guide

The RWA narrative has been hot recently.

With the continuous expansion of the user base, real asset tokenization (RWA) is in a stage of rapid growth. In an environment where the Federal Reserve continues to raise interest rates, investors are reaping huge returns through tokenized U.S. bonds.

Recently, Binance Research Institute released a report on the RWA market situation, which deeply analyzed the development status, ecosystem and main participants of RWA.

The content of the report shows that traditional financial institutions are also actively deploying the RWA market. Goldman Sachs, Fidelity Financial, etc. have launched related businesses, and some institutions have built their own private chains for asset tokenization. Regulatory departments are also studying the direction of RWA regulation.

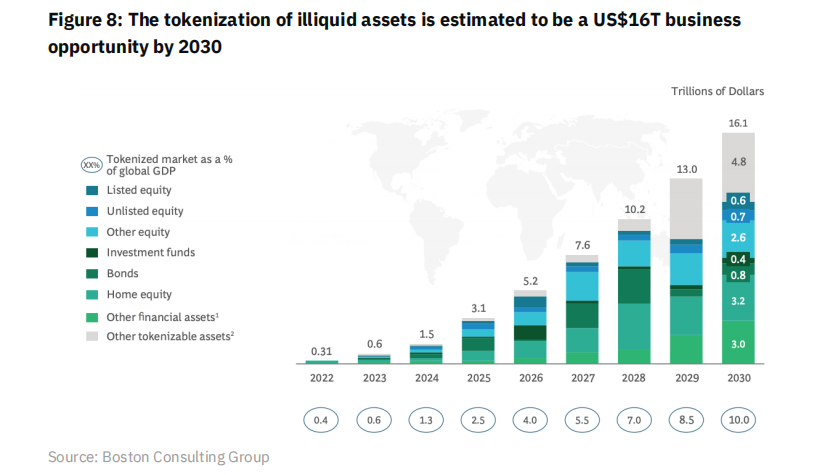

The report predicts that the total value of tokenized assets will reach 16 trillion US dollars by 2030, with huge room for growth. RWA is profoundly changing the way of asset circulation and opening a new era of integration of traditional and digital assets.

TechFlow compiled and interpreted the report, and systematically sorted out the development trend of RWA, so that readers can fully understand this emerging and fast-growing market.

Key Takeaways:

Tokenization of real-world assets (RWAs) continues to gain momentum as user adoption increases and large institutional investors step in;

Rising interest rates, combined with relatively low decentralized finance (DeFi) yields, have fueled the growth of RWAs, especially tokenized treasuries.

Investors currently effectively lend more than $600 million to the U.S. government through the tokenized treasury bond market, and are rewarded at an annualized rate of return of approximately 4.2%.

It is estimated that by 2030, the market size of tokenized assets will reach 16 trillion U.S. dollars, which shows huge room for growth compared with 310 billion U.S. dollars in 2022.

Many protocols have already integrated RWAs or are participating in their growth. MakerDAO, Maple Finance, and Ondo Finance are briefly introduced in this report.

RWA Definition and Market Overview

Definition of RWA : Assets that mortgage physical assets and bring them to the blockchain through tokenization, including real estate, bonds, commodities, etc.

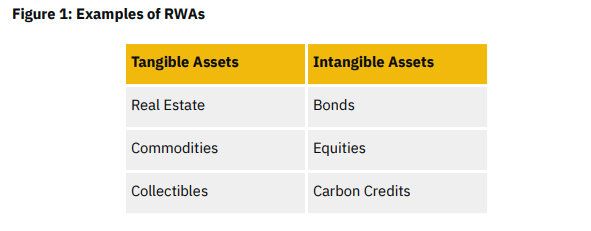

Types of RWAs :

Tangible assets: real estate, commodities, collectibles

Intangible assets: bonds, stocks, carbon credits, etc.

By tokenizing RWA, market participants can enjoy greater efficiency, greater transparency, and reduced human error as these assets can be stored and tracked on-chain.

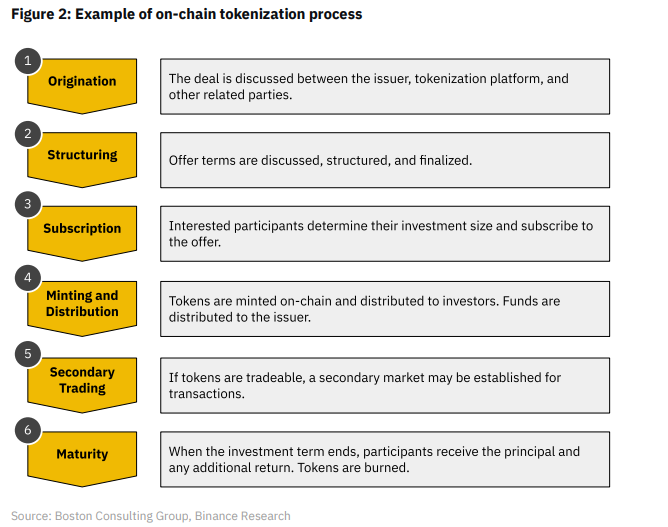

The general process of RWA on-chain is summarized:

Origin: Asset issuers, token platforms and relevant parties discuss on-chain matters;

Conception: Discuss, conceive and finalize the offer terms;

Subscription: Participants who are interested in the asset decide the size of their investment and subscribe to the asset;

Mint and Distribution: Tokens are minted on-chain and distributed to investors. The amount raised is distributed to asset issuers;

Secondary transactions: If the tokens are tradable, a secondary market may be established to facilitate the circulation of token transactions;

Maturity stage: When the term of the investment expires, the participant receives the principal and additional returns. Tokens are destroyed.

RWA ecological panorama:

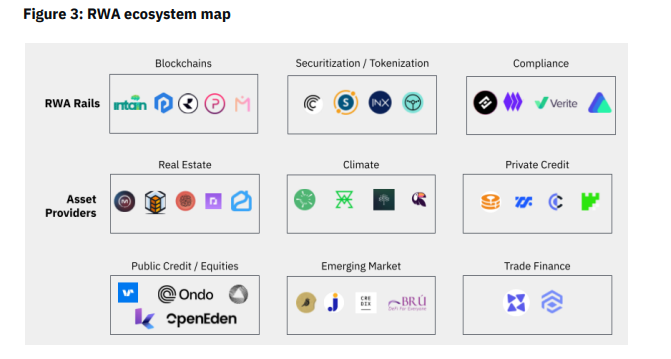

The RWA ecosystem has diversified and steadily expanded. The report divides RWA-related projects into two broad categories:

RWA Rails : Provides the regulatory, technical and operational conditions that RWA relies on, and is called rails (guide rails, meaning guidance or infrastructure)

Asset Provider : RWA demand class that focuses on initiating and creating various assets. These include real estate, fixed income, equities and other

In the ecological panorama, each subcategory can be subdivided into:

Blockchain infrastructure : permission chain and public chain dedicated to RWA, providing infrastructure for RWA.

Securitization/tokenization service : A service that puts RWA on the chain.

Compliance Services : Ensure investors and issuers follow compliance requirements.

Real Estate : The need to develop and create RWA for real estate mortgages.

Climate Assets : The need to develop and create climate asset-backed RWA.

Private Credit : The need to develop and create private credit collateral RWA.

Public Credit/Equity : Develop and create demand for public credit and equity-backed RWA.

Emerging Markets : To develop and create demand for RWA in emerging markets.

Trade Finance : Develop and create demand for trade finance collateralized RWA.

RWA Track Growth Situation and Outlook

Overall situation:

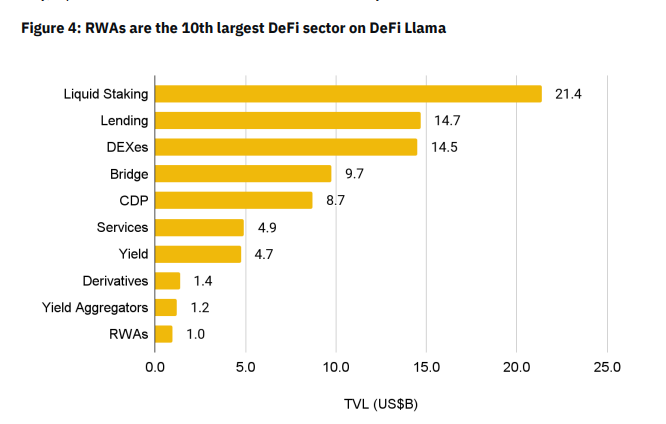

The RWA market is in the early stages of its development but has seen increasing adoption and rising TVL.

According to the protocol tracked by DeFi Llama, RWA has become the 10th largest category in DeFi , with a total locked value of about $6 billion . At the end of June, RWA was ranked 13th. A huge contributor to this rise is stUSDT, which launched in July, allowing USDT stakers to earn RWA-based earnings.

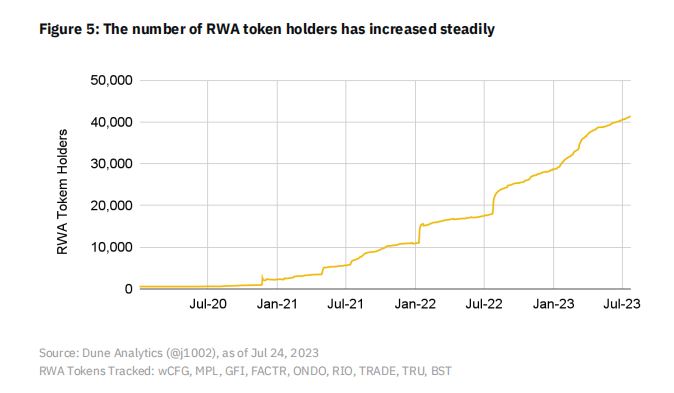

There are currently over 41.3K RWA token holders on the Ethereum blockchain. While this may not seem like a lot, the number of token holders has grown significantly from a year ago, more than doubling. The data for the same period last year was about 17.9K.

The Rise of the US National Debt :

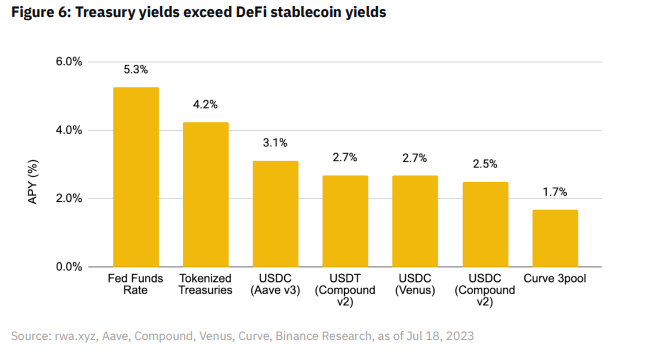

Yields are an important incentive : U.S. Treasuries are widely considered the benchmark for risk-free assets in traditional financial markets. Against the backdrop of rising interest rates, U.S. Treasury bonds

Yields have risen steadily and slightly, and now easily exceed DeFi yields .

And assets always look for the most profitable place, and to prove the utility of RWA, today's investors can invest in tokenized treasury bonds without leaving the blockchain, thereby taking advantage of real world gains.

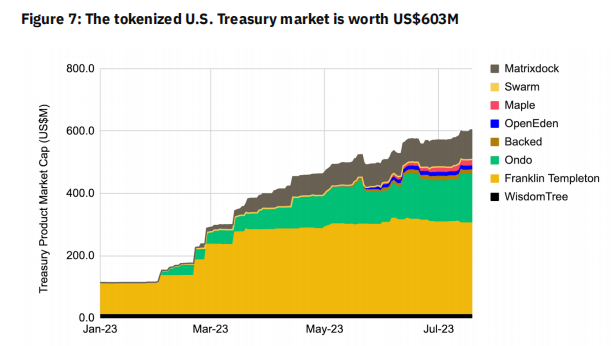

Market size and yield : The tokenized Treasury market is currently worth about $ 603 million, and investors are effectively lending this to the U.S. government at about 4.2% APY.

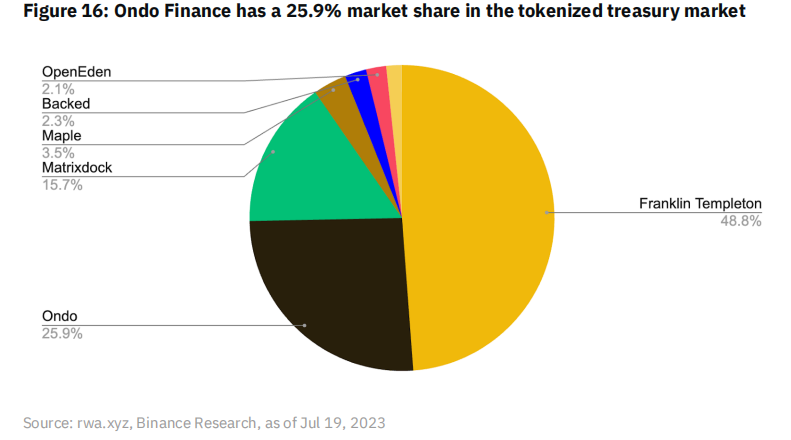

Product Type : Protocols and companies in the treasury market include Franklin Templeton, Ondo Finance, Matrixdock, etc. The founder of Compound, Robert Leshner, also recently announced that he has established a new venture called "Superstate" and has submitted documents to the United States. The SEC will set up a short-term government bond fund and use the ethereum blockchain as a secondary record-keeping tool.

(TechFlow has related introductions in previous podcast notes: Podcast Notes|Talk to the founder of Compound, how does Superstate bring RWA into the encrypted world? )

RWA future outlook

Market space forecast: According to a report by Boston Consulting Group, the market size of tokenized assets is expected to reach $16 trillion by 2030.

By the end of this decade (2030), this will account for 10% of global GDP, a substantial increase from the US$310 billion in 2022.

This estimate includes on-chain asset tokenization (more relevant to the blockchain industry) and traditional asset tiering (exchange-traded funds “ETFs,” real estate investment trusts), among others. Considering the potential market size, capturing even a small portion of the market would be a boon for the blockchain industry.

Protocols that are conducting RWA business

Maple Finance:

Business model :

Maple Finance is an institutional capital network that provides credit specialists with the infrastructure to run on-chain lending operations

Connecting Institutional Borrowers and Lenders

There are three key groups of parties: borrowers, lenders, and pooling agents

Market Size :

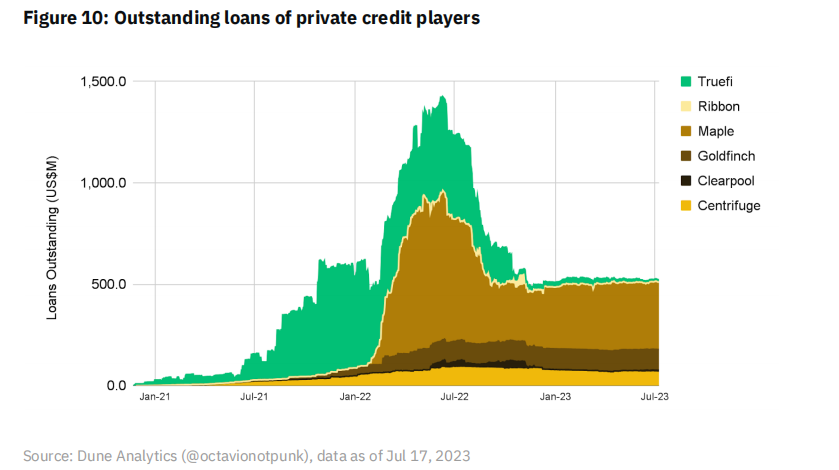

Maple Finance is one of the market leaders in private credit

Currently in its business, it has issued more than $300 million in outstanding loans

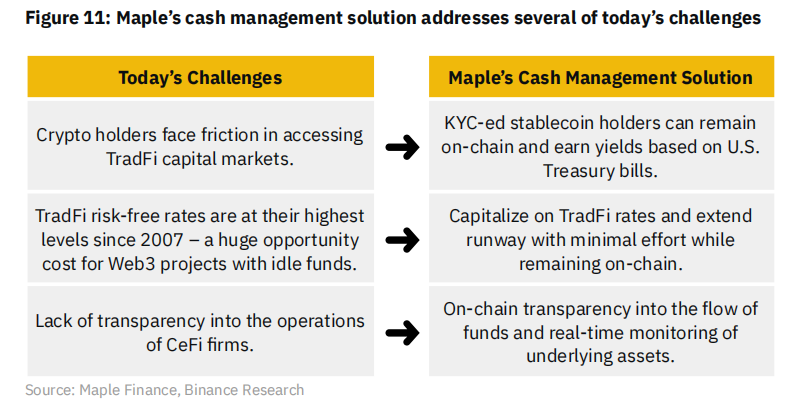

Product Benefits :

Products backed by U.S. Treasuries launched in April

The target annualized rate of return is the 1-month U.S. Treasury yield minus a 1% fee

Cash management solutions for users holding stablecoins

Business value :

Users can obtain income from U.S. bonds on the chain without leaving the chain to participate in the traditional market

The transparency on the chain is high, and assets can be monitored in real time

Help expand the business scope of decentralized finance

Exports that provide yield for stablecoins

Maker DAO :

Business model :

MakerDAO Lends DAI Stablecoin Through Mortgage

The borrower deposits collateral into the Vault and obtains a DAI loan

Collateral types include encrypted assets and RWA

Market Size :

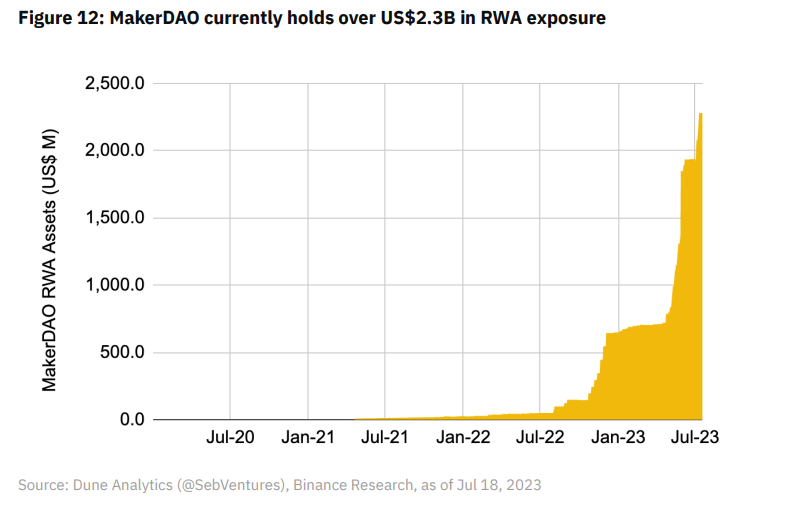

MakerDAO is one of the leading agreements in the field of decentralized finance, with the third largest total locked value

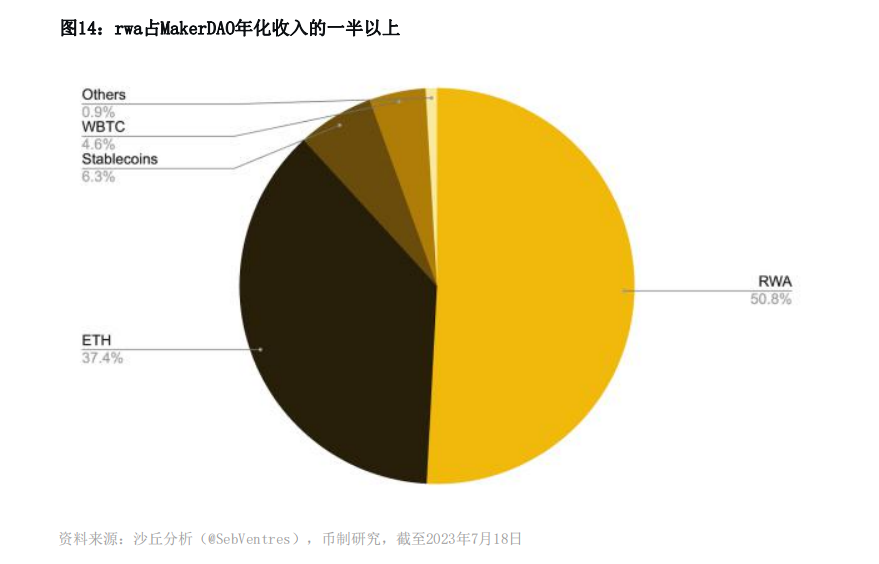

RWA assets accounted for nearly half of the total assets, about 2.3 billion US dollars

Key data :

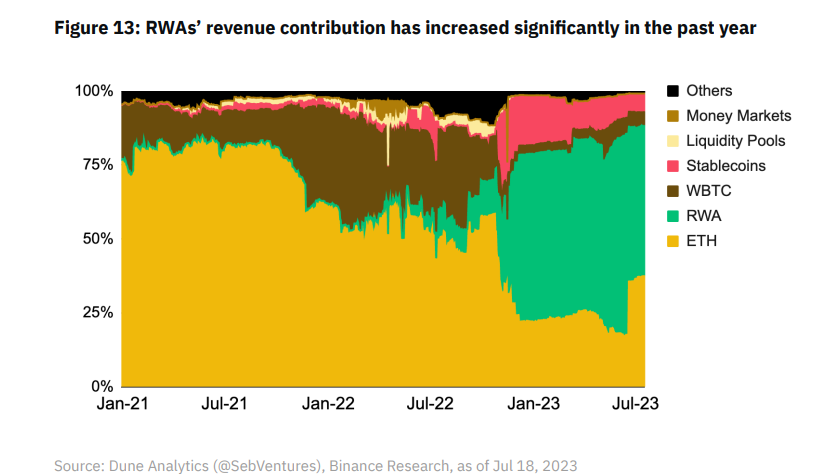

The proportion of RWA revenue contribution has increased significantly to about 50% in the past year

It recently purchased $700 million worth of Treasury bonds in June, bringing its total holdings to $1.2 billion. A diverse collateral base allows MakerDAO to take advantage of the current yield environment while diversifying its risk.

Ondo Finance:

Business model :

Provide institutional investors with blockchain-based investment products and services. Investors deposit USDC to purchase products such as bond funds, obtain equivalent tokens, destroy tokens when redeeming, and return USDC;

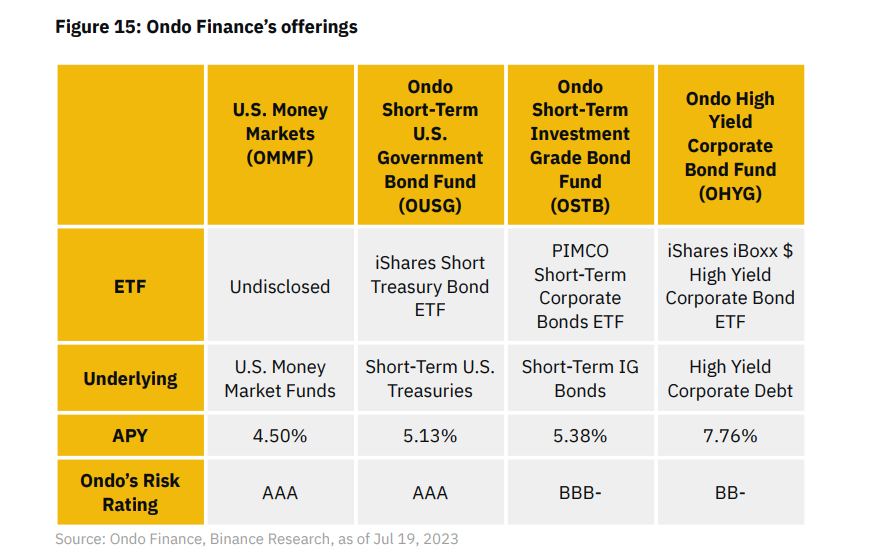

Provide 4 products based on real assets, such as monetary funds, short-term government bonds, etc.

The annualized rate of return of the product ranges from 4.5% to 7.76%

Market Size :

It accounts for nearly 26% of the tokenized U.S. bond market, ranking second

Business value :

Let investors obtain blockchain-based institutional-grade investment products, expanding the investor base of traditional assets

Users can obtain the benefits of bonds, currency markets and other products on the chain, and tokenization improves the liquidity of assets

RWA Noteworthy Developments

Asset tokenization has become a buzzword, dubbed “TradFi’s killer app” by JPMorgan. 2023, dubbed "the next generation of the market" by Blackrock CEO Larry Fink.

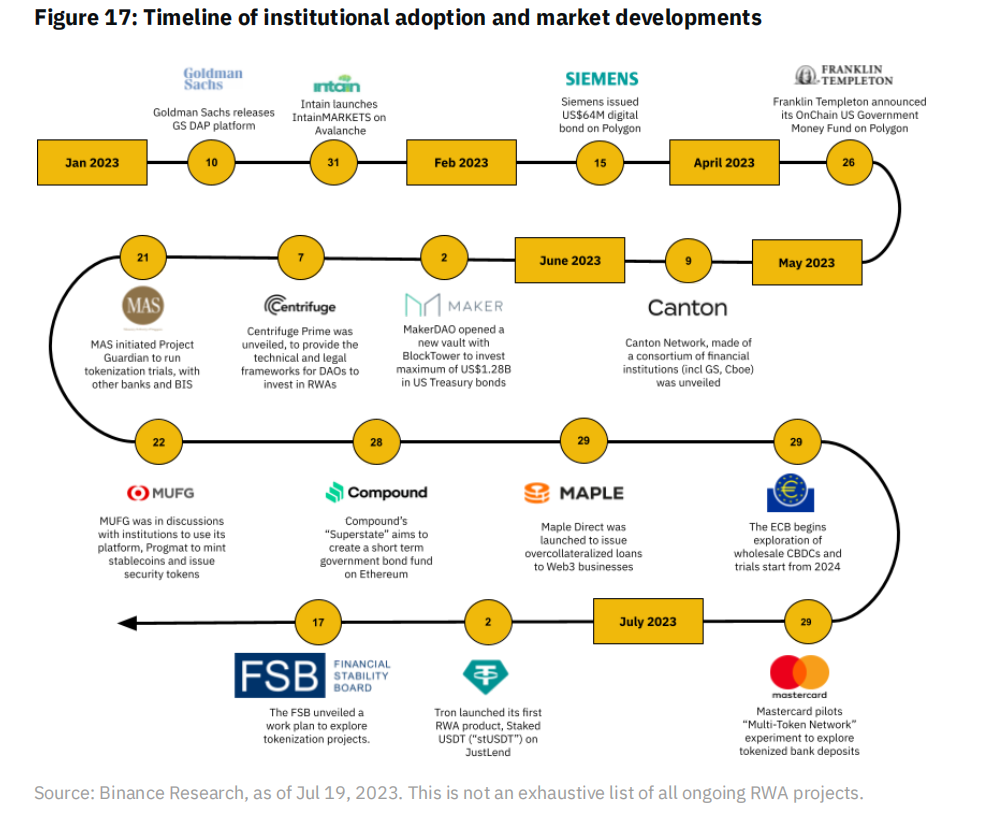

Interestingly, in addition to DeFi protocols, traditional financial institutions have also shown increasing acceptance of RWA tokenization:

First, Franklin Templeton, a global asset manager, launched his own fund on the public blockchain; in addition, institutions have also begun to explore the establishment of their own private blockchain to tokenize assets. Looking to the future, it is not inconceivable that traditional exchanges will promote the development of the secondary market. The transaction of tokenized RWA may become popular as the adoption rate increases. exist

The key events and timeline of RWA are summarized below:

epilogue

The tokenization of real-world assets provides a powerful use case for blockchain technology, potentially bringing the next wave of users into the cryptocurrency space.

By offering greater transparency and greater efficiency, tokenization could be an attractive alternative to existing mechanisms. We're already witnessing early signs of institutional adoption: Traditional companies are exploring a technology that could address the inefficiencies of today's solutions. The surge in RWA is also a positive development for cryptocurrency investors, who now have access to more opportunities outside of the crypto ecosystem. In addition to being able to take advantage of the increase in government bond yields, the integration of risk-weighted assets has introduced more stable assets into DeFi and increased the diversity of collateral. Going forward, we hope that RWA's continued innovation and growth space will lead to more use cases and help drive cryptocurrency adoption.

Link to original report:

https://research.binance.com/static/pdf/real-world-assets-state-of-the-market.pdf