According to crypto research firm K33 Research, ETH is trading near yearly lows against Bitcoin, with the market showing steady rotation between the assets.

The downtrend started in September 2022, around the time Ethereum made the transition from PoW to PoS consensus, known as The Merge. ETH is currently trading for around 0.06 Bitcoin.

“ETH trended steadily down throughout the year as DeFi and Non-Fungible Token activity faded. Without any meaningful narrative or adoption narrative, ETH has struggled to maintain strength versus Bitcoin,” K33 Senior Analyst Vetle Lunde and Vice President Anders Helseth noted in the paper their latest report.

ETH/ BTC Price Chart | Source: K33 Research

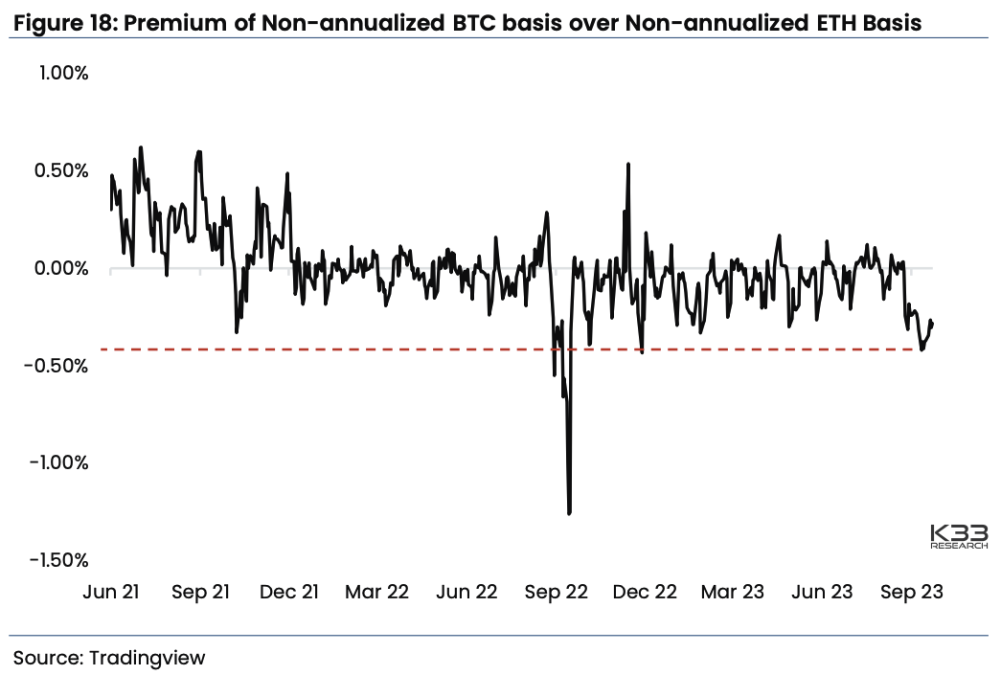

CME Derivative traders also maintain a bearish outlook for ETH , the analyst said, with the spread in ETH Futures Contract prices over spot prices significantly lower than for Bitcoin, although the contract opens have increased 60% since August.

This suggests that ETH traders on CME have low expectations for approval or meaningful Capital into potential Ethereum futures ETFs in the coming weeks, Lunde and Helseth added.

ETH Futures Contract remain at a discount to Bitcoin | Source: K33 Research

Despite the bearish picture painted, K33 analysts reiterated their stance that a move towards ETH is the right play later this year, given the approval of ETFs based on New ETH Futures Contract in the coming weeks could reverse the trend.

Multiple applications for an Ethereum futures ETF have been filed in recent months, including proposals from Ark Invest, ProShares, Valkyrie and Grayscale. The Ethereum futures ETF could receive a final verdict by mid-October, with the US Securities and Exchange Commission indicating it is ready to green-light the proposals.

Bitcoin futures ETF previously launched in 2021.

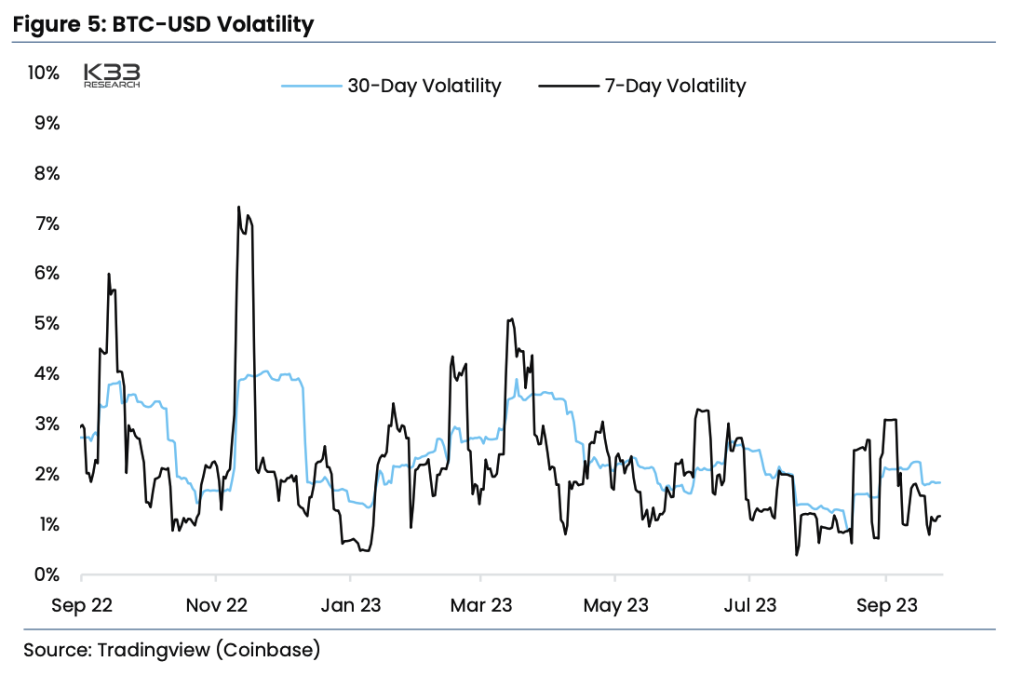

Last week's interest rate decisions have barely breathed life back into the cryptocurrency market, with prices still trading in a tight range amid low volume and volatility – little change in performance. Bitcoin's biggest movement during the U.S. Federal Reserve meeting in the previous 2.5 years, Lunde and Helseth noted.

BTC/USD volatility | Source: K33 Research

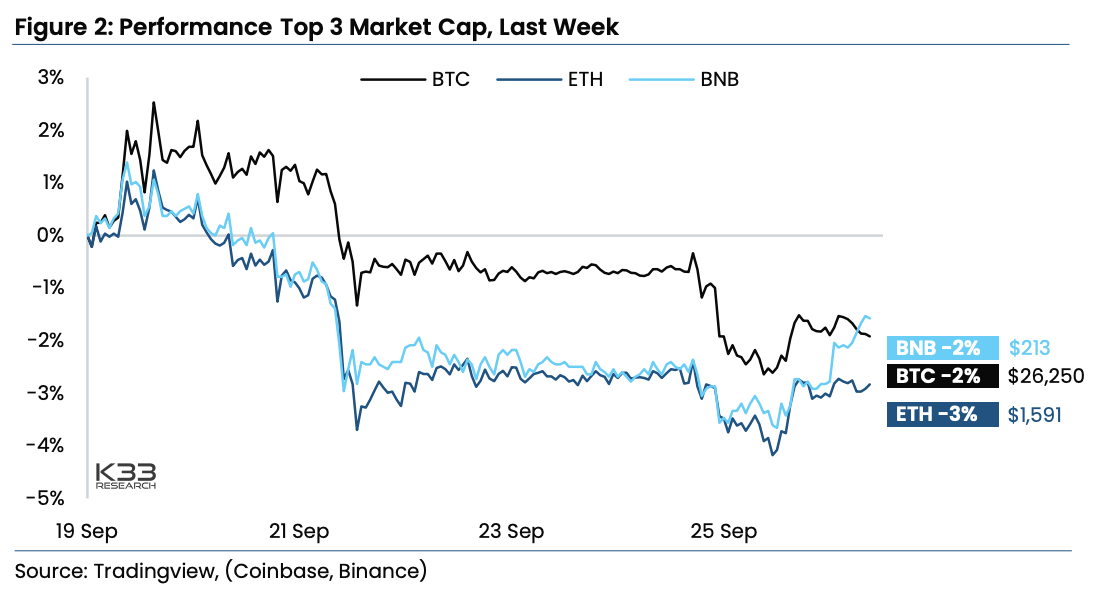

Bitcoin is down 2.2.% over the past 7 days, with ETH down 0.22%. In the top 3 by market Capital , BNB also decreased by 0.52%.

Top Market Capital Performance | Source: K33 Research

Analysts said the outlook for the Derivative market was mixed to bearish, with ongoing divergence between CME and foreign Derivative traders. While CME's Bitcoin month-ahead spread stands at 0.5%, suggesting mildly bullish sentiment, overseas funding rates are significantly below neutral, suggesting a more bearish outlook. They added options prices suggest a more bullish long-term view, despite turning slightly bearish due to Bitcoin's recent price drop.

Lunde and Helseth suggest short-term traders watch for signs of directional aggression among CME traders as an indicator of potential price movements ahead.

Last week, K33 Research analysts said Binance led the market-wide decline in Bitcoin spot volume in September, down 57% since September 1, with volumes down 48% across exchanges. transactions in general.

You can XEM the coin prices here.

Join Bitcoin Magazine's Telegram: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Home home

According to The Block