BTC is very likely to have bottomed out during this deleveraging trend in the US stock market: 1. The decline is accelerating, the slope is becoming steeper, and it's clearly speeding up, with increasing volume. An upward parabolic curve is unsustainable, and similarly, a downward parabolic curve is unsustainable. The slope should gradually slow down. 2. BTC correction is increasingly resembling that of the US stock market | _2024111120230_ | 3. Then there's the time dimension: From my personal perspective, the real bottom of the 2022 BTC bear market was in mid-June, not November (at that time, the FTX collapse led to a downturn, and Ethereum didn't actually reach a new low in November 2022). From the peak in early November 2021 to the bottom in June 2022, it took approximately seven months. This time, from early October last year to now, it's been about five months, and the time frame might be even faster. Therefore, as mentioned at the beginning, BTC is very likely to bottom out during this deleveraging trend in the US stock market. This morning, I bought a few BTC at a price of just over 60,000, with tears in my eyes. I fired the first shot and am now preparing to buy more when the price drops.

This article is machine translated

Show original

qinbafrank

@qinbafrank

02-06

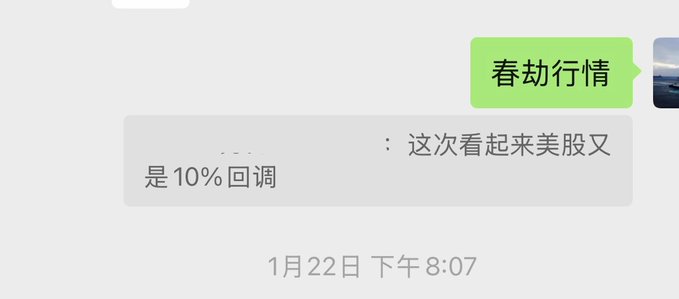

再聊聊这一轮美股的抛售,主因在于产业市场本身而宏观只是次因。周三提出了一个“春劫行情”的说法,其实最早跟朋友在1月下旬就聊到过。很多人都在寻找各种原因,特别是想从宏观上找原因。其实这一次并不是宏观上出了大问题,跟去年一季度关税战带动的大跌逻辑还不一样。更多的还是AI产业内部以及市场自 x.com/qinbafrank/sta…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content