Bitcoin's drop below the $72,000 mark (BlockBeats: Bitcoin has now fallen below $71,000) has brought the issue of "faith" in the crypto market to the forefront. Against the backdrop of a sharp decline in global risk appetite, investors are reassessing Bitcoin's position in market turmoil, and the safe-haven narrative of crypto assets is being questioned.

According to Bloomberg, Bitcoin fell as low as $71,739 in late New York trading on Wednesday, marking its first drop below $72,000 in about 15 months. Compared to its peak last October, Bitcoin has retreated by more than 42%, with a year-to-date decline of about 17%, reaching its lowest level since November 6, 2024.

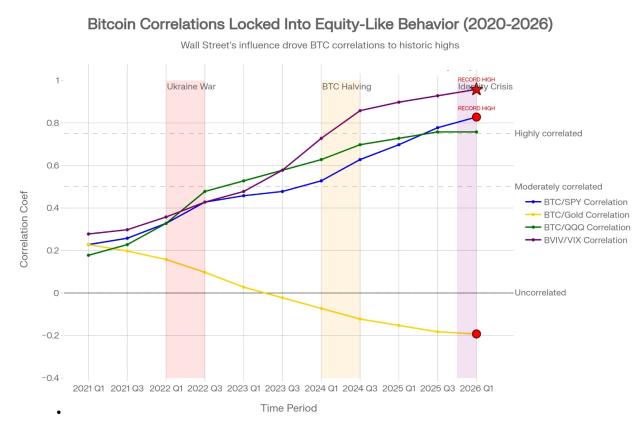

This round of decline is no longer just a continuation of deleveraging within the crypto market, but rather a result of broader cross-asset pressure. A synchronized sell-off occurred in global markets on Wednesday, with the Nasdaq 100 index falling by more than 2%. Sectors more sensitive to interest rates, such as software and chips, generally came under pressure, and Bitcoin weakened accordingly.

On an emotional level, a "crisis of faith" is forming. Shiliang Tang, managing partner of Monarq Asset Management, said the market is experiencing a "crisis of faith".

Andrew Tu, head of business development at Efficient Frontier, said that the crypto market sentiment is in a state of "extreme fear." If $72,000 is breached, Bitcoin could fall to $68,000, or even back to the lows before the initial rebound in 2024.

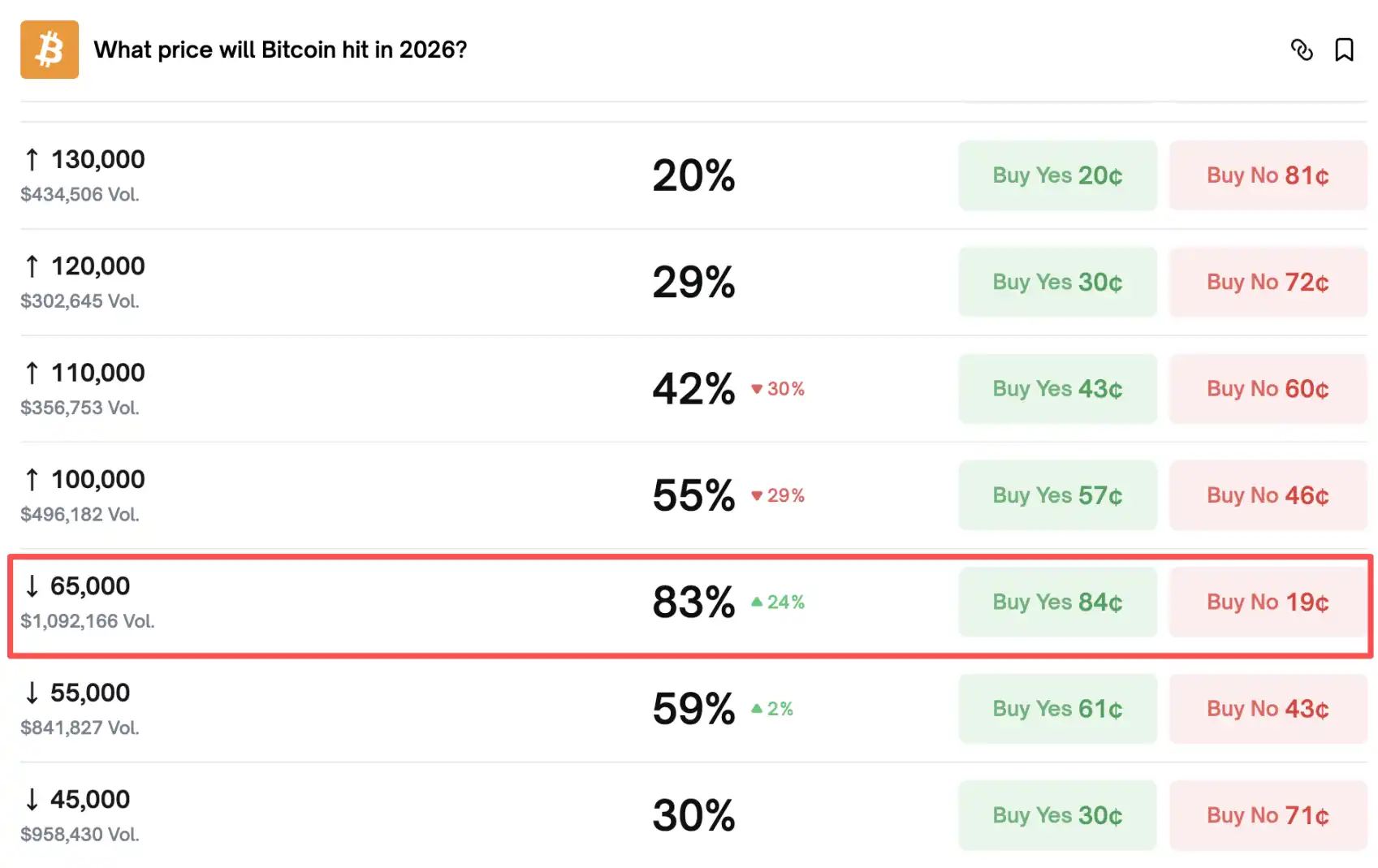

According to Polymarket, there is an 83% probability that Bitcoin will fall to $65,000 this year, while the probability of it falling below $55,000 has climbed to about 59%.

Risk appetite has shifted sharply, and Bitcoin is now being viewed as a "high-volatility, high-risk asset."

According to Bloomberg, Wednesday's sell-off in Bitcoin was related to broader cross-asset tensions, rather than being driven solely by internal liquidations within the crypto asset market. This has clear implications for investors: as the market enters a synchronized selling phase, Bitcoin has not demonstrated resilience independent of risk assets, but rather resembles a highly volatile, long-tail risk asset.

The Nasdaq 100 index fell by more than 2% that day, dragging down sectors such as software and chips. Bitcoin also fell below a key psychological level on the same trading day, reinforcing market perceptions that it resonates with risk appetite.

The crypto market has retreated 42% from its peak, wiping out over $460 billion in a single week.

The price pullback is rapidly transmitting through market capitalization contraction. According to CoinGecko data, the combined market capitalization of crypto assets has shrunk by approximately $1.7 trillion since its peak last October. In the past week alone, the crypto market capitalization has decreased by more than $460 billion.

As the largest cryptocurrency, Bitcoin's decline and speed have an "anchoring effect" on market sentiment. When Bitcoin's year-to-date decline widens to approximately 17%, pressure on risk control, margin management, and fund redemption tends to increase simultaneously, thereby exacerbating overall volatility.

How a "crisis of faith" arises: from the shock of forced demolition to emotional collapse.

Market participants' statements indicate that shifts in sentiment are becoming a key variable. Shiliang Tang's term "crisis of faith" refers to the simultaneous wavering of investors' belief in the long-term narrative and short-term pricing mechanisms of crypto assets.

More importantly, the drivers of the decline have changed. According to Bloomberg, previous declines were driven more by liquidations specific to crypto assets, while Wednesday's pressure came from broader cross-market tensions.

This means that even if the deleveraging process within the crypto market comes to an end, Bitcoin may still lack a catalyst for an independent rebound as long as external risk assets continue to be under pressure.

72,000 has become a short-term watershed, with the market predicting a drop to 65,000 within the year.

Many traders consider $72,000 a key short-term price level. Andrew Tu pointed out that if this level cannot be held, Bitcoin is "very likely" to fall to $68,000 and may return to the low range before the initial rebound in early 2024.

According to Polymarket, there is an 83% probability that Bitcoin will fall to $65,000 this year, while the probability of it falling below $55,000 has climbed to about 59%.

The funding situation also showed signs of instability. According to data compiled by Bloomberg, the U.S.-listed Bitcoin spot ETF recorded a net inflow of approximately $562 million on Monday, but then turned into a net outflow of $272 million on Tuesday, indicating that the incremental funds were not stable.

Amid declining prices and fluctuating capital flows, market skepticism is rising regarding Bitcoin's role as a "safe-haven asset during periods of stress."

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush