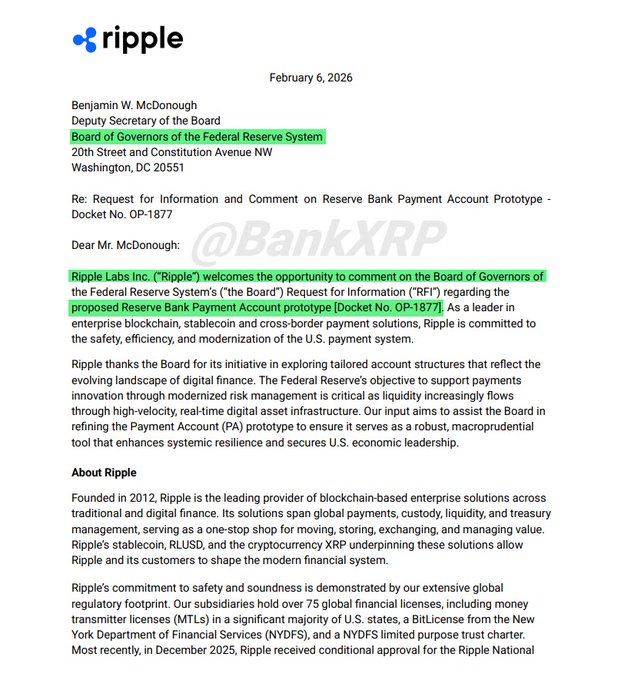

Is the Federal Reserve quietly opening a backdoor for a crypto company? A document numbered OP-1877 reveals that Ripple may open a "payments account" directly with the Federal Reserve. What does this mean? If approved, Ripple's USD stablecoin, RLUSD, would have its reserves held directly at the Federal Reserve. This completely bypasses the counterparty risk associated with all commercial banks. This move could allow settlements to occur directly on the Federal Reserve's track. Will this solidify XRP's position as a global bridge asset? RLUSD would also gain institutional-grade stability backing. The deeper question is, why Ripple? Against the backdrop of the Trump administration's emphasis on financial sovereignty and vigilance against the infiltration of a globalized financial system, what kind of precedent does a decentralized private company directly linking itself to a national central bank set? Could this be a move by Wall Street and tech elites to circumvent traditional regulations and create a new financial hegemony?

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share