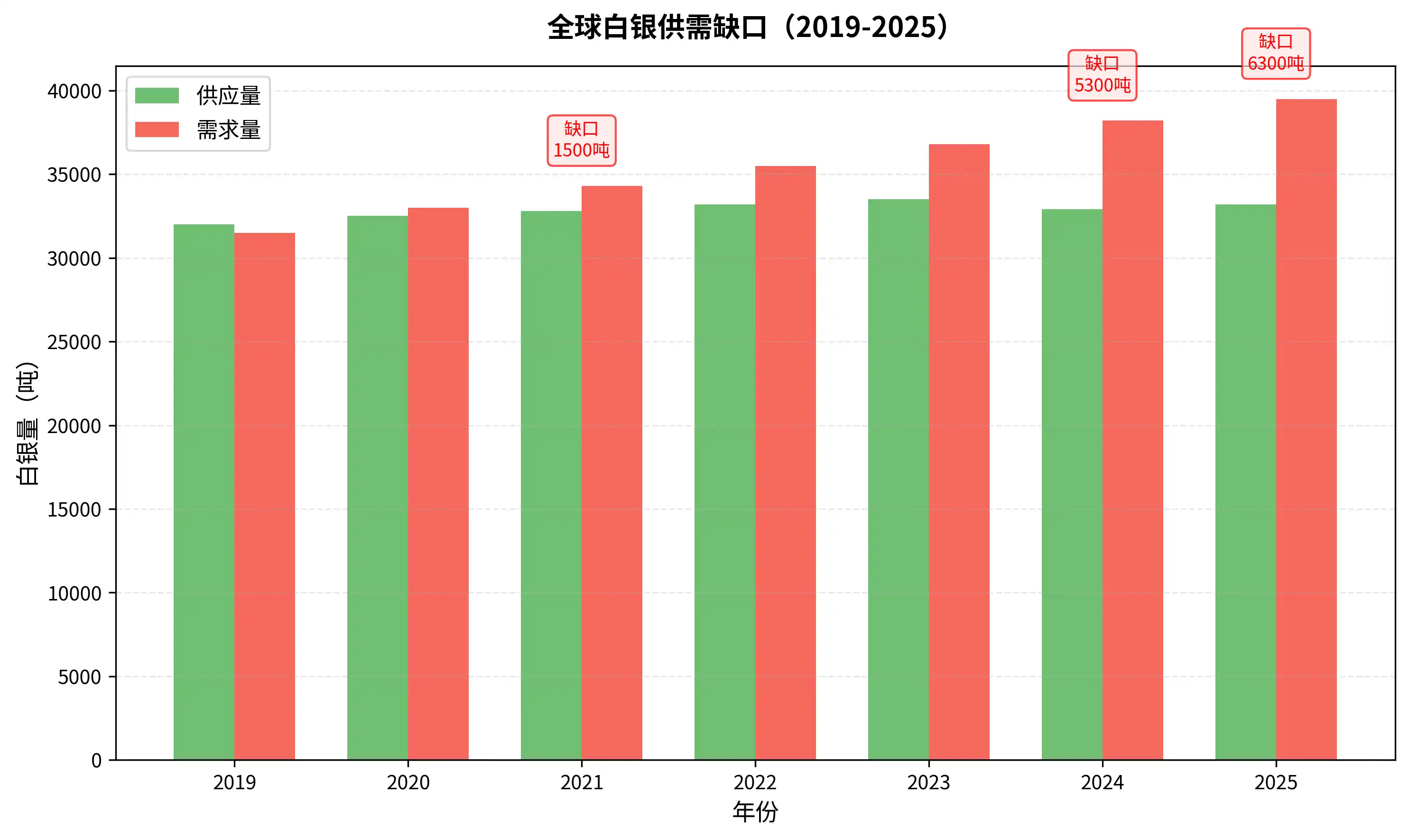

Data shows that the global silver market has experienced a structural shortage for five consecutive years since 2021, and the gap is still widening. When uncontrollable demand meets inelastic supply, a sharp price increase is only a matter of time.

The awakening of monetary attributes

Gold-silver ratio

Beyond industrial demand, silver's long-suppressed monetary attributes are being reawakened by the market. To understand this, the key lies in the gold-silver ratio, which is how many ounces of silver are needed to buy one ounce of gold.

Gold's value is almost entirely supported by its monetary attributes, while silver possesses both industrial and monetary attributes. In traditional economic cycles, during economic recessions, shrinking industrial demand drags down silver prices, while safe-haven demand pushes up gold prices, leading to a higher gold-silver ratio.

For example, after the 2008 financial crisis, global industrial production stagnated, and demand for silver from industries such as automobiles and electronics plummeted. Meanwhile, investors flocked to gold as a safe haven, causing the gold-silver ratio to exceed 80 at one point. Conversely, during economic recovery, a rebound in industrial demand drives up silver prices, causing the gold-silver ratio to fall. Following the 2020 pandemic, global manufacturing recovered, and the gold-silver ratio fell from its historical high of 123 to 65.

However, this pricing logic is undergoing a profound transformation. Against the backdrop of a weakening global fiat currency system dominated by the US dollar, the "currency" attribute of precious metals has been reactivated.

Gold-silver ratio trend

The gold-silver ratio has now fallen below 50, more than halved from 103 at the beginning of last year, hitting a new low in nearly 14 years. Historically, the long-term average of the gold-silver ratio has been between 60 and 70; falling below 50 is a clear signal of a revaluation of silver.

Investors are buying gold and silver not merely for traditional safe-haven or industrial applications, but also to hedge against the risk of fiat currency devaluation. Silver's monetary and industrial attributes are being activated in tandem, making it, along with gold, a medium for storing value.

The "Dragon Two" of precious metals

The sharp decline in the gold-silver ratio is driven not only by the fundamental demand for silver itself, but also by the rotation effect of funds.

In the precious metals sector, gold is undoubtedly the "leader," while silver is the more volatile "second-in-command." When monetary attributes become the main factor in market pricing, silver, with its lower price and historically greater volatility, naturally attracts funds seeking higher returns.

According to nearly 50 years of data from the Chicago Mercantile Exchange (CME Group), five of the six major corrections in the gold-silver ratio occurred during major bull markets for gold.

Once a bull market in gold is established, funds tend to rotate to silver, which has greater volatility, in pursuit of excess returns. The performance throughout 2025 perfectly illustrates this point: gold rose by 67.5%, while silver's increase reached a staggering 175%, 2.6 times that of the former.

The sharp decline in the gold-silver ratio reflects a shift in market funds from gold to silver. Investors are not only buying precious metals to hedge risks, but also pursuing the higher potential returns of silver relative to gold.

The biggest bull: JPMorgan Chase

The most intriguing signal in the market comes from JPMorgan Chase. In 2020, it was fined a staggering $920 million by the U.S. Department of Justice and the Commodity Futures Trading Commission (CFTC) for its long-term manipulation and suppression of silver prices.

Their main manipulation tactic is to create a false impression of demand or supply in the market by placing a large number of fake buy and sell orders, thereby affecting prices, and then quickly cancel the orders and make profits by trading in the opposite direction.

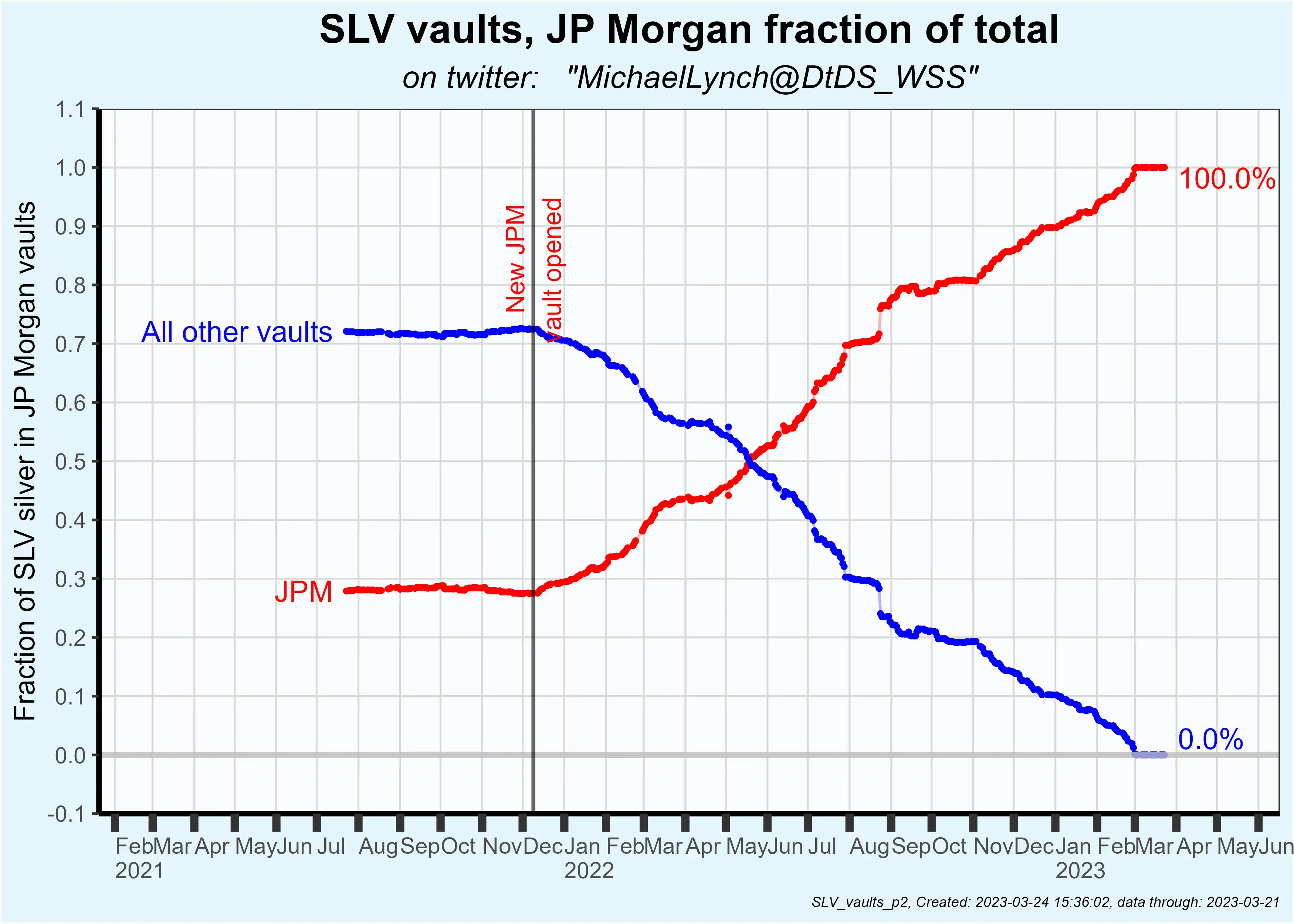

However, immediately after being penalized, JPMorgan Chase shifted from a long-term paper short position to a frenzied accumulation of physical silver. According to multiple sources, JPMorgan Chase currently holds more than 750 million ounces of physical silver, ranking first in the world and even exceeding the holdings of the world's largest silver ETF (SLV).

JPMorgan closed approximately 200 million ounces of paper short positions between June and October 2025, and subsequently increased its holdings of physical silver by 21 million ounces in just six weeks between November and December 2025.

After opening a new warehouse in November 2021, JPMorgan Chase gradually took over all of SLV's silver inventory.

CFTC data also confirms this shift. In January 2026, non-commercial net long positions in silver reached a new high, with JPMorgan Chase accounting for a significant proportion of net long positions.

Regarding the reasons for JPMorgan Chase's shift, analyses by Bloomberg and Reuters generally believe that part of the reason lies in its prior knowledge of the huge and inelastic demand for silver from Chinese photovoltaic and new energy companies through client transactions.

In late 2025, JPMorgan Chase moved its core precious metals trading team to Singapore and built a large-scale silver vault there.

This series of actions was interpreted by the market as Wall Street's top "smart money" betting on an epic rally in silver. When the manipulators who had previously suppressed prices became the largest holders, silver immediately embarked on a frenzied bull market.

From "digital assets" back to "physical assets"?

While silver's fundamentals are exceptionally strong, Bitcoin, once considered "digital gold," appears to be facing a crisis of confidence. In contrast, a shift is underway, with digital assets returning to physical assets.

The ETF fund flow data for January 2026 most clearly illustrates this rotation. On one hand, Bitcoin spot ETFs saw a net outflow of up to $1.7 billion in 11 trading days; on the other hand, funds are pouring into silver at an unprecedented scale.

On January 27, the world's largest silver ETF, iShares Silver Trust (SLV), saw its daily trading volume surge to $32 billion, topping the list of all ETFs by trading volume that day.

The market frenzy doesn't stop there. ProShares Ultra Silver (AGQ), a leveraged ETF that long in silver, is also among the top ten most actively traded ETFs, ranking fifth.

This indicates that the influx of funds into silver comes not only from those seeking stable asset allocation, but also from a large number of speculative forces seeking high returns.

ETF trading volume rankings on January 27th

Retail investor enthusiasm was already high prior to this. According to VandaTrack, in the 30 days ending January 15, retail traders poured more than $920 million into silver-related ETFs, marking the largest single-month inflow on record.

Funds are flowing out of Bitcoin ETFs and into precious metals ETFs, such as those for gold and silver. This reflects investors' reassessment of the risk-reward ratio of these two assets.

Rumors suggest that this inflow and outflow of funds could be explained by the fact that the US government cracked Bitcoin wallets through a credential stuffing attack, and that Prince Edward Group transferred 127,000 Bitcoins directly into the US government's wallet, worth approximately $15 billion.

Simply put, this group of funds believes that Bitcoin is insecure. Coupled with news such as the claim that quantum computing can crack Bitcoin's algorithm, this has driven funds to accelerate their shift towards gold and silver.

In terms of price, the marginal effect of Bitcoin's price increase diminishes every four years, while silver has just emerged from a decade-long period of bottoming out. In 2025, while silver prices rose by 175%, Bitcoin prices fell by more than 30% from their highs. Entering 2026, the divergence between the two became increasingly apparent.

As Bitcoin's narrative begins to falter and funds seek new avenues, silver, driven by fundamental changes, is becoming the darling of the era.