Binance lost 1,385 tokens, OKEx lost 982, and Coinbase Pro lost 833.

Gemini alone saw a net inflow of 1,002 units… Investors prefer to store their tokens in their own wallets.

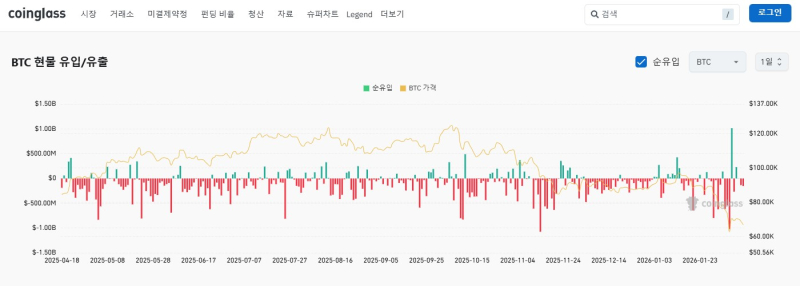

According to Coinglass, a virtual asset data analysis platform, a total of 1,533.33 BTC was net outflowed from centralized exchanges over the past 24 hours.

Net exchange outflows refer to investors withdrawing Bitcoin from exchanges and moving it to their personal wallets, typically indicating long-term holding intentions or a preference for self-custody.

In terms of outflow volume, Binance recorded the largest outflow with 1,385.61 BTC (approximately $94.6 million, KRW 137.7 billion).

OKX ranked second with 982.74 BTC (approximately $67.1 million, or 97.7 billion won) lost. CoinbasePro ranked third with 833.32 BTC (approximately $56.9 million, or 82.8 billion won) lost.

A total of 3,201.67 BTC was withdrawn from these three exchanges alone. However, Gemini saw an inflow of 1,002.42 BTC (approximately $68.5 million, or 99.7 billion won), bringing the total net outflow to 1,533.33 BTC.

A decrease in Bitcoin balances held on exchanges has the effect of reducing the supply available for immediate sale on the market. This could exert upward pressure on Bitcoin prices in the medium to long term.

However, in the short term, exchange outflows may not have an immediate impact on prices. While exchange outflows indicate a decrease in selling pressure, the actual price increase occurs when new buying demand flows in.

Joohoon Choi joohoon@blockstreet.co.kr