This article is machine translated

Show original

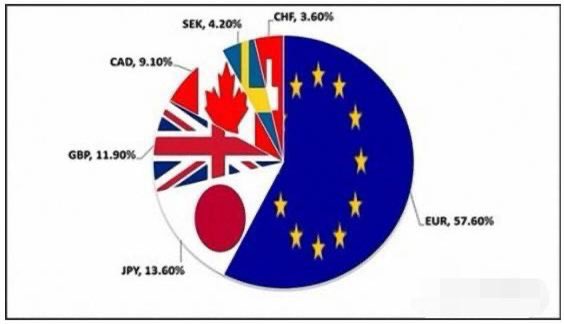

The U.S. dollar index has been going strong recently and has continued to rebound since mid-July. Some people wonder why the Fed is still so strong since it did not raise interest rates in September. The Federal Reserve is nearing the end of raising interest rates, and interest rates are also close to the peak of this round of tightening. However, at the same time, the European Central Bank and the Bank of England in the U.S. dollar index basket currency are also coming to an end and have expressed their intention to stop. At the same time, the Bank of Japan continues to maintain its loose policy today. Exceeded expectations. Then the U.S. dollar will continue to be strong in the short term.

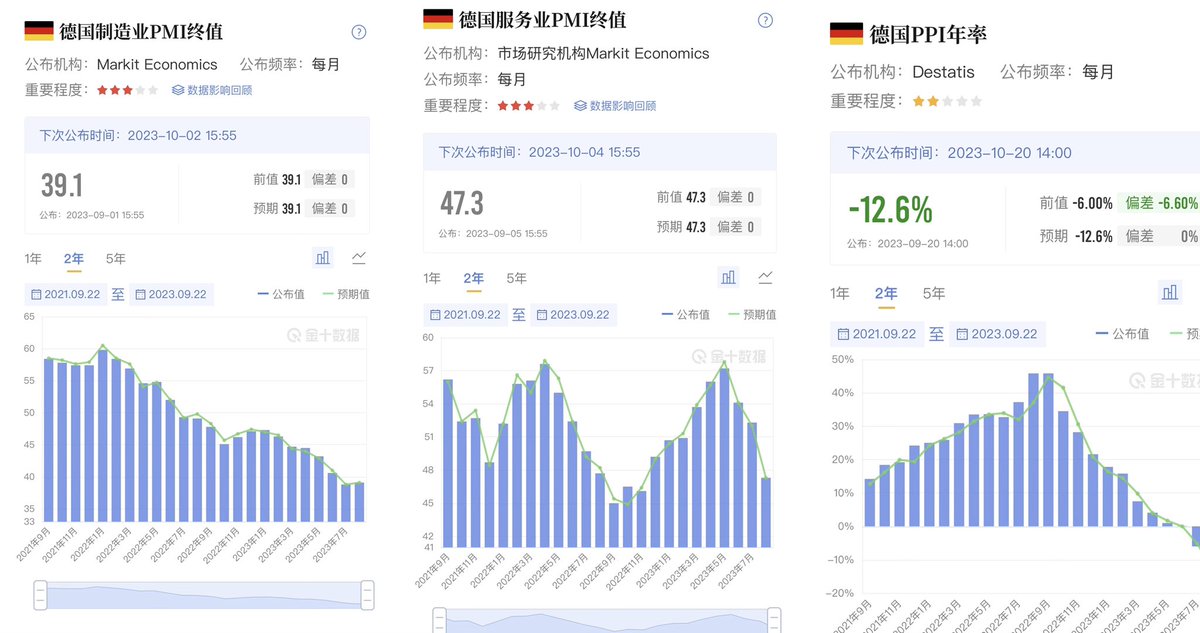

On the other hand, in addition to reflecting interest rates and exchange rates, the U.S. dollar index also reflects economic fundamentals. Especially when several major central banks are at the end of raising interest rates, the support of economic fundamentals for the currency is even more obvious. Take Germany, the leader of the European economy, for example. The German manufacturing PMI fell to 38 in July and slightly rebounded to 39 in August, which is in an extreme state of contraction. The service industry PMI also fell below 50. It suddenly occurred to me that if China’s manufacturing PMI fell in a certain month,

When it falls below 40, it is estimated that the theory of China's collapse has become more popular again. The German manufacturing industry is so sluggish that the market does not pay much attention to it. Of course, there are also good signs. Germany's manufacturing PMI in August rebounded slightly from July. If the non-US economy can continue to stabilize and rebound, the top of this rebound in the US dollar index should be visible.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content