Crypto has lost its "wild west" appeal 🤔 Previously, crypto was XEM a "new territory" for speculation. Its appeal stemmed from two main factors. Firstly, there is genuine belief in the technology and its future application potential. Secondly, the inefficiency of the market due to the limited participation of professional organizations leads to significant volatility and creates many opportunities for individual investors. However, the context has changed. According to @CryptoCred, artificial intelligence (AI) is becoming the new center of speculation. AI has specific applications, practical impacts, and a faster rate of development in the short term. Meanwhile, crypto – despite notable innovations – seems increasingly focused on pure speculation. Memecoin cycles, extreme financial skepticism, and profiteering have highlighted the negative aspects of this ecosystem. Instead of participating in publicly traded and highly liquidation markets as before, many individual investors are drawn to short-term projects with lifespans measured in hours. Without an informational advantage or exceptional luck, losses can reach 99% in a single day. This is very different from the period in 2017, when the uptrend was more sustained and accessible through centralized exchanges. Perhaps that's why some traders have switched to 0DTE options, Futures Contract, precious metals, or other markets, instead of sticking with crypto (except for some predictive markets). 😵💫 What does that mean? Perhaps no one has a clear answer yet. After nearly a decade in this field, many people remain both convinced and skeptical – like in a relationship that's hard to break free from.

This article is machine translated

Show original

Upside GM

@gm_upside

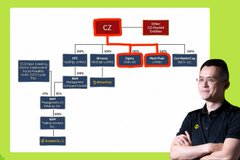

KHI CHỦ SÀN CŨNG LÀ NGƯỜI CHƠI

@cz_binance từng nói ông không giao dịch. Nhưng vấn đề không nằm ở việc “có tự tay trade hay không”, mà ở chỗ ông sở hữu các công ty tạo lập thị trường như Merit Peak và Sigma Chain – những đơn vị trực tiếp giao dịch trên x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share