The recent rapid rise of the Bitcoin ecosystem has caused some concerns in the crypto community as some routes may overlap with the Ethereum ecosystem. Will the rise of the Bitcoin ecosystem really weaken Ethereum? In fact, not necessarily, Ethereum also has its own unique value expression...

It is undeniable that the current development of the Internet has brought us endless richness. But it's missing two key elements:

- Internet users have no digital property rights.

- The Internet does not have a trusted neutral, shared, secure, permissionless global accounting system to record the status of users and enable global trade on a shared ledger.

These two points happen to be the core value proposition of blockchain, and the revolution of the Internet is on the way.

01

The construction of Ethereum mirrors the construction of the Internet

Bitcoin is the first public blockchain. In the early days, if you wanted to create a new application using this new technological breakthrough, you had to launch your own blockchain. For example, Namecoin (peer-to-peer naming system) was originally a fork of the Bitcoin network. This era of public blockchains is similar to the early days of the internet, where you had to host your own servers to build your website.

Founded in 2015 and created as a "geographic city for public blockchains, " Ethereum enables developers to leverage shared infrastructure to build blockchain-based applications more cheaply and efficiently.

However, building applications for special use cases requires a lot of flexibility. The move into L2 and application-specific blockchains has led to people starting to build execution services "on top" of Ethereum, which serves as the base layer settlement infrastructure.

So Ethereum is becoming a "network of networks." Just like the internet. L2 looks very similar to the Taobao service - enabling flexibility and scalability while maintaining a shared infrastructure.

Additionally, L2’s enhanced scalability is being developed alongside zero-knowledge proofs, which bring privacy to public blockchains — just as HTTPS brought encryption to the internet, enabling e-commerce.

02

Ethereum’s business model

Investors should view the Ethereum network as two different things:

ETH – The native token that powers the network and creates economic incentives for it to operate in a decentralized manner.

Ethereum - a computing network and accounting system that serves as the base layer infrastructure "on top" of which other businesses build applications.

1) Data overview

Non-zero addresses: The cumulative total has grown exponentially over the past 8 years. As of September 30, 2023, the growth exceeded 107 million, an increase of 26% from a year ago and an increase of 4.9% from the previous quarter.

Active addresses: In the third quarter, Ethereum’s average daily active addresses were about 400,000, down 4% from the previous quarter. A similar decline occurred during the cryptocurrency trough last year, but as market conditions improved, New users started arriving.

Average daily transaction volume: In the third quarter, Ethereum’s average daily transaction volume increased slightly, network demand continued to exceed supply, and as the network scale increased, L2 networks (such as Optimism, Arbitrum, and Base) were handling a larger proportion of transactions. Transaction volume on L2 has grown by more than 3438% over the past few years, highlighting the power of Moore’s Law in the Ethereum network.

Average number of developers: The average number of core developers working on Ethereum leveled off in the third quarter. According to Electric Capital’s developer report, the Ethereum ecosystem has more than 5,946 active developers, a 51% increase over the past two years and more than three times that of its closest competitor. Note that these numbers are likely an underestimate as they do not reflect any contributions to proprietary crypto businesses built on Ethereum.

Average Daily Gas Usage: Average Gas Usage, an indicator of block space demand on Ethereum L1, is similar to daily transaction volume, which has increased slightly recently; the Gas limit has increased 5 times since the network was founded, each time The increases are all to meet block space needs, and this relationship is expected to continue to further develop L2 solutions and expand Ethereum's computing resources.

Average Transaction Fees: Ethereum’s average transaction fee in Q3 was $4.85, down 46% from the previous quarter, indicating that insufficient supply of block space during times of high demand causes fees to surge, while the network uses L2 solutions and sidechains (such as Arbitrum, Optimism , Base and Polygon), transaction costs for applications leveraging L2 range from as low as 1 cent to 13 cents; the implementation of EIP4844 is expected to further reduce fees in the fourth quarter.

ETH pledge: The growth of the ETH pledge rate is crucial to the healthy development of the Ethereum network. This indicator tracks the percentage of circulating ETH that is pledged in the network. With the sharp increase in pledge participation, ETH holders gradually show their long-term prospects. ETH is currently the only public blockchain network to achieve a positive real equity rate (3.6%).

ETH Price: The crypto market is extremely reflective, and ETH price is closely related to on-chain indicators, showing violent fluctuations every year since 2015, such as the price bottom of $83.79 in 2018 and the 57-fold growth peak in 2021, later article A more in-depth valuation analysis will be provided.

Daily Trading Volume: Trading volumes continued to decline in the third quarter, down 56% compared to the same period last year, while Jane Street and Jump Trading’s market-making operations in the U.S. market were scaled back due to regulatory uncertainty, and as the cryptocurrency winter Continuing, retail investors have lost interest in the sector.

TVL (USD): TVL in Ethereum DeFi applications is US$3.9 billion, down 12% from the previous quarter, but still 5.8 times higher than the nearest competitor; another perspective of TVL is "assets under management", currently smart The proportion of ETH held in the contract reached 32%, a record high, showing the health of assets under management.

Unit economics: Daily revenue per active address increased 87% in the second quarter from the previous quarter, but fell 24.9% from the same period in 2022, showing that active user daily fee growth is consistent with transaction fee growth, indicating that when network congestion occurs, users Willing to pay higher fees due to the time value and sensitivity of on-chain transactions.

With L2 solutions, we've seen user fees drop significantly. When this happens, transaction volumes are expected to grow exponentially.

2) Business model

Although Ethereum's economic and market structure is decentralized, its business model is simple and charges a small calculation/settlement fee. As its application expands, the network becomes more and more profitable. Next, Ethereum's financial situation is analyzed in detail. .

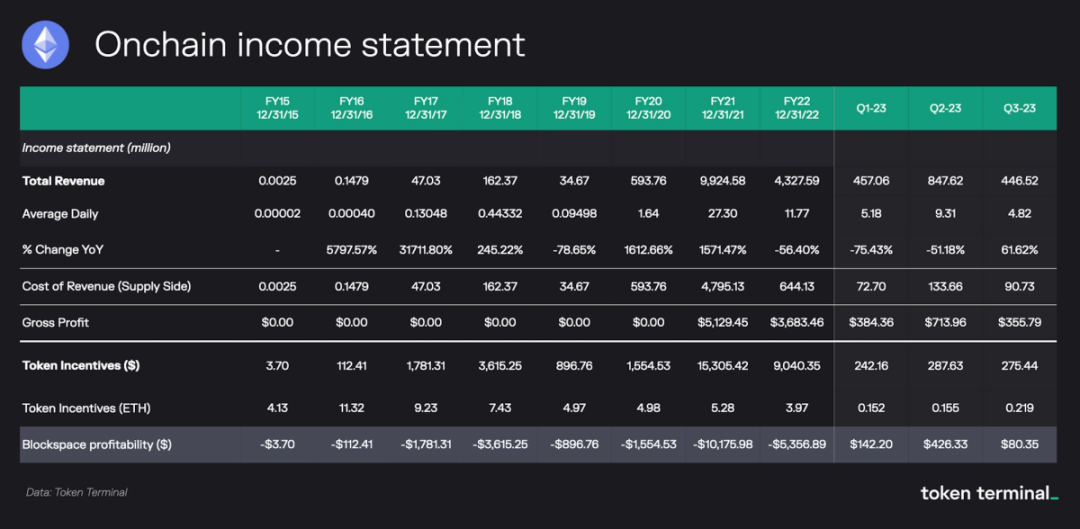

Total revenue: Ethereum’s transaction fees refer to the total fees paid by users on the network. It is expected that in the future applications will pay fees on behalf of users, covering peer-to-peer payments, DeFi loans, trading platform transactions, gaming experiences, NFT minting, etc. Any use of the Ethereum area The operation of the blockchain, while applications using 2 solutions will ultimately settle data for transactions on the Ethereum base layer, has enabled the network to remain profitable despite a 47% decline in Q3 revenue from Q2.

Cost of Revenue: This line item represents the amount paid to providers (validators) who provide services to the network by approving transactions and ensuring network security, with 80% of user fees being burned during the quarter and the remaining 20% representing Priority fees and MEV costs.

Token Incentive: Token incentive represents the block subsidy paid by the network to validators. After the "merger" in 2022, Ethereum's security fees were significantly reduced by 87%, bringing the network into a profitable state for validators and passive holders Reimbursement of user fees is provided.

There are different views on Token incentives. The general view is that it is a "fee" paid by the network to the verifier, but its essence is different from the fee in the traditional sense because the verifier does not directly pay the reward. This concept is currently circumstances may be difficult to quantify precisely.

Blockspace profitability: From an on-chain perspective, Ethereum’s net revenue this quarter was $78.7 million, down 81% from the second quarter. Despite the decrease, Ethereum is still the only profitable public blockchain because users The fee exceeds the fee for network token incentives.

03

Relative Valuation: “GDP” Analysis

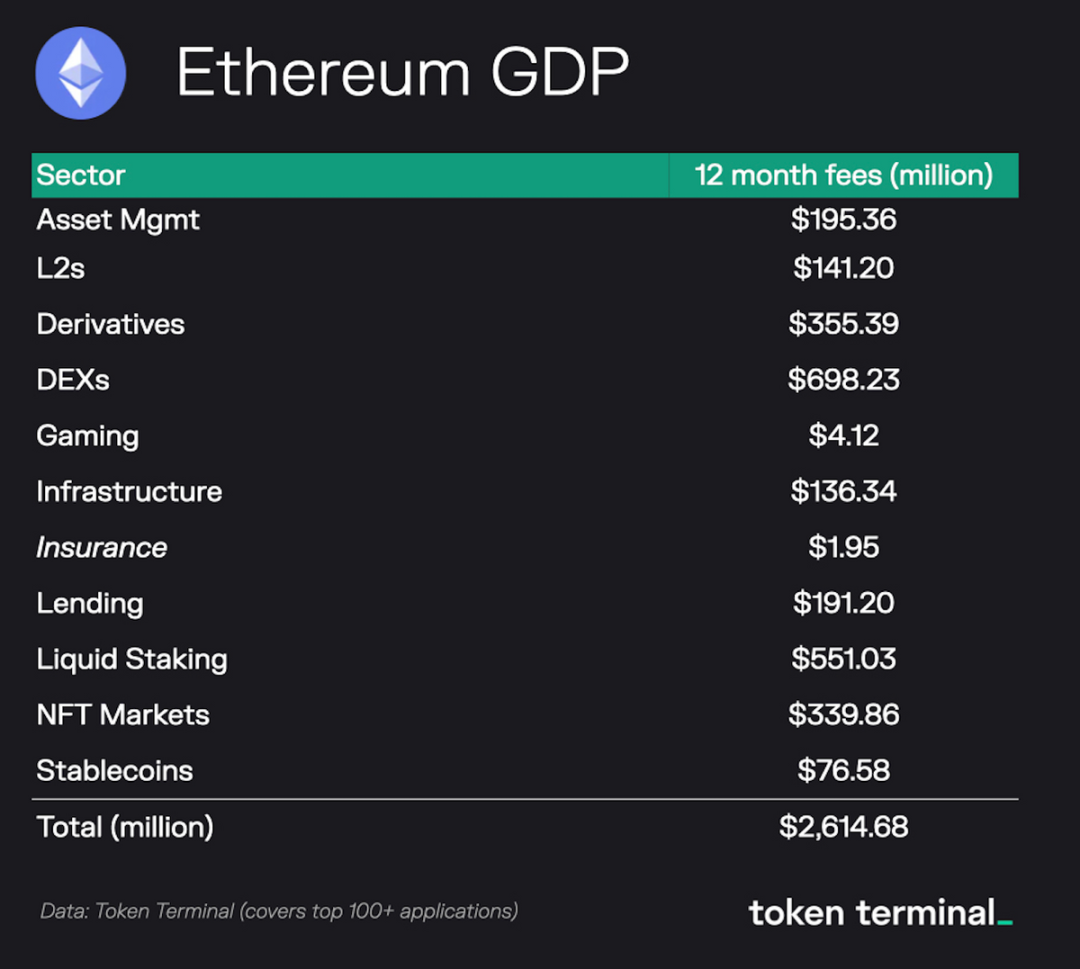

One way to compare the valuation of Ethereum to other L1 networks is to use “GDP” analysis. In this case, we will quantify and predict the economic opportunity or GDP of the network. The GDP of a blockchain network is the sum of all revenue generated by applications built on top of L1.

From this perspective, we view L1 blockchains as “countries” rather than networks or companies. The strength of a country's currency depends on its economy/GDP, property rights and legal system (the country's infrastructure), and the demand for the currency (paying taxes, buying goods, consuming services, storing value, etc.). )

In a public blockchain network, L1's native Token is the currency of the network. The property rights and legal system within a public blockchain network are derived from its consensus mechanism, decentralization, security, community and value. Similar to countries, the strength of a currency is related to the economy/GDP supported by the L1 infrastructure and the demand for tokens to access services within the network.

According to data pulled from Token Terminal, Ethereum’s “GDP” over the past year was $2.6 billion. Our annual revenue breakdown by industry is as follows:

Ethereum currently leads its competitors in terms of “GDP” and TVL ($39 billion). As networks scale with L2 solutions, we expect the economic opportunity (or GDP) to expand exponentially in the coming years through net new use cases brought about by enhanced throughput and zero-knowledge privacy solutions ("Broadband" + "Privacy") level growth.

Compare ETH demand to USD demand

To expand on the concept of ETH as a currency, we analyze the strength of one currency relative to others. The U.S. dollar has established a strong position in the world due to structural needs such as oil trade needs and taxation, demonstrating the relative strength of currencies. Dollars themselves have no utility, but we need them to get what we want.

We see the same pattern in Ethereum. In order to access the network, computing resources must be paid for in ETH. If users want to send stablecoins across borders, they need some ETH. To use DeFi services, you need to pay with ETH. To play on-chain games, users must have some ETH. To mint or buy NFTs, you'd better have some ETH. Additionally, if you want to secure the Ethereum network and earn revenue, you need to hold some ETH.

We are even now seeing ETH being used to provide economic security for additional layers of the technology stack through Eigen Layer – an emerging “re-collateralization” solution that creates even more demand for ETH.

All in all, we see similarities between ETH and traditional currencies such as the US dollar . If Ethereum can continue to expand its global network effects, we believe there will be strong demand from users and businesses to hold the asset, given the requirements for accessing services within the network.

04

The arrival of the next cycle

There are three main drivers of the crypto cycle:

- Global Liquidity/Business Cycles: Interest Rates and Monetary Policy

- Innovation Cycle: Development of Infrastructure and Applications

- Bitcoin Halving: The date when new Bitcoin issuance is halved (during this cycle we go from 900 Bitcoins issued per day to 450)

Using Bitcoin as a benchmark, we observe significant consistency in timing and price action over the past three cycles:

Retracement percentage from peak per cycle: approximately 80%

Time to cycle bottom: 1 year to peak

Time to regain all-time high: 2 years

Furthermore, each cycle is almost entirely consistent with cyclical changes in the business cycle as measured by the ISM Manufacturer's PMI, which is also consistent with global liquidity cycles.

Looking forward, we believe that all three factors are likely to align again as we prepare for the next Bitcoin halving, which will occur in April 2024.

05

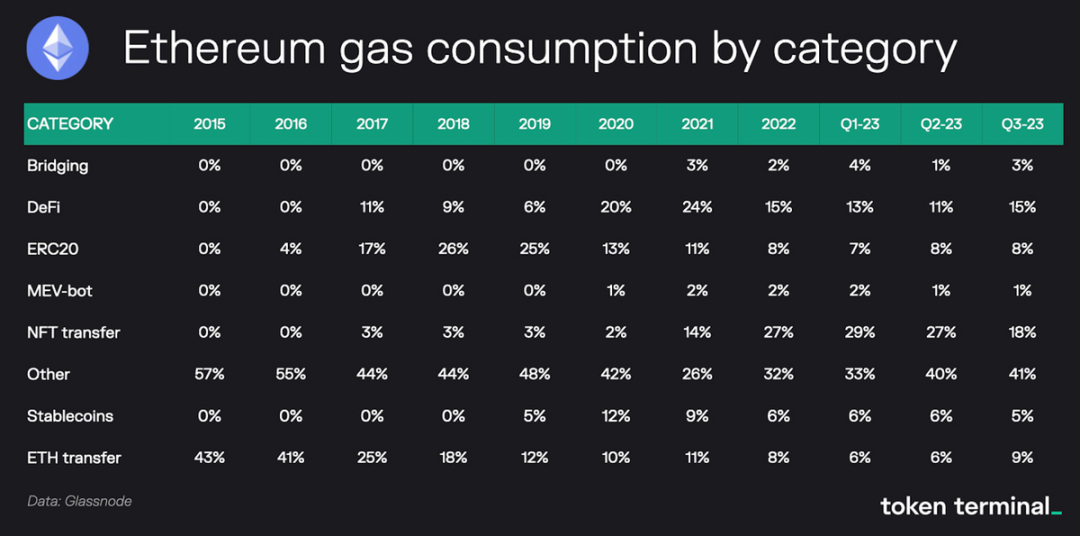

Gas consumption on the chain in each year

The above Gas consumption data shows the development process of Ethereum as a computing infrastructure. Notably, we can see the introduction of DeFi in 2017, stablecoins as payments and collateral in 2019, NFTs in 2020, and bridges in 2021, all of which alleviated the congestion of Ethereum at the time.

In the future, we expect that most of Ethereum’s gas consumption will come from L2 solutions, which will drive an explosion of new use cases as costs compress.

06

Competition between modular and integrated blockchains

Ethereum as we know it is maturing and evolving as a “network of networks” or “modular” technology stack – where settlement (L1) and execution (L2) are separate yet connected.

In contrast, Solana (ranked third) operates in a monolithic or integrated architecture. In this architecture, settlement and execution are brought together.

We think both Ethereum and Solana have opportunities to thrive, with some comparing them to Android and iOS. In this case, Ethereum is more like Android, which values modularity and runs on many different devices made by hundreds of manufacturers around the world. Android's flexibility and expressiveness enable hardware developers to build anything from smartphones to TVs without having to invest in building a custom operating system.

Solana is more like iOS in that it provides a more integrated experience for users and developers, seamlessly connecting the complexities required to connect disparate L2 networks. As a unified network, Solana has lower transaction costs and higher throughput than Ethereum and EVM operating systems. This allows developers to focus on delivering applications with a single high-performance platform without having to deal with the complexities associated with transaction speed or interoperability between different networks. It also eliminates the hassle of bridging assets or dealing with inconsistent wallets, making the user experience more seamless.

However, we believe there is room for alternative architectures such as Solana. We believe that both can coexist.

07

Catalysts and drivers for Ethereum adoption

In the short term (2-3 years), we see scalability, privacy solutions, and regulatory clarity driving adoption. Longer term, Ethereum has several tailwinds supporting network adoption this decade:

1) Open source technology: The Ethereum network is the center of the web3 movement. As a leader in open source technology, it has created new standards, promoted the iteration of the next generation of the Internet through composability and decentralization, and is innovating and Benefit from a broad talent network and rapid iteration during development.

2) Demographics: Currently, the world's largest demographic change is shaping the future of the United States and other countries. As the last baby boomers gradually retire, the concepts and career paths of the younger generation are increasingly changing the overall landscape.

3) Global distribution of wallets: As web3 products and services improve, we believe adoption will likely expand non-linearly due to the open source nature of the technology and the fact that anyone with a smartphone can participate. An estimated 83% of the world's population now owns a smartphone (compared to 49% six years ago).

4) Outward distribution of tokens and value: Encrypted networks such as Ethereum lay the foundation for new business models. The token distribution mechanism guides value distribution, giving more value to users, creators and suppliers, and achieving a more equal distribution of ownership.

5) Internet Culture: We have not forgotten that Bitcoin has no CEO, no boardroom. There is no sales or marketing team, and there is no “roadmap.” However, Bitcoin reached a valuation of $1 trillion faster than any company in history. This also brings potential confidence to networks like Ethereum and other web3 networks.

6) Lack of trust in institutions: According to Gallup polls, the United States currently has poor trust in organized religion, the Supreme Court, public schools, newspapers, Congress, television news, the president, the police, the World Bank, the IMF, NATO, the European Union , the World Trade Organization and other global institutions were all established after World War II. History shows that decades of relative stability can be followed by dramatic changes in just a decade.

7) Macroeconomics: History also shows the existence of a long-term debt cycle, which is currently at its end, indicating possible geopolitical turmoil. This period may trigger rapid social changes and bring new opportunities to web3 and the Ethereum network.

8) L2 scaling solutions: Ethereum’s settlement network is still slow and expensive, but the growth of L2 scaling networks such as Arbitrum, Optimism, Base, and Polygon, as well as the upcoming EIP-4844, heralds a significant increase in transaction throughput, prompting Ethereum to With broader applications and better user experience, Fang may reach 1 billion users in the next few years.

9) Financial innovation: The Internet has subverted almost every imaginable business model. However, the business model of the financial services industry remains relatively unchanged. Public blockchains are seen as a driving force for financial system reform, especially the privacy-based L2 called Nightfall launched by Ernst & Young on Ethereum, which is expected to be a catalyst for institutions to migrate to public blockchains.

10) New Internet-native business models: As we have introduced in this article, Ethereum enables many new Internet-native business models by introducing user-controlled data, smart contracts, peer-to-peer interactions, and global accounting ledgers.

08

in conclusion

In 2021, the total market value of cryptocurrency will reach $3 trillion. Despite the volatility in the space, we believe cryptocurrencies are in the midst of a long-term, exponential adoption cycle. Therefore, if the industry follows past growth patterns, the total market capitalization could reach $10 trillion during the next adoption cycle. Based on simple logic and historical data, more than 50% of this number may return to Bitcoin and Ethereum (currently 68.1% of the cryptocurrency market). If we assume Ethereum captures $1-2.5 trillion, then in the next adoption cycle, the price will be in the range of $8,300 - $20,800.

After all, Ethereum demonstrates strong network effects, clear revenue generation/outward distribution of value, and a “post-merger” high-quality token economy. The core team has demonstrated the ability to execute on its roadmap, and the Ethereum ecosystem/community is the strongest we have ever seen in a smart contract platform.

We believe ETH represents the best risk-adjusted return potential in the crypto ecosystem today. Investors can think of ETH as an index fund representing call options on web3. The S&P 500 index rotates among new companies. Ethereum rotates new L2, applications and protocols. Given Ethereum's strong network effects, we believe that the value of ETH will likely grow with the adoption of web3, similar to how Google, Amazon, and Apple grew with the adoption of the Internet.