Source: Fidelity; Compiled by: Songxue, Jinse Finance

background:

In November 2020, we highlighted some of the most common criticisms of Bitcoin , drawn from our regular conversations with institutional investors and observations of public commentary on Bitcoin. More than three years later, Bitcoin not only remains the largest digital asset by market capitalization, but it continues to grow as a currency network.

In this article, we discuss common Bitcoin criticisms and opinions—some justified, some debunked.

First, let’s review some of the criticisms we reported on in 2020 that have been refuted numerous times:

1. Bitcoin is too volatile to serve as a store of value.

2. Bitcoin has failed as a means of payment.

3. Bitcoin is a waste of energy and harmful to the environment.

4. Bitcoin will be replaced by competitors.

5. Bitcoin is not backed by anything.

The initial criticisms above are ones that we think can be refuted or are unlikely to become serious problems.

However, we believe that there are some legitimate concerns that have some chance of occurring, even if they are small, and therefore investors should be aware. These include:

6. Bugs in Bitcoin’s code could render it worthless.

7. Regulations will slow down Bitcoin adoption.

8. People may lose interest.

9. There are “unknown unknowns.”

Criticism #1: Bitcoin is too volatile to serve as a store of value.

Response: Bitcoin’s volatility is a trade-off between perfect supply inelasticity and an unintervened market.

However, as history shows, Bitcoin volatility will continue to decline as there is greater adoption of Bitcoin and Bitcoin-related derivatives and investment products.

As discussed in Bitcoin as an Ideal Store of Value, the trajectory of a new asset from fringe awareness to a global store of value is unlikely to be linear. At the time of writing, Bitcoin is an emerging store of value that is undergoing financialization and is consolidating its position as a store of value. Bitcoin holdings are small relative to other store-of-value assets such as gold.

Daily volatility is likely to decrease over time as liquidity increases in spot and derivatives markets and products are developed that allow investors to express interest in Bitcoin in different ways, leading to greater ownership and participation Spend. As Bitcoin ownership becomes more widespread, the price of Bitcoin should stabilize as the ability of net new participants to drive the market diminishes. However, while Bitcoin’s volatility may continue to decline relative to current conditions, it remains relatively high compared to other financial assets. Its volatility is as follows.

Bitcoin volatility

Bitcoin’s volatility is also emblematic of gold’s volatility, as early investors also didn’t understand gold’s role. This resulted in annual and even daily fluctuations similar to those seen today. However, as high-profile hedge fund manager Paul Tudor Jones outlined in his widely read May 2020 investor letter:

"In terms of gold, this is a huge buying opportunity as prices have more than quadrupled from their previous highs."

Another way to understand Bitcoin’s volatility is to think in terms of the consequences of its supply being completely inelastic. An increase in demand cannot increase the supply of Bitcoin or increase the rate at which Bitcoin is issued (thanks to the difficulty adjustment, which ensures that a block is produced approximately every 10 minutes). This supply inelasticity is also why Bitcoin is scarce and valuable. As Bitcoin educator Parker Lewis says, “Bitcoin is valuable because it has a fixed supply, and by the same token, it fluctuates.” In other words, what makes Bitcoin valuable? One is its scarcity, but this scarcity comes from the fact that its supply is fixed, as mentioned above, which in turn makes it more volatile. Therefore, there is no way to eliminate Bitcoin’s volatility without eliminating one of the core fundamentals that made Bitcoin valuable in the first place.

Bitcoin’s volatility can also be explained by the fact that Bitcoin is an intervention-resistant market – no central bank or government can manipulate or artificially suppress its volatility. Bitcoin’s volatility is the trade-off of a distortion-free market. True price discovery that accompanies volatility may be preferable to artificial stability, which may lead to market distortions that may collapse without intervention.

"We are operating in a highly distorted market whose upward trajectory increasingly relies on investors holding on to their collective belief in the ability of an already nervous monetary policy stance to offset mounting headwinds."

– Mohamed A. El-Erian, Bloomberg

Criticism #2: Bitcoin has failed as a means of payment.

Response: Bitcoin makes smart trade-offs, such as limited and expensive capacity, to provide core properties such as decentralization and immutability. Considering the high degree of settlement guarantee of Bitcoin, the most valuable use of its limited capacity is to settle high-value transactions that cannot be effectively satisfied by the traditional system.

Many people still believe that Bitcoin’s core use case is as a means of payment for everyday low-value transactions. Critics believe this, arguing that Bitcoin has failed because it (at least its base layer) currently does not (and cannot) offer the same transaction throughput as traditional payment methods such as Visa, Mastercard or PayPal. However, Bitcoin is not an apples-to-apples comparison to Mastercard or Visa, as traditional transaction processors do not provide final settlement until days later, and Bitcoin's slower 5 to 7 transactions per second (TPS) represents Final settlement.

Contrary to what some believe, data from Coin Metrics shows significant transaction volume on the Bitcoin network, with more than $3.1 trillion settled, just shy of the roughly 40% of total transactions handled by Mastercard last year. This provides a baseline for Bitcoin’s lower limit as a means of payment. However, while Bitcoin may serve as a medium of exchange in specific situations, this is not Bitcoin’s core function, nor is it its only function.

“As a payment method, it can perform better than existing technologies in certain situations (think international payments), but for most everyday payments, Visa, Apple Pay, Google Pay, PayPal and fiat currencies Both work well and are better than cryptocurrencies .”

——John Pfeffer

The characteristics of Bitcoin make it a viable payment instrument – it is portable, fungible, and easily divisible. On the other hand, it also faces challenges as it can be unstable at times and has limited throughput. As mentioned above, volatility is the trade-off Bitcoin makes in order to achieve perfect scarcity. Limited throughput is Bitcoin’s trade-off for decentralization, a direct result of cheap and easy verification. By setting a capacity cap (limiting the amount of data stored on the ledger), Bitcoin enables people with basic computers to run nodes. Nodes are important because they validate the work performed by miners and enforce checks and balances on these entities responsible for creating blocks and processing transactions so that no individual or single stakeholder group has disproportionate power and influence, thereby making Bitcoin Coin is as decentralized as possible.

After accepting Bitcoin’s limited throughput to achieve decentralization and implementing appropriate checks and balances, the next questions worth asking include: Which transactions are worthy of being written on Bitcoin’s base layer? Which transactions require Bitcoin’s global, immutable settlement? Arguably, the most valuable use of Bitcoin's limited capacity is not at the point of sale to record transaction data related to daily payments, such as buying a cup of coffee, but for situations that benefit most from Bitcoin's high price, traditional system services. Inadequate situation.

This includes, but is not limited to, global settlements between international businesses and eventually even central banks and governments. One such example is BitPesa, which helps clients (SMEs and multinational corporations) move in and out of African currencies through Bitcoin.

BitPesa is one of the first companies to leverage Bitcoin for commercial settlements to reduce the cost and friction of doing business in frontier markets. Another situation where Bitcoin might offer a better option as a payment system is when slow speeds create high remittance fees. For example, in the fourth quarter of 2017, the global average cost of sending $200 was 6.2%, according to the World Bank.

To meet the growing demand for more convenient Bitcoin payments and micropayments, the Bitcoin network must support an exponential increase in transactions that is impractical to scale on a Layer 1 chain. This is why many believe that layer 2 solutions for Bitcoin, such as the Lightning Network, can help scale Bitcoin without sacrificing decentralization. Since payments on the Lightning Network are not recorded on the blockchain, they do not require block confirmations to be completed. This makes payments nearly instantaneous and extremely low-cost, with an extremely low median base rate of $0.00014 per transaction, assuming 1 sat per transaction, according to data provider Glassnode. This Bitcoin extension can be used for commercial retail, peer sales, and more. Visa can theoretically reach 24,000 TPS, but in reality its daily processing volume is only a fraction of that. Compared with Visa, Bitcoin's Lightning Network is by far the fastest and cheapest payment technology.

Tax treatment is another factor that complicates the use of Bitcoin as a payment method in developed countries such as the United States. For example, the IRS classifies Bitcoin as “property.” On the payments side, this means that Bitcoin users have to calculate their gains or losses every time they use Bitcoin to make a payment or purchase, making Bitcoin less attractive as a payment option. If small amounts of Bitcoin used for purchases were allowed to be exempt from tax calculations (something currently being discussed in Congress), then people might be more willing to use it as a means of payment.

Criticism #3: Bitcoin is wasteful and/or harmful to the environment.

Response: Most Bitcoin mining is powered by renewable energy or energy that would otherwise be wasted. Furthermore, the energy consumed by the Bitcoin network can be said to be an efficient and important use of resources.

There is no denying that Bitcoin mining does consume energy. So the question becomes, is it worth using energy to secure the Bitcoin network and process transactions? The answer varies from person to person.

Those who recognize the importance of the first, most provably scarce, decentralized, censorship-resistant and seizure-resistant digital asset and provide irreversible settlement would argue that this is indeed the case. Bitcoin’s most valuable features—perfect scarcity, immutability (irreversibility of transactions), and security (resistance to attacks)—are directly related to the real-world resources used in mining. Without high mining and maintenance costs, Bitcoin would not be able to fulfill its role as a secure global value transfer and storage system. Furthermore, if powering Bitcoin, the global digital currency network, is considered wasteful, what impact does this have on the traditional financial system? Consider the energy use and carbon footprint of brick-and-mortar banks and credit unions, corporate office buildings, paper credit card statements, plastic credit cards, paper promotional offers, mining metals to produce fiat coins, harvesting wood and other materials to print brick-and-mortar governments - issuance currency, the human time and energy required to keep the traditional financial system running, and so on. Energy is a basic need of modern society, so more questions are where it comes from and what its uses are.

"In the long term, there is no more important use for energy than the energy used to maintain the integrity of the currency network, specifically the construction and maintenance of the Bitcoin network." - Parker Lewis

While Bitcoin mining is often criticized for the energy it consumes, it's important to consider which energy source is used. There are varying estimates for the portion of Bitcoin mining powered by renewable energy. For example, the Cambridge Center for Alternative Finance (CCAF)’s third global cryptoasset benchmark study estimates that as many as 76% of Bitcoin miners use renewable energy, especially hydropower, as part of their energy mix. According to CCAF, renewable energy accounts for 39% of total energy consumption by Bitcoin miners. CoinShares estimates that as of the fourth quarter of 2022, the renewable energy component of the energy mix powering Bitcoin mining will account for 58.9%. Both estimates indicate a significant increase in the share of renewable energy used in Bitcoin mining. Many operations are powered by renewable energy sources (e.g. hydroelectric, wind, solar). Recent announcements also suggest that the share of mining related to renewable energy will continue to grow. For example, En+ Group formed a joint venture to mine Bitcoin using renewable energy assets with a low carbon footprint. CCAF also estimates that even if all Bitcoin mining were powered entirely by coal, total CO2 emissions from Bitcoin mining would not exceed 58 million tons, or 0.17% of total global CO2 emissions. To put this into perspective, Bitcoin produces greenhouse gas emissions equivalent to only 3% of global air conditioning use.

More recently, oil and gas extraction operations have led to the use of trapped gas to power Bitcoin mining, which significantly reduces carbon and methane emissions by utilizing energy that may not be used for other purposes. Companies that use stranded gas byproducts to mine Bitcoin can also generate up to 15 times more revenue than selling natural gas at market prices. Setting up a Bitcoin mining operation may also help these companies comply with regulations that limit the amount of trapped gas - flaring or venting it, avoiding regulatory fines or shutting down operations to prevent gas buildup.

Trapped gas is natural gas that has limited utility and is likely to be wasted. Oil or natural gas wells that do not have the pipeline infrastructure required to transport the gas to where it can be used are considered stranded gas. If it is unavailable, has no pipeline capacity, or if the market price is too low, the trapped gas will be burned (deliberately burned into the air to avoid the risk of explosion) or vented (allowed to escape into the air). Globally, humans burn nearly 5,000 billion cubic feet (140 billion cubic meters) of natural gas every year. Listed oil multinational Equinor also revealed plans to use stranded natural gas that would otherwise be burned and produce carbon emissions to power Bitcoin. In January 2021, ExxonMobil launched a Bitcoin mining pilot program that uses 18 million cubic feet of natural gas per month to mine Bitcoin that would otherwise be burned or flared due to a lack of pipelines. Due to the program's early success, in 2022 ExxonMobil began exploring expanding the program's operations into four new countries.

“My favorite way to think about it (Bitcoin’s use case for harnessing stranded energy) is as follows. Imagine a topographic map of the world, but with local electricity costs as the variable that determines the peaks and troughs. Adding Bitcoin to the mix is like creating a map in 3D Pour a glass of water over them - it will settle in the troughs and smooth them out." - Nic Carter, Castle Island Ventures

Criticism #4: Bitcoin will be replaced by competitors.

Response: Bitcoin trades off core properties that the market deems valuable. While Bitcoin’s open source software can be copied, its community and network effects cannot.

Many digital assets have emerged claiming to improve Bitcoin. However, to date, none have been able to replicate Bitcoin’s network effects. Bitcoin has qualities that make it valuable, and for this it makes clear trade-offs to provide those qualities mentioned earlier. While competitors attempt to improve on Bitcoin's limitations (e.g., limited base layer transaction throughput, volatility), they do so at the expense of core attributes of Bitcoin's value (e.g., perfect scarcity, decentralization, immutability) At a cost, this explains why Bitcoin continues to dominate in terms of market capitalization, investors and users, miners and validators, and retail and institutional infrastructure, product and service providers. As shown in the chart below, Bitcoin’s market capitalization is by far the largest digital asset, accounting for approximately 50% of the digital asset market.

BTC VS ETH VS “Cryptocurrency” Market Cap

While Bitcoin’s software is open source and can be forked and “improved,” its community of stakeholders (users, miners, validators, developers, service providers) and network effects cannot be easily replicated.

Criticism #5: Bitcoin is not backed by anything.

Response: Bitcoin is not backed by cash flow, industrial utility, or fiat. Bitcoin is backed by code brought to life by a social contract of stakeholders.

In "What Are Asset Classes Anyway?" (Journal of Portfolio Management, 1997), Robert Greer defines three asset "superclasses"—capital assets, consumable/convertible (C/T) assets, and value Storage (SOV) assets.

Greer classifies gold as part of the sovereign currency (SOV) super-category, which includes “assets that are neither consumable nor income-producing. They nonetheless have value.” However, given gold’s use in jewelry and technology such as electronics and (dentistry), gold also has characteristics of the Commodity/Industrial (C/T) supercategory. This drives the belief that gold's value comes from its usefulness in jewelry and industrial applications. However, gold jewelry can be seen as an alternative tool to store wealth and is used as a "private currency reserve", while only a small proportion of gold is used for industrial applications (only 7% of gold demand in 2019 was related to electronics and dental) application related).

Robert Greer also classified fiat currencies as SOV assets. Fiat exists by decree. The argument in favor of fiat currencies is that they are backed by the full faith and credit of their respective governments. However, in many cases, confidence in the ability of governments and central banks to properly manage fiat currencies is misplaced (see Venezuela and Lebanon). Multiple central banks and governments have exhausted the leverage of monetary and fiscal policy, resulting in significant losses in the purchasing power of their currencies over time.

According to Greer's definition, Bitcoin best fits the SOV superclass. Bitcoin is not backed by cash flow, industrial utilities or fiat. Clearly, Bitcoin is backed by code that is brought to life by the social contract that exists between stakeholders:

• Select users to transact on the network.

• Select miners who bear the fees to process transactions and protect the network.

• Select nodes that run Bitcoin code and verify transactions.

• Select developers who maintain the Bitcoin code.

• Holders who choose to store a portion of their wealth in Bitcoin.

Bitcoin’s stakeholders make these clear choices that bring to life Bitcoin’s unique properties—its perfect scarcity, transaction irreversibility, and resistance to seizure and censorship. Bitcoin’s network effect, or the addition of each new stakeholder, makes Bitcoin more reliable and further strengthens its properties, attracting more stakeholders to use the asset, and so on. The Bitcoin code proposed the rules, but it was the enforcement and agreement of the rules by stakeholders that resulted in the secure, open, and global value storage and transfer system that exists today.

Criticism #6: Bugs in Bitcoin’s code could render it worthless.

Response: The Bitcoin network and its Bitcoin token are made up of connected computers, all running the same core Bitcoin software. So, indeed, at the most basic technical level, Bitcoin is just software running on computer hardware, and as we know, software can have "bugs" that cause it to behave in unexpected ways.

The Bitcoin network did experience two errors early in its history. The first time was in August 2010, when someone exploited a vulnerability to create 184 billion Bitcoins. Not only were these Bitcoins not minted or created through the regular mining process, but they far exceeded the 21 million hard supply cap built into Bitcoin’s design, and were therefore a clear mistake. This is still very early in Bitcoin's history, and Bitcoin's creator, Satoshi Nakamoto, is still actively working on the project. The bug was noticed by others within hours, and Satoshi created and sent a code update within the next few hours. Soon enough validator nodes were upgraded and continued to build on the "good" version of the blockchain (in which 184 billion Bitcoins did not exist) and replaced the "buggy" version, highlighting the The role of community and social consensus in this process.

The second error occurred in March 2013, causing the network to be offline for approximately six hours. In this case, a version upgrade of the Bitcoin software (which is often done to make small improvements or increase efficiency) inadvertently causes the network to split, or "fork," with two versions running simultaneously. While users' Bitcoin tokens were safe and unaffected, it did cause major exchanges and traders to suspend or cease trading. The issue was once again solved through a social consensus process where developers and miners communicated with each other and voluntarily reverted to previous versions to synchronize everything again. The incident did cause the price of the Bitcoin token to drop by more than 20% on some exchanges, to as low as $37.

There have been no other network “down” events since the 2013 bug, meaning that the Bitcoin network has maintained 100% uptime for over a decade, and, including these events, the Bitcoin network has experienced The uptime has reached 99.99%.

While we can't rule out the possibility of another bug or unintended consequences of an upgrade, we do think that as the network becomes more resilient and more developers continue to work on it, the likelihood of such an event will be greater. Much lower. We think this possibility is indeed reduced because the Bitcoin code is completely open source, so anyone from large companies to independent software engineers can view and test it. We also note that if another bug is discovered, those with a vested interest and large holdings of Bitcoin and equipment (miners, etc.) will likely be incentivized to work together to fix it quickly. Nonetheless, we do think this is a criticism worth considering, and investors should assign a non-zero chance to the possibility of a sufficiently severe bug in the core Bitcoin network that could cause its value to decline, perhaps dramatically. decline.

Criticism #7: Regulations will slow down Bitcoin adoption.

Response: Increased regulation of Bitcoin may actually be a positive indicator of adoption and its value proposition. In other words, if Bitcoin had no value and was destined to disappear, there would be no need to regulate it.

The recent closures of prominent banks that provided services to cryptocurrency exchanges, such as Signature Bank and Silvergate Capital, have created challenges for digital asset market participants to seamlessly interact with parts of the regulated financial system such as banks.

While we believe that Bitcoin’s technology cannot be stopped (just like the Internet and other decentralized technologies), we believe that poor design or lack of regulation could significantly hinder Bitcoin’s adoption and growth, and is indeed worth investing in be considered. It could also give rise to another legitimate criticism, discussed below, namely the threat of investor apathy. Policymakers’ discussion of digital asset regulation has increased recently, and we are pleased to see that digital asset regulation is receiving increasing attention and attention from government representatives. That said, it’s clear that unclear or lack of regulatory clarity around digital assets and the unique nature of blockchain could hinder Bitcoin’s adoption and growth.

Criticism #8: People may lose interest.

Response: While we have outlined Bitcoin’s core value proposition and characteristics that are unmatched by any other digital asset (trusted scarcity, immutability, decentralization, censorship resistance, etc.), this does not mean Other users or investors will value these characteristics equally. Bitcoin's success and increased adoption (and thus its price and market capitalization) are not guaranteed, but rather are a direct result of more and more people valuing these things over alternative or competing investment vehicles and digital assets. result.

For example, some are willing to compromise on decentralization and censorship resistance in exchange for other digital assets that may offer greater convenience or other rewards. As a hypothetical example, the launch of a central bank digital currency (CBDC) may attract some user adoption. Reasons why they are superior to Bitcoin are their built-in network effects (such as government-incentivized merchant acceptance), lower volatility, or their association with different services or benefits. If other investors place less value on Bitcoin’s decentralization, immutability, or stability, they may shift funds to competing digital assets that are faster or more programmable.

Ultimately, we believe value is subjective, and if the subjective value scale of most investors and users differs from how they currently value Bitcoin, Bitcoin adoption may be limited.

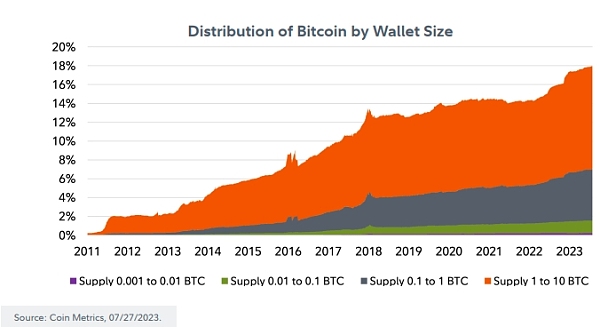

However, there is little evidence from on-chain data that interest in Bitcoin is waning. Since the birth of Bitcoin, as the price has increased significantly, so has the number of wallets that continue to accumulate and hold balances. In the early days of Bitcoin's history, holding a few dollars' worth of Bitcoin could mean having more than 10 Bitcoins in your wallet, but today, we can see the accumulation of small amounts of Bitcoin taking place. In 2014, approximately 96% of addresses held more than 10 Bitcoins. Today, that number is down to around 82%, a 14% drop in nine years. The number of smaller addresses (i.e., those holding less than 10 Bitcoins) has increased by 319%, from approximately 4% in early 2014 to 18% at the time of writing. In the image below, we can see the distribution and accumulation of small wallets (those holding less than 10 Bitcoins).

Bitcoin distribution by wallet size

Criticism #9: There are “unknown unknowns.”

Response: We actually completely agree with this criticism, but please note that this is not a criticism unique to Bitcoin. In this article, we attempt to debunk some common criticisms that we believe are irrelevant, while also covering the risks and criticisms that we believe investors should consider. These are "known unknowns", such as a bug in Bitcoin's code, or Bitcoin's anonymous creator Satoshi Nakamoto suddenly reappearing and selling all Bitcoins, we know this could be a risk but don't know the exact probability or time.

However, there are “unknown unknowns,” or possible risks that we don’t even know about or imagine. Investors in any asset should be aware of these and humbly accept that not all risks are known, let alone quantified, and should therefore position their investments and portfolios accordingly. Revisiting persistent Bitcoin criticisms.

Conclusion

While this article does not cover the complete list of criticisms leveled at Bitcoin, the responses outlined here may be adapted to address other common misconceptions.

Bitcoin is a unique digital asset for an increasingly digital world that requires digging deeper than the surface to understand its core properties and trade-offs. It prompts onlookers to question widely accepted preconceived notions of what is right to begin to understand its full value proposition.