This article is machine translated

Show original

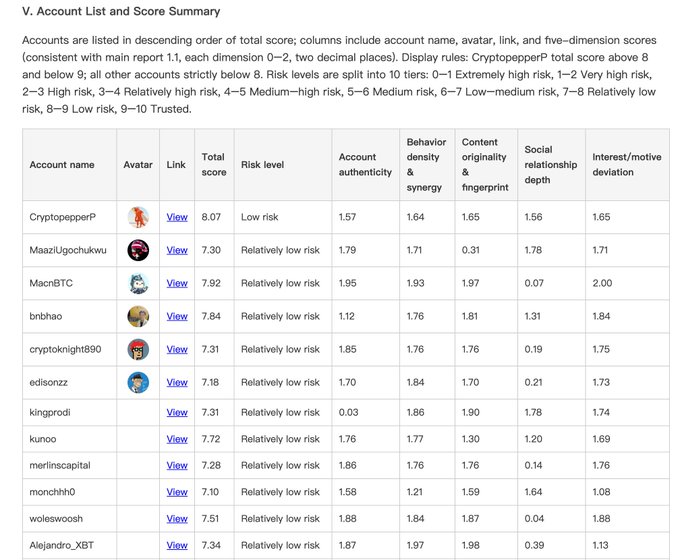

AI big data models have indeed evolved to the point where they can replace many functions. For example, many traditional functions such as fairness, arbitration, and auditing can be performed by AI. Regarding the recent FUD (Fear, Uncertainty, and Doubt) issues surrounding Binance's inability to deposit and withdraw funds and the freezing of accounts, BIRDEYE used an AI big data model to systematically analyze and break down the situation to see what was actually happening. The core idea of BIRDEYE's MAS framework is: Instead of pre-assuming who is good or bad, it first scores accounts across five dimensions, then adds risk signals for interpretation. The five dimensions are: Account Identity Authenticity, Behavioral Density and Collaboration, Content Originality and Fingerprint, Social Relationship Depth, and Motivation and Interest Shift. Each dimension is scored from 0 to 2 points, for a total score of 0 to 10 points. Finally, the risk levels are segmented. And here's the key point: Out of 92 sample accounts, 0 fell within the confidence interval. The overall average score was 4.54, the median was 5.09, and the highest was 8.07. In other words, even the most human-like accounts didn't reach a 9. Threshold 1: If you only see the score, it's only suspicious. What's truly damaging is the closed-loop evidence chain.

1/ Image fingerprints and pHash directly match.

Screenshots from 15 accounts supposedly from different regions and devices show a pHash Hamming distance of 0. The same upstream material was distributed across multiple accounts.

2/ Forgery is revealed in UI characters.

Replacing the Latin letter 'o' with the Greek letter 'ο' is almost imperceptible to the naked eye.

However, code extraction reveals the forgery. This method is closer to phishing and impersonation.

3/ Image material suspected of AI synthesis.

Multi-model anti-AI detection scores range from 0.82 to 0.94; anything exceeding 0.80 is flagged.

Combined with descriptions of lighting inconsistencies and abnormal facial features, this at least indicates the material's credibility is weak.

4/ Behavioral synchronization and scripted resonance.

High-density similar content is published within the same time window, even using Poisson fitting with p less than 1e-6 for statistical judgment. Add to that typos and wording. The script structure is highly homogeneous; the narrative feels mass-generated rather than spontaneously generated.

5/ A concentrated trend of name changes and asset reuse emerges at the identity level.

The report mentions that in January 2026, approximately 42% of accounts changed their names or bios, with name changes occurring in clusters.

This synchronicity is extremely rare among organic users.

A single advertising system is running the process.

Unified materials, unified distribution, unified pacing, unified script.

Too obvious, and the work isn't sophisticated.

openai.study/html/report_en.ht...…

openai.study/html/BIRDEYE_repo...…

OpenAI.study

@Openai_study

AI NEVER LIE. The Verdict is In. ⚖️🤖

Binance FUD Wave wins the vote!

Now, let BIRDEYE cut through the noise and reveal the TRYTH⬇️

https://openai.study/html/report_en.html…

https://openai.study/html/BIRDEYE_report/index.html…

🔍 BIRDEYE Analysis Verdict: After deep-diving into the narrative patterns and data clusters

BNB also fell.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content