Bitcoin hit a new monthly high on September 18 as a strong weekly close reinforced a bullish start to trading on Wall Street.

BTC 1 Day Chart | Source: TradingView

Data from TradingView tracked a BTC price increase of more than 3% on the day, with Bitcoin breaking $27,000 for the first time in September.

As Wall Street opens, market participants are paying attention to the return of “momentum” among Bitcoin bulls.

Michaël van de Poppe, founder and CEO of trading company Eight, summarizes :

“Bitcoin price breaks barrier at $26,800 and reaches high of $27,200.”

“The trend looks to increase from here as altcoins are also awakening. It's still the best time to buy property.”

Van de Poppe uploaded the latest analysis chart to X (formerly Twitter), showing the resistance area now needed for a recovery.

BTC Chart | Source: Michaël van de Poppe/X

Meanwhile, source monitoring Material Indicators has revealed daily buy signals on its proprietary trading tools.

“The bulls appear to have gathered some momentum since candle D opened,” the accompanying commentary said.

Source: Material Indicators

Elsewhere, cautious Daan Crypto Trades flagged a spike in open interest, returning to levels last seen after a brief BTC price rally following asset manager Grayscale's legal victory against regulators US management.

Source: Daan Crypto Trades

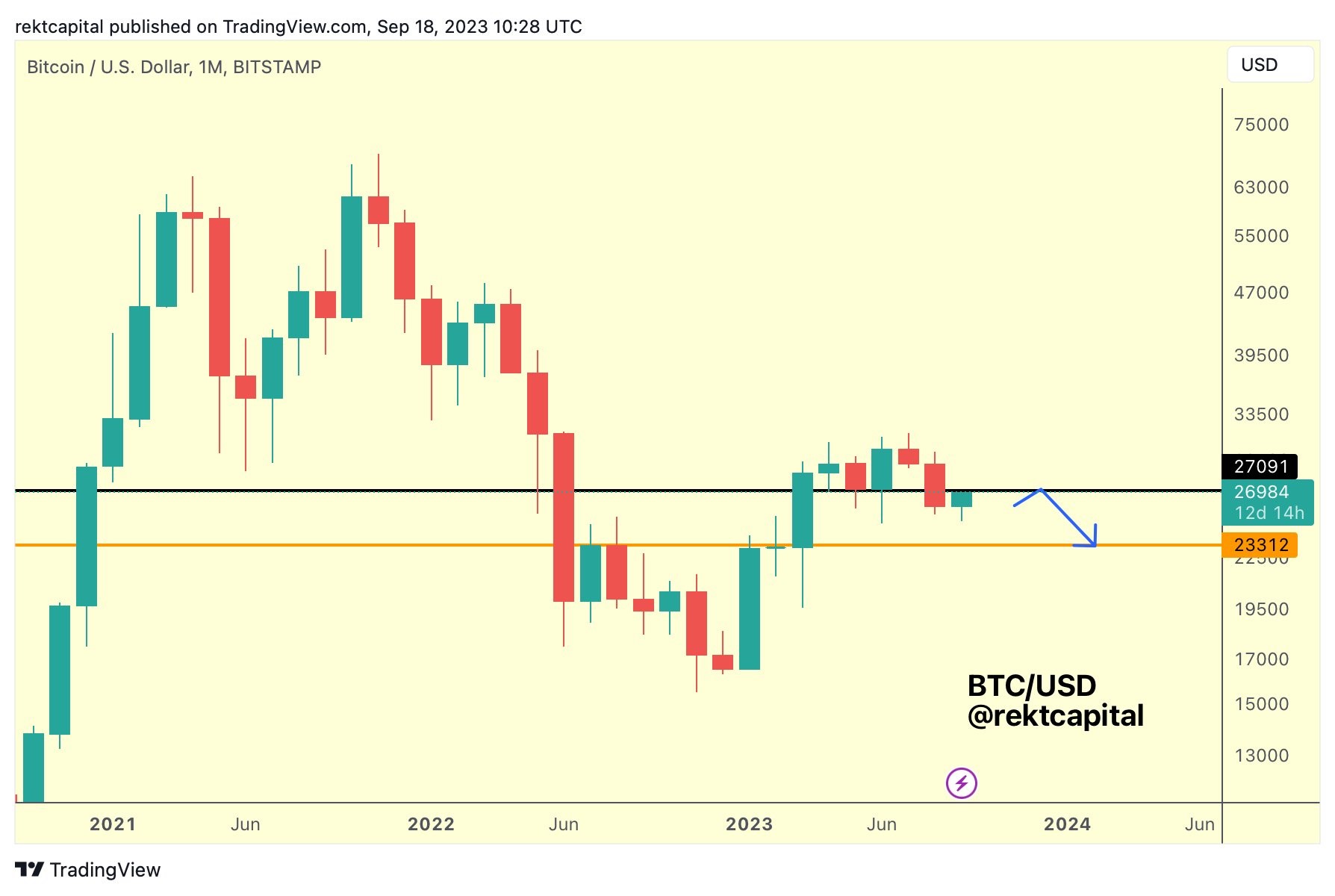

Meanwhile, trader and analyst Rekt Capital calls for bulls to reclaim higher levels and hold them until the monthly close in September.

“Will return to ~$27,100 (black) soon,” Rekt Capital predicted on the day along with the chart.

“This level Vai as support earlier this year and could become new resistance this month, unless BTC reclaims its monthly close above the black.”

BTC Chart | Source: Rekt Capital/X

With the US Fed's decision on interest rates looming on September 20, the macro conversation focuses on preparations for the event.

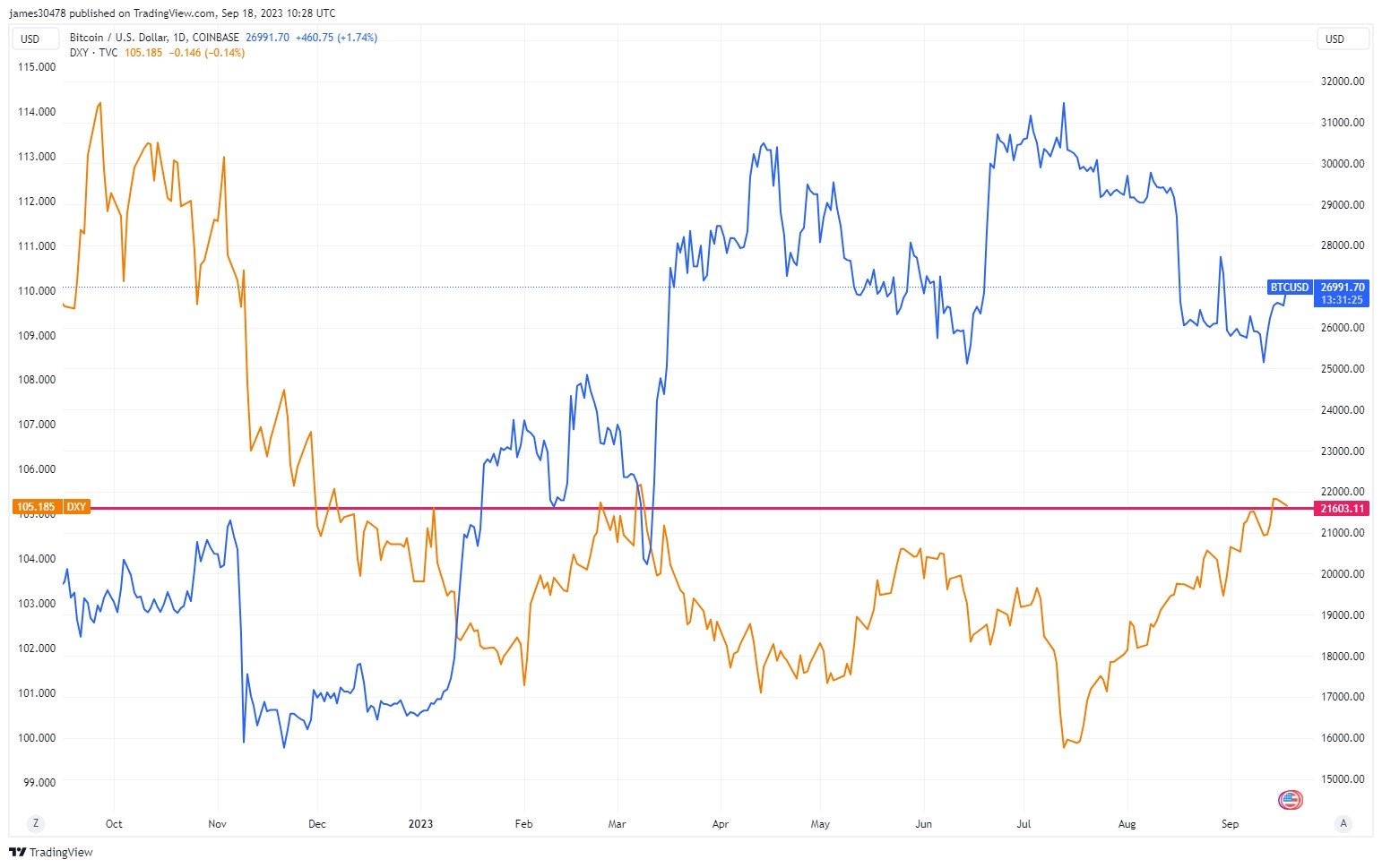

The US Dollar Index (DXY) showed continued strength during the day despite the assumption that interest rates will not rise later in the week.

DXY hovered above 105, breaking above that level for the first time since mid-March.

Bitcoin, which traditionally has a negative correlation with the Index, however shows no signs of weakening.

“Bitcoin hits $27,000, while DXY stays above 105,” noted researcher and data analyst James Straten with a comparison chart.

BTC and DXY comparison chart | Source: James Straten/X

“The last time DXY traded at 105 was in March when Bitcoin was trading at under $20,000. Previously, in the fourth quarter of 2022, Bitcoin was trading at $17,000.

Morgan Creek Capital founder claims the combination of the Bitcoin network's upcoming halving and BlackRock's potential approval of a Bitcoin spot ETF will bring “tens of billions, if not hundreds of billions, of demand.” dollars into the physical spot market.”

On the Forward Guidance podcast ( Spotify / Apple ), Yusko stated the current trend for the crypto industry popular among traditional investment institutions is that “it will all go away” following ETF approval.

Many barriers are currently in place to prevent institutional investors from accessing cryptocurrencies, Yusko said, but that will change. “No one can say no,” Yusko said, “not UBS, not Merrill Lynch, no one.”

But sentiment has faltered significantly since the most recent cryptocurrency bull run, when many other institutional clients were clamoring for access, Yusko said. “They say that less now than they did two years ago because people buy what they wish they bought.”

“It's on sale now,” Yusko said, “but they're selling it all.”

In every “other business in the world” besides stocks and cryptocurrencies, Yusko said, people will “clash each other” to get a good deal, but investing exhibits the opposite behavior.

Podcast host Jack Farley commented:

“Demand for something is always highest at the top and lowest at the Dip.”

Yusko replied:

“Humans are really simple animals. They buy what they wish they had bought and they sell what they soon need.”

Turning the conversation to focus on stocks and bonds, Yusko asserted that patterns of irrational behavior can be objectively observed over long periods of time. “Here's the proof,” Yusko said, citing 20 years of JPMorgan data showing that “stocks earned 8.5% over that period. The bond is implemented for 5.5 years.

“All you have to do,” Yusko said, is simply “pick one.” But over that same period, the Medium investor earned only a 2.9% return, Yusko said.

“How is that possible?” Yusko asked. “All you have to do is choose one or a little of each.”

"Are not. They buy stocks when prices are hot and sell them when prices are not so high.”

Yusko argues young investors should “embrace volatility” rather than play it safe with “risk-free investments” like bonds.

“It is literally against the law for people between 20 and 65 years old to own bonds. If you're 20 years old and can't touch your money for 50 years…you should own the asset with the highest volatility.”

So-called “risk-free” investing ultimately gives the conservative investor near-zero returns because “inflation will destroy what you earn,” Yusko said.

“Volatility is your friend.”

You can XEM the coin prices here.

Join Bitcoin Magazine's Telegram: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Minh Anh

According to AZCoin News