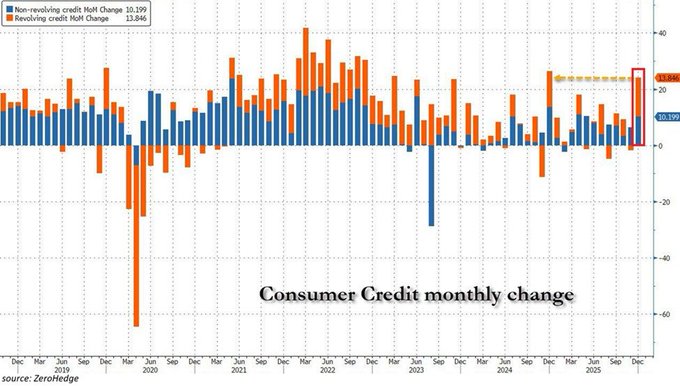

BREAKING: Total consumer credit surged +$24 billion in December, to a record $5.11 trillion.

This marks the biggest monthly increase of 2025 and the largest since 2023.

Revolving credit, which includes credit cards, jumped +$13.8 billion, to $1.33 trillion, the highest since November 2022.

This was also the largest monthly increase since 2023.

Non-revolving credit, mainly auto and student loans, soared +$10.2 billion, to a record $3.78 trillion.

Meanwhile, the average credit card interest rate remains elevated at 22.2%, near its all-time high of 23.4%, despite the Fed slashing rates by 175 bps since September 2024.

Americans are "fighting" surging prices with more debt.

Credit expansion at records is the canary. The unwind is always messier than the build.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content