This article is machine translated

Show original

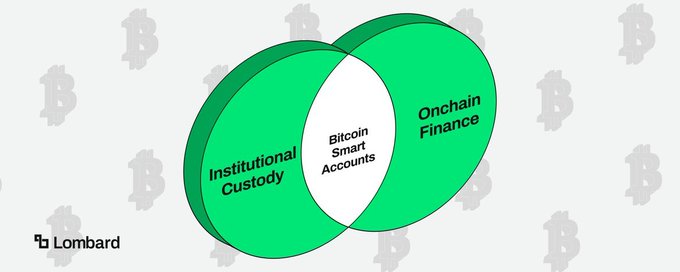

In the realm of crypto finance, two parallel worlds have always existed:

One is the "Fortress World." This is the domain of top custodians like Fidelity and BitGo, who safeguard approximately $500 billion worth of Bitcoin.

This demands absolute security and cold storage of assets, but also means zero liquidity and zero returns.

The other is the "On-Chain World." This world features lending protocols like Aave and Morpho, offering extremely high capital efficiency and enticing returns.

However, this means abandoning traditional insurance protection and taking on the risks of hacker attacks or contract vulnerabilities.

This forces hundreds of billions of dollars worth of Bitcoin into a "dormant" state, completely unable to participate in on-chain finance.

@Lombard_Finance, what is the newly launched "Bitcoin Smart Account"?

In layman's terms: it aims to be the SWIFT system of the Bitcoin world.

Because the interbank SWIFT system never actually moves tons of cash around; it only transmits "instructions" and "trust."

Lombard's Smart Account does the same thing.

Under this new architecture, institutional Bitcoin remains securely held in its original compliant custodian accounts (whether MPC or not). (Whether it's a wallet or a cold wallet, ownership remains completely unchanged, and it's not lent to any third party.)

However, through smart account technology, these locked Bitcoins are "identified" as usable collateral on-chain.

For example: you mortgage your house to a bank for a loan; you still live in the house, the house hasn't been moved, but you've received liquid funds.

Institutional users can directly use this account to borrow stablecoins or earn yield on lending protocols like Morpho. Throughout the process, there's no need to transfer the coins to a third party, no lengthy approval processes, and no tax issues arising from selling the coins.

🛫Why is this important?

1. Allows Bitcoin holders to simultaneously choose "absolute security" and "on-chain rewards."

2. Activates hundreds of billions of dollars worth of Bitcoin in the market, enabling these funds to safely enter the lending market.

3. Preserves the "legal ownership" and "custodial integrity" most valued by institutions.

4. When SWIFT first connected 239 banks, no one imagined it would become the artery of global finance.

Now, Lombard is laying similar pipelines, building a truly achievable bridge between traditional financial giants and decentralized finance.

5. In this narrative, the biggest winner may not be any particular protocol, but Bitcoin itself.

Because through Lombard's protocol, BTC can not only preserve its value but also generate enormous productivity like a modern financial asset.

twitter.com/one_snowball/statu...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content