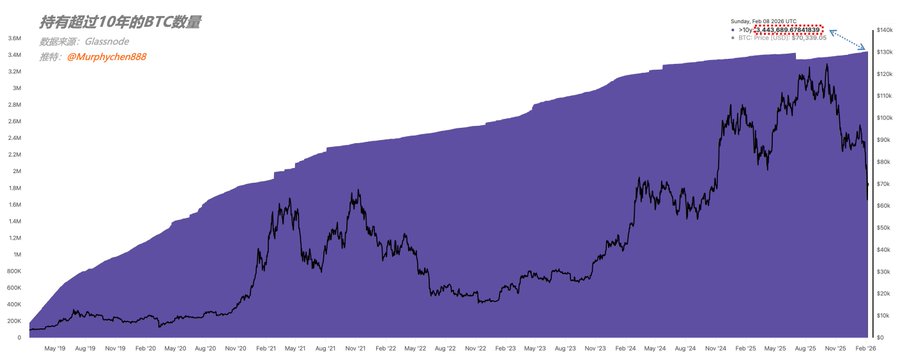

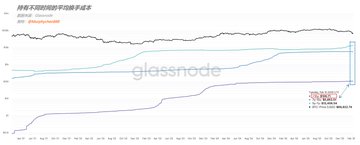

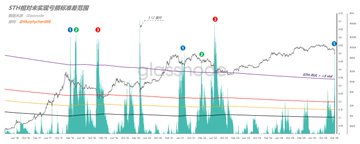

Winter is here—are you ready? The $65,000 Psychological Threshold and Lifeline Realized Price (RP) reflects the price when BTC was last moved on-chain, making it widely seen as the average cost basis for all Bitcoin holders. But in reality, this figure is somewhat distorted. (Chart 1) A huge stash of ancient coins are either lost or held in deep cold storage, which massively drags down the “average cost” we see on-chain. Currently, there are 3.443 million BTC held for over 10 years, with an average cost basis of just $106.7 (see Chart 1 & 2). While the average cost for coins held 5-7 years is also pretty low, it’s much closer to the “real” picture. (Chart 2) So, by filtering out coins held for 10+ years from the stats, we get a much more realistic “historical average cost” for BTC. On Chart 3, the purple line is <10y_RP and the yellow line is the standard RP. You can see that in the early days, both lines were almost identical, but the gap has widened over time. Right now, RP is at $55,000, while <10y_RP sits at $65,000. (Chart 3) Looking back at history, whenever BTC price drops below <10y_RP, it signals the market has entered a deep bear phase. After that, it’s tough for price to break back above this line—think in terms of months or even quarters. Only when BTC climbs back above <10y_RP can we call it the bottom of the bear market. This is the coldest part of crypto winter, where many—retail, institutions, projects, platforms—get wiped out, black swan events hit, and panic and despair take over. In other words, as long as BTC stays above <10y_RP, there’s still hope for a mild bear. But if it breaks below—chances are, we’re heading into a brutal deep bear. Right now, BTC is finding support exactly at $65,000 (<10y_RP), which means this pullback has reached the market’s psychological limit. Will we bounce back from the brink, or get sucked into the abyss? No one knows for sure. What you can do is have your execution plan ready for whatever comes next. ----------------------------------------------- For educational purposes only. Not financial advice!

This article is machine translated

Show original

Murphy

@Murphychen888

02-09

短期持有者的相对未实现亏损(STH-RUL)均值超过5个标准差(紫线),这是极端恐慌的标志性信号!

在本轮周期尚属首次出现,但在过去全部4轮周期中是第11次,意味着平均每轮周期会出现3次。 x.com/Murphychen888/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content