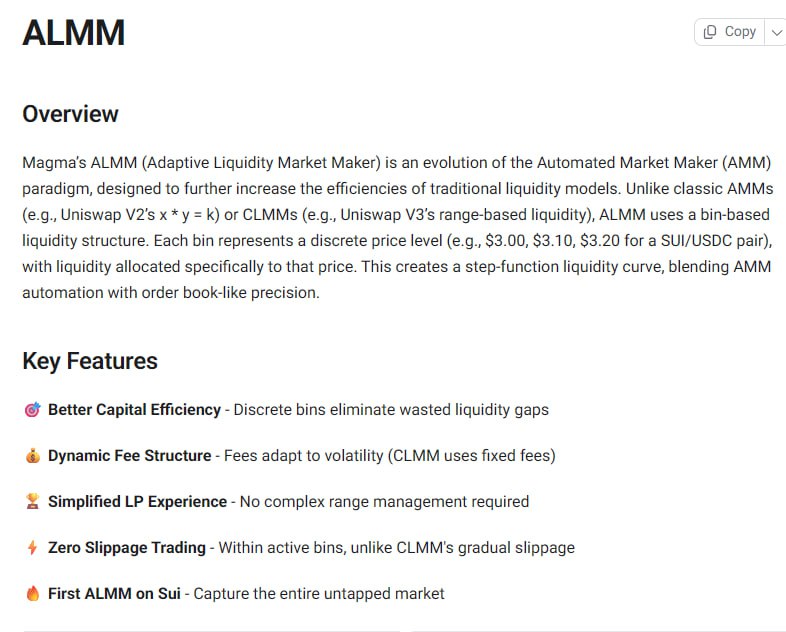

⭐️Is V3 beneficial? Magma Finance's 'ALMM' feature! ❓ ALMM 🟠 An evolution of the adaptive market maker (AMM) paradigm 🟠 A system that maximizes the efficiency of traditional liquidity models using a bin-based liquidity structure. —— 🏆 5 Key Benefits!! 1️⃣ Improved Capital Efficiency - Each bin covers a specific price range (e.g., SUI/USDC $3.00, $3.10, $3.20), eliminating liquidity gaps. 2️⃣ Dynamic Fee Structure - Fees automatically adjust based on market volatility, optimizing LP profits compared to CLMM's fixed fees. 3️⃣ Simple LP Experience - Unlike Uniswap V3, complex price range settings are not required, making liquidity provision easy even for beginners. 4️⃣ Zero-Slippage Trading - No slippage occurs within active bins, making it more advantageous for traders than CLMM's incremental slippage. 5️⃣ Sui's First ALMM - As the first ALMM protocol on the Sui chain, it offers an opportunity to capture an untapped market. —- This is roughly a compilation of the best features. So, does ㅁㅁㅌ use CLMM? If their technology was superior, they might have achieved better results... For now, it seems like ㅁㅁㅌ's virality was a step ahead...

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share