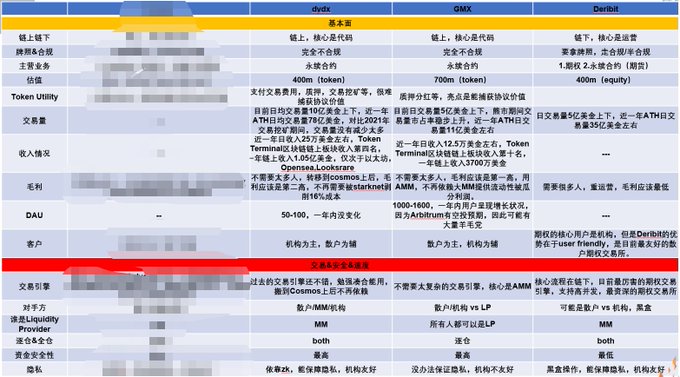

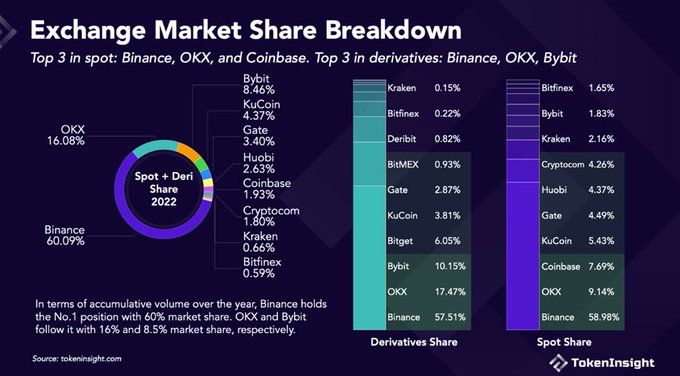

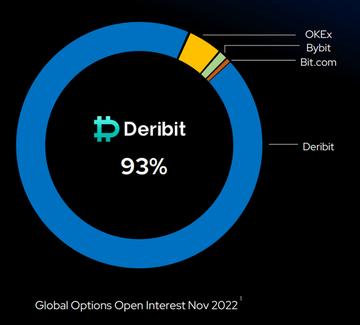

In CEX, Binance+Ok+Bybit occupies most of the market of off-chain Derivatives(perpetual contracts). Deribit, which uses options as its biggest selling point, only accounts for 0.82% of the trading volume in the Derivatives, but it occupies 93% of the market share in the options subdivision track.

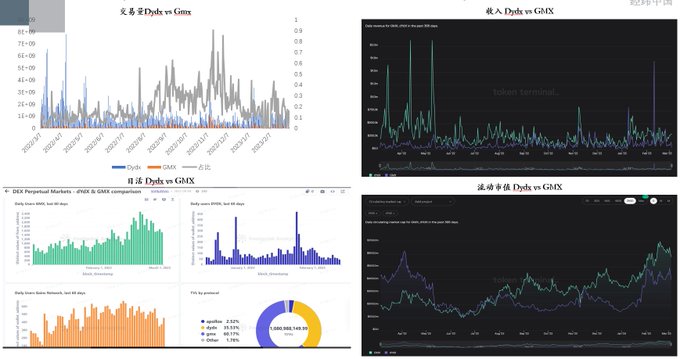

• Among Dex, GMX and dYdX occupy the vast majority of the on-chain Derivatives trading market. It took GMX a year to slowly eat away at the trading volume of dydx.

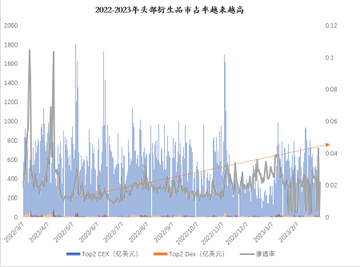

The market share of on-chain Derivatives is increasing

• Judging from the data from February 2021 to March 2023, the market share of top Derivatives is getting higher and higher, and the market share has gradually increased from the original 0.033% to nearly 4%.

• Note: The large fluctuations in the penetration rate in 2023 are due to the lack of data for some days in dydx, which may be due to system maintenance and other reasons.

nDydx is an order book perpetual contract exchange built on Starkware in 2021. Dydx built its own Appchain through starkware. Users only need to link their wallets to log in to Dydx, and then recharge funds into the appchain network to use it (actually Cross-chain). When a user opens and closes a position, the matcher will match the order, the sequencer will sort the order, and then upload the result to the chain. Except for a small gas fee, most of the experience is the same as CEX

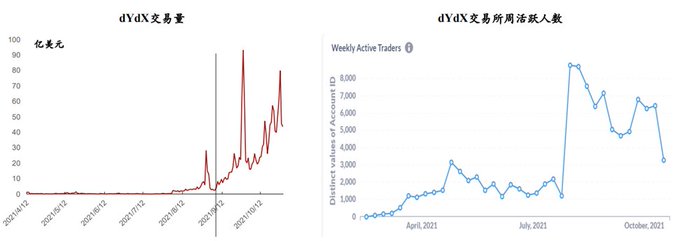

nDydx can explode in the second half of 2021 because of the adoption of transaction mining, that is, issuing tokens to encourage users to trade on the protocol; for market makers who provide Liquidity, a greater degree of discount will be given. Therefore, the trading volume and DAU of dydx have increased significantly during the transaction mining period, and the market value of circulation has reached nearly 1.5 billion US dollars, and the current market value is about 370 million US dollars. But transaction mining is not a long-term solution, and the money printing machine will stop printing money one day

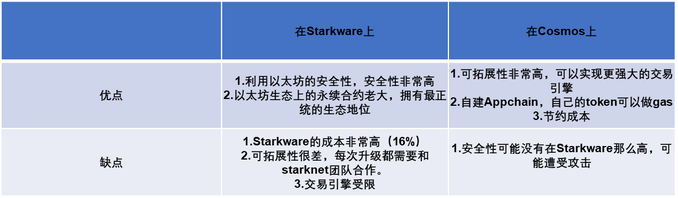

In June 2022, Dydx announced its departure. The V4 version left Starkware and used the Cosmos SDK to build its own Appchain. Dydx's traditional order book model has been running smoothly so far. However, in the transaction mining stage where the transaction volume and users have increased significantly, dydx has already shown some lag.

As dydx official said: "The problem with every L1/L2 we develop is that they cannot achieve high throughput. The existing dYdX products process about 10 transactions per second and 1000 orders/cancellations per second. The goal is to expand the above-mentioned transactions to a greater magnitude.” Compared with the trading experience of binance, the on-chain exchanges represented by dydx are still not smooth enough, and Starkware needs to charge transaction commissions (about 15%)

Using the Cosmos SDK, dydx can build its own Appchain. In the future universe, each validator of dydx will run an in-memory order book, and the Order-book stored by each validator will eventually be consistent with each other. On a real-time basis, orders will be matched together across the network. The resulting transactions are then submitted to each block on the chain. This allows dYdX V4 to have extremely high Order-book throughput, possibly 100 times the current throughput

In addition, the layer2 appchain represented by dydx has the problem of excessive centralization (but users may not care at all). That is, dydx relies on a unique sequencer every time a block is generated, and the sequencer can arbitrarily sort blocks to earn MEV. However, using Cosmos' validator set can solve the problem of decentralization

The model of nGMX is more similar to AMM, that is, the model of common acceptance of all LPs + price feeding by oracles. A large number of traditional market makers are no longer needed here, LPs only need to deposit tokens such as ETH/ BTC/USDC into the LP pool. Different from the happy bean model of dydx/gravity/cex, that is, market makers provide U as Liquidity, and users open positions with collateral such as U to buy contracts instead of physical tokens; GMX is an AMM with physical transactions.

Assuming that the price of ETH fed by the oracle machine at this time is 1000U, and the user uses 1000U security deposit to open 10 times leverage, then the user needs to borrow 9000U from the pool, which is enough to buy 10ETH in the pool. Pen gas completes the above process. When closing a position, assume that the price of ETH fed by the oracle machine is 1100U, then the user will swap 1100U*10 ETH to the LP in the pool, and the user will make a profit and all LP pools will lose.

GMX is a retail investor, with high DAU, high market value, and low income dYdX is an institution, with low DAU, low market value (partly because the token itself does not capture the value of the protocol), and high income

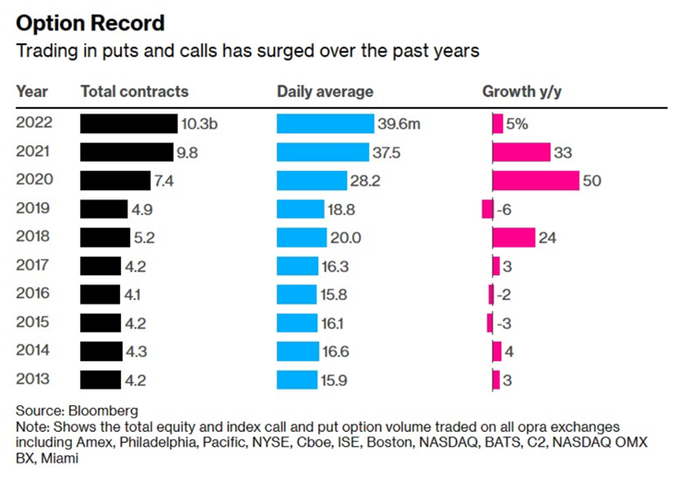

The North American traditional options market will usher in greater growth throughout 2020. Unlike the growth of the options market before 2020, which was driven by traditional institutions, the core growth of the US stock options market in 2020 comes from retail investors. The epidemic has led to unemployment/shutdown/release of water, and a large number of retail investors have poured into trading platforms such as Robinhood, Schwab and Etrade, making stock trading activity rise to a ATH.

According to data provided by Robinhood, 3 million new stock trading accounts were added in Q1 2020, and the average age of users is 31 years old, and half of them have no investment experience. Subsequently, option investment with higher risks and higher leverage became more popular, and the trading volume of options in 2020/2021/2022 increased significantly.

According to the current interview results, Bybit/Okex/Binance will focus on the development of options business from Q3Q4 in 2022. The core is because the spot/contract is already very heavy when the market is not good, but the option market has not yet been fully developed, and the profit margin of the option market is higher than that of the spot/contract, so the above three exchanges began to expand options market + cannibalize deribit market share.

The core logic of their expansion of options is: 1. They have seen the large-scale growth of the traditional financial options market in North America. 2. This part of the growth comes from retail investors. 3. If the crypto market becomes bigger and bigger, the risk seeker of this part of the US stock options will be slower. Slowly come to the currency circle to speculate on options 4. Comparing with traditional finance, the crypto option market has a very large room for growth 5. Deribit should not be the only one

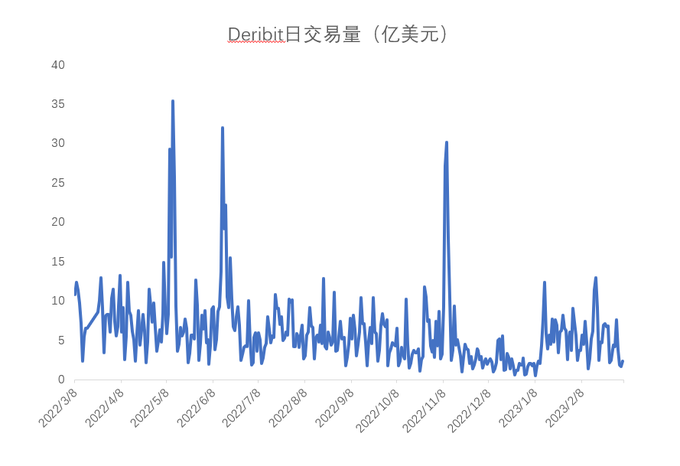

Among the CEXs, Deribit is the only one, with a valuation of 400 million US dollars in 2022. The daily trading volume fluctuates around 500 million US dollars, and the peak daily trading volume reaches 3.5 billion US dollars. • Doing options is different from spot and Derivatives. A professional option trader needs a complete set of options management tools. For example, the option trader at UBC/GS has a special option board to assist the trader in placing orders and making judgments.

This set of option management tools requires about a year of work by 20-30 code farmers who understand trading to be implemented, and many specialized option market makers and trading institutions are blocked from option trading. Deribit has been working for a year or two to complete the infra of options. In addition, Deribit has made 16 risk models, but compared to the 32 risk control models of traditional finance, Deribit is still 30-50 years behind traditional finance.

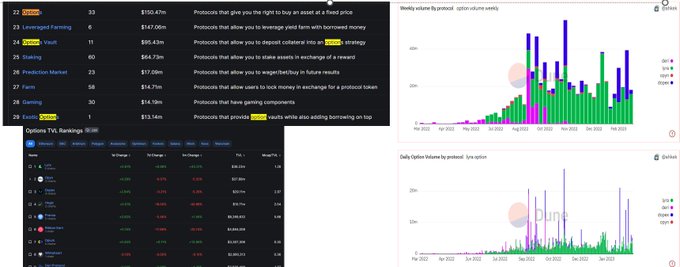

Compared with Deribit's daily trading volume of 500 million US dollars, the daily trading volume of the on-chain options market is less than 5 million US dollars. Most of them adopt the Vault+ AMM model, which is not so much for special traders. Packaged into financial products to attract Farmers to farm. And to make Orderbook options on the current public chain, due to the need for high concurrency + performance, the current Infra is actually not perfect.

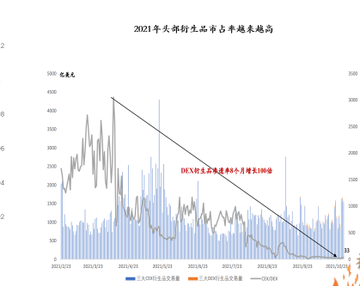

Review the starting volume paths of the two decentralized Derivatives exchanges that are currently starting up. •The reason for the starting amount of dydx comes from transaction mining + big bull market. In July 2021, Dydx started transaction mining, the time was very correct, and it was in a state of violent bull market, and dydx has won the support of many investors. Therefore, from a 2C perspective, retail investors will think that dydx transaction mining will bring high AirDrop, so they switch to dydx to start transaction mining.

Dydx has a good market maker to make the market on the chain, which can guarantee Liquidity and depth, and at the same time, give MM a lower Maker/Taker rate to ensure depth and transaction volume. With the right time and place, dydx will reach a maximum market value of 1.4 billion US dollars by the end of 2021. The highest daily transaction volume during transaction mining was 9 billion U.S. dollars, WAU8000; now the daily transaction volume is about 1 billion U.S. dollars, DAU100. For dydx, large institutions > users.

n• The GMX starting amount comes from product innovation + expected plucking. GMX completely adopts the trading mode of AMM. Compared with the traditional order book relying on MM to provide Liquidity, GMX only needs to inject funds into the pool, and users can complete a perpetual contract transaction relying on the oracle quotes, which can achieve zero slippage and avoid the need for the trading engine to The problem of matching orders off-chain. In addition, Arbitrum has AirDrop expectations, and many users are masturbating on arb

Therefore, in GMX, we have seen the contrarian growth of users + trading volume in the bear market, but even though GMX’s weekly activities (about 11,000) are much higher than DYDX’s daily activities (50-100), the market value of GMX(700 million) is also greater than that of Dydx ( 400 million), but the overall trading volume and revenue of dydx are still greater than GMX. Of course, it also includes the reason why staking GMX token can obtain agreement income, but dydx does not capture agreement income.

in conclusion