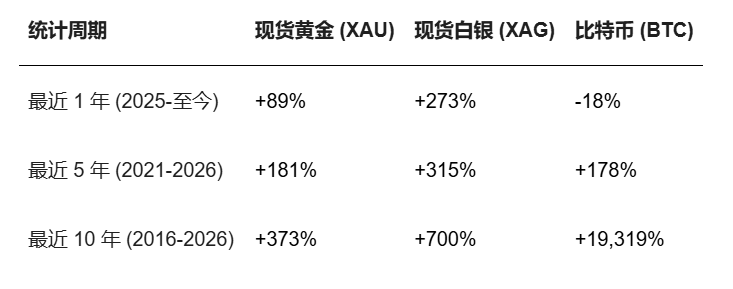

[2/3] (PANews | BlockBeats | Kobeissi Letter) Market Analysis 1. CoinDesk: BTC breaks below 85,000 after breaching "two-month support level," next technical level to watch may be around 75,000. The report points out that while gold and stocks have rebounded from their worst levels in the day, crypto assets remain relatively weak, and the market is focused on the risk of further testing of key support. (CoinDesk) 2. Increased volatility in precious metals: Gold experienced a "V-shaped reversal" with a single-day range exceeding $500; UBS raised its 2026 gold price target to $6,200. Spot gold fell rapidly from approximately $5,550/ounce to $5,155 before rebounding to around $5,450; silver also saw significant volatility before recovering. UBS raised its 2026 price target to $6,200 (upside scenario $7,200, downside scenario $4,600). (BlockBeats) ━━ Project Updates ━━ 1. Ethereum plans to use the "unclaimed ETH" from The DAO hack to establish a security fund of approximately $220-250 million for auditing, tools, and incident response. Ethereum developer Griff Green and others disclosed that the funds will be used to fund security audits, infrastructure, and incident response, and some security grants will be distributed through the DAO mechanism. (CoinDesk | The Block | Decrypt | Foresight News) 2. Bitmine has pledged another 314,496 ETH (approximately $887 million), bringing its total pledged ETH to approximately 2,831,392 ETH (approximately $7.98 billion). The continued increase in large-scale institutional pledging indicates that some funds are still choosing to obtain returns through pledging even in a declining market environment. (PANews) 3. Securitize reports 841% revenue growth and prepares for an IPO; its partner SPAC (Cantor Equity Partners II) rises 4.4%. The strong performance growth of tokenization and compliant issuance infrastructure has attracted market attention, and the listing process continues to move forward. (CoinDesk) 4. Crypto custody company Copper is in early talks about an IPO. Reports indicate that Copper is evaluating a potential listing, with Goldman Sachs, Citigroup, and Deutsche Bank reportedly involved, depending on recent revenue performance; the report also mentions that its peer BitGo is already listed on the NYSE. (CoinDesk | Foresight News | PANews | TechFlow) 5. On-chain monitoring: The "1011 / BTC OG Insider Whale" long position retraced by about $53 million in two hours, with an overall floating loss of about $84 million. Monitoring shows that it holds about $704 million of BTC long positions, which have experienced a significant retracement and floating loss as the market declines. (BlockBeats | Odaily) ━━ Other ━━ 1. The Central Bank of El Salvador purchases $50 million in gold: Gold holdings exceed $360 million; the government continues to increase its BTC holdings, with a total value of approximately $635 million. While continuing to increase its Bitcoin holdings, the country is further increasing the proportion of its gold reserves. (CoinDesk) 2. SpaceX is reportedly evaluating integration options: a merger with Tesla or a merger with xAI before its IPO, with a combined valuation potentially exceeding $1.5 trillion. Sources say the deal could attract the attention of infrastructure funds and Middle Eastern sovereign wealth funds and may require substantial financing, but no final decision has been made yet, and it may also remain an independent entity. (PANews | Watcher.Guru | Kobeissi Letter) 3. OpenAI reportedly plans to IPO in the fourth quarter of 2026 and is "accelerating" its progress to become the first major generative AI startup to go public. Reports indicate that it hopes to be the first to complete its IPO, competing with companies like Anthropic. (AGGR Newswire | Kobeissi Letter) 4. The CFTC will withdraw its 2024 "Political and Sports Events Contract" proposal and begin drafting new rules for prediction markets. The CFTC chairman has stated publicly that the focus will shift to advancing the development of a new regulatory framework for prediction markets. (BWEtradfi)

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content