L2 This business strategy can bear fruit quickly, but I hope you don't waste your money.

Author: David

Produced by: TechFlow Research

Doing L2 seems to have become a craze recently.

From emerging projects to established public chains, L2 solutions are being actively explored and implemented.

On July 17, Mantle Network, a modular L2 solution using Optimistic Rollup , was incubated by BitDAO and launched mainnet;

On July 18, the L2 solution Linea developed by Consensys, the Metamask company of Metamask, also opened the mainnet Alpha version;

Earlier, Coinbase also announced the test network of its L2 solution BASE.

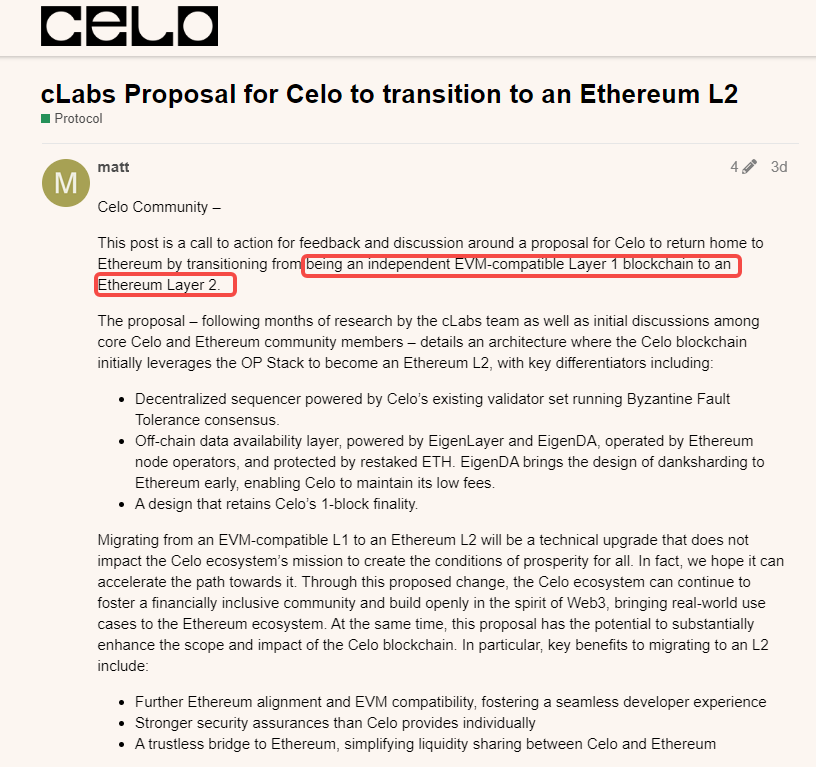

Recently, even the old public chain CELO issued a proposal in its internal forum, calling for its own development direction to be changed from an independent Layer1 public chain to an L2 solution compatible with Ethereum.

I vaguely remember the battle for the new public chain two years ago. All the princes appeared as "Ethereum killers" and tried to "kill" Ethereum; now they get together to build L2, which is more like "Ethereum Builder". Optimized to "share" Ethereum's performance issues.

These are two completely different ideas: the former competes head-on, while the latter is elegantly parasitic.

Now, why are everyone eager to invest in the embrace of L2, but can’t see the phenomenon of getting together to build a new public chain? Is it because the new public chain is not popular, or can L2 really bring new narratives and benefits?

L2, a business with faster results

We won’t repeat Mantle and Linea’s L2 solutions from the very beginning. Their external narrative is nothing more than improving the scalability of ETH and reducing costs, creating a better interactive experience for applications and users.

And CELO , which is a public chain that is originally L1, chooses to be L2. The first intuitive reaction is "compromise and backtracking"-the public chain that competes with ETH solves the shortcomings of Ethereum through a way that cannot be broken or established, that is, "myself We can do better”; and in turn, choosing to become the L2 of Ethereum is quite a sign of surrender and joining.

For the reason, let’s take a look at what CELO himself said:

The benefits brought by compatibility, security and mobility cannot be refuted, but the author thinks that the core interests have not been touched: what is it that determines whether a project chooses to do a separate L1 front-end, or take advantage of the situation to parasitize on Ethereum, Use the L2 method to staking the land?

The answer is costs and benefits.

The article "Rollup is a good business" from Lightning HSL provides a very good business perspective: whether it is developing L1 or L2, it is to solve existing problems and create value. From a business standpoint, however, L2 appears to be making more money.

Business model: L2–> Equivalent to ETH main chain function–>lower gas fee, faster speed–>attract dapp and users–>increase transaction volume on the chain;

L2 income: the gas fee paid by users for transactions on the L2 chain;

L2 expenditure: L2 operators regularly package and upload Rollup transactions in batches to Ethereum L1, and pay gas fees;

The difference between income and expenditure is the approximate gross profit of operating the L2 Rollup model ; therefore, as long as there are more applications and TVL on L2, more user transactions may be generated, making L2 operators relatively fixed in expenditure. Increase income and increase profits.

In terms of cost, Rollup does not need to develop a complex consensus mechanism, and it does not need tokens in theory (even if the current project has one). At least one server is needed to start and run, and the most core technical components can use Optimistic Or Arbitrum to build, it is equivalent to have a complete open source solution, the difficulty is definitely lower than doing a single L1.

In contrast, the cost and difficulty of developing a new public chain (L1) are much higher:

- First of all, you need to develop a consensus mechanism that the market can buy, which requires a lot of research and development resources, time and accumulation;

- Secondly, you need to attract enough nodes to participate in your network to ensure the security and decentralization of the network;

- Finally, you need to build some differentiated narratives, such as focusing on privacy or security, etc...

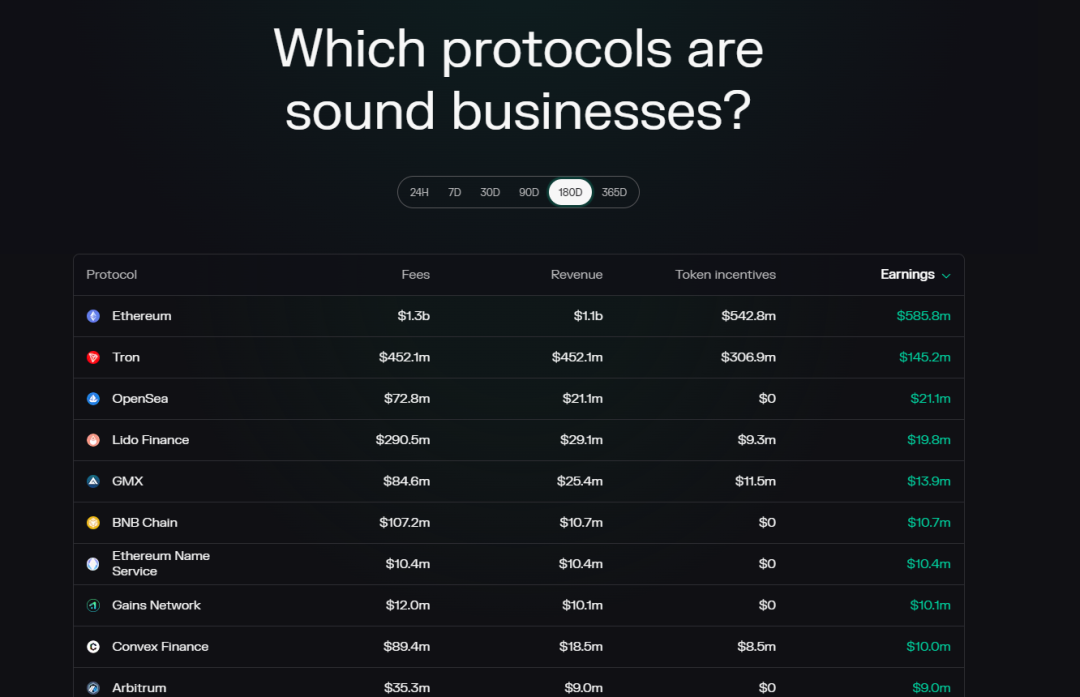

At the same time, the data is also confirming the cost-benefit analysis.

According to data from Token Terminal, among the top ten projects by revenue in the past six months, if we only look at the public chain layer, only Ethereum, Tron and BNB Chain are shortlisted, and Arbitrum in L2 is also in this ranking. Considering the comparison between these L1 and Arbitrum in terms of construction time, it is clear that Arbitrum is more cost-effective in terms of net income.

In addition, in a bear market environment, it is more difficult to raise funds for VCs, and it is even more difficult for retail investors to buy it. Building a new L1 from the primary market to the secondary market will inevitably go through twists and turns. The project party itself realizes the Token through the capital market. The way to earn money has obviously become more difficult, so it is far less practical and cost-effective than making an L2.

Instead of going from 0 to 1 to a public chain full of characteristics, which requires a large investment and slow results; it is better to parasitize in the L2 of Ethereum, with a small investment and relatively fast results.

What is more important is the "traffic business" , that is, where the users come from.

As mentioned earlier, TVL and transaction volume are the key to whether L2 can obtain income, which depends on the entry of more users.

Coinbase, Metamask or Binance do L2, which can naturally introduce existing users in their CEX or wallet business into L2 through product integration, which has incomparable advantages for start-up teams in terms of customer acquisition costs;

The conversion of L1 such as CELO to L2 can also migrate existing users on L1, but more incentives and guidance may be needed.

But in any case, projects and capital choose to do L2, most of which start from the stock users in their own product ecology or Ethereum ecology, and then expand to more cooperation scenarios (such as Polygon's actions in the Web2 field).

L1 is the Dead Sea, and L2 is close to the Red Sea?

The above analysis is only based on some internal characteristics of L1 and L2, but if we look at the external competitive environment, it is easier to understand the choice of L2.

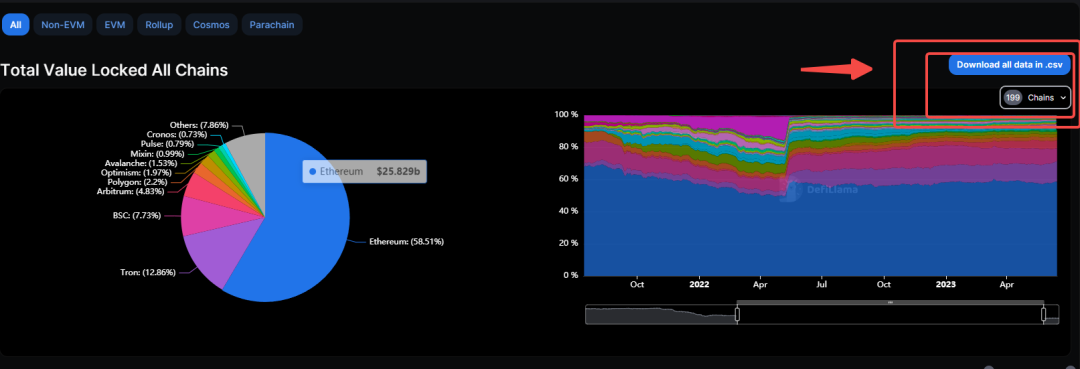

According to data from DeFiLlama, there are currently nearly 200 public chains on the market. Excluding the dozens of L2s included, it probably means that we are facing nearly 190 L1 public chains.

Therefore, the current L1 track is more like the Dead Sea: the salt (density) exceeds the standard and the competition is fierce.

There are only a few public chains that occupy the minds of users, not to mention that with the black swan incidents and the withdrawal of capital in recent years, many public chains that were once popular are now active in various types of users, income composition, transaction volume, etc. Gone from the metrics dashboard.

Most of the L1s, the concept is still there, but not full of vitality. Choosing to jump into the Dead Sea is not a wise choice from a business point of view.

In contrast, the large pool of L2 will be slightly better.

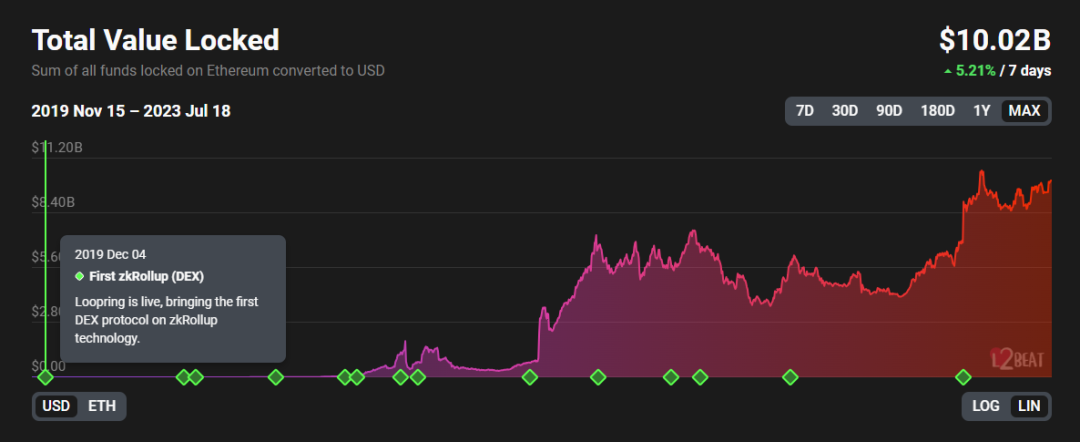

The total TVL of L2 is still in a growing upward trend in the long run;

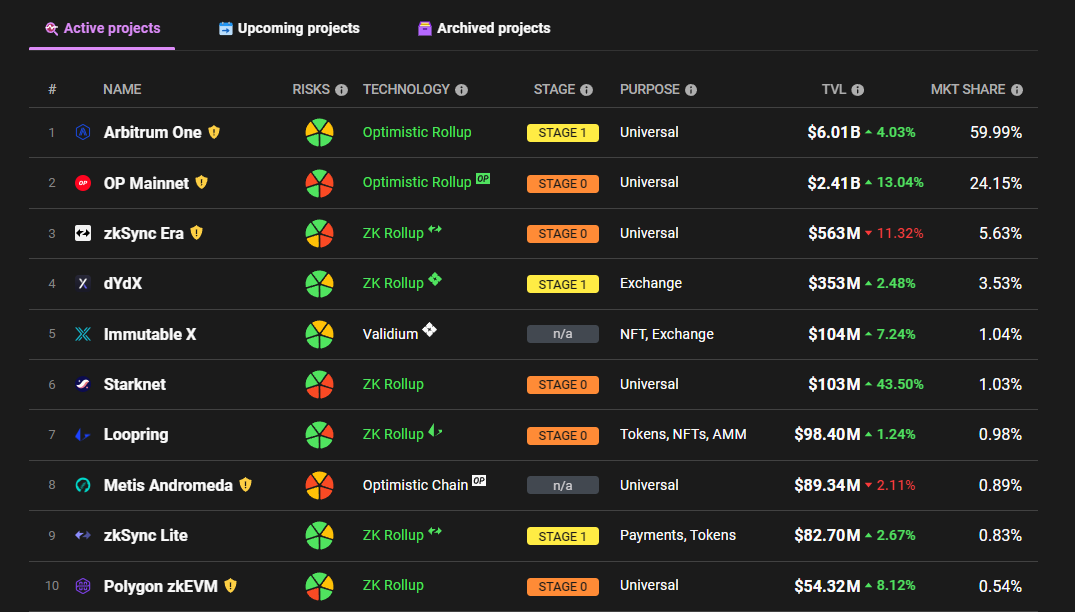

In terms of competition pattern, currently L2Beat can count 26 L2, and the competitive pressure is about one-seventh of L1. At the same time, in terms of market share, although ARB and OP have two major players, the market share of other projects is relatively scattered and average, and there is a greater chance of another major player.

However, considering the technical architecture, L2 of different technology stacks in the stock market already has typical representatives:

- OPtimism and Arbitrum with Optimistic Rollup ;

- Those using Zk-Proof include Zksync and Starknet;

- Base built on OP Stack;

- Linea, an EVM compatible chain launched by Consensys;

- Zk-EVM from Polygon etc….

Although it is not a blue ocean, there are still opportunities compared to L1.

With the completion of the technical upgrade of Ethereum this year and several subsequent upgrades, the narrative around performance will exist for a long time, and L2s still have a long development window; Not much, L2 also has the advantage of continuing to be noticed in an environment where attention and funds are scarce.

Therefore, from the perspective of the competitive landscape and the external environment, doing L2 seems to be a profitable business at present.

Who does L2's business serve?

Outside of business, the author feels a kind of "redundancy" in the circle.

We often see a project migrate from one L1 to another, from supporting one L2 to supporting more L2s. Projects are running around across the chain, while the chain itself is growing.

If you change the ecology, you will be able to staking the land again, gather another wave of resources, and capture another wave of users. L1 and L2 are like undeveloped colonies to some extent, ignoring the differences in technical details, the same business can come again in another place.

Do we need so many "places"? Who do so many places serve?

Capital needs, hair pulling needs, scam needs, narrative needs... only normal needs may not be needed.

If all L2s are indiscriminately talking about lower cost and faster speed, what is the essential difference between them?

After all , as an end user, the technical process is not important. In the case of consistent use results, the increasingly volume L2 can be a substitute for each other.

History shows that after the new public chain movement, Ethereum is still the same Ethereum, but it has grown stronger in the competition.

Will the same be true for the current state of L2? From the blue sea to the red sea to the dead sea, after a round of money spreading, the density of projects is getting higher and higher, and finally only one or two projects remain on the surface of the water, and there may not be many users in the pool.

L2 This business strategy can bear fruit quickly, but I hope you don't waste your money.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.