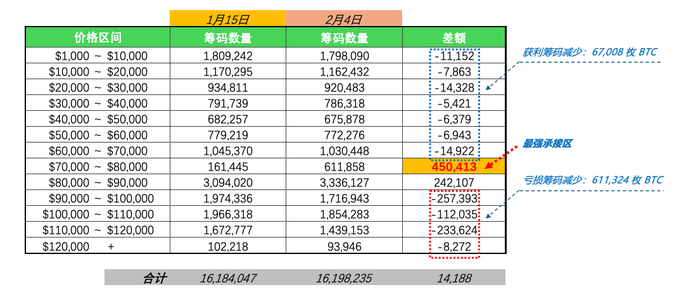

Slow Grind Down, Not a Collapse — URPD Reveals How Panic Is Reshuffling BTC Bags Since Jan 15, BTC has tanked from its $97K high to $73K on Feb 4. The drop was fast and deep, instantly crushing the optimism that expected some resistance around $80K. It’s impossible to say there’s no panic in the air. So let’s break down what’s really happening with BTC’s bag distribution during this period, and what alpha might be hiding underneath. To make things simple, I pulled the full URPD data and broke it down by $10K intervals. This way, we can clearly see how the bags are moving and get a read on the current market sentiment. (See Chart 1) Between Jan 15 and Feb 4, profitable bags below the current price shrank by 67,008 BTC (about 9.7% of total outflow). Meanwhile, loss-making bags above the current price dropped by a massive 611,324 BTC (88% of total outflow). What does this mean? In this overall downtrend, OG holders with bags still in profit are selling less and less. Either they think there’s no point in selling now with most gains already gone, or they’re just long-term diamond hands who DGAF about price swings. Bottom line: the lower it goes, the less they sell. The majority of selling is coming from those trapped at the top. Over 600K BTC dumped in just 20 days shows just how intense the panic-driven capitulation really is. But here’s the twist: we’re seeing massive buy walls step in at $80K–$90K and especially $70K–$80K. The latter zone saw net buys of 450,413 BTC—almost double the previous range. Clearly, there’s big money lurking in the background, flexing hard and putting real skin in the game: “You dump, I buy.” The lower it goes, the harder they ape in. That’s a key difference between this cycle and previous ones. Even if the 4-year cycle theory isn’t dead yet, bulls are fighting back at every level on the way down: $100K, $90K, $80K, $70K… Bag clusters are shifting down gradually, not falling off a cliff. A lot of people are calling for a cycle bottom at $50K or even $30K. Personally, I’m not convinced. But I do believe, once bears squeeze the bulls’ “territory” to the limit, and supply starts running dry, we’ll see an epic bull counterattack. --------------------------------------------- Here’s a question for you guys to chew on: According to the chart, on 2026/1/15 the total BTC bag count was 16,184,047; on Feb 4 it was 16,198,235. So where did the extra 14,188 BTC come from? What does this mean? Drop your thoughts in the comments—let’s discuss! --------------------------------------------- All of the above is for educational purposes only, NOT financial advice!

This article is machine translated

Show original

Murphy

@Murphychen888

02-03

恐慌盘出逃!

昨天,BTC链上“实体调整后的已实现亏损(EARL)”—— 剔除了同一实体间内部互转的行为 —— 其规模高达13亿美元。

虽然比2025年11月21日BTC急速跌至$85,000时产生的18亿美元的EARL要小很多,还算不上是天量级,但即便是放在过去十年历史中,BTC单日EARL能超过10亿美元的次数也屈指可数。 x.com/Murphychen888/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content