How bad has the US debt crisis become?

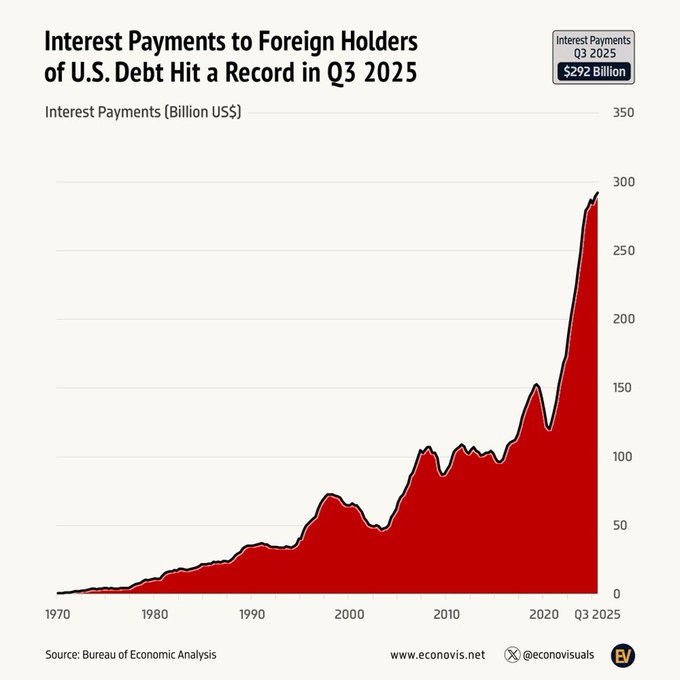

Interest payments on US public debt to overseas holders surged to a record $292 billion in Q3 2025.

This amount has more than DOUBLED since 2020.

The US Treasury now pays 6 TIMES more to international holders of US debt than before the 2008 Financial Crisis.

This comes as foreign investors hold a record $9.1 trillion in US Treasuries, 4 TIMES higher than 2005 levels.

The US government is paying insane amounts of interest.

This surge amplifies US fiscal vulnerabilities.

Interest costs exceed defense spending annually and could pressure future borrowing rates.

$292B going overseas just on interest. And that's only Q3 numbers. The US is basically paying rent to the rest of the world now. Doubled since 2020 means we're on an exponential curve here. Can't cut spending, can't raise taxes enough. Only real option left is inflate it away. Which is exactly why hard assets keep going up.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share