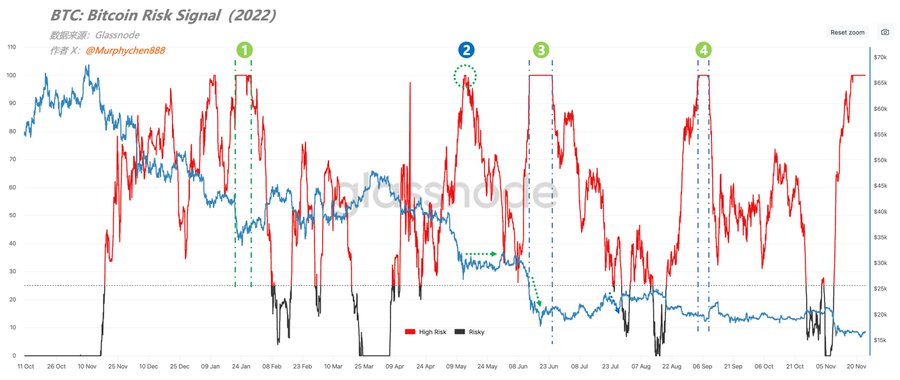

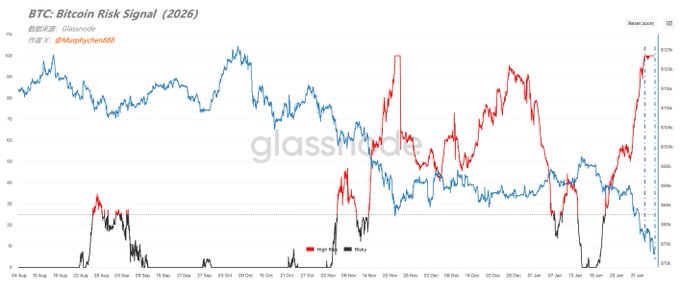

It looks like this round of bottom-fishing for a rebound didn’t pan out as expected, which really shows just how tough it is to trade against the trend in a down market. But after spending enough time in crypto, it’s hard to resist the urge to go long. Theoretically, the play is simple: buy when BRS hits 100, sell when it drops back to 0. That’s a classic swing trade. I’ve backtested the BRS signal with historical data, and during bull-bear transitions, the success rate for catching rebounds is around 70%. Of course, there are uncertainties. For example (see chart 1, where I’ve adjusted BTC price to the blue line for easier viewing): Take point 2 in chart 1: BRS just briefly touches 100 and immediately starts dropping, while BTC is chopping sideways. This usually ends up as a failed trade. Because when BRS climbs back to 100, BTC often dumps. If you bought at the first touch and held until BRS returned to 0, you’d end up in the red. So ideally, you want to see BRS stay at 100 for a while — meaning panic keeps getting flushed out. Then, as BRS moves toward zero, BTC should rebound in sync. But here’s the catch: While BRS is pinned at 100, BTC tends to whipsaw up and down. So the first time BRS hits 100, the price isn’t always the cycle low. Like points 1/3/4 in chart 1, where price retraced to varying degrees. I’ve backtested data from the past 10 years: on average, the drawdown is about -13%, with the worst case at -25% (and that only happened once). (See chart 2) Looking at the current setup, BRS has stayed at 100 for a while now — it’s not a “sharp spike” scenario. So there’s a 70% chance of success here. We logged that when BRS hit 100 this time, BTC was at $75,992. Based on historical backtests, a drawdown of around -13% is normal, so $65,000–$66,000 is within range. Here’s the real question: If you bought at $75,000, and BTC drops below the psychological $70k level, should you keep buying to average down? Or should you cut losses and wait for another setup? Honestly, I can’t give you advice on that. Everyone’s bankroll, risk appetite, time horizon, and position sizing are different. But one thing is key: whatever strategy you choose, it shouldn’t keep you up at night, stressing over every tick. As they say: Survive today, and you’ll live to trade another day.

This article is machine translated

Show original

Murphy

@Murphychen888

02-04

一早醒来看到私信都是问我有没有抄底的,好啦,你们别问了,我摊牌了…… 知行合一,生死有命🤣

这里只是考虑搏一个反弹预期,考虑的因素有3点:

1、BRS维持在100,持续越久反机会越大;

2、URPD双锚结构的缺口已慢慢回补;

3、当前价格和STH-RP严重偏离。 x.com/murphychen888/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content