Author: Jiang Haibo, PANews

With the expected adoption of the Bitcoin spot ETF and the increase in asset prices based on the BRC-20 standard, the overall development of the Bitcoin ecosystem has ushered in new opportunities. This includes not only Bitcoin itself, but also innovative applications like cross-chain Bitcoin.

As a Layer 1 solution, Flare is different from other blockchains in that it provides official cross-chain bridge and oracle services, fundamentally enhancing the security of these critical infrastructures. This means that Flare not only supports the Ethereum Virtual Machine (EVM), but also provides a solution for secure communication between blockchains.

On November 30, 2023, FAssets, a key feature of Flare, began testing. The core value of this feature is that it allows non-smart contract assets like BTC and DOGE to be utilized on the Flare platform. Taking it a step further, these assets can also be transferred to other blockchains with the help of cross-chain bridges such as LayerCake. In a market currently dominated by Bitcoin cross-chain assets such as WBTC that are handled in a centralized manner, this decentralized solution provided by Flare could lead to new applications.

FAssets solution, a trustless cross-chain bridge

In the blockchain ecosystem, security is of paramount importance. Usually, the market value of the native tokens of the public chain is higher than that of dApps on the chain, because dApps rely on the security of the public chain. Only when the value of the native token of the public chain is higher can its security provide better protection for dApps. However, most assets, including stablecoins, are currently concentrated on Ethereum, and other public chains need to rely on cross-chain bridges to introduce these assets. This is equivalent to establishing the security of assets on the public chain on the cross-chain bridge.

Many public chains try to develop cross-chain bridges on their own, and usually these bridges only rely on multi-signature systems to ensure security, which is centralized to some extent. In fact, public chains such as Harmony and Ronin have been attacked due to this. For public chains that choose to cooperate with third-party cross-chain bridges, their asset security completely relies on these external bridges. As what happened in the Multichain incident, some public chain ecology has been devastatingly affected.

FAssets is a cross-chain solution developed by Flare Labs and designed specifically for Flare. It allows tokens that are not on the smart contract chain (such as BTC, DOGE, XRP) to be used securely in smart contracts on Flare without relying on trust. The minting process of FAssets involves a strict mortgage mechanism: not only the minter requires a 1:1 mortgage, but the agent responsible for minting also needs to over-collateralize. This approach is similar to the mechanism of early Ren Protocol, but FAssets allows agents to use a basket of mixed assets as collateral, such as stablecoins, BTC, ETH, and Flare’s native token FLR. If the collateral value is insufficient, the agent is exposed to liquidation risk.

This innovation of Flare relies on two core components in its network: the State Connector and the Flare Time Series Oracle (FTSO). State connectors enable information from other blockchains to be used trustlessly in Flare smart contracts, ensuring that minters’ underlying assets have been safely delivered to specific addresses. FTSO provides Flare with real-time price feeds, ensuring that the collateral value in FAssets is sufficient and avoiding the risk of untimely liquidation.

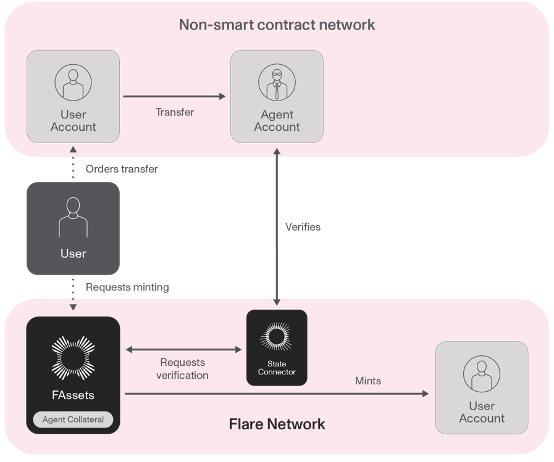

The minting process and the parties involved

The minting process of FAssets is to transfer assets on the non-smart contract chain to the Flare network for use in various applications. The basic steps of the coinage process are as follows:

Users first choose an agent and pay a certain fee.

Users send underlying assets (such as BTC, XRP, etc.) to the agent.

Agents use Flare's state connector to verify that the underlying asset has been deposited into a specific address.

Once the transaction is verified, FAssets are minted on Flare. FAssets are ERC-20 tokens that can be used in Flare’s DeFi applications or bridged to other EVM chains through LayerCake and others.

The minting process can come to an end here, but the entire FAssets system is far from simple. As mentioned before, the agent needs to be over-collateralized and will be liquidated if under-collateralized. In addition, there needs to be a role to monitor that the agent's collateral is correctly deposited on the chain. The entire process will involve four types of roles: coin miner/redemptor, agent, liquidator, and challenger.

Minters and redeemers, as the names suggest, are clients who initiate the minting or redemption process. They may be users of the Flare network. The agent is responsible for the minting and redemption of FAssets, but the agent first needs to lock the collateral by itself, which also ensures that the minting process and the assets issued by FAssets are trustless. The liquidator is responsible for liquidation. When the value of the agent's collateral is too low, the liquidator will exchange the agent's collateral for FAssets. Challengers use state connectors to detect whether an agent's funds are held in a specific contract, if not, the agent will be banned from minting and minted assets will be liquidated.

In order to ensure that there is no centralized third party involved in the entire process, FAssets’ solution is more complex than other cross-chain bridges and requires the cooperation of these four types of roles. This system not only involves the minting and redemption process, but also includes multi-layered operations to ensure the security of collateral, timely liquidation, and monitoring agent behavior.

Comparison of cross-chain BTC solutions

BTC is the most dominant crypto asset. As of December 6, according to data from CoinMarketCap, BTC accounted for 51.9% of the market value of crypto assets. How to introduce BTC to other chains has always been a problem. In addition to FAssets' solution, several representative solutions include BitGo's wBTC, Threshold's tBTC, Ren Protocol's RenBTC, etc.

At present, wBTC is the most used, and some cross-chain bridges even directly use wBTC as the underlying asset. Although it has the best liquidity and can be purchased directly through centralized exchanges (CEX) and decentralized exchanges (DEX), which is more convenient to use, it also carries risks. wBTC is issued centrally, the minting and redemption process requires KYC, and the underlying BTC assets are hosted by BitGo.

Threshold's tBTC is a cross-chain asset currently used in DeFi applications. It is supported by Curve and can be used as collateral for minting crvUSD. In LlamaRisk's evaluation of tBTC, it is believed that tBTC performs well in terms of volatility and decentralization, and performs generally in terms of liquidity, smart contracts and dependencies, and legal aspects. Threshold has also been questioned about the issue of censoring transactions. Because FTX attackers used tBTC to redeem, redemptions from other users were also rejected by node operators. After the update, other users' redemptions returned to normal, but the attacker's redemption was still rejected.

Ren Protocol's RenBTC was also the main decentralized cross-chain BTC. However, due to the bankruptcy of FTX/Alameda Research, the Ren team was short of development funds. Ren 1.0 has suspended minting and the development of 2.0 has been delayed.

The scheme of FAssets is more complicated. Officially, the collateral in the agent and community pools is more than 200% of the issued FAssets, and the collateral is provided by the agents and community pools. In theory, FAssets provide a trustless way to mint cross-chain BTC, but this system is more complex. Both the collateral and minted FAssets involve multiple assets and require the cooperation of various roles. For security and Due to decentralization considerations, it may take more time to go online on the mainnet.

Subsequent development of FAssets and recent updates of Flare

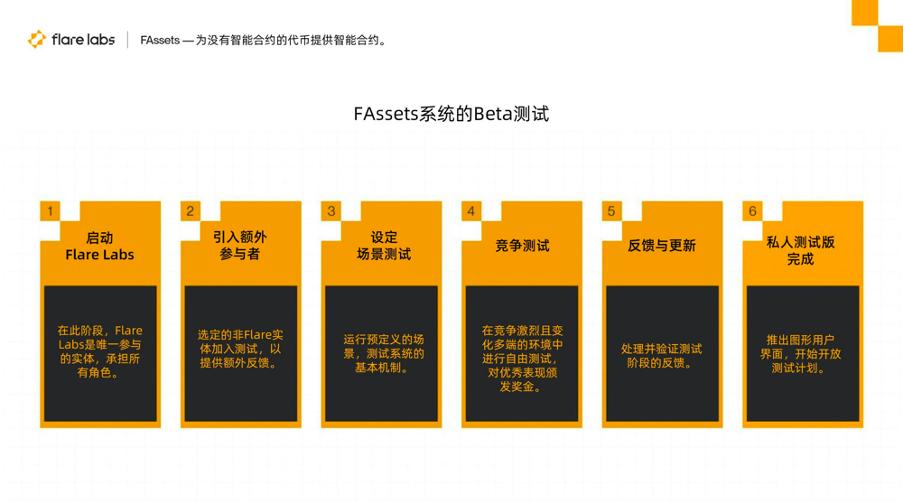

FAssets is currently running on its Coston test network, and will be launched on Flare's pioneer network Songbird after multiple rounds of testing, and will finally be integrated into the Flare main network. During the initial phase of testing, Flare Labs and initial partners will assume all necessary roles within the system and provide the necessary infrastructure. As testing work such as minting, redemption, and liquidation is completed, external participants will be able to join.

The testing on Coston is divided into seven stages. The testing of FAssets is currently in the second stage, in which Flare Labs plays various roles. In the future, developers will be invited to test, update and verify, public tests, etc., and then launched on the Songbird and Flare mainnet. This means that it may take some time before FAssets is finally launched on the Flare mainnet. Officials stated that after the official launch, rewards will be issued to FAssets cross-chain users through the cross-chain incentive pool, encouraging users and dApps to earn FLR tokens by providing sustainable value, further enhancing Flare Network's decentralized financial ecosystem.

Since September, Flare has made progress in project development, reached partnerships with multiple other projects, and held a number of events. In terms of project progress, in recent months, FAssets testing has been launched, the second phase of Flare staking has been launched, 2.1 billion FLR tokens have been destroyed, FTSO developer tutorials have been prepared, and the second version of the API Portal has been developed. In terms of partnerships, it has reached cooperation with Arkham, Flarescan, Subsquid, Web3Auth, Etherspot, Elliptic, Bloxico, etc., and also cooperated with Encode to host the ETH London hackathon.

summary

Flare's FAssets began to run on the test network. It provides a trustless solution for transferring assets on non-smart contract chains such as BTC, DOGE, and XRP to Flare for use. It can also be used across cross-chain bridges such as LayerCake Link to other chains.

Essentially, FAssets are a class of synthetic assets. Unlike other cross-chain solutions, not only the minter needs a 1:1 mortgage, but the agent responsible for minting and redeeming the coin also needs to be over-collateralized to complete the minting. The agent will face liquidation when the collateral is insufficient. The entire mechanism is theoretically trustless and decentralized, but it is relatively complex and requires the cooperation of various roles to ensure its reliability.