TL;DR

- Competition in the NFT trading market will face two difficulties: insufficient differentiation and insufficient Liquidity;

- Blur made a differentiated positioning by integrating professional trading tools and aggregators, and then used the Bid Pool mechanism to emulate the Order-book to solve the problem of insufficient Liquidity;

- Blur needs to face the problems of lack of increment, points accumulation and unsustainable economic model;

- NFTfi and NFT market makers will benefit from Blur, and the market will have higher requirements for new NFT projects;

Competitive Difficulties in the NFT Trading Market

For a long time, Opensea has been a representative of the entire NFT market, occupying more than 70% - 90% of the market share, and was valued at $13 billion in the latest round of financing. Although the current market is sluggish and NFT still has some problems Unresolved, but NFT is still a huge untapped market in the eyes of many.

Facing such a market full of potential, Opensea has no shortage of challengers. However, from beginning to end, there are only two real threats, one is Gem and the other is Blur.

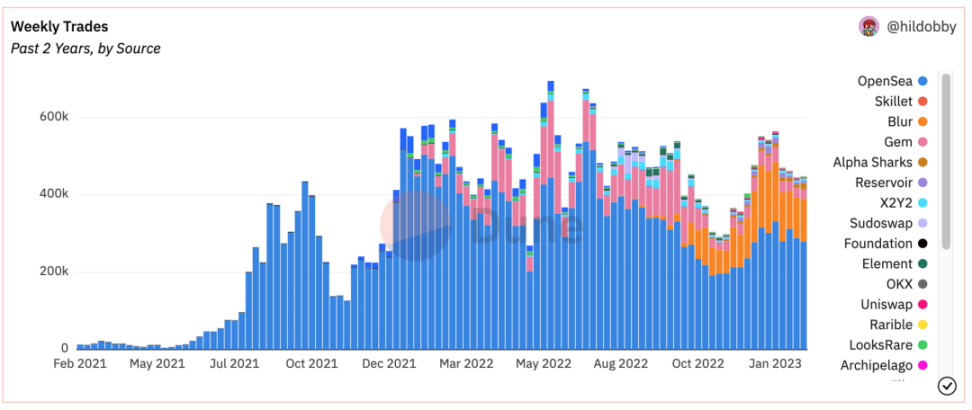

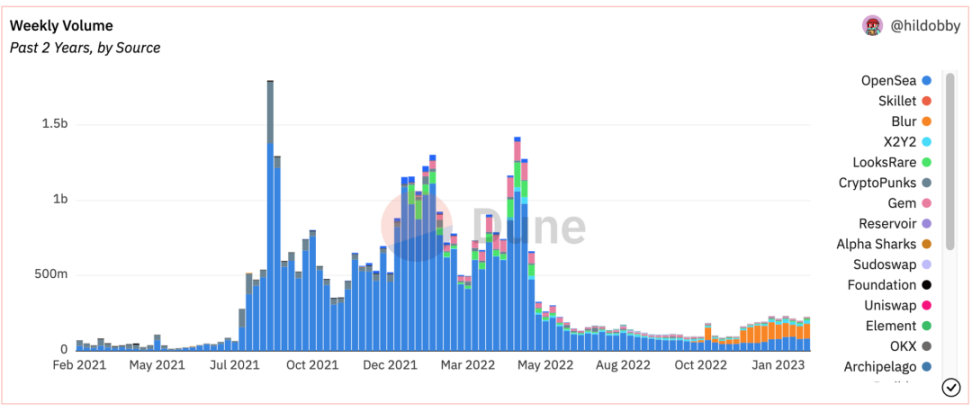

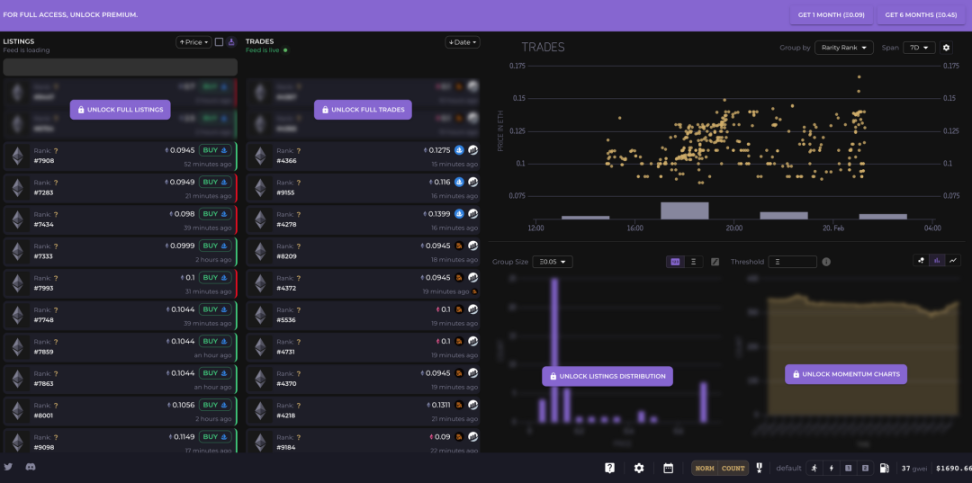

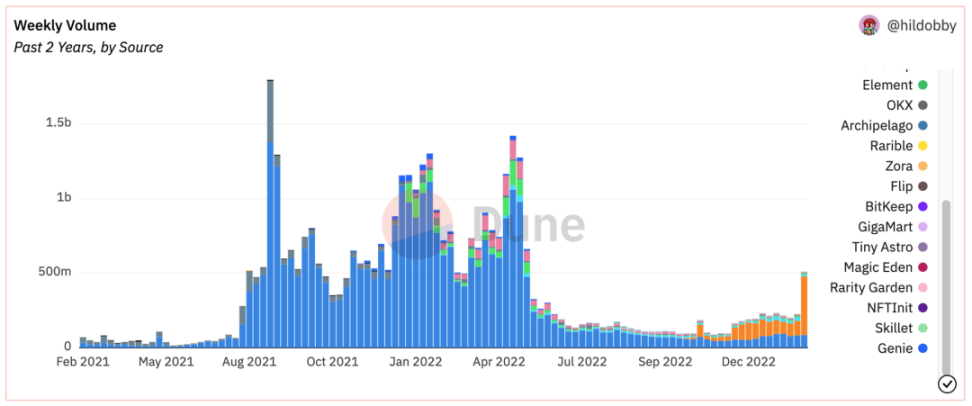

Attached picture: The real weekly transaction volume and weekly transaction number of major NFT Marketplaces from February 2021 to February 2023 before Blur was issued. Among them, only Blur and Gem have seized Opensea's share in terms of transaction volume and number of transactions.

Personally, many challengers will encounter two main problems, one is "insufficient differentiation" and the other is "insufficient Liquidity" .

Insufficient differentiation means that the difference in experience is too small, and users can migrate to other trading markets at any time

Most of Opensea's competitions are almost the same as Opensea from the perspective of UI/UX, only functional micro-innovations, such as Collection Offer, batch listing, etc., token incentives have not changed the way users trade NFT.

But the vast majority of NFTs conform to a unified standard (ERC721 / ERC1155), and there is no permission on the chain, and the trading market can easily support these projects, so that any NFT market seems to have no need to worry about supply due to this on-chain feature. This is also the basis on which later competitors can compete with Opensea in theory.

Insufficient Liquidity refers to insufficient supply and fragmented Liquidity

Due to the unified standard and on-chain of NFT, it seems that the NFT trading market does not need to worry about supply, but in fact, for most competitors, the supply is seriously insufficient, because List is the supply of the NFT trading market.

In the bull market, due to the scattered and independent Liquidity of each trading market, if the order is placed in multiple trading markets at the same time, but the price change is not as expected, and the price of the pending order needs to be adjusted, the listing in multiple markets will require payment. Multiple Gas transactions, in the face of such a situation, traders will tend to choose the market with the best Liquidity.

Therefore, for the NFT trading market, it is difficult and indirect for vampire attacks to attack Liquidity. Token incentives can only attract temporary trading volume, but it is difficult to maintain. When the price fluctuates greatly, placing orders to mine in multiple trading markets can easily become a mine by itself.

Insufficient Liquidity is the biggest problem for all challengers. At present, there are not many tradable targets in the NFT market, and there are not many players. The stock competition is the most intense.

What's good about Blur

Based on the above-mentioned difficulties in the NFT market, we can actually infer what Blur has done well. Simply put, there are two points:

Be Different, Think Different.

Be different

Marketplace for Pro traders

Blur has positioned itself differently from Opensea, Marketplace for Pro traders from the beginning of financing. It is reasonable to do so, because according to the data NFT transaction volume, more than 45% of the transactions are concentrated in blue-chip transactions. At the same time, NFT itself is still It is the transaction demand that is far greater than other needs. Specifically, Blur's differentiation strategy can be summed up in four words: "more, faster, better and more economical" .

more: more supply

Blur provides aggregator services with a very open mind, users can place orders on Blur and other trading markets.

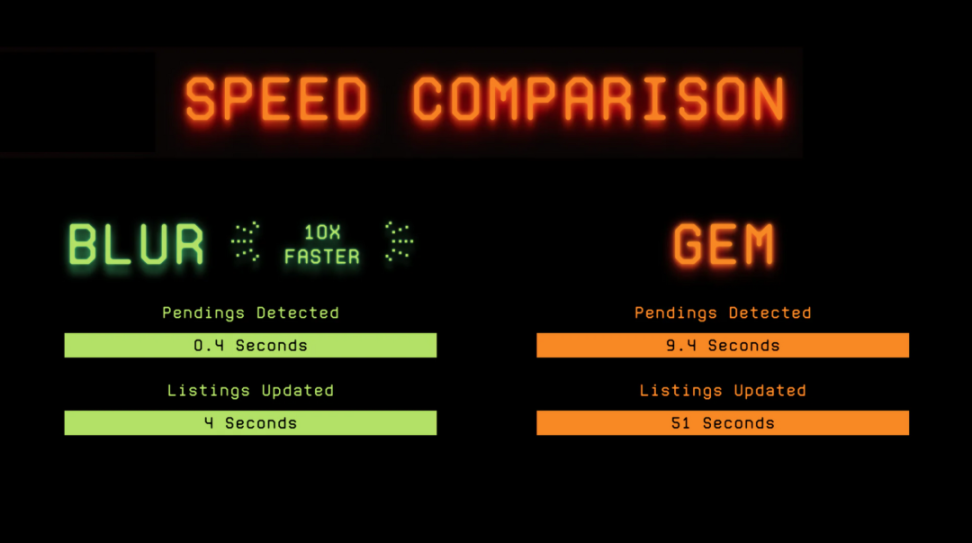

fast: fast

According to Blur’s official statement, Blur is ten times faster than GEM, and basically achieves the fastest update of Listing information among all platforms. The comparison is also known for its speed and aggregation. It was once regarded as a must-buy trading aid by many NFT traders NFT nerds , Blur has exactly the same features and is completely free.

And how important is it to be fast?

For example, when a new project is launched, the transaction is often the most, and the price has not reached a consensus, which is the prime time for transactions. However, when using GEM or OS for transactions, it is very likely that the floor will be refreshed, and users will not refresh In this case, the user submits the transaction, but it has already been closed by someone else. In this case, the user only knows that the transaction has failed when he loses the Gas fee. He loses money and misses the prime time for the transaction.

Good: easy to use, more in line with Traders trading habits

Blur's UI & UX are completely different from Opensea, closer to professional trading aids such as NFT nerds or SOL Sniper rather than trading markets.

In addition to optimizing the speed to bring a silky experience and perfectly replicating almost all the functions of NFT nerds, it also has its own unique understanding of the needs of Pro Traders:

Smart scanning, smart bulk pending orders, automatic calculation of P&L, display of address abbreviations and positions of the maker, etc. Blur will provide almost all the public information a professional Trader needs.

Province: low transaction costs

Blur was once a completely zero-royalty and zero-fee trading market, and has always adhered to this strategy. Even after Opensea launched the blacklist, Blur's choice is still an optional royalty market rather than a mandatory royalty, and it is solved from a technical point of view. Opensea's strategy.

In addition to the product experience, Blur's AirDrop distribution method is also different.

In this regard, Blur is more like Yuga Labs in the trading market, that is, it is always blurred and always retains expectations. Every AirDrop of Blur is a kind of user education:

- The first AirDrop brings users to experience Blur's smart pending order function;

- The second AirDrop will lead users to experience the Bid Pool function;

- The third AirDrop is to allow users to fully experience the feeling of NFT market making from the two perspectives of List and Bid.

Through its unique product positioning, product design and AirDrop distribution method, Blur initially created a different positioning from Opensea, solved the problem of insufficient differentiation, and occupied a certain position in many NFT trading markets.

However, differentiation can only help Blur replace Gem at most, but it is still not enough to help it come from behind to challenge or even surpass Opensea. What is really difficult to solve is the lack of Liquidity.

Think Different

Incentivize liquidity but not volume

Blur's catching up with Opensea began with the launch of the Bid Pool function in December. Bid refers to the way buyers quote for acquisitions, which is a bit similar to buying on Xianyu.

The difference between Bid Pool and traditional Collection Bid is that users no longer need WETH, but need to deposit ETH into Blur’s Bid Pool to initiate a Bid. At the same time, Bid can only be conducted for the entire Collection and not for a specific NFT.

This angle of entry is very interesting and was not initially considered a revolutionary feature.

Because Bid, as a function that has long been available on major trading platforms, is not actually a mainstream transaction method. It exists more as an auxiliary tool for normal transactions, and is used to sell non-floor NFTs that cannot be uniformly priced. Bid, or bid at a low price to find holders who are in urgent need of Liquidity for arbitrage.

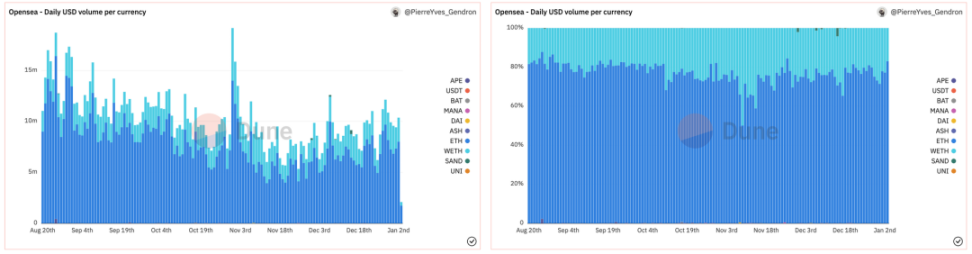

According to Opensea's data, only 10% - 20% of transactions are concluded through Bid. Usually, only under extreme market conditions, users will choose to accept Offer.

So how does such a small feature leverage Opensea's throne?

First of all, it must be clear that for a transaction, it is impossible to happen in two trading markets at the same time, so the competition between NFT markets is actually a competition for Liquidity.

The biggest difference between Blur and other NFT trading markets lies in the understanding of Liquidity and the way to motivate it.

Since the NFT trading market does not have the concept of TVL, Liquidity is difficult to quantify. Therefore, when people compare different NFT trading markets, they usually compare their trading volume. Many Opensea challengers are also from the perspective of stimulating trading volume. stimulating Liquidity.

However, high trading volume is the result of good Liquidity, not the cause. Left-handed and right-handed trading will also result in high trading volume but poor Liquidity.

What is good Liquidity?

Blur’s answer is that it can be bought and sold, and can accommodate large-scale transactions without greatly affecting its floor price. What motivates Liquidity is enough buy and sell orders, not enough transactions. The purpose is to improve the matching transaction success rate.

In fact, Liquidity has always been a problem that NFT needs to be solved, and therefore countless NFTfi products have been derived. Usually, there are three ways of solving the problem of Liquidity and two ways of doing nothing.

One is that NFT does not need good Liquidity due to its non-homogeneous characteristics, and the other is that NFT lacks Liquidity because of the lack of real use cases, and the utility that is closer to ordinary people has Liquidity will be fine.

Here we will not talk about the right and wrong of these two ideas, but focus on the idea of solving Liquidity .

Idea 1: Change the essence of NFT

The idea behind it is that the poor Liquidity of NFT is because the unit price is too expensive and the threshold is too high, so it is closer to Token, such as NFT fragmentation, NFT perpetual contract, etc.

Idea 2: Provide NFT Derivatives tools

Such as lending, leasing, etc., the idea behind it is that the Liquidity of NFT is not good because it occupies a large amount of funds, which reduces the efficiency of capital utilization and reduces users' willingness to purchase.

Idea 3: Introduce market makers

Such as NFT AMM Marketplace, Dogecoin is also not empowered, but Dogecoin has much better Liquidity than NFT, because Dogecoin can carry out the most basic market making by adding LP on Uniswap, borrowing this idea And so the AMM of NFT was born.

The above three methods, in my personal opinion, are all right in thinking, but each has its own problems.

The problem with NFTfi is that Liquidity is both the problem they are trying to solve and the problem it faces.

Because NFTfi generally needs to price NFT, and the pricing of NFT is currently completely determined by the market. When the market Liquidity is not good, there may be a risk that the pricing changes will be extremely uneven and easy to be manipulated, which will affect the use of products. The situation of experience.

Take Azuki of the NFT perpetual contract as an example. When the Liquidity is insufficient, it is very likely that the user opens a long order on Azuki and the contract mark price is pulled from 14.35 to 14.7. At this time, the floor price may only be 14.5. Then consider For the handling fee for opening and closing orders, the floor price of Azuki cannot start to make a profit until the floor price is 15.5 or even higher.

In addition to the inability to distinguish the rarity of NFT AMM , the biggest problem is that the habits of users ≠ the habits of market makers.

At the same time, because the total amount of NFT is small and the smallest unit is large (at least one transaction at a time), AMM 's market making is very prone to huge slippage, which is very unfavorable for Liquidity.

Therefore, NFT AMM is currently neither suitable for user transactions nor for market makers.

NFT AMM requires the emergence of a large NFT Collection. Just imagine that when there is an NFT Collection with a total of 1 million, can the current NFT market with Taobao-style transaction experience still meet the transaction needs? No.

Bid Pool solves the Liquidity problem from the perspective of a market maker, and becomes a small market maker by incentivizing users to participate in bidding and pending orders.

"Visible, accumulative, low-cost, subsidized"

Bid Pool is essentially a model similar to an exchange Order-book. It provides a clear and visualized buy order wall, allowing buyers and sellers to have a clearer data support for judging the Liquidity status of a Collection. At the same time, tokens are used to motivate bids and pending orders. Behavior, to ensure that even if the participants actually Bid to the NFT, they will not choose to immediately accept other people's Offers and smash the market.

If the floor price is understood as the current easiest transaction price of the token, this kind of behavior that continuously encourages users to provide buy orders and sell orders near the floor price is market making . What Bid Pool does is to allow every user to become a A small market maker.

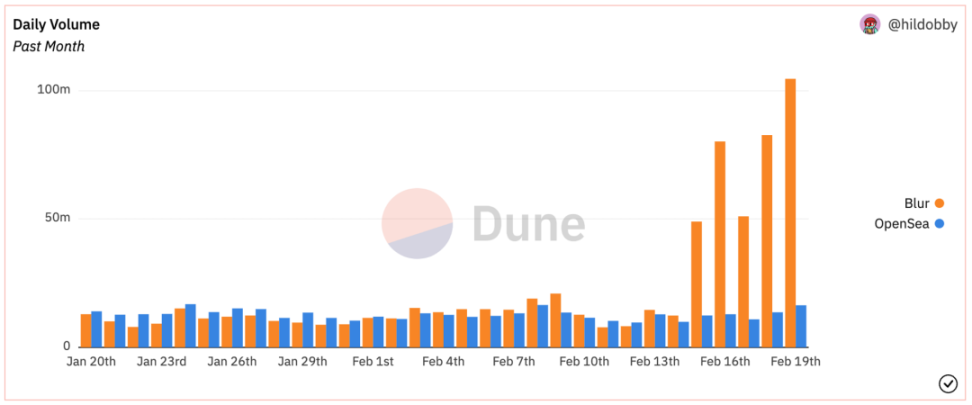

The impact of this method is that since the launch of Bid Pool, 70% of the transactions of leading blue-chip projects have been concentrated in Blur, and the monthly transaction volume has tripled. With Bid Pool, giant whales such as Pransky can Sell 40 Doodles at once without breaking the floor.

So is this method replicable for other trading platforms? not completely.

First of all, because Bid pool puts ETH in Blur's contract, it allows users' funds to be reused on multiple platforms unlike NFT, which raises the requirements for platform vampire attacks. Only when the token incentive is greater than Blur This kind of attack is only possible, which creates a kind of barrier for Blur.

Secondly, platforms that use the Bid Pool method to stimulate Liquidity must have a fee and royalty system with Blur, because excessively high fee and royalty systems will increase the cost and risk of market making and hinder the improvement of Liquidity. Finally, the basis of market making is inseparable from Blur’s fast, efficient and economical experience. Just imagine that when you find that the transaction has increased and Bid wants to cancel it, the platform is stuck...

Opensea's Barriers

Opensea still has two major barriers unbroken under Blur's attack.

One is the Seaport protocol , and the other is daily active users .

Seaport agreement

Because the competition between Blur and Opensea is still a stock competition, and they are competing for the PFP battlefield where transaction demand is the main focus .

However, the final form of NFT is still unknown, but one direction is relatively certain, that is, NFT assets in a vertical field or a specific application are more likely to be traded in its built-in NFT market rather than in a comprehensive trading market.

Because this is the shortest path for users, and it is also easier for the platform to capture the value of the transaction and monitor the data (just as most of StepN's transactions occur on the built-in trading market instead of MagicEden).

Thanks to the existence of the Seaport protocol, Opensea can aggregate all pending orders that use Seaport to establish vertical trading markets, and solve the problem of fragmented Liquidity in these vertical trading markets. But how Opensea can better capture the value of these trading markets is still unclear.

Daily active users

In fact, I am still not sure the main reason behind this. Just according to the data, even when Blur’s transaction volume is 4-5 times that of Opensea, Opensea’s daily active users are still higher than Blur’s. There are several possible reasons:

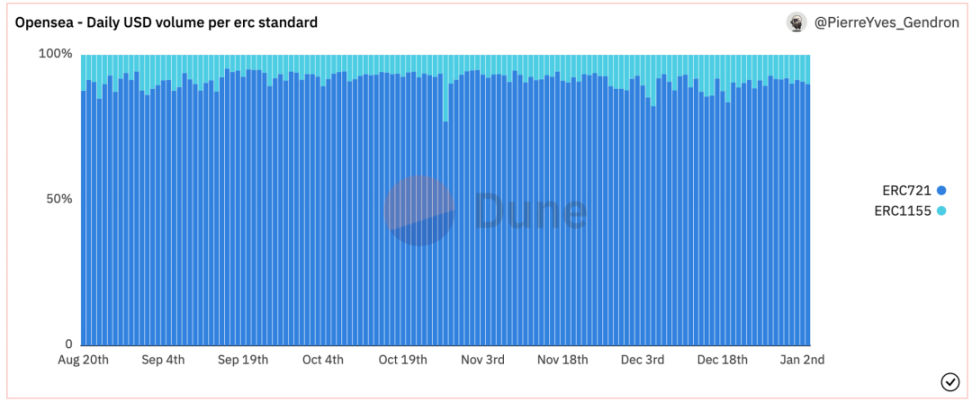

First of all, Blur currently does not support many NFTs that use the ERC1155 type very well , and the transaction volume ratio of ERC1155 and ERC721 is about 1:9, which will make some users use Opensea;

On the other hand, the NFTs of the Art Blocks series generally cannot be traded on Blur , and many Blur transactions and users have been separated, which may be due to Opensea's support for the royalty system, but as the Opensea royalty system benchmarks against Blur, I believe The gap between the two sides in this regard will be gradually smoothed out;

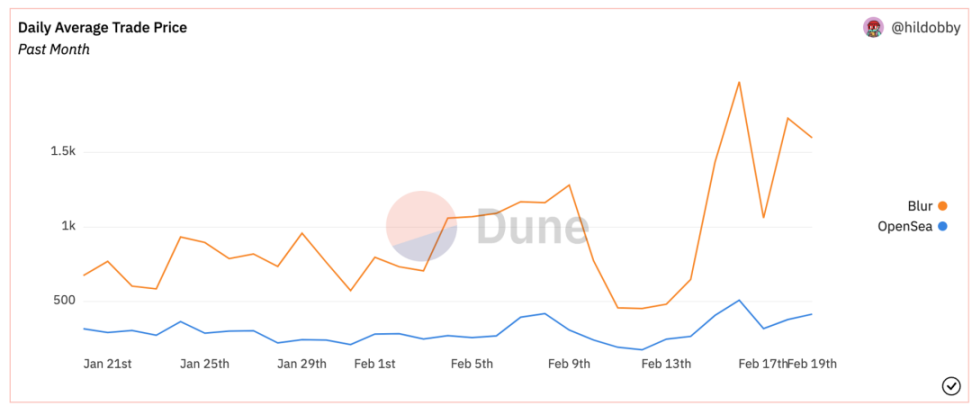

In addition, the average transaction price of Opensea is much lower than that of Blur . It is speculated that some cheap NFTs may have a high transaction frequency. However, due to the price, traders are not so sensitive to royalties and prefer to communicate with their accustomed platforms.

Difficulties with Blur

Even if Blur has done so many things right, there are still many problems in front of Blur and NFT that need to be solved.

no increment

Although Blur has brought Liquidity to the NFT market, it has not brought growth, nor has it changed the views of people who do not play NFT on NFT. The success of Blur is the success of involution, which is also the competition between Blur and Opensea. Different from traditional Internet subsidy competition, Internet subsidies can indeed attract new users.

How to expand this market is a problem that Opensea and Blur need to face together, but for Blur, it is good enough to grab the stock market first and build its own Liquidity barriers.

Anti-Scam

There is always a game between arbitrageurs and platforms, and many skilled arbitrageurs have managed to only collect points without providing real Liquidity.

If you use Bot to monitor the transaction and find that your Bid is about to be sold, you can cancel the Bid with a higher Gas in time, or use a price lower than the Gas Fee to bid, so that the seller’s income from the Bid is lower than the cost of the Gas Fee. Achieve lossless brush points.

Similar methods emerge in endlessly, and Blur's Bid mechanism still has a lot of room for optimization.

The current model is not sustainable

In order to motivate market makers to make markets, Blur needs to continuously release token incentives, but the tokens have no consumption scenarios and no effective empowerment outside of governance, which will lead to a great potential selling pressure of tokens, and Blur has always been no income.

And once Blur tries to start charging transaction fees, regardless of whether it will share the profits to token holders for token empowerment, it will first increase the market-making costs of market makers. There is a basic relationship between Blur’s income and market-making. conflicts, and market making is the current foundation of Blur.

How to continue to motivate in a reasonable way is a question that Blur needs to consider.

On the other hand, the cost for users to participate in Bid & List is in units of Ethereum, and the tokens obtained are indeed in units of Blur. If the price of Ethereum rises and the price of Blur falls, it will cause Blur to subsidize the cost. Spend more Blur tokens, and the total amount of tokens in the treasury is capped.

Ways of token empowerment that may be considered include staking tokens for bribery to change the benefits of Bid and Listing for a specific Collection, etc., but considering that the Blur team is located in North America, there are more restrictions on token empowerment, so Stop imagining.

All in all, how to convert the advantage of the OS into a victory within a limited time window is the next problem for Blur.

Effects of Blur

NFT fi Summer?

Blur has injected Liquidity into the NFT market, especially blue-chip NFTs, and this Liquidity will continue as long as the incentives of tokens can be greater than the cost of market makers.

The increase in Liquidity will bring about the frequency of use of a series of NFTfi products developed around blue-chip NFT, because the increase in Liquidity means the increase in transaction frequency and price change speed, which will also bring various arbitrage opportunities and transaction needs. NFTfi will be needed as a secondary tool.

At the same time, with more and more participants, the difficulty of Blur's market making will definitely increase, and there will be opportunities for products similar to NFTfi smart pools to help users provide Liquidity for the NFT market in an optimal way while obtaining income.

The market-making demand for NFT has increased

Due to the visualization of Liquidity, in the future, as the market-making risk continues to increase, most of the natural market-making funds will flow to assets with better quality and better Liquidity. For most long-tail NFTs, if the project party does not conduct market-making , will only pull the hips more and more.

At the same time, for new project parties, if the project does not provide Liquidity, it will lower user expectations to a certain extent. Market making provides a new dimension of NFT operations, so the demand for professional NFT market making will increase.