Before the big market rebound so far in October, major cryptocurrency exchanges generally faced the challenge of sluggish trading volumes. The market lacked volatility for a long time. Investors faced difficulties in finding actionable quotes, and it became relatively difficult to make profits, prompting Investors began to look for other ways to make profits.

Against this background, trading platforms have launched trading activities and new trading functions to attract users. OKX Exchange provides a variety of quantitative trading tools, allowing retail investors to participate in quantitative strategy investment opportunities. This article will introduce the basic concepts and common strategies of quantitative trading, and help understand the OKX strategy trading types and usage.

What is quantitative trading?

Quantitative trading refers to using data and mathematical models to find effective trading strategies, and after clearly defining trading rules, automatically executing the set transactions through programs. This trading method has become an indispensable part of the modern financial market. Professional investment institutions often invest a lot of resources to develop and optimize their quantitative trading strategies to achieve the goals of improving transaction efficiency and reducing risks.

Quantitative trading can be regarded as a trading robot that can execute transactions based on instructions 24 hours a day. This factor makes quantitative trading particularly suitable for use in the cryptocurrency market that trades around the clock.

While quantitative trading has its advantages, it also requires attention to the many challenges that impact its performance. Therefore, quantitative traders need to continuously perform backtesting and optimization to ensure the robustness and effectiveness of their strategies in different market environments.

Advantages and Disadvantages of Quantitative Strategies

Quantitative strategies have many advantages over subjective trading and are increasingly popular in the financial market. The benefits they bring to investors include:

- Objective data analysis, continuous backtesting and optimization

Quantitative strategies use big data analysis methods to find potential trading trends in huge market data, providing strategies that are in line with market dynamics and more accurate trading decisions. Traders can also use historical data for backtesting, evaluate the effectiveness of strategies, and optimize parameters to improve performance.

- Improve transaction efficiency

Quantitative trading does not require manual operation by investors. When a trading signal appears on the investment target, it will quickly enter the market automatically through the program. High-frequency trading strategies can even execute multiple operations within milliseconds, saving a lot of time for tracking the market, allowing investors to can focus on optimizing strategies. Many quantitative strategies can even be applied to different investment targets.

- Overcome human weaknesses

Unlike subjective trading, which relies on investors' own experience and judgment, quantitative strategies are based on rigorous systematic rules, which can make the trading process more stable and efficient, avoiding interference from human errors and greed or panic in the market.

- Risk Management

Quantitative trading usually establishes strict risk control rules, which help control losses and stop losses immediately to ensure that portfolio performance remains robust.

Quantitative trading strategies also have some shortcomings and challenges. Common problems include:

- Overfitting risk: Quantitative strategies may overfit historical data when optimizing, which makes the future performance of the strategy less than expected.

- Data quality issues: The quality of the data used will affect the effectiveness of the strategy. If there are errors or missing data, the strategy may be inaccurate and affect performance.

- Strategy failure: Once a successful strategy is widely used, it may be attacked by other hedging strategies when the amount of market funds becomes larger, thereby reducing the profit potential of the strategy.

- Market fluctuation risk: When the market environment changes significantly, historical data may no longer be applicable, which will lead to the gradual failure of quantitative strategies. The stability of the data needs to be improved and updated in real time. Insufficient liquidity in the market may also result in the inability to execute transactions at the expected price, affecting the subsequent operations of the strategy.

- System failure risk: Quantitative trading relies on algorithm models and computer technology to operate, so there is a risk of system failure, such as program errors and signal transmission failures. Such factors can lead to abnormal execution of quantitative strategies or transaction delays.

Common quantitative strategy arbitrage methods

There are many types of quantitative strategies, among which CTA strategy (Commodity Trading Advisor Strategy) and statistical arbitrage strategy are the most common and are widely used by professional investors and institutions. Investors who employ quantitative CTA strategies often profit from rising and falling trends in the futures market.

The statistical arbitrage strategy is more common. It aims to use the price difference in the market to hedge or swap to achieve arbitrage, and the income is relatively stable. Arbitrage strategies can be further distinguished into types such as funding rate arbitrage , futures and spot arbitrage , intertemporal arbitrage and triangular arbitrage :

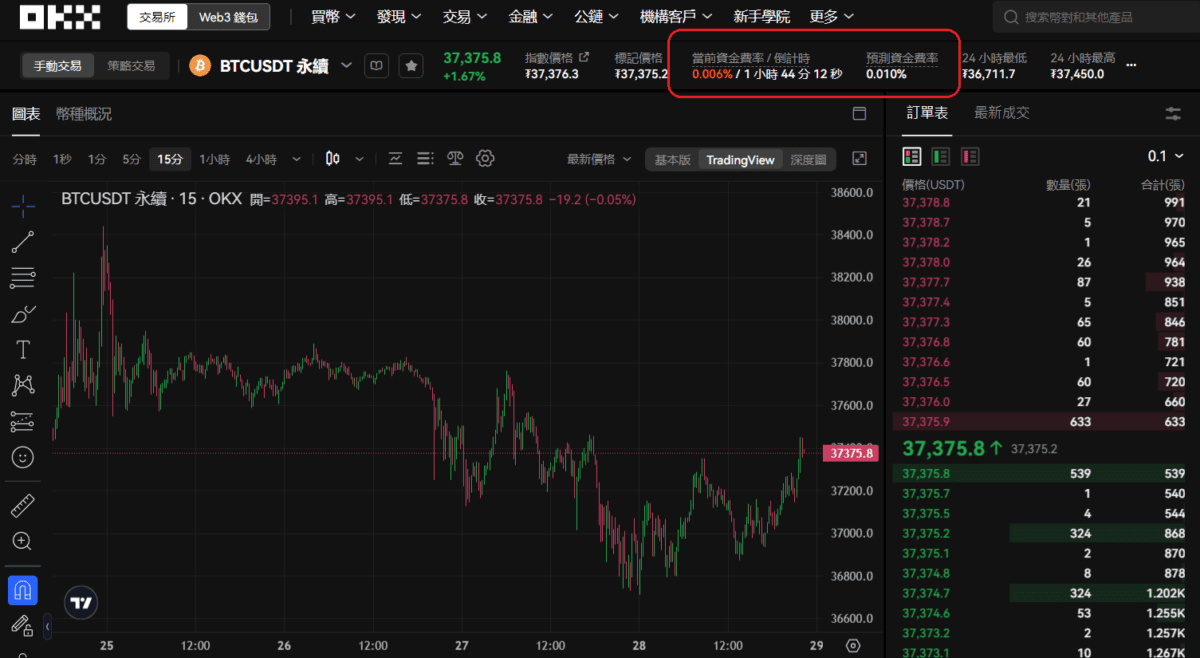

Funding rate arbitrage

The way the perpetual contract reduces the spot premium is through the funding rate . When the market is bullish and there are long long, it will cause the asset’s perpetual contract price > the spot price. At this time, the funds for the perpetual contract will When the rate is positive, the long side has to pay the capital fee to the short side, so that the number of long positions will decrease and the price of the perpetual contract will become consistent with the spot price. On the contrary, when the perpetual contract price <spot price and the funding rate is negative, the short side has to pay the funding fee to the long side.

Funding rate arbitrage aims to earn funding fee income through the hedging of contracts and spot prices. It is to conduct two transactions of equal quantity, opposite directions, and offsetting profits and losses in the perpetual contract market and spot market at the same time to obtain the funding rate band. income to come.

Operation method:

- When the underlying perpetual contract price > the spot price and the funding rate is positive, short the perpetual contract and buy the spot with the same position value.

- When the underlying perpetual contract price <spot price and the funding rate is negative, short the spot (short through borrowing currency) and long the perpetual contract at the same time.

For example: Assume that the spot price of BTC is US$36,000 and the funding rate is 0.04%. If a trader wants to use 1,000 USDT for funding rate arbitrage, he can use 500 USDT to purchase BTC spot and use the other 500 USDT to short the BTC perpetual contract. . Assuming that no leverage is used and the funding rate remains unchanged, a funding fee of 0.2 USDT (500*0.04%) can be charged every 8 hours, then the daily funding fee income totals 0.6 USDT.

In addition, traders can also use leverage to amplify profits. Assume that 750 USDT is used to purchase BTC spot, and 250 USDT is used to triple short the BTC perpetual contract (the position value is 750 USDT). If the funding rate remains unchanged, A capital fee of 0.3 USDT can be collected every 8 hours (750*0.04%), so the total daily capital fee income is 0.9 USDT. (Note: Remember that borrowing interest and transaction fees must also be included in the calculation of arbitrage income)

Although funding rate arbitrage is considered a relatively low-risk and stable arbitrage strategy, it may still face risks when the market suddenly changes (the funding rate changes from positive to negative or negative to positive). At this time, if leverage is used excessively There is even a possibility of liquidation. Arbitrageurs also need to consider whether funding charges are sufficient to cover transaction fees.

Other common arbitrage strategies:

- Futures and spot arbitrage: Use the price difference between the futures market and the spot market of a specific asset to carry out arbitrage. By buying the low-priced side and selling the same amount of high-priced side, when the price difference between the two narrows, you can close the position at the same time to obtain the part of the narrowed price difference. profit.

- Intertemporal arbitrage (period arbitrage): When there is a large abnormal price difference between delivery contracts of the same futures type with different delivery periods, by long on the low-priced side and short the same amount on the high-priced side, the price difference between the two contracts will be balanced at the same time. position and obtain the profit from the narrowed price difference.

- Triangular arbitrage: Use the price relationship between three tokens to conduct arbitrage and observe whether there are arbitrage opportunities in the quotes between trading pairs. It is often used in the foreign exchange market.

Get started with profit trading quickly with OKX strategy tools!

OKX, founded in 2017, is one of the top three cryptocurrency exchanges in the world, providing users with a variety of trading services, including spot, perpetual contracts, delivery contracts, options and leverage trading. OKX supports a large number of currencies, has an efficient trading engine, high liquidity depth, and relatively low handling fees. These characteristics make OKX a suitable trading place for executing trade arbitrage.

Comparison of handling fees and strategy tools of the top three international exchanges:

| OKX | Binance | Bybit | ||

| handling fee | Spot goods | The transaction fee for pending orders is 0.08% Taker transaction fee 0.1% | The transaction fee for pending orders is 0.1% Taker transaction fee 0.1% | The transaction fee for pending orders is 0.1% Taker transaction fee 0.1% |

| Perpetual contract | The transaction fee for pending orders is 0.02% Taker transaction fee 0.05% | The transaction fee for pending orders is 0.02% Taker transaction fee 0.05% | The transaction fee for pending orders is 0.02% Taker transaction fee is 0.055% | |

| Strategic trading tools | Five major types, 14 strategies (including fixed investment strategies) | 8 types of trading robots and fixed investment plans | 4 types of trading robots and fixed investment robots |

OKX’s advantages also include:

- Diversified products, including cryptocurrency earning, lending and other crypto financial services

- Through OKX's Jumpstart platform, users can participate in high-quality new projects early

- Launched Web3 wallet, allowing users to easily browse the on-chain ecosystem on the same platform

In terms of OKX security:

- Protect the platform's cold wallet storage through an offline storage system, multi-signature and off-site backup, effectively ensuring the security of funds.

- Establish OKX Universal Fund to protect user assets in the event of security risks

- Publish reserve certificates regularly to maintain asset transparency, and publish audit results regularly

Although OKX has the above security and risk control measures, users' own protection work must be done, such as enabling OKX's multi-verification function, good fund control, and maintaining risk awareness of the platform.

In addition to the above advantages, OKX Exchange also overcomes the conditions required for retail investors to use quantitative trading and provides a variety of easy-to-use quantitative strategy tools, allowing ordinary investors to create their own strategies based on market conditions, as well as observe and follow professional transactions. member’s investment strategy.

Use OKX to place arbitrage orders

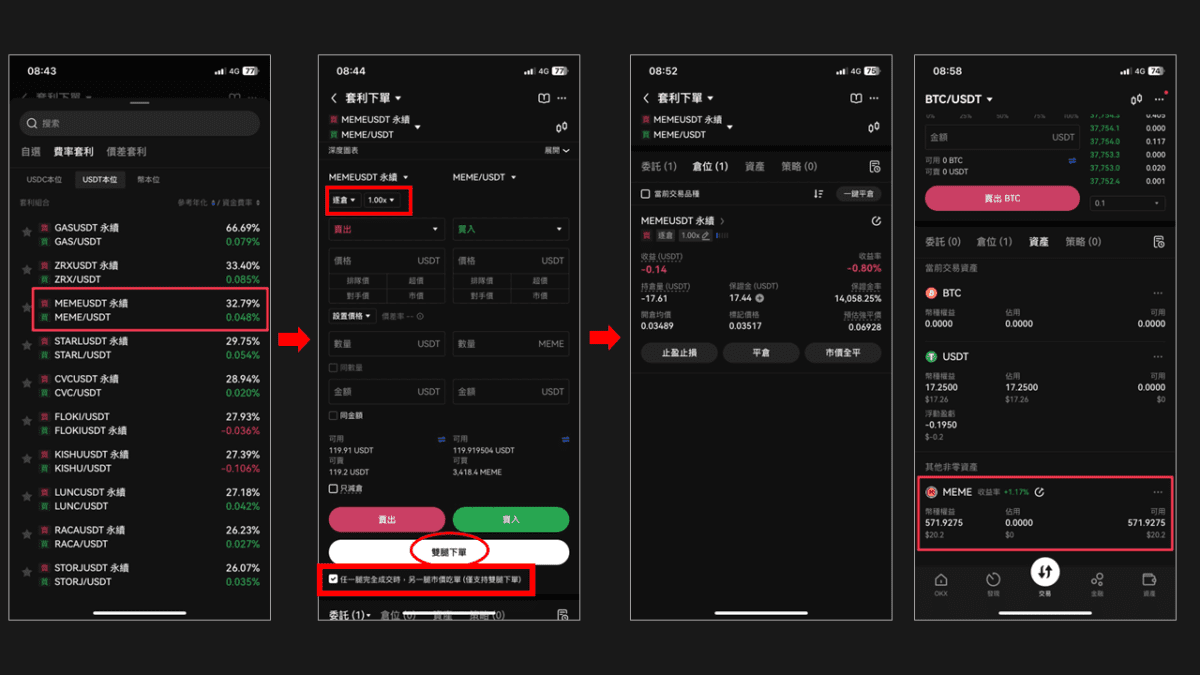

OKX has developed an "arbitrage order" strategy for arbitrage trading, allowing users to conduct arbitrage trading with one click, and intelligent recommendations through the system help users quickly screen and find suitable arbitrage combinations. As shown in the picture below, after entering the OKX arbitrage order page, you can choose rate arbitrage or price difference arbitrage (futures and cash arbitrage).

rate arbitrage

1. Enter the rate arbitrage page: After selecting rate arbitrage, click "USDT Standard", and use the reference annualization to sort from most to least to analyze which targets have more room for arbitrage. After clicking on the target for arbitrage operation, you can start setting the arbitrage order strategy.

2. Parameter setting: It is recommended that first-time users first adjust to the "isolated margin" mode to avoid affecting other positions, and then adjust the leverage multiple. Using high leverage arbitrage can obtain higher annualized returns, but relatively you need to bear price fluctuations. risk.

Assuming that the funding rate of the selected arbitrage portfolio is positive, it means that we need to short the perpetual contract to obtain funding fees, and at the same time, we need to buy spot with an equal position value to hedge against price fluctuations. Enter the order amount and quantity (or amount) of the arbitrage combination, and then click " Place an order with two legs " to complete the strategy creation.

The OKX arbitrage order strategy allows us to complete the above operations at one time. The system will help us buy spot and short the perpetual contract at the same time. You can check "When any leg is fully completed, the market price of the other leg will be taken (only supports placing orders on both legs)" "Order)" to ensure that positions are opened at the same time and reduce the price difference between the positions on both sides.

3. View the created strategy: After the arbitrage order strategy is created, you can see the short contract position of the strategy in the "Positions" section, and the spot assets purchased by the strategy in the "Assets" section.

spread arbitrage

1. Enter the spread arbitrage page: go to the OKX arbitrage order page and select the "spread arbitrage" strategy, then select "period" arbitrage or "spot" arbitrage, and "USDC standard", "USDT standard" or "coin standard" , and then select an arbitrage combination of strategies.

2. Parameter setting: Take the "BTCUSDC-29DEC23" USDC standard delivery contract in futures and spot arbitrage as an example. The delivery time of this delivery contract is December 29, 2023. There is a price difference between its price and the spot price. If you want to arbitrage from it, you need to Hold BTC spot and short an equal amount of delivery contracts.

After entering the relevant parameters, click "Place Order with Two Legs" to complete the strategy creation. This strategy must be held until the delivery date, which is December 29. By then, the premium of the delivery contract has basically been flattened, and users can directly close their positions to earn profits.

3. Check performance: The capital fee income from rate arbitrage will be settled to the "trading account" every day, and the income for each period can be viewed in the capital bill. Futures and spot arbitrage requires timely closing of positions when the price gap between the two leg markets returns to make a profit.

OKX’s top five trading strategy tools

In addition to arbitrage orders, OKX provides five major types of strategy tools and subdivides up to 14 trading strategies:

- Grid strategy: spot grid, contract grid, infinite grid, heaven and earth grid

- Average cost: contract martingale (contract DCA), spot martingale (spot DCA), fixed investment strategy

- Combination arbitrage: Tunbibao, buy the dips treasure, escape top treasure, arbitrage order

- Large order split: iceberg strategy, time-weighted strategy

- Signal trading

Among the above strategies, fixed investment in spot grid, sky and earth grid, and average cost strategies are the simplest and easiest to use. Users can create appropriate strategy tools based on market conditions and trading cycles.

1. Grid strategy

Grid trading is one of the popular strategic trading strategies in the crypto space, which earns volatility profits by constantly and automatically "buying low and selling high." After the grid strategy is created, the system will automatically place buy orders above the opening price and sell orders below the opening price based on the grid parameters preset by the user. When the underlying price falls and touches the grid, the system will buy, otherwise it will sell.

The grid strategy is more suitable for use in volatile market conditions. Continuous arbitrage amid price fluctuations can help investors save trading time and avoid losses caused by market sentiment or fluctuations. OKX users can use different grid strategy types based on price trends and trading cycles.

spot grid

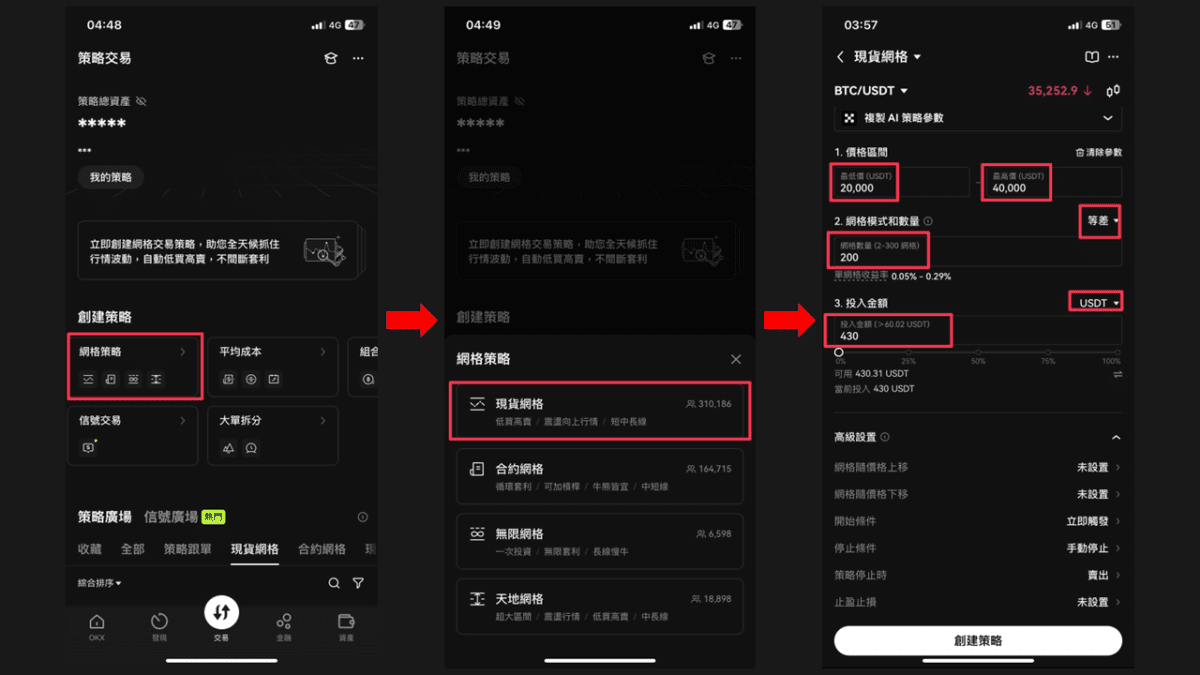

The spot grid strategy refers to the automatic execution of buying low and selling high within a preset specific price range. Users need to select the currency, set the highest price and lowest price of the price range, select the grid mode (equal difference or equal ratio), the number of grids and the amount of investment. After the strategy is created, the system will automatically execute transactions according to parameters and market changes.

Take the execution of the BTC/USDT spot grid strategy as an example. After the user creates the strategy, the system will first use USDT to buy a portion of BTC, and then buy or sell BTC after touching the grid according to the market trend. Users can also set additional conditions to control risks, such as take-profit, stop-loss, and stop conditions. OKX also provides the function of copying AI strategy parameters.

Heaven and earth grid

"Heaven and Earth Grid" is similar to the spot grid, but the preset grid range is wider, which is suitable for investors with longer trading cycles. OKX's Tiandi Grid strategy has no stop loss or take profit, and all its parameters are based on AI parameters using historical market backtesting.

Contract Grid

The contract grid strategy is an automated strategy of buying low and selling high futures contracts within a specific price range. It is mainly used for arbitrage in volatile markets. Before running the contract grid strategy, the user must also set the highest price and lowest price in the range and the number of grids in the range, and select the long and short direction of the grid (long, short, neutral).

It should be noted that the contract grid strategy will no longer operate after it runs out of the range. If the unilateral market trend of the contract target continues and does not return to the range, you may suffer floating losses or even be forced to liquidate. It is recommended to use this strategy. Set a stop loss price. In addition, although the contract grid can expand potential profits through leverage, it will also suffer greater losses when losing money. It is recommended that you have an in-depth understanding of period operations and rules before using this strategy.

infinite grid

In the operation of a general grid, when the price exceeds the upper limit of the grid, all positions will be sold, and the benefits brought by the subsequent market will not be obtained. The infinite grid strategy solves the problem that the spot grid may be miss the pump.

The OKX infinite grid strategy must set the parameters of "lowest price in the range" and "single grid yield". When running, it also arbitrages by continuing to buy low and sell high, and ensure that the user's holdings are consistent with the initial value (opening) in the rising market. (single time) equivalent priced monetary assets, and the assets sold come from rising floating income.

2. Average cost

Dollar Cost Averaging (DCA) is a simple and long-term investment strategy suitable for most investors. By buying in batches, you can avoid being exposed to the risk of plummeting due to one-time purchases. This strategy spreads the cost of holding assets by continuously buying assets, which allows investors to avoid unfavorable buying and selling operations affected by short-term market fluctuations.

Fixed investment strategy

Fixed investment means that investors purchase specific targets at the same cost at fixed intervals, for example, a fixed cost of NT$1,000 to buy Bitcoin on the 1st of every month. OKX's fixed investment strategy allows users to buy cryptocurrencies in regular fixed amounts through the U.S. dollar stablecoin USDC, and arrange their own fixed investment period (daily, weekly or monthly) and amount. This strategy also allows you to select up to 20 currencies for fixed investment at the same time, freely adjust the allocation ratio, and build your own investment portfolio.

Spot martingale

The spot Martingale strategy is an operation of buying after the underlying price drops by a fixed percentage, and automatically selling when the market reverses and reaches the preset profit-taking target percentage. Compared with the fixed investment strategy, the Martingale strategy is more flexible in cost control and is suitable for medium and long-term market fluctuations.

OKX spot martingale strategy allows investors to adjust strategy parameters according to their own trading habits and risk preferences, such as single-time profit-taking targets and multiples of position addition amounts. First-time users can first try the AI strategy parameters provided by OKX (as shown below).

Contract martingale

The contract martingale strategy is similar to the spot martingale strategy. The difference is that you are buying and selling long or short position contracts instead of spot. This strategy can set a leverage multiple to maximize profits, but leveraged trading has its own risks, and it is recommended that you fully understand it before using it.

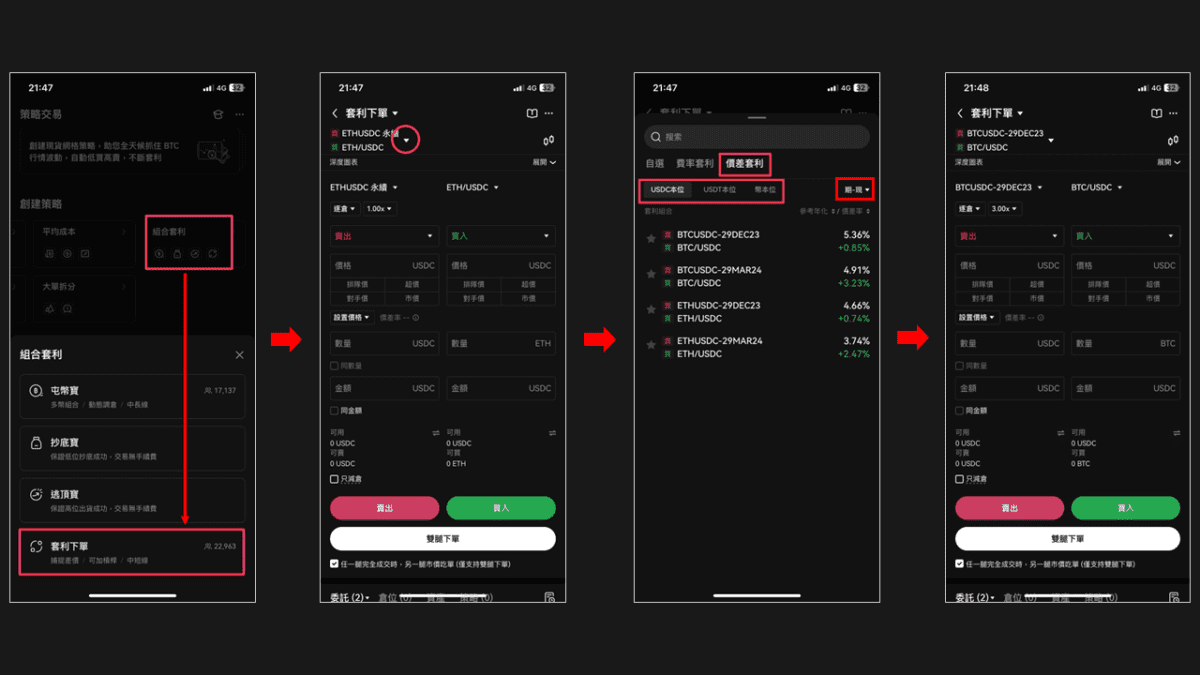

3. Portfolio arbitrage strategy

Tunbibao

Tunbibao strategy applies the concept of "rebalancing". After traders establish an investment portfolio through Tunbibao, when the market fluctuates, the strategy will automatically adjust the proportion of various assets in the portfolio and restore the original default investment. Configuration ratio. For example: After a period of market movement, the original 1:1 ratio of the BTC and ETH investment portfolio increases, and the market value ratio of BTC in the portfolio increases. The Tunbibao strategy will replace BTC with ETH to restore the investment portfolio to 1:1. configuration.

In the setting of the OKX Tunbibao strategy, traders can choose multiple currencies (up to 10) to form an investment portfolio, set the proportion of each currency in the portfolio, and choose the method to trigger balance. "Proportional balance" triggers balance based on the currency change ratio, and "timed balance" detects the degree of deviation and triggers balance in a fixed time period.

Rising prices in the crypto market often involve sector rotations, that is, currencies in different crypto fields will rise in turn. Some investors will use the Tunbibao strategy to build multi-sector investment portfolios to grasp the benefits of each sector rotation. .

The treasure of buy the dips and the treasure of escaping from the top

buy the dips treasures and escape-top treasures are both structured products derived from option products. Buy the dips buying treasures can guarantee users to buy a certain proportion of the underlying assets below the market price, while escape-top treasures guarantee users to sell them above the market price. For a certain proportion of the underlying assets, neither strategy will incur transaction fees.

OKX's buy the dips hunting strategy currently supports Bitcoin (BTC) and Ethereum (ETH), and the system recommends a series of selected strategies for users to choose from. Take the buy the dips hunting strategy in the figure below as an example. When a user wants to buy the dips 1 BTC at the bottom and chooses the strategy of buying at a high discount of $32,000, he can buy BTC with a guaranteed ratio of 22.31% at a 19.9 discount from the current price, but the invested funds will be locked for 72 sky.

At the time of expiration and delivery, if the BTC price is higher than $32,000, the user will trade 22.31% of the share (i.e. 0.2231 BTC) at a price of $32,000, and the remaining funds will be returned to the user. If the BTC price is lower than $32,000, the user will be fully executed to buy 1 BTC at a price of $32,000.

The operation method of escape treasure is similar to that of buy the dips hunting, allowing users who want to sell at a high price to ensure that part of the order will be filled at the peak price when it expires, avoiding the situation that the order cannot be filled after placing a limit order at a higher price.

4. Split of large orders

Investors with large funds often split large orders to avoid excessive impact on the market and solve problems including market following, transaction costs and exposure of trading intentions. OKX provides two strategic tools for easily splitting large orders, helping to hide trading intentions and reduce slippage and costs.

OKX Iceberg Strategy can automatically split large orders into multiple orders, and automatically re-entrust when the order is completed or the position changes to complete the buying and selling of large orders. The OKX time-weighted strategy will enter the market to take orders in a time-sharing manner according to the interval set by the user after the large order is split.

How to use OKX strategy? How to follow an order?

1. Register an OKX account and complete KYC

Before using OKX services, users need to complete account registration on the OKX official website. They can also download the OKX App in the App Store and Google Play store and register through the mobile terminal. After completing registration, users must go through a KYC process (identity verification) to increase account security and unlock full platform functionality.

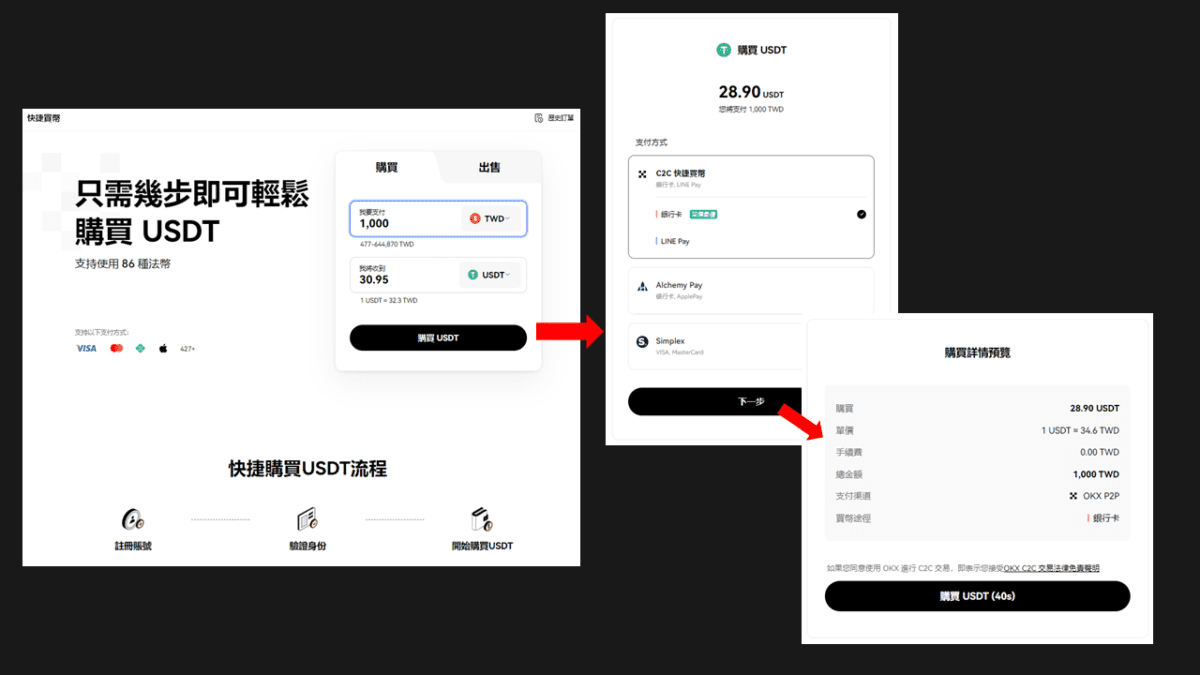

2. Deposit

Users can directly purchase a variety of cryptocurrencies including Bitcoin (BTC) and USDT stablecoins through the currency buying service provided by OKX, including three methods: quick currency buying, C2C currency buying, and third-party payment.

OKX's quick currency purchase service supports the use of financial cards to purchase cryptocurrency. Users first select the type of legal currency used for purchase (supports New Taiwan Dollars and US dollars) and the cryptocurrency they want to purchase on the quick currency purchase interface. After entering the purchase amount, confirm the quantity and After pressing purchase, confirm the payment method, and finally confirm the purchase information again before purchasing.

Although it is convenient to buy coins quickly, you need to consider the exchange rate and handling fee costs. Taiwanese users can also first purchase cryptocurrencies with Taiwan dollars on Taiwan’s cryptocurrency exchanges, and then transfer the funds to the OKX platform through the blockchain.

3. Use strategic trading

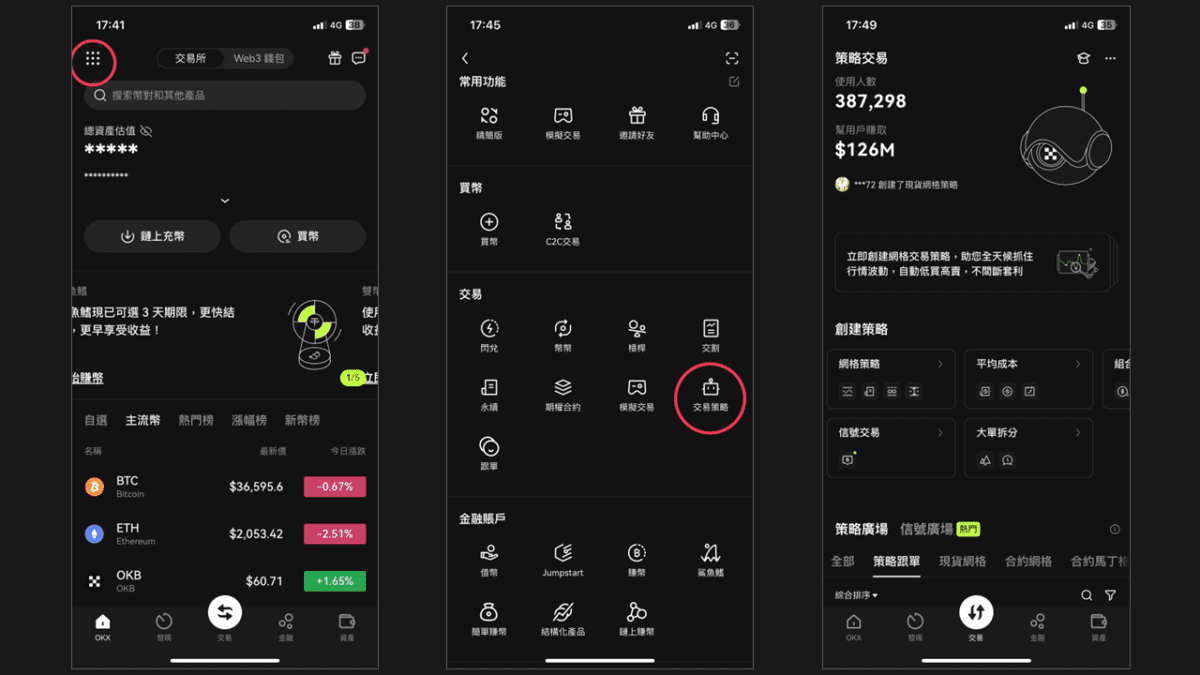

Users who use OKX App can click the function menu icon in the upper left corner of the homepage and find "Trading Strategy" in the financial services of the menu. Then you can select the strategy you want to create on the trading strategy page, or browse the strategies developed by other users in the strategy square.

Taking creating a spot grid strategy as an example, click "Grid Strategy" on the strategy trading page, select "Spot Grid", and then enter the strategy parameters. For the spot grid, you need to enter the highest price and lowest price of the price range, select the grid mode and fill in the number of grids, enter the investment amount, and click "Create Strategy" after confirmation to complete.

To check the operation of the strategy, you can click on the "Trade" icon in the middle on the OKX App, select "Strategy" to quickly enter the strategy trading page, and then click "My Strategy" to view the currently running strategy. , including detailed information on the strategy and earnings status. Take profit, stop loss or manual stop strategies can also be added on this page. When stopping a strategy, users can choose to keep trading assets or exit the position in exchange for the denominated cryptocurrency.

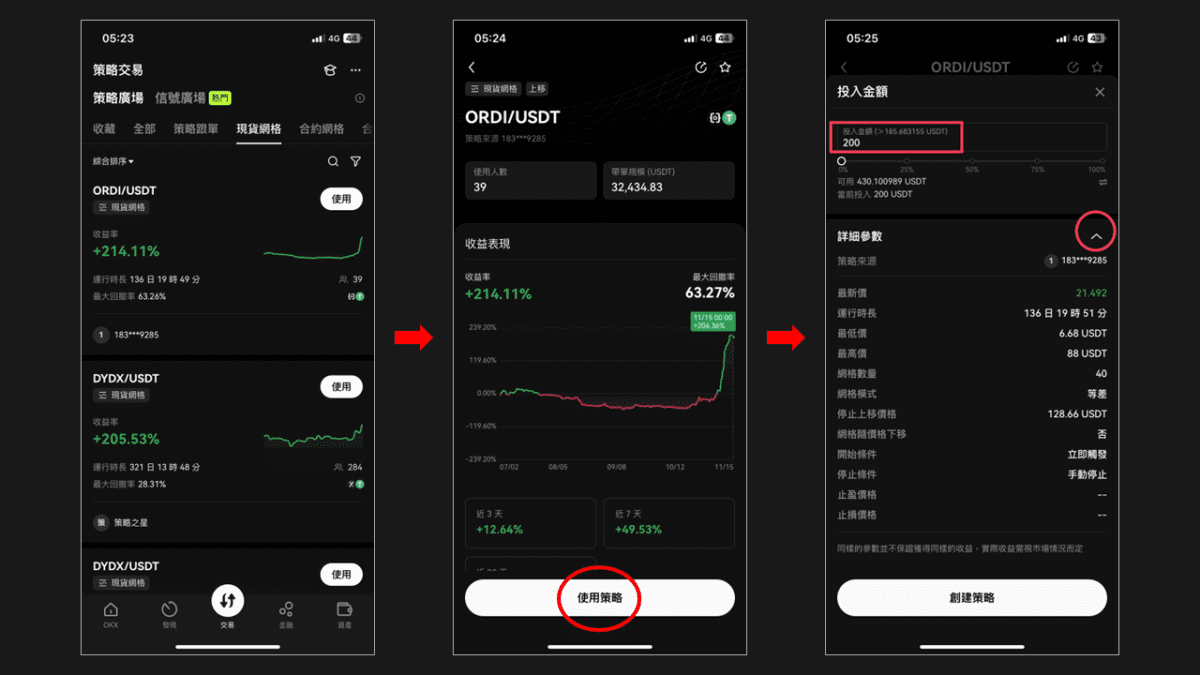

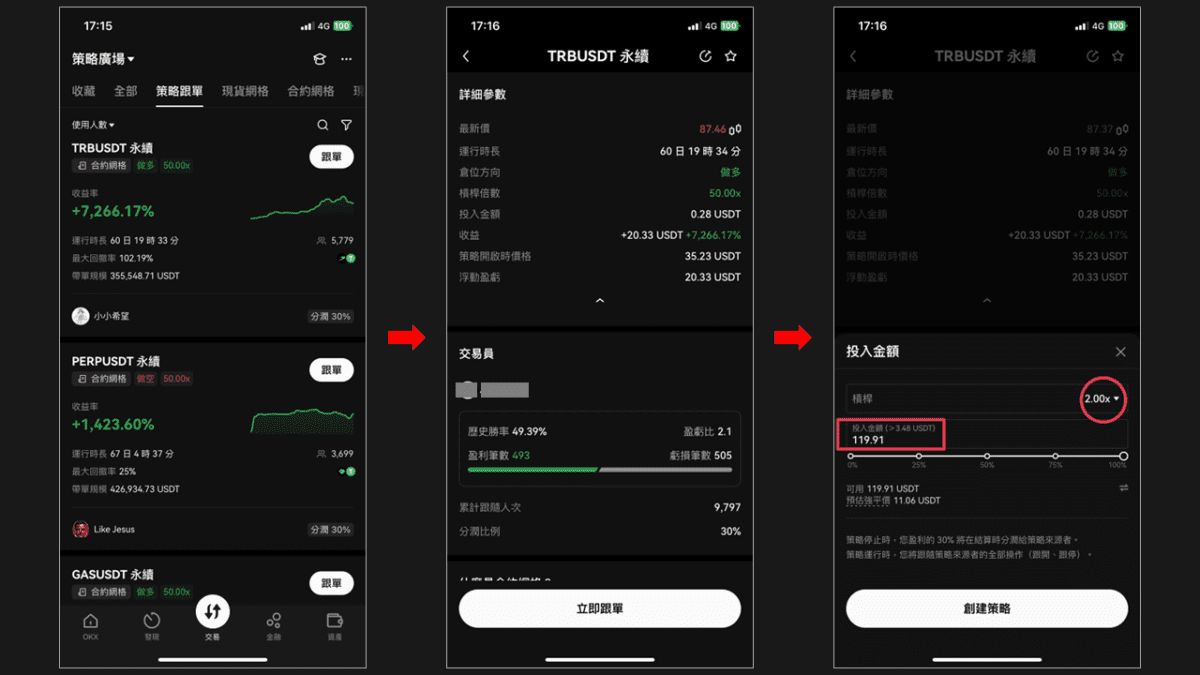

4. Follow orders or copy strategies

In addition to creating their own strategies, users can find "high-quality strategies" created by other professional traders in the strategy square, copy their strategies or directly follow the strategies. The platform will then automatically synchronize all operations of the user and the order operator, saving the user a lot of time in researching strategies and monitoring the market. The copying situation can also be viewed in the "My Strategy" interface.

Copy transaction details

It is not difficult to use the copying service provided by OKX Exchange, but there are many things that you must pay attention to before copying. If you follow the wrong order, you may suffer a larger loss than expected.

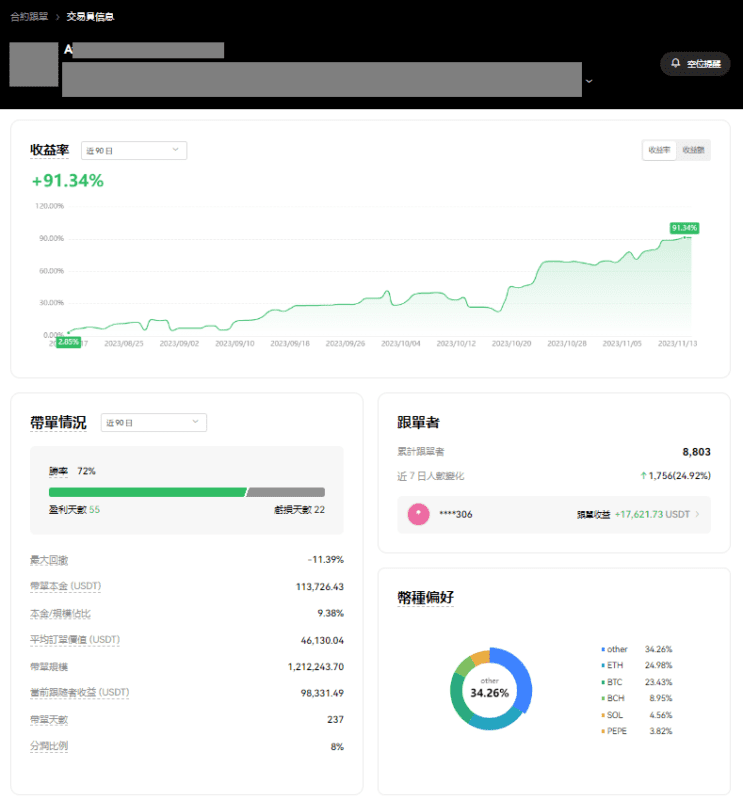

View salesperson data

Checking the data of the order leader before carrying out strategy copying is the most important step in copy trading. The excellent performance of the order leader does not necessarily mean that the copying strategy is OK. A variety of data also need to be considered, including the strategy running time, Trading style and currency preference. When using the OKX copying strategy, you can first refer to the strategy performance, order leader data and performance provided by the platform.

Set the order amount and adjust the order parameters

When initially following an order, it is recommended to invest a small amount of money for testing first, and then gradually increase the amount of investment after confirming that the actual performance after following the order is not much different from the data presented in the past.

Adjusting copying parameters is an important thing but is easily overlooked by users. OKX strategy copying provides the function of leverage adjustment. In the follow-up order service, users can adjust the copy target, follow-up take-profit and stop-loss in the advanced settings.

Start trying OKX quantitative trading

The quantitative trading tools provided by OKX break the traditional threshold and allow retail investors to easily participate in technology-driven quantitative trading. From simple grid strategies to complex arbitrage orders, investors can flexibly construct their own quantitative strategies based on their own risk preferences and investment goals. Even if we face another bleak market like the 2022 bear market, there are more trading options to operate. However, we cannot ignore the potential risks of quantitative trading. We need to evaluate the applicability of the strategy in the market, operate with caution and do a good job in risk control.

If you want to learn more about OKX strategic trading, you can go to the OKX Newbie Academy to view various strategic tool trading guides , or join the OKX community to get the latest information and strategy teaching: