Original title: Here's what @a16z is betting on for the next bull run

Original Author: MooMs

Original source: Twitter

Compilation: Lynn, MarsBit

Wondering what's next for cryptocurrencies?

Here are @a16z's bets on the next bull run.

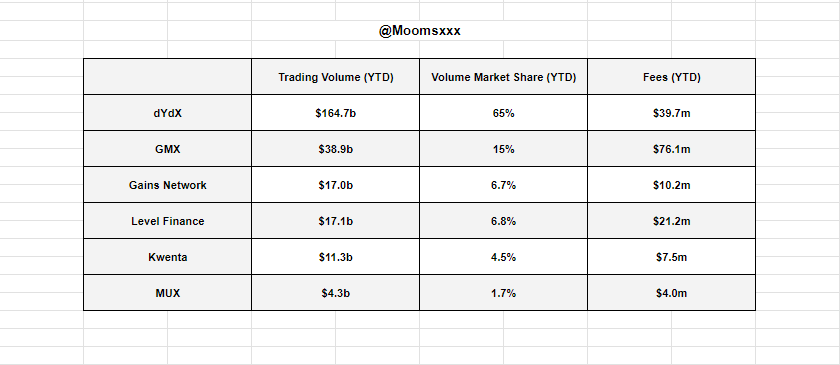

1/ @dYdX

dYdX is one of the first perpetual DEXs launched in DeFi. Currently, dYdX still has more daily trading volume than all other competitors combined.

Amount raised: USD 87,500,000

Co-investors: @paradigm, @polychaincap, @Dragonfly_xyz, and others.

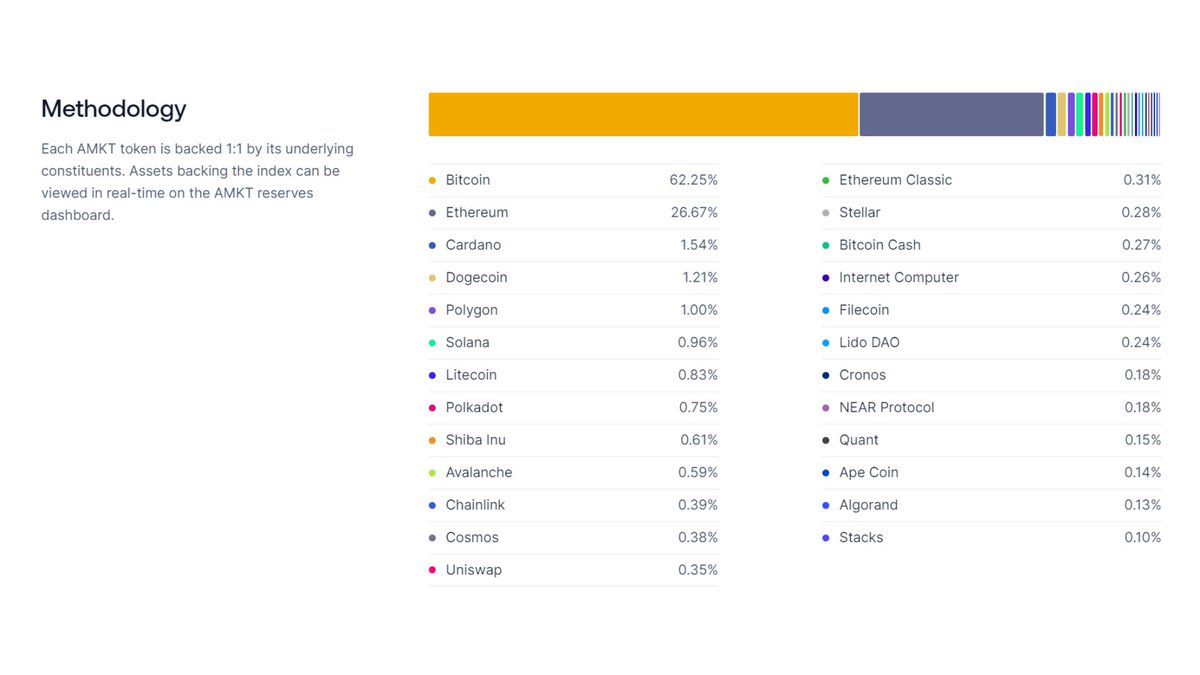

2/ @alongsidefi

AMKT is a cryptographic index token designed to provide market exposure to a market cap-weighted basket of 25 assets, rebalanced monthly and restructured quarterly.

Amount raised: USD 11,000,000

Co-investors: @coinbase, @FTI_Global, and others.

3/ @LayerZero_Labs

LayerZero is an interoperability protocol for the omnipotent chain, which realizes Cross-chain applications through optical nodes on the chain.

Amount raised: USD 263,000,000

Co-investors: @Binance, @Circle, @coinbase, @sequoia, and others.

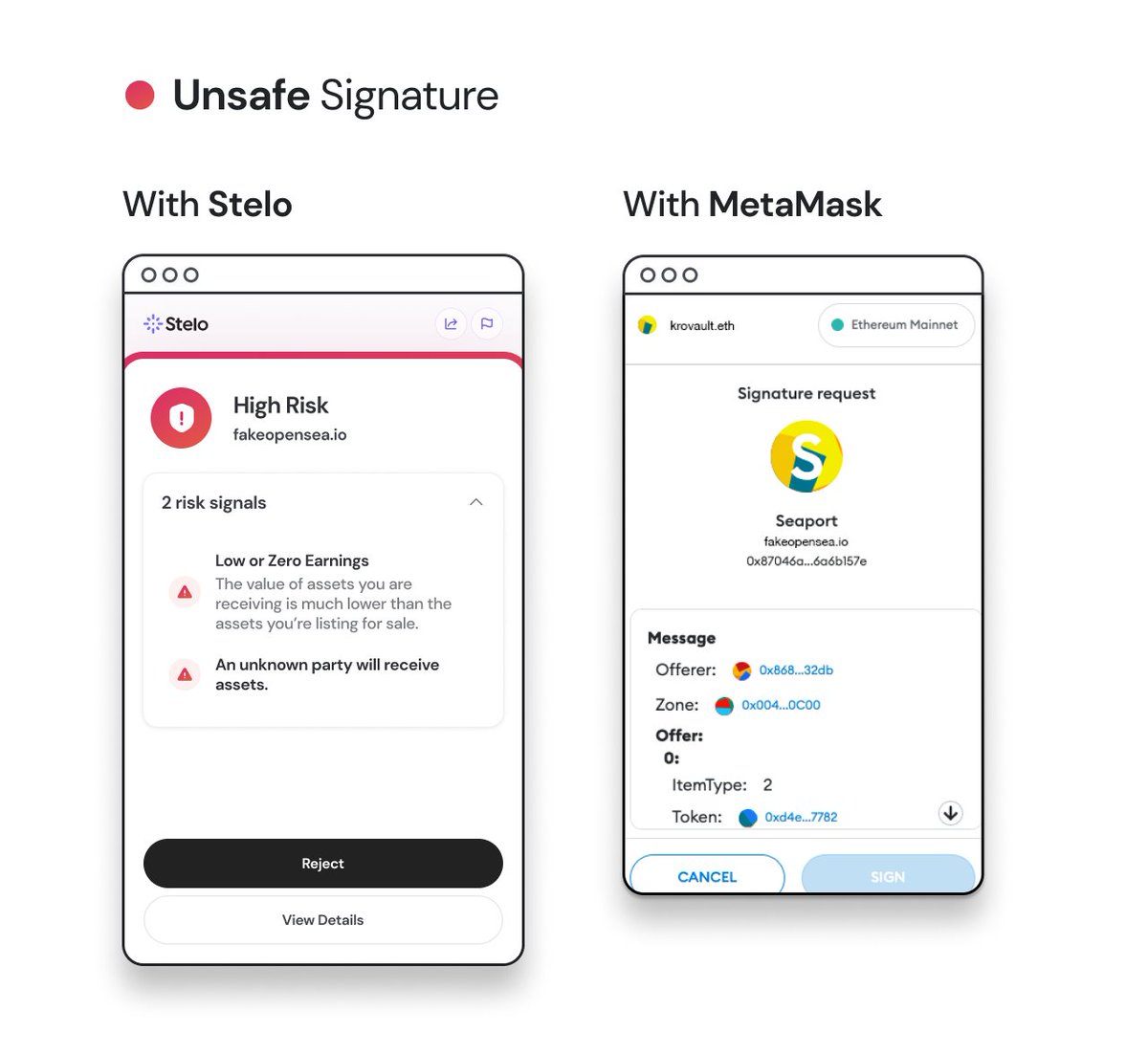

4/ @stelolabs

Stelo is a browser extension that helps protect crypto assets from Web3 phishing by conducting predictive risk assessments and providing an easy-to-read interface.

Amount raised: $6 million

Co-investors: @opensea and others.

5/ Going forward, newcomers will enter the Web3 space and may lose their funds at any time, a protocol like Stelo is clearly needed.

Don't sleep on it.

Go install it and keep your funds safe.

6/ @zksync

zkSync is a Layer 2 protocol that scales Ethereum by increasing its throughput while maintaining its decentralization and security.

Amount raised: USD 458,000,000

Co-investors: @BitDAO_Official, @ConsenSys, and others.

7/ @goldfinch_fi

Goldfinch is a decentralized credit platform that enables real-world lending on the blockchain, collateralized by real-world assets rather than cryptocurrencies.

Amount raised: USD 37,000,000

Co-investors: @coinbase, @OrangeDAOxyz, and others.

8/ With the RWAs narrative gaining traction and more growth expected, it's worth keeping an eye on $GFI, even if its chart looks like a rollercoaster ride.

9/ @aztecnetwork

Aztec, similar to zkSync, is a private ZK- Rollup on Ethereum that enables decentralized applications to gain privacy and scale.

Amount raised: USD 119,000,000

Co-investors: @coinbase, @paradigm, and others.

10/ @syndicateio

Syndicate allows users to create a DAO of roughly 99 participants, pool their capital, and then vote as a group on where the funds will be invested.

Amount raised: USD 28,000,000

Co-investors: @coinbase, @paradigm, and others.

11/ The concept behind this is quite interesting to me, especially given the growing popularity of venture DAOs.

Imagine the possibility of opening a DAO with your close friends in minutes and collectively investing in early-stage projects.

12/ @weareflowcarbon

Flowcarbon provides investment strategies and solutions, from carbon project origination and financing to credit sales and corporate carbon portfolio management.

Amount raised: USD 70,000,000

Co-investors: @CeloOrg and others.

13/ @TrueFiDAO

TrueFi is a credit protocol for real-world and crypto-native lending managed by TRU holders.

To date, TrueFi has originated $1.7 billion in loans and received $1.5 billion in repayments.

Amount raised: USD 32,500,000

Co-investors: @BlockTower, @Jumpcapital, and others.

14/ blue chips

Finally, a16z has made significant investments in major protocols such as:

$ COMP $LDO $UNI $MKR $ETH -20232023202320232023- 4- $SOL$ AVAX