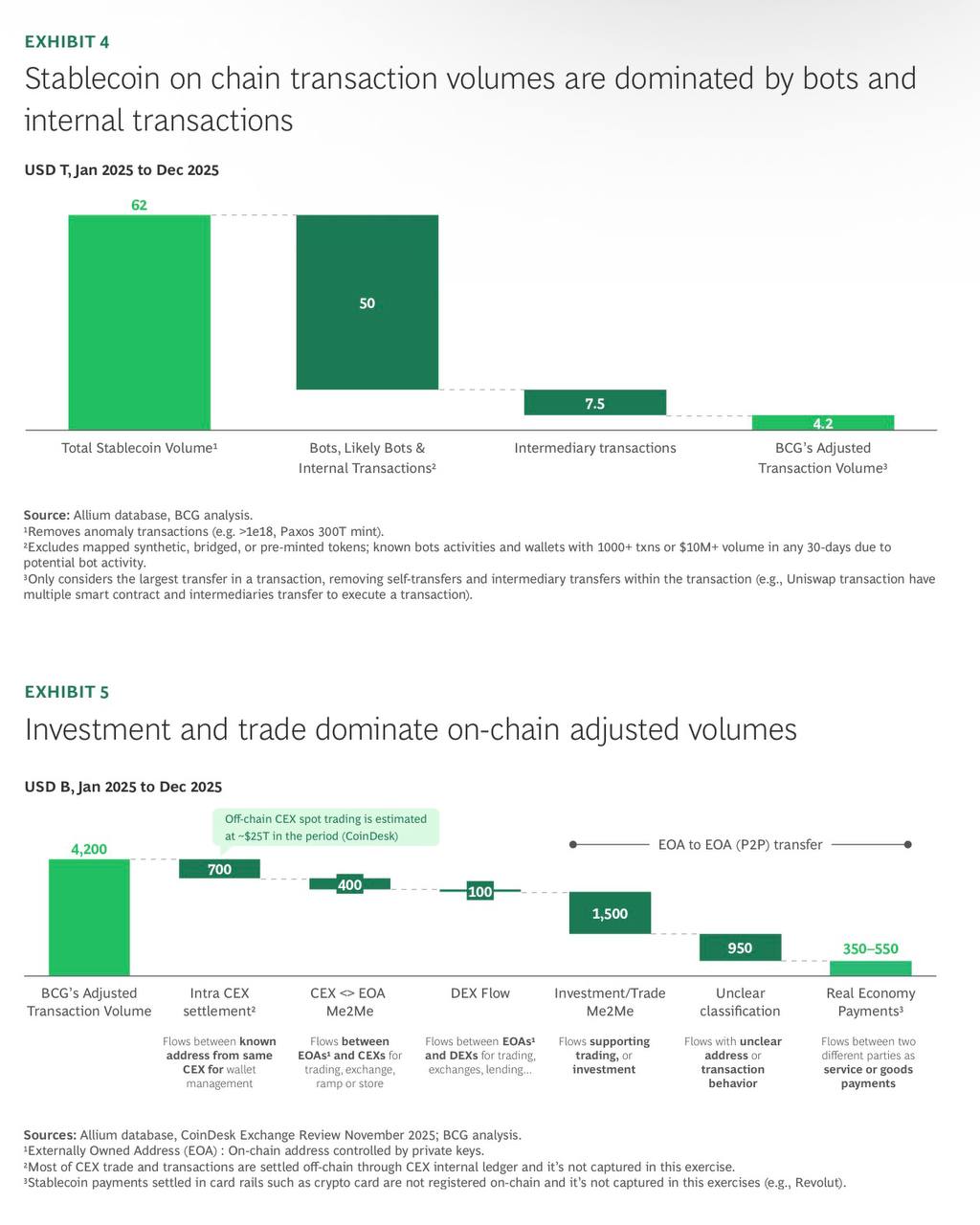

Stablecoin Payments: The Truth Behind the Numbers (BCG & Allium) - While the total stablecoin transaction volume is $62 trillion, actual economic activity related to payments for physical goods and services accounts for only about 7% ($4.2 trillion). - The majority (93%) of transactions involve cryptocurrency transactions, derivatives transactions, protocols, and internal routing within exchanges. - The actual goods and services payment market is approximately $350-550 billion. - B2B payments: $150-230 billion (40%), a smaller market compared to the payments market, but showing a high annual growth rate of 65%. - C2C payments: $90-130 billion (25%), primarily cross-border remittances and person-to-person transfers. Rapid annual growth rate of 75%. - Declining usage of TRON: While still dominant (approximately 60-80%) thanks to low fees and high USDT liquidity, it will decline from 74% at the beginning of 2025 to around 60% by the end of the year. - With the emergence of institutional stablecoin payment platforms, adoption of Ethereum, Solana, BNB, and Polygon is on the rise.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content