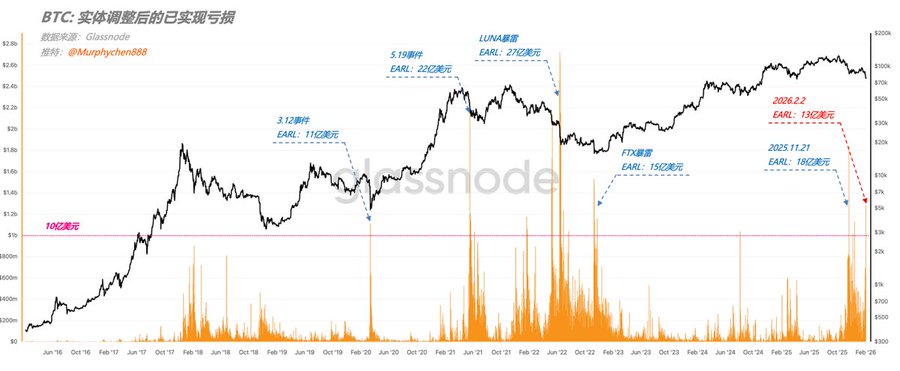

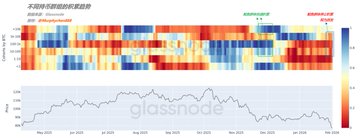

Panic selling in full swing! Yesterday, BTC’s on-chain “Entity-Adjusted Realized Loss (EARL)”—which excludes internal transfers within the same entity—spiked to a whopping $1.3 billion. Even though that’s still much lower than the $1.8 billion EARL we saw during the sharp BTC dump to $85,000 on Nov 21, 2025, it’s still a massive number by any standard. In fact, there have only been a handful of days in the past decade where BTC’s daily EARL topped $1 billion. (Chart 1) Let’s be real, only a bear market can shake out this much weak-handed supply. But the good news is, panic flushes like this often give BTC some much-needed breathing room during downtrends. With less sell pressure, it’s easier for price to stabilize in the short term, setting the stage for a potential bounce. What’s more, BTC’s supply concentration has dropped from a high of 16% on Jan 28 to just 8.7% yesterday. That means the risk of massive price swings caused by clustered supply pockets is decreasing. (Chart 2) Of course, there are plenty of factors that can amplify volatility—liquidations from leveraged positions, short gamma in options, thin liquidity, you name it. Supply concentration is just one piece of the puzzle (just highlighting this factor here, not saying it’s the only one). Bottom line: Lower volatility and panic flushes both help set up a more stable price and increase the odds for a short-term bounce. But whether that bounce is strong or weak depends on demand and market momentum. ----------------------------------------------- For educational purposes only. Not financial advice!

This article is machine translated

Show original

Murphy

@Murphychen888

02-02

鲸鱼群体的行为趋势从前期的积累,犹豫,到现在停止,甚至转为派发,意味着市场主要的需求端正在正在以肉眼可见的速度退出(图1)。

当鲸鱼们开始积累筹码时,可能不会立刻反映到价格上,但却真实承接了超额供应,也可以稳定和提振市场情绪。然而现在他们的转变,对市场的影响可能是更加深远的。 x.com/Murphychen888/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content