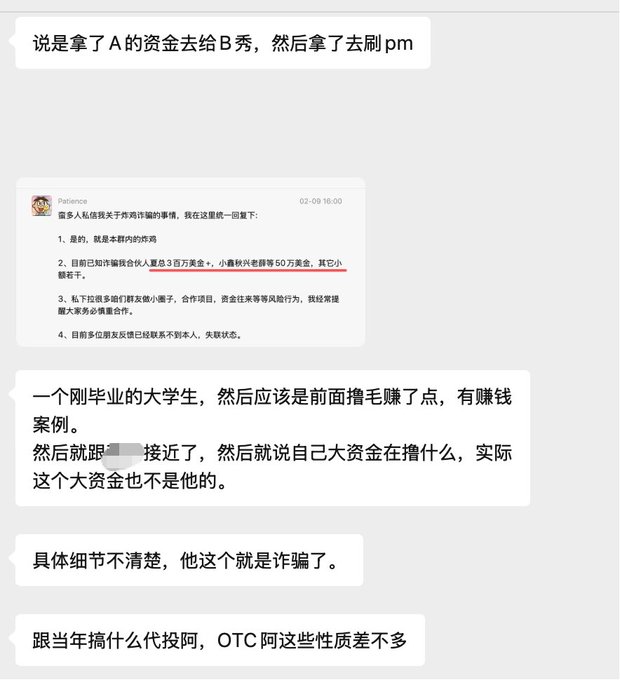

I was a bit surprised to see this kid scamming several million (reportedly 10 million) yesterday and today, because some of the guys who invested are experienced investors with their own studios, and they still fell for this kid's tricks. Later I realized the reason might be that Polymarket is different from regular money-making schemes; it offers more strategic options. Many people want to profit from it, but how to do it is crucial, which leaves room for scammers (who claim to be very good at manipulating product managers). This is similar to scammers during the ICO era claiming they could invest in projects that others couldn't. Two things to take away from this: 1/ People who flaunt their wealth excessively and are unusually high-profile—just observe from afar, and never form any financial relationship with them. None of the truly successful people I know flaunt their wealth, and none of them ask for money to make money for you. If they're already so rich, why would they need to use other people's money to make more money? Learn from those who make money their thought processes, understanding, logic, and skills. 2/ When the market is bad, prioritize risk and scale back your investments. Why did DeFi get hacked so often during market downturns? Why were so many projects halved in value? It's because making money became difficult, so many people started looking for ways to profit. Why didn't this kid abscond before, instead maintaining a carefully crafted persona? It's likely because Ponzi was able to survive when the market was good, and now that there aren't many new projects to exploit, he's simply closing the net. This mentality is very common. Even some less malicious hackers are now increasing phishing and attacks due to fewer ways to make money. Therefore, we are now in a high-risk period. Everyone must be extremely careful and ideally keep your funds in your own hands from on-chain protocols and other sources until the market recovers.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content