market down.

$800m liquidated.

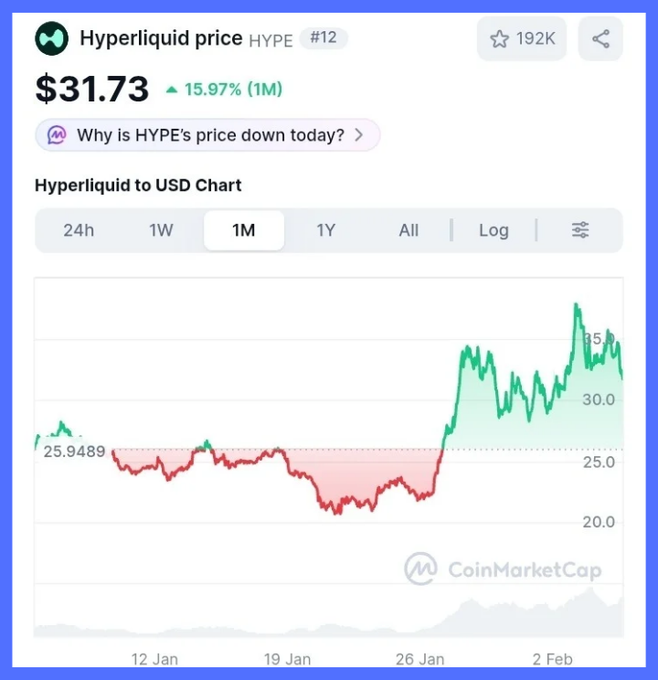

$hype up 15% in last 30d.

that divergence isn’t narrative.

it’s mechanical.

when volatility spikes, activity compresses into a single surface.

➤ volume accelerates

➤ fees expand

➤ revenue is realized instantly

@HyperliquidX isn’t an exchange sitting on top of a chain.

it is the chain.

execution, liquidity, and settlement collapse into one loop.

in stress phases, capital doesn’t want optionality.

it wants immediacy.

general-purpose L1s lose throughput when risk comes off.

chains that are the application absorb it.

price action is secondary.

behavior under load is the signal.

if this holds while $btc retests lows,

market is repricing what “infrastructure” means.

lol that's the only $HYPE atm

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content