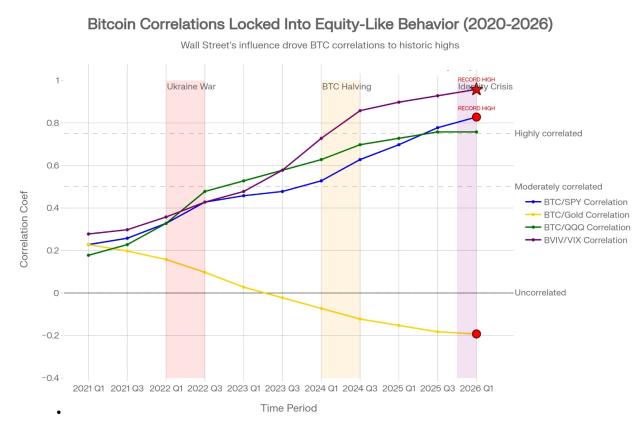

After a 40% plunge, what cards does the crypto market still hold? [Plain Language Summary] The first storm of 2026 hit the crypto market, with Bitcoin plummeting over 40% from its high of $126,000 to $74,000, Ethereum halving in value, Solana recovering to double digits, and over $2.5 billion in liquidations. The triggers included profit-taking by long-term holders, leverage backlash, and a sudden shift in macroeconomic expectations. However, positive factors are quietly converging: the release of US regulatory dividends, the entry of sovereign nations, Ethereum's technological upgrade, and the dawn of the AI agent era. Institutional consensus: short-term caution, long-term steadfastness; the market is shifting to a new phase driven by regulation and productivity. The current extreme fear may be a structural clearing, foreshadowing the dawn of a new crypto era. For details, please see: hellobtc.com/kp/du/02/6219.htm...…

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content