"Gains Network was founded on Ethereum. It was not popular at the beginning. Later, it migrated to the Polygon chain and gradually accumulated business. It was not until the integration of the Arbitrum chain that the market was detonated. As of now, the cumulative transaction volume of the platform exceeds 870,000 , the transaction volume exceeded 34 billion U.S. dollars. Its founder is very good, and only one UI developer was hired in the early stage, while all other work, from business design to code implementation, was done by him alone.” gTrade was launched by Gains Network The first product, which is a decentralized leveraged trading platform, is currently deployed on Arbitrum and Polygon.

1. The core features of gTrade

(1) Synthetic Liquidity pool

Synthetic Liquidity pools are critical to the efficient operation of Liquidity pools. Currently, gTrade uses a DAI-based synthetic Liquidity pool (gDAI pool) to act as a counterparty to leveraged traders. The design of this Liquidity pool has several characteristics:

First, its synthesis mechanism can make the use of funds more efficient.

Second, its synthesis mechanism can make transactions more flexible. Because through the synthetic Liquidity pool, gTrade can provide more leveraged trading pairs, which means that traders can choose trading pairs more flexibly and trade according to market conditions.

Finally, gTrade’s synthetic Liquidity pool can control risks through different synthetic mechanisms, such as reducing risk by adjusting leverage or limiting the size of synthetic Liquidity pools. In this way, both traders and Liquidity providers can participate in the transaction with more peace of mind. dydx adopts the orderbook mechanism, which requires orderbooks to be stored off-chain and market makers to provide Liquidity, so the degree of decentralization is not high and capital efficiency is low.

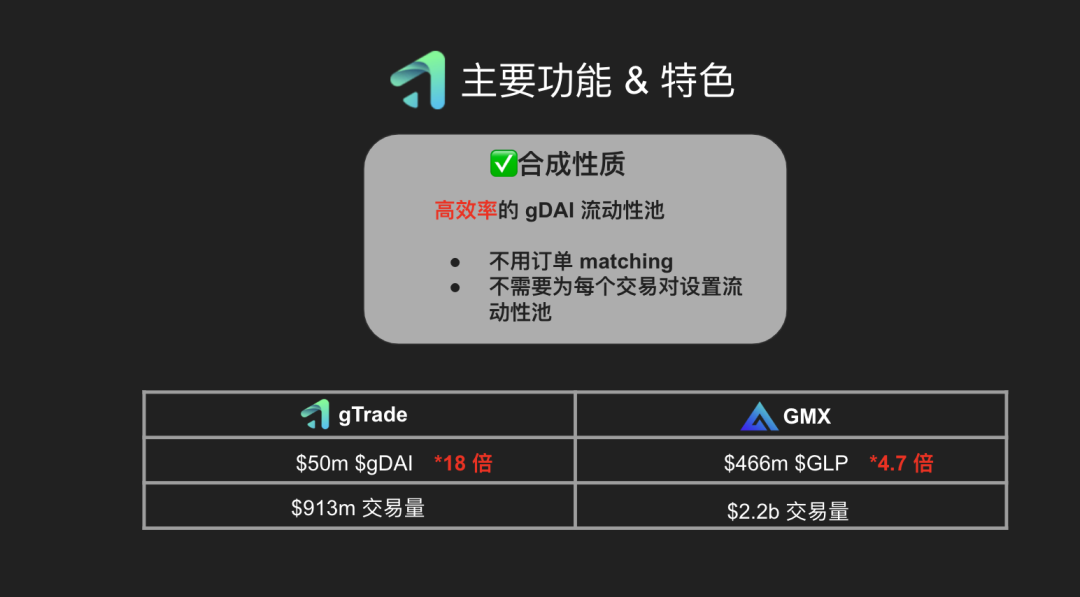

In contrast, gTrade's gDAI pool avoids these problems and eliminates the need to set up a Liquidity pool for each trading pair. Compared with GMX, although they all use Liquidity pools to provide Liquidity, gTrade has shown extremely high capital efficiency.

Taking the data of the past 7 days as an example, the TVL of gTrade’s 50m gDAI pool has achieved a trading volume of 913m, and the Volume/TVL is 18. GMX achieved a transaction volume of 2.2b with a GLP pool TVL of 466m, and the Volume/TVL was 4.7. It is obvious that gTrade's capital efficiency is more than 3 times that of GMX during this period. However, higher capital efficiency also brings some risks, so gTrade has adopted a number of protective measures.

Taking the data of the past 7 days as an example, the TVL of gTrade’s 50m gDAI pool has achieved a trading volume of 913m, and the Volume/TVL is 18. GMX achieved a transaction volume of 2.2b with a GLP pool TVL of 466m, and the Volume/TVL was 4.7. It is obvious that gTrade's capital efficiency is more than 3 times that of GMX during this period. However, higher capital efficiency also brings some risks, so gTrade has adopted a number of protective measures.

(2) Abundant trading pairs

Supporting multiple trading pairs and high leverage at the same time is another important feature of gTrade. It is currently the only on-chain leveraged trading platform that supports 91+ trading pairs. The trading pairs cover three aspects: cryptocurrency, foreign exchange and stocks. The leverage of foreign exchange on the gTrade platform can be as high as 1,000 times, and the leverage of encrypted assets can be as high as 150 times, which is currently impossible for GMX.

(3) Self-made oracle machine

(3) Self-made oracle machine

The oracle machine DON used by gTrade is the bottom layer built by the founders with Chainlink. DON has 8 nodes, obtains prices through APIs of 7 different exchanges, and feeds prices to gTrade in real time. It effectively prevents price manipulation and ensures the accuracy of prices.

There will be pin insertion in centralized exchanges, and this kind of situation will not happen on gTrade. Because the data they get and the subsequent execution are all completed on the chain, 7 APIs and 8 nodes also minimize the possibility of doing evil.

There will be pin insertion in centralized exchanges, and this kind of situation will not happen on gTrade. Because the data they get and the subsequent execution are all completed on the chain, 7 APIs and 8 nodes also minimize the possibility of doing evil.

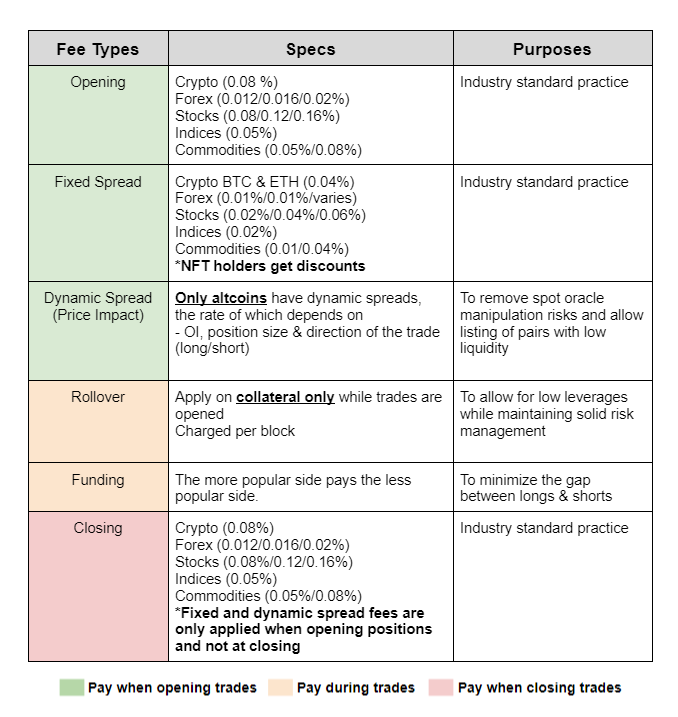

(4) Transaction costs and protection mechanism

1. Fixed Spread

In addition to the basic Opening and Closing fees, gTrade will also charge an additional Fixed Spread. For assets that are more difficult to manipulate, such as cryptocurrencies with large market capitalizations such as BTC and ETH, Forex and US stocks, gTrade sets a fixed fee.

2. Price Impact

Price Impact has a good protection for the security of gTrade, which GMX does not have. Because of this, GMX cannot allow users to trade in small currencies. If the Open Interest of a transaction on the exchange platform is high, but the Liquidity of other exchanges outside the exchange is not high, the Price Impact may be greater.

When the Luna incident happened, the gTrade team adhered to the principle of decentralization and insisted on not intervening in Luna’s trading and delisting. In the end, the market emptied the platform’s Liquidity, and the project was almost in a desperate situation. After the Luna incident, the platform added many protection mechanisms. In fact, in the case of Price Impact fees, the impact of the Luna incident on gTrade is relatively limited, because traders have to pay high Impact fees.

When the Luna incident happened, the gTrade team adhered to the principle of decentralization and insisted on not intervening in Luna’s trading and delisting. In the end, the market emptied the platform’s Liquidity, and the project was almost in a desperate situation. After the Luna incident, the platform added many protection mechanisms. In fact, in the case of Price Impact fees, the impact of the Luna incident on gTrade is relatively limited, because traders have to pay high Impact fees.

3. Rollover Fee

The Rollover Fee will cause the user to always pay the fee during the position holding process, and this fee is related to the volatility of the market, that is, the greater the market volatility, the higher the fee will be. Because the greater the volatility, the greater its impact on gTrade, and the ultimate goal is to allow users to quickly close positions. Recently, the team increased the Rollover Fee. The reason is that the team calculated that if there are some large positions that are hedging and the Rollover Fee is not increased, they can hedge at a very low cost on gTrade and hold positions for a long time, which will cause their Open Interest to become very small, Very few people will be able to actually trade with leverage. So they raised that fee so that these people can't keep holding positions for a long time or hedge on gTrade very cheaply, which is another protective feature of the Rollover Fee.

4.Funding Fee

The biggest difference from GMX is the Funding Fee. The trading method on GMX is that users must pay lending fees to GLP's Liquidity Provider when conducting leveraged transactions. On gTrade, it uses Funding Fee to balance short and long traders, so the side with more positions will pay less fees. It is precisely because of the way the Funding Fee balances long and short traders that leveraged trading on gTrade is more balanced and fair.

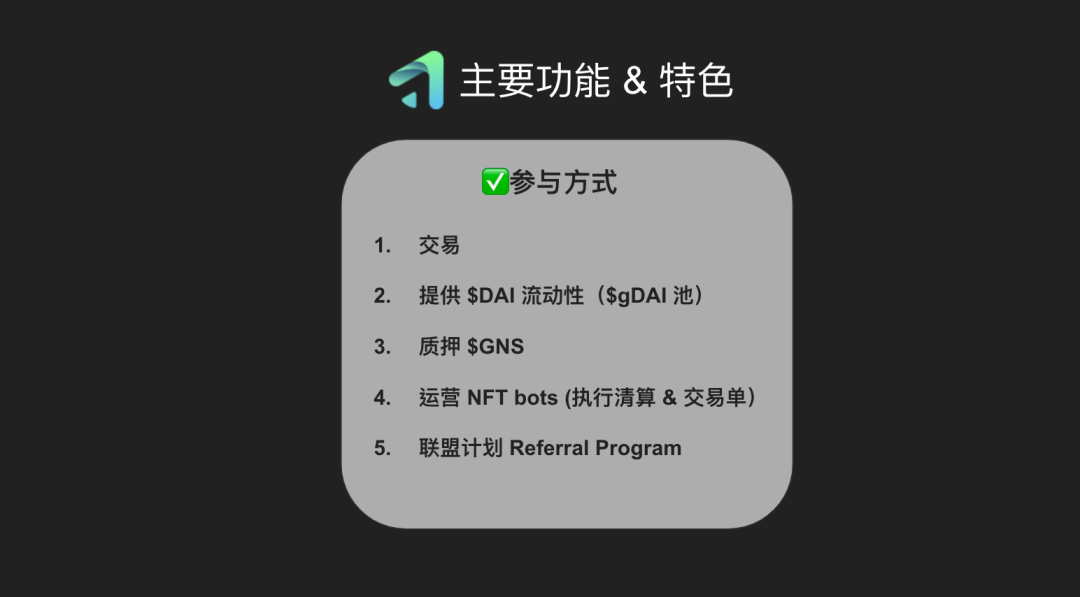

In addition, gTrade has other protection measures, such as a maximum return of 900%, a transaction can only earn a maximum of 900%, and automatically close the position when the 900% return is obtained; if the user's collateral or principal loss reaches 90% , it will also automatically help users close their positions. These protective measures can ensure that users will not take excessive risks when conducting high-risk leveraged transactions. Ordinary users can generally use the following functions when participating in gTrade:

gTrade is a leveraged trading platform that provides a good trading environment for users who are good at trading. At the same time, it also provides many other ways to play DeFi. Since it is a groundbreaking platform, you can earn by providing Liquidity to its Liquidity pool. gDAI pools have many characteristics, and most Liquidity trading platforms that provide liquidity with single-currency collateral often face the risk of losing money when traders make a lot of money.

gTrade is a leveraged trading platform that provides a good trading environment for users who are good at trading. At the same time, it also provides many other ways to play DeFi. Since it is a groundbreaking platform, you can earn by providing Liquidity to its Liquidity pool. gDAI pools have many characteristics, and most Liquidity trading platforms that provide liquidity with single-currency collateral often face the risk of losing money when traders make a lot of money.

However, gTrade has adopted a variety of mechanisms to reduce the risk of loss in the gDAI pool, making it almost close to zero. In addition, Gains Network also has its own token, GNS, which is a widely used token that will empower the platform with governance functions in the future. Currently, holding GNS tokens can be deposited into Gains Network to share platform revenue. In addition to this, all types of transactions on gTrade are executed through decentralized NFT bots.

Therefore, if you want to perform corresponding operations, you must hold the corresponding NFT. The target users of gTrade are those who want to trade. If you have the corresponding resources, you can also try to apply for the Referral Program.

2. gToken Liquidity pool

Regarding the gToken Liquidity pool, gDAI is only its first collateral, and it will also add gETH, gBTC, gFrax, gLUSD and other collaterals in the future. The risk of USDC did cause some panic, which also inspired the team to prioritize this requirement higher. At present, we are rushing to launch the next more decentralized Liquidity pool. If the next launch is gETH, traders can use ETH as collateral, and those who provide Liquidity can get ETH as income. It is worth noting that the biggest difference between gTrade and other similar agreements lies in the settlement method of gTrade.

If you use one ether to open an order, if your trading pair increases by 10%, your profit is 10%, calculated in ether. In contrast, the settlement method of GMX 's leveraged transaction is done in USD price, but the profit paid to the trader depends on whether the trader is long or short. If the trader is long: GMX will use their long trade Assets pay profits; if traders are short: GMX will pay profits in the form of Stablecoin. The Liquidity operation of gToken is as follows: if you are a depositor and want to deposit DAI, the receipt you get is gDAI, and you put the DAI in, and you get a receipt (this is actually an ERC20 token) currency, you can use it on other DeFi protocols). If you go to withdraw money, you take the gDAI back, it burns the gDAI, and you can take out your DAI. Currently gTrade only has one trading pair, gDAI, but it is worth noting that even though it now only has $50 million in gDAI, it has already processed 18 times the volume. If the team adds more collateral, the trading volume can be expanded even more, so gTrade has greater expansion potential than GMX.

What's so special about gToken?

What's so special about gToken?

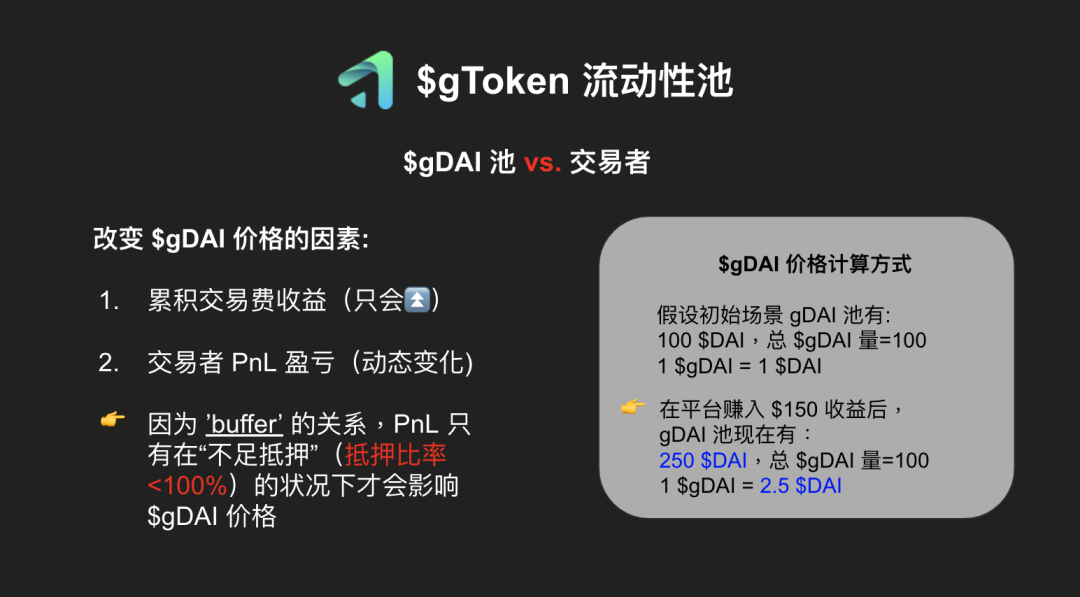

As mentioned earlier, its gDAI pool is the counterparty of the trader, that is to say, if the trader makes a profit, he will take DAI from the gDAI pool, and if the trader loses money, the trader's DAI will enter the Liquidity pool. When the user deposits DAI, he can get the receipt gDAI from the pool, which represents the depositor’s share in the pool. There are two factors that can affect the price of gDAI . The first factor is the transaction fee accumulated in the transaction, the transaction fee It is the opening and closing fees mentioned above, and this part will only rise forever . The second factor is the profit and loss of the user's counterparty, but it will only affect the price of gDAI under the condition of insufficient collateral, because it also has a buffer protection layer. The calculation method of gDAI price is quite simple. Suppose the pool has 100 DAI in the initial scenario, and then its total gDAI circulation is 100. Now the value of one gDAI is one DAI.

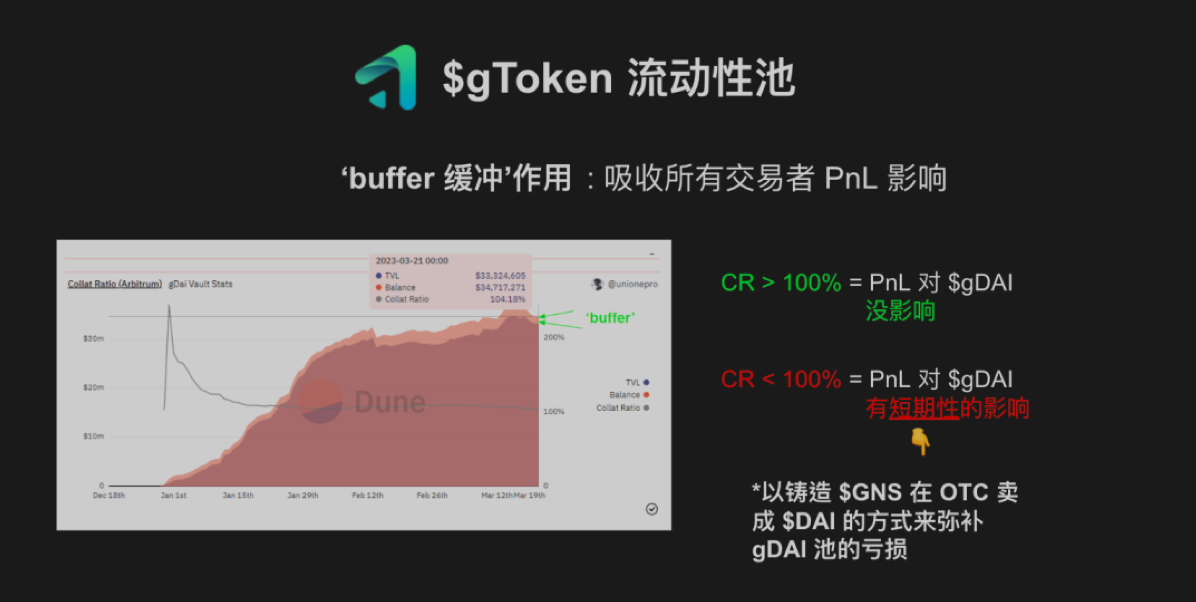

If the platform now earns $150 in revenue, there are now 250 DAI in the gDAI pool, but the circulation of gDAI is still only 100. At this time, the value of one gDAI is 2.5 DAI. What is the buffer? To explain buffer, we must understand the mortgage rate of its gDAI pool. Its mortgage rate will be affected by the trader's profit and loss. Each of its Epoch will settle the trader's profit and loss, as long as the earned fee is greater than the trader's Profit and loss expenses, then this Epoch will have a positive return on income. If we go to their website, in the Vault and CR section, we will see a lot of numbers when we pull down the data, but there are two numbers, one is TVL, and the other is Collateration mortgage rate. The gap between these two data is relatively high. Its price difference is its buffer, its protection layer. To calculate its CR is to divide the total collateral value by TVL, and this percentage is its buffer.

In Dune Analytics, we can see that the bottom part of its gDAI pool is 100%, and the extra 4% is the buffer. Its balance is actually higher than TVL. What does it do? The main function is to absorb the impact of the trader's profit and loss.

When its mortgage rate is greater than 100%, the trader's profit and loss has no effect on gDAI at all. Only when the mortgage rate is less than 100%, the trader's profit and loss will have a short-term impact on gDAI. It must be emphasized here that short term. Because at this time, the agreement will start to mint GNS and sell it into DAI in the form of OTC to make up for the loss of this gDAI pool.

The gDAI Liquidity pool basically has three protection layers. The first protection layer is the buffer. With the buffer, the profit and loss of the trader has no effect on the gDAI holders. The second protection layer is his TVL. When the buffer disappears, the trader's profit and loss will start to affect the price of gDAI, but at this time GNS has already started to be minted to make up for the loss of this pool. The third layer is that while the GNS is being minted, the platform is still operating normally. On the one hand, the agreement has income, and on the other hand, traders may lose money to replenish the Liquidity pool. Ultimately bring the pool back to 100% in these three ways. The gDAI pool is iterated from the previous DAI pool. Compared with the DAI pool, the gDAI pool has one of the biggest characteristics, that is, you can do many things with gDAI. It becomes an ERC20 token with automatic compound interest. It allows you to play various Lego combinations in Defi. All shares in the gDAI pool share profits and losses. Because it is a homogeneous token, it is impossible to have a situation like in the previous FTX incident where you can withdraw money earlier, but you may not be able to withdraw later, and you have to bear all the losses for the people behind.

As mentioned earlier, there are two factors that can affect the price of gDAI. The first factor is the fees charged by the platform, which will never change. It will only drop a little in the short-term undercollateralized, but that's short-term. When its pool is replenished and the mortgage rate returns to more than 100%, the income you earned before still belongs to you. Then, there is a very interesting point here, which is the incentive mechanism described in the third item in the figure. When the mortgage ratio is insufficient, it will provide you with a very good opportunity to buy gDAI. why? Because what you buy at this time is actually helping the gDAI pool, so you can get corresponding benefits.

As mentioned earlier, there are two factors that can affect the price of gDAI. The first factor is the fees charged by the platform, which will never change. It will only drop a little in the short-term undercollateralized, but that's short-term. When its pool is replenished and the mortgage rate returns to more than 100%, the income you earned before still belongs to you. Then, there is a very interesting point here, which is the incentive mechanism described in the third item in the figure. When the mortgage ratio is insufficient, it will provide you with a very good opportunity to buy gDAI. why? Because what you buy at this time is actually helping the gDAI pool, so you can get corresponding benefits.

Also, in the incentive mechanism, it will have a discount. Under normal circumstances, the mortgage rate remains above 100%, and it decreases linearly between 100 and 150%. The higher the mortgage rate, the lower the discount rate. If it reaches 150%, there is no corresponding discount rate. gDAI is extremely composable. It is an ERC20 token. By locking the position, that is, through a time limit to promise not to exit the pool for a period of time, the user can also get a corresponding discount.

But in this case, the user's holdings will be expressed in the form of ERC721 tokens. It is a very high-quality collateral of choice because its value increases steadily, barring a very extreme black swan event. In addition, it has a time lock for withdrawals. When the mortgage rate is less than 110%, users need to wait for three Epochs, and one Epoch is 72 hours, which is 9 days. The Epoch system is actually very secure. An Epoch is three days. The first 48 hours is the only time you can apply for or withdraw funds, and the trader's profit and loss settlement will be executed on the last day.

Therefore, throughout Epoch, when users withdraw funds or apply for withdrawals, they actually do not know whether the Epoch protocol is making money or losing money. That way, frontrunning or cash grabs don't happen.

3. Application Scenarios of GNS

GNS is a utility token, and the relationship between GNS and the gDAI pool is very close. When the mortgage rate of DAI is less than 100%, GNS will be minted and then sold to fill the gap in the gDAI pool. When overcollateralized, 5% of the trader's profit and loss income will be used to repurchase these GNSs. Also, there is a case where GNS is minted. This situation involves NFT bots and referral programs, why would they want to participate? Because there is income, this income is the minted GNS. But these GNSs were not forged in thin air. Their minting is entirely derived from actual income - that is, the actual income of the gTrade platform, that is, DAI.

However, what the motivators get is not DAI, but GNS. This means that these DAI will go into the buffer, thereby increasing the assets of the buffer and enhancing the protection of the gDAI pool. In conclusion, the actual number of GNSs is completely dynamic. How much it is minted depends on demand. It is minted when it needs to be minted, and destroyed when it needs to be destroyed. As long as it burns more than it mints, GNS will deflate. Its minting amount is capped at 0.05% per day.

Therefore, the maximum annual inflation rate is only 18.25%. This upper limit is unlikely to be reached except in extreme circumstances. After all, the mortgage rate cannot be less than 100% every day. Because the gTrade platform is still making money, traders are still losing money, and these earnings are calculated every day. At present, the inflation of GNS is negative, which means that its burning is greater than its casting.

4. NFT bots

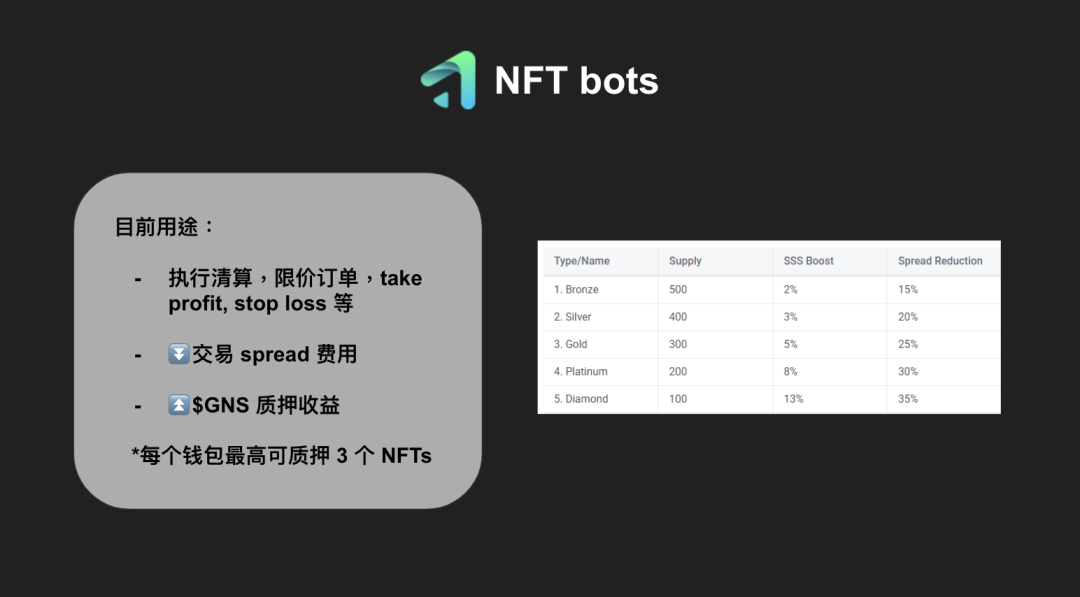

The NFT bots just mentioned are used to perform all automatic functions on gTtrade, including settlement, liquidation, new orders, take profit, stop loss and other functions.

Another function is that for large traders, it can reduce the spread fee of the transaction, which is actually quite considerable, so its NFT is very expensive now. If these holders have pledged GNS, they can increase the pledge income of their GNS. A wallet can pledge up to three NFTs. If you hold the three NFTs of Bronze, Silver and Gold, you can add them up. 2%+3%+5% is 10%. That is to say, if you With pledged GNS, the income can be increased by 10%. If you're doing the deal, you'll get up to 25% off.

Another function is that for large traders, it can reduce the spread fee of the transaction, which is actually quite considerable, so its NFT is very expensive now. If these holders have pledged GNS, they can increase the pledge income of their GNS. A wallet can pledge up to three NFTs. If you hold the three NFTs of Bronze, Silver and Gold, you can add them up. 2%+3%+5% is 10%. That is to say, if you With pledged GNS, the income can be increased by 10%. If you're doing the deal, you'll get up to 25% off.

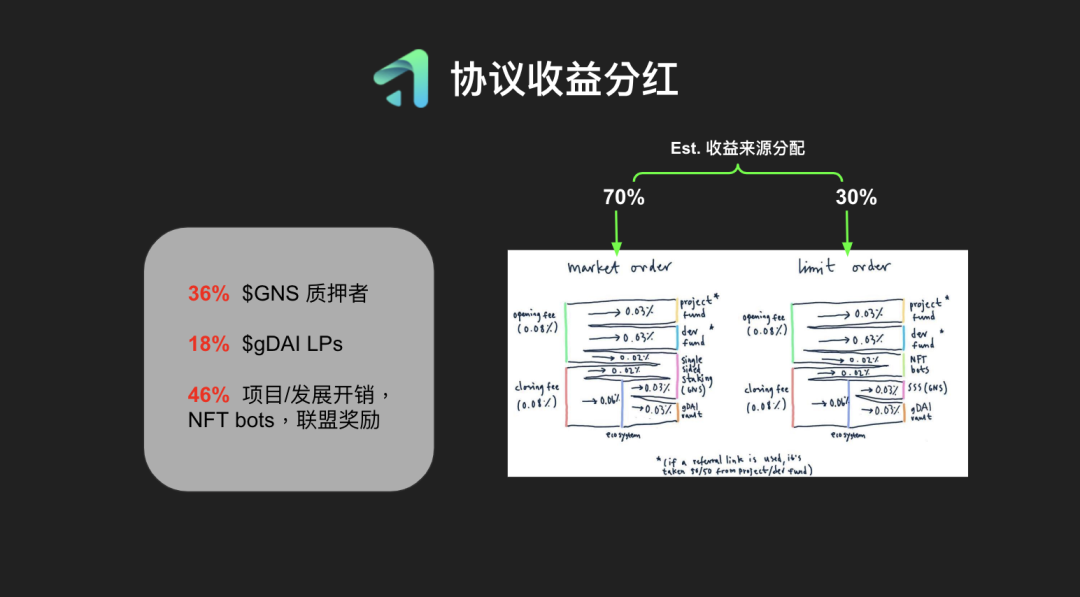

5. Agreement on dividends

GNS now has two revenue sources, one from Market Order and the other from Limit Order. Roughly 70% of the source of income is obtained from its Market Order. Through calculation, it is found that GNS pledgers can get 36% of the platform income, gDAI Liquidity Provider can get 18% of the platform income, and the rest It is issued to project development expenses, NFT bots, and alliance rewards. For comparison, GMX stakers can get 30% of the platform's revenue, and Liquidity Provider can get 70% of the platform's revenue.

For GMX, Liquidity Provider take more risks, and LP must bear the impact of traders' profits and losses. But it is the GNS staker who bears the greatest risk on the Gains Network. Of course, his income is also higher, and the income he earns is twice that of the Liquidity Provider.

For GMX, Liquidity Provider take more risks, and LP must bear the impact of traders' profits and losses. But it is the GNS staker who bears the greatest risk on the Gains Network. Of course, his income is also higher, and the income he earns is twice that of the Liquidity Provider.

Summarize

Gains Network provides users with a brand-new Liquidity pool solution by introducing gToken tokens, and handles a large amount of transactions, showing the efficiency and sustainability of its Liquidity solution. The success of Gains Network lies in its keen perception of user needs and quick response to market changes. The platform continuously introduces new solutions to meet the different needs of users, and continuously improves its existing services to provide users with a more complete DeFi experience.

DeFi Derivatives are a track with greater business opportunities than the spot market. Gains Network has continuously iterated in a bear market environment and has grown into a leading player in the decentralized leveraged trading track. market recognition. It is believed that with the continuous addition of gToken pools, gTrade will capture a larger market share in the increasingly competitive Derivatives track.