This article is machine translated

Show original

ETH broke below $2200 without any resistance. Yesterday, we mentioned that large players were continuously adding to their put positions, even those with very low strike prices.

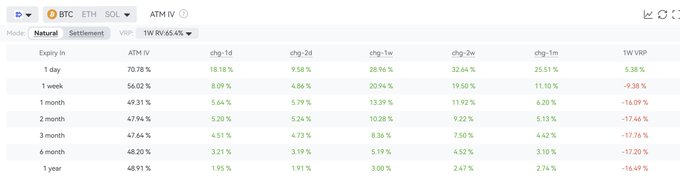

This strategy is still in place today, but trading volume is starting to concentrate on put options expiring in March at $70,000 to $80,000. Implied volatility (IV) is rising rapidly, and skewness is quickly turning negative, indicating that large players are shifting from short-term speculation to expressing medium- to long-term views.

The bearish sentiment is starting to materialize from mere concern. Based on my years of experience, ETH is very likely to test the $2000 psychological level.

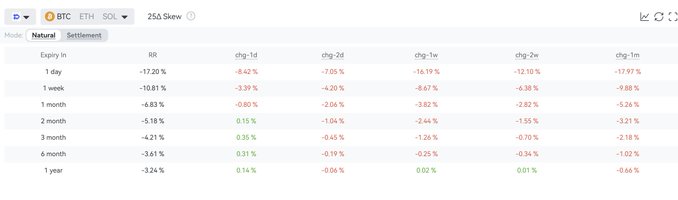

Volatility has increased significantly overall, and the skew has tested new lows again, leading large players in the options market to worry that the downward trend in BTC may not be contained.

Put options also saw consistently high trading volume, with the top five traded options all being puts, primarily with a strike price of $70,000, indicating strong bearish sentiment. Even the fourth-ranked option was a March put option at $55,000!

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share