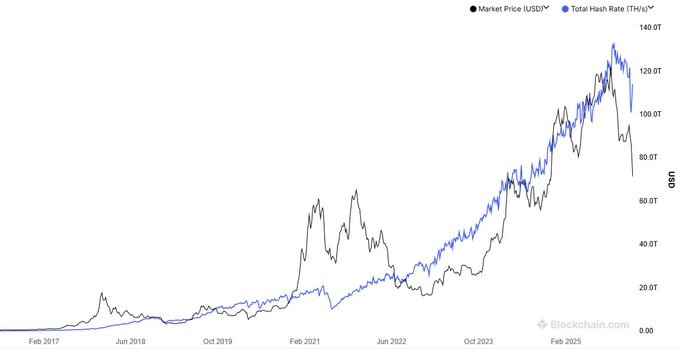

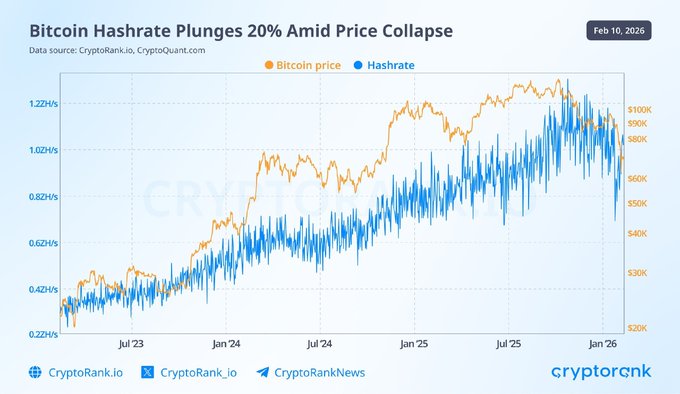

Bitcoin mining hashrate drops 20% - Is this related to the price of $ BTC? Hashrate, which represents the mining difficulty of Bitcoin, has just experienced its biggest drop since 2021, causing weaker miners to leave. So what caused this and does it correlate with the price? 1. Analyze the causes of the hashrate decline. - When the price of BTC drops sharply, the revenue of Miners (calculated in USD) is no longer enough to cover electricity and operating costs, forcing small-scale Miners or those using older machines to disconnect. - By early 2026, winter storms in the US (where many large mining farms are located) caused rolling power outages or soaring electricity prices, making it uneconomical to maintain hashrate. - A new trend in 2025-2026 is for Bitcoin mining companies to shift their infrastructure to powering AI (High-Performance Computing - HPC) data centers due to the stable and higher profitability compared to mining BTC in a bear market. 2. Correlation Between Hashrate and BTC Price - In the short term, prices usually fall first, then hashrate decreases (because Miners need time to assess profit/loss before shutting down their machines). - When the hash rate drops sharply (~20%) and a difficulty adjustment occurs, this is often a signal of " Miners capitulation". History shows that large hash rate drops (like in 2021) often mark the end of a price decline, establishing a new long-term price range. 3. Consequences for the price of BTC - Once the less skilled Miners have left the game, the selling pressure from this group to cover costs will dry up. - The market needs time to absorb the sell-off in BTC . The price may form a consolidation zone around the current support level. - After the difficulty decreases, the increased mining efficiency will attract newer, more efficient machines back to the network. Hashrate will gradually recover and set a new all-time high (ATH).

This article is machine translated

Show original

Steven | Crypto Research

@Steven_Research

02-09

Phân Tích Cấu Trúc Chi Phí Bitcoin - Sự Chuyển Dịch Giữa Các Nhóm Holder $BTC

1. Áp lực của các nhóm nhà đầu tư ngắn hạn (STH)

- Hiện tại, thị trường đã đẩy toàn bộ nhóm STH vào trạng thái thua lỗ vị thế. Khi thị trường vận hành dưới mức chi phí trung x.com/Steven_Researc…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share