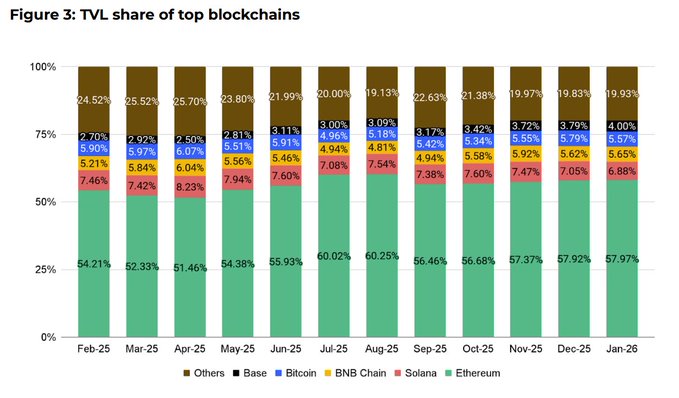

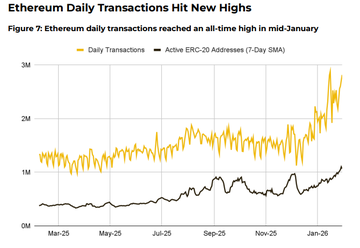

ETHEREUM'S IRRELIMINABLE POSITION - Despite intense competition and expansion efforts from numerous large ecosystems, Ethereum's DeFi market share remains dominant at 57.97% of the total value locked (TVL) across the industry. Although this figure has fluctuated slightly from 54.21% in February 2025, Ethereum continues to demonstrate its resilience and superior Capital absorption capacity compared to its competitors. - The Fusaka upgrade, implemented at the end of 2025, addressed the critical data availability issue through PeerDAS, helping the number of daily transactions peak at nearly 3 million by mid-January 2026. The number of daily active addresses maintained steady growth and officially surpassed 1 million. - Over 65% of real-world Tokenize assets (RWA) choose Ethereum as their storage and trading platform. RWAs alone have a TVL of $19.5 billion. - The Capital of stablecoins on the network remains stable at $160 billion. The volume of stablecoins is expected to reach $1 trillion by the end of 2025. - Although the Ethereum Mainnet is increasingly becoming a safe haven for large Capital flows (whales) and institutional assets, small-scale and high-frequency transactions are shifting to Layer 2 or competitors like Solana (currently holding around 6.88% of TVL market share), creating polarization among users as they gravitate towards specific chains. Ethereum remains the largest funnel capturing value in the entire DeFi industry, but its market share is also highly Shard .

This article is machine translated

Show original

Steven | Crypto Research

@Steven_Research

02-04

ETHREUM L1 KHÔNG CẦN TỚI CÁC L2?

Điều này mình đã từng phần tích cách đây 3 năm, lúc đó thị trường vẫn đặt niềm tin rất lớn vào các L2, tới hiện tại thì trong 135 Layer 2 hiện có, 109L2s có ít hơn 1 thao tác người dùng mỗi giây

- Mới đây, Vitalik vạch ra x.com/Steven_Researc…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share