This article is machine translated

Show original

I've recently been pondering another question: which mindset is most likely to lead to significant financial losses?

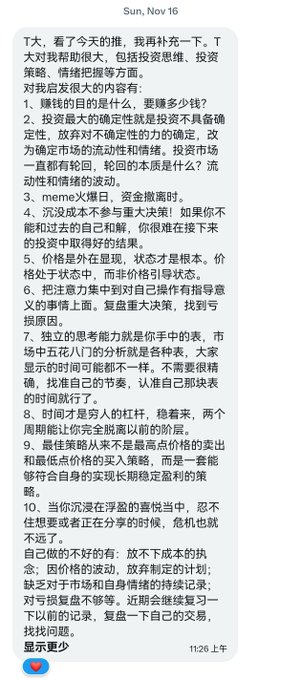

After much thought, based on my own experience and lessons learned from various markets, the fear of "selling too early" ranks first.

Whether it's hoping for continued gains, a return to previous highs, or simply breaking even, this fear of "selling too early" often has nothing to do with market prediction; it's merely a form of "prayer," and many people are forever praying.

This is a general rule, not specific guidance.

In my personal investment career, aside from the devastating liquidation at the bottom of 2018, I've experienced significant drawdowns in principal at other times. The reason for these massive drawdowns is that I didn't sell on clearly positive news or unexpectedly large gains—I was afraid of "selling too early." I was afraid to sell too early when positive news emerged, and afraid to sell too early when there was a pullback after the positive news. I kept delaying, hoping it would return to a certain level before selling, fearing I'd miss out. This is the path I've walked before.

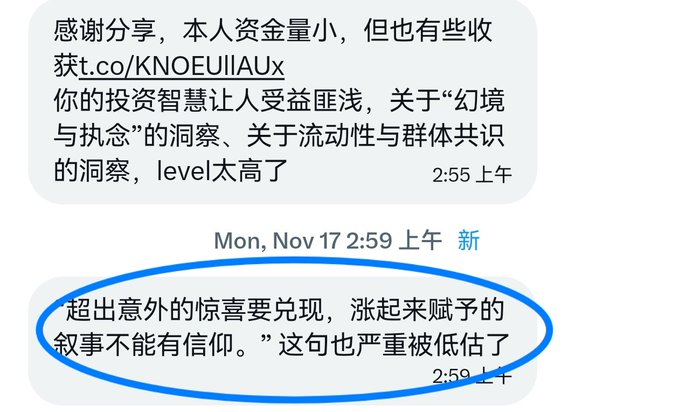

"Unexpected surprises should be realized, and narratives that drive up prices shouldn't be blinded by faith." I particularly like this selling strategy I shared before; it encapsulates so much experience and lessons learned—it's practically a secret manual!

TingHu♪

@TingHu888

11-30

目前私信回复进度在11月中,有很多值得分享的私信,抽空先分享两个~

我自认为还是分享了不少行之有效的投资思路和策略的,中间分享的买入卖出也只不过是为了辅证分享的投资思路和策略的有效性(渔的有效性)。

“超出意外的惊喜要兑现,涨起来的叙事不能有信仰”我个人也认为被严重低估🥳~

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content