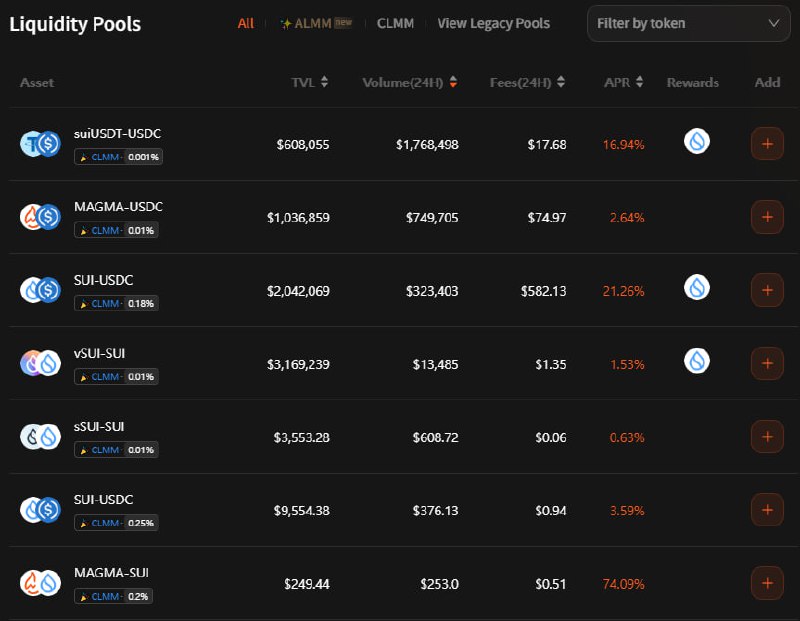

So, what are the best conditions for providing LPs among the liquidity pools offered by Magma Finance? ✅ Checklist 1. Pair Characteristics - Stable / Major / High Volatility 2. Model Selection - Passive: ALMM-Spot / CLMM-Wide - Active: ALMM-Curve / CLMM-Narrow 3. Fee Tier - Stable = Low / Volatility = High 4. Bin Step / Range - The tighter the Bin Step, the more precise it is, but management, costs, and structure can become more complex. - The above information varies by pool, so please refer to the table. 5. Liquidity - Shallow Bin Step / Increased Price Impact - Both Swap and LP can be disadvantageous. 6. Trading Volume / Fees - Actual trading is more important than high APR. - The image above is sorted by trading volume. 7. Gas / Operating Costs - Be aware that a wide Bin range can result in higher gas costs. In simple terms, beginners and passive traders should use a relatively wide ALMM Spot. If you prefer a major with high trading volume, use ALMM Curve to improve fee efficiency. Single Asset If you want to create a DCA or grid feel, you can use the ALMM Bid-Ask strategy, where the lower part is waiting to buy and the upper part is waiting to sell.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content