Produced by: TchFlow Deep Tide

Author: 0xmin

"Vinegar can't be guarded against", the PEPE myth has begun to make everyone feel anxious about other people's rich stories.

At this time, there will always be a large number of articles using very academic theories to demonstrate the rationality of MEME, stories/emotions/incentives, etc... But in my opinion, the success of MEME coins lies in its simplicity, directness and honesty. There are not too many incomprehensible technical language and false propaganda, and it can quickly attract attention with zero cognitive threshold. One of the most important features of the encryption industry is the financialization of attention and traffic. The competition is to use narrative and price to capture public attention ability to force.

MEME is also rebellious, and he itself represents a kind of banter, sarcasm and low-level resistance.

One is a king-level project, cutting-edge technology, which claims to be able to change the world, and has a large number of top VC support. Of course, the chips are also in the hands of the project party and VC. The token economics is very violent, with a small amount of circulation and high FDV. With the project party/ VCs continued to sell, and a large number of retail investors became the price of Liquidity exit.

One is a pure MEME project, without any practical value, let alone any technical support. The token economics is open and fair, and everyone plays games in the Liquidity pool.

As a retail investor, how do you choose between the two?

At least from the current point of view, it is difficult for retail investors to rely on VC projects with high FDV to "make a fortune". MEME uses its exaggerated wealth stories to attract attention, but it has become a life-saving straw for many losers. This is different from the early Bit Similar to coins, they have no practical value, and everyone gets them fairly (mining). With one story after another, they get out of the circle and gradually become the consensus of the industry.

Another factor that has been overlooked is that the rise of every ** MEME ** is inseparable from "big brother", another name of big brother is "banker".

Undoubtedly, Doge ’s boss is Musk, the big brother who publicly called out orders; SHIB ’s early big brother was also Musk, although it may be unintentional or passive, and then a large number of whales and Jump and other market makers poured in, supporting its strong market value.

Who is the big brother behind PEPE?

By analyzing the holding addresses of a large number of PEPE in the head, it is found that a large number of early buyers hold a kind of NFT - Milady.

For example, the address ETH that bought 0.125 ETH PEPE on the first day holds a large amount of Milady and the same project remilio. At present, he has realized more than 6 million US dollars, and the account still has PEPE worth more than 9.7 million US dollars.

In addition, the new address of one of the multi-signature wallets that manages 6.9% of the total supply of PEPE, its earliest ETH comes from an on-chain address that holds a large number of Milady's fellow project Remilio.

According to the person who holds Milady, he first discovered and purchased PEPE on April 17. At the same time, a large number of Milady holders who bought PEPE cashed out their profits and increased their positions in Milady, which led to a continuous surge in the floor price of Milady amid the recent downturn in the NFT market.

In general, it can be confirmed that there is a mysterious NFT community and Chinese forces who bought PEPE together in the early stage, which became the key driving force for the early growth of PEPE.

How to spot a promising MEME?

Execution/information channels are indispensable, and sometimes a little fate is needed.

The core point is early detection, either off-chain or on-chain.

Off-chain, mainly rely on Twitter or communities, track high-quality Twitter bloggers and community dynamics, and stay curious and concerned about the early Alpha projects mentioned in them.

On the chain, through @lookonchain and other bloggers or by yourself to find early buyers of a Token on the chain, and mark the address, so as to track their purchase behavior and position changes on the chain.

Here are some of the tools I use frequently :

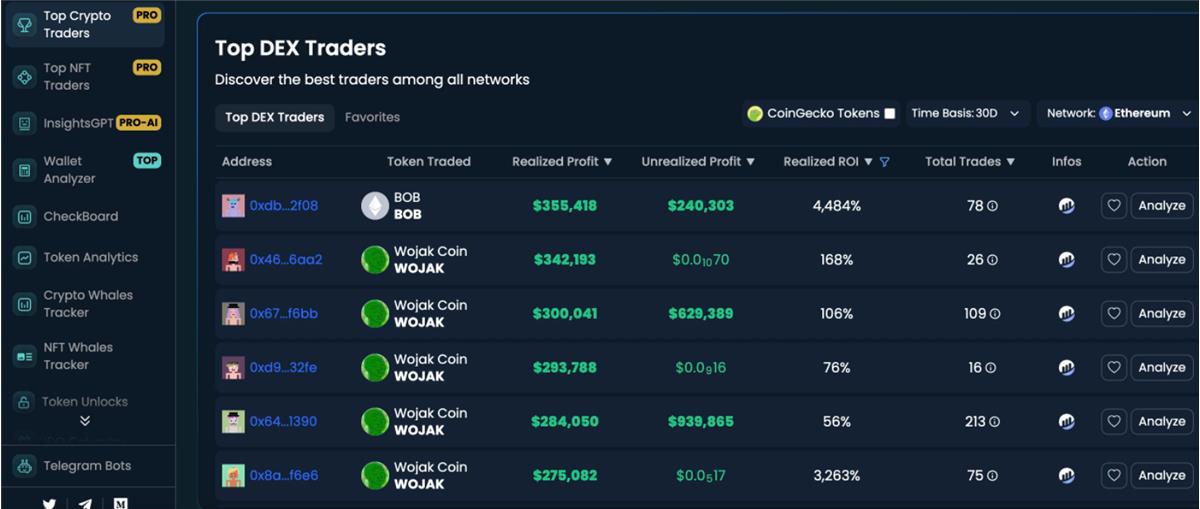

https://dexcheck.io/ @DexCheck_io

Find out that on-chain traders are currently mainly trading Token/NFT that is profitable, track whale movements, and perform on-chain analysis (code audit, position distribution) on a single Token.

https://dexscreener.com/ethereum @dexscreener

The DEX visual aggregation platform can find out which currencies are currently mainly traded in DEX.

https://debank.com/ @DeBankDeFi

Track changes in smart money's on-chain positions.

https://bubblemaps.io @bubblemaps

Check the distribution of Token holdings. Some of them are particularly centralized. If a few wallets control most of the circulation, you must be vigilant.

There are many scams in MEME coins, try this tool to detect whether the item is Pixiu.

Finally, I wish everyone a fortune in MEME.

https://www.techflowpost.com/article/detail_11822.html

Deep Tide TechFlow is an in-depth content platform driven by the community, dedicated to providing valuable information and thinking with attitude.

Community:

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Enter the WeChat group to add assistant WeChat: blocktheworld