Note: This article comes from @cheng_shutong Twitter, and is compiled by Mars Finance as follows:

First principles, just find the key factors and work backwards. The key to the formation of the trend is ① development basis: Bitcoin itself has a large amount of capital deposits, ② growth space: there is a sufficient difference between the narrative ceiling and the price, and the key two legs: ③ retail investors can obtain chips at a low cost and ④ accommodate a large number of Players form a wealth-making effect.

Needless to say, point ① is the financial foundation. Bitcoin ecological funds are mainly responsible for the overflow of funds from Bitcoin and Ethereum projects. The next step is the improvement of macro liquidity + the passage of spot ETFs + halving + Cancun expectations, etc. Funds will dominate the track and narrative in value during the bull and bear market. Dominate track switching.

The second point is the value-added space, the value difference between the narrative ending and market value. The financial market looks at expectations. The difference means space, and the smoothing out of the difference also means that dividends are approaching; assuming that the current situation of the Ethereum ecosystem is the future of the Bitcoin ecosystem (expected upper limit), a conservative figure of 300 billion US dollars (only NFT+Game+L2s (a market exceeding 100 billion);

The core assets of the Bitcoin ecosystem such as Ordi (Figure 1 @zad1130 ) are less than 2 billion, and the market value of the leading NFT and Metaverse is less than 1 billion. There is at least a 2-order difference between the two in the Ethereum ecosystem; from active Judging from the address, the difference between the two is at least two orders of magnitude; therefore, under the same narrative space, the fundamentals and values of the two are relatively different by at least two orders of magnitude. Therefore, the ecological dividend of Bitcoin disappears, and the market value of its core assets and the number of active people need to increase by at least another order of magnitude.

Points ③④ Most players in the market can get chips at a low cost. The key for the Bitcoin ecosystem to take off is fair launch, but similar to the long-term proposition of the blockchain, decentralization and trust are one means and the other is the direction of the goal. Fair launch is the means, and retail investors can obtain chips at low cost as the goal. The core mechanism in the middle is that the handling fee serves as an entry threshold and a natural barrier against cheating.

From an extreme perspective, too low a handling fee will inevitably lead to a concentration of chips and unfairness, breaking the original intention. This is also the reason why other public chains are not optimistic about the long-term sustainability of Inscription; too high a handling fee will inevitably lead to a sharp decline in the number of participants and high chip costs, resulting in losses. The purpose of fair launch; therefore, the handling fee in the middle and above is a suitable position, and where is the upper limit of the range?

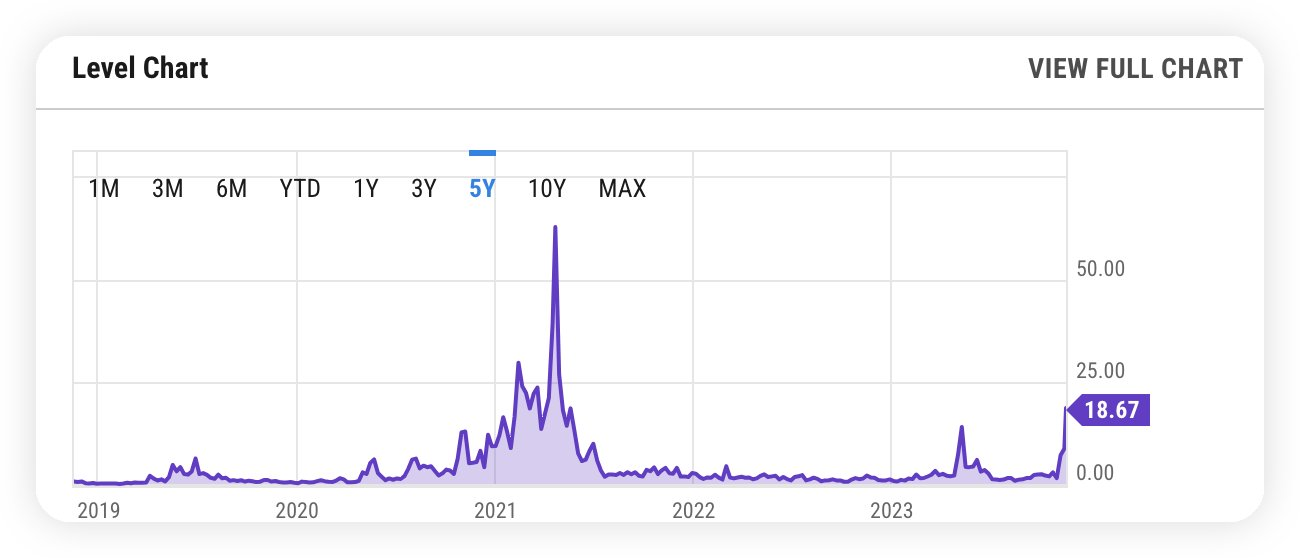

At present, the highest mint cost is sats, but it still does not exceed 3kw; the recent peak value of a transfer exceeds $20 (Figure 2), which is actually not expensive. Popular projects that issue more than 10,000 coins generally cost around 5 million, and if the gas increases again An order of magnitude, if the cost of each mint reaches $200, and the number of participants must be guaranteed, then the mint cost of popular projects will exceed 5000w-100 million. If this threshold of issuance cost is exceeded, the issuance cost will be at the end of the fundamental value and narrative. If the value is on the right side, participants will not receive high first-level returns. The lack of a general wealth-making story will bring the positive feedback of this chain to an abrupt end.

In addition, we can also observe from the primary market financing. A vivid example is that EOS raised 3 billion in ICO in 18. This does not mean that the ICO issuance mechanism has gone global, but that the ICO dividends have been exhausted; compared with Ethereum, if there is a 10-30 Financing with a valuation of US$100 million is a sign of institutional FOMO, and it also means that most retail investors cannot get low-cost chips; then the price they can get from the secondary market will not have much room for appreciation, so For example, in the current Ethereum ecosystem, there is not much difference in market expectations, fundamentals, and listing prices.

That is, the conduction chain of ③④

The handling fee is too low → cannot be launched fairly×

Handling fees are too high → High-cost chips for retail investors → Concentrated number of participants → Retail investors cannot make big money, and the story of wealth creation is missing → All dividends ×

Therefore, the Bitcoin ecosystem still has a long way to go. At least one of the following conditions needs to be met. The value of core assets, active addresses, and handling fees increase by an order of magnitude before you can consider retirement after success.

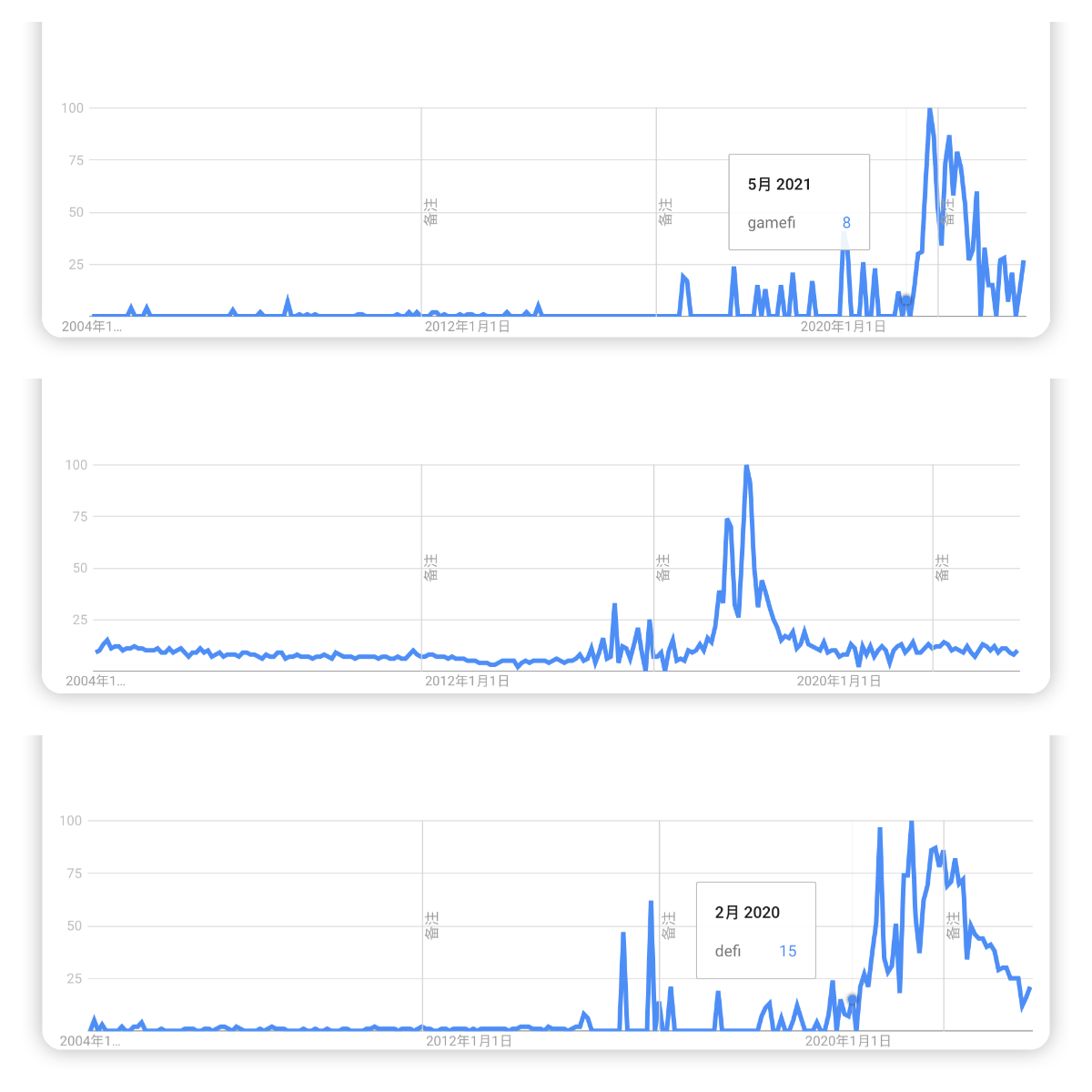

The power of trends cannot be underestimated, and big narratives will be long-lasting (Figure 3). ICO started to last for 1 year+ in 2017.2, DeFi started to last for 1 year+ in 2020.3, and gamefi started to last for 1 year+ in 2021.5; if the Bitcoin ecosystem is currently in As for the position, you will have the answer after looking at the aave trend chart. Before there is enough increase, there will be no (year/quarter) level retracement, but only (week/month) level retracement.