BTC fluctuates around $66,000... Exploring direction ahead of the event

ETH holds in the mid-$1,900s, with rebound expectations and caution coexisting.

XRP breaks $1.40… Short-term selling pressure persists.

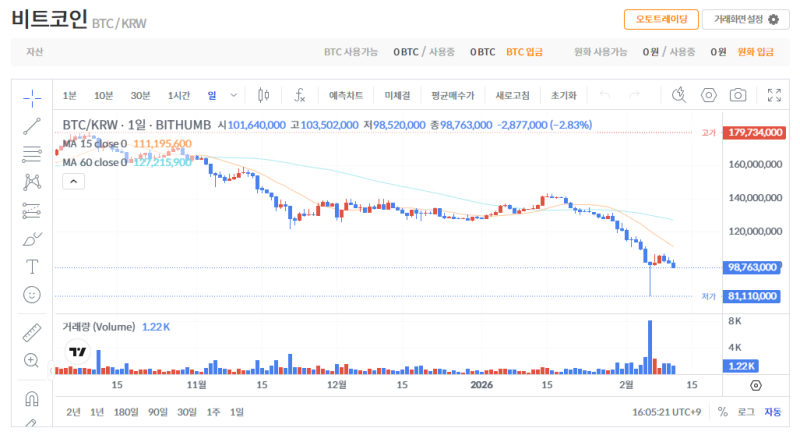

Bitcoin (BTC) is trading at $66,710 as of 4:00 PM. In the short term, the price is likely to remain within the $66,000 range until the release of the data. If Tether dominance fails to fall below 8% again, further rebound momentum appears limited.

Ethereum (ETH) is trading at $1,947 at the same time, holding steady in the mid-$1,900s. While it has entered a technical rebound phase following the recent plunge, both trading volume and supply/demand are still insufficient to signal a trend reversal.

XRP is trading at $1.36, having broken below $1.40. If it fails to re-establish itself at $1.40, short-term downward pressure could persist, and it appears to have entered a period of increased volatility.

While the market anticipates that if the latest employment figures are weaker than expected, a short-term trend of dollar weakness → risk asset preference recovery may emerge, the analysis predicts that Tether dominance breaking below 8% and falling below 7.92% will be the primary condition for determining a trend reversal in the virtual asset market.

Volatility is likely to continue until the direction becomes clear after the release of the indicator.

Reporter Jeong Ha-yeon yomwork8824@blockstreet.co.kr