Written by: TechFlow TechFlow

Do you still remember the Bitcoin L2 project SatoshiVM that increased 50 times in one day, IDO income 300 times, and was promoted by more than 280 well-known KOLs?

From the first tweet to the official launch of the issuance, it only took 10 days to create a popular Bitcoin concept project with a market value of hundreds of millions of dollars.

There are a lot of questions surrounding this project:

Who is the publisher behind this project? Why can more than 200 of the most influential KOLs in the encryption field be mobilized for collective publicity in a short period of time?

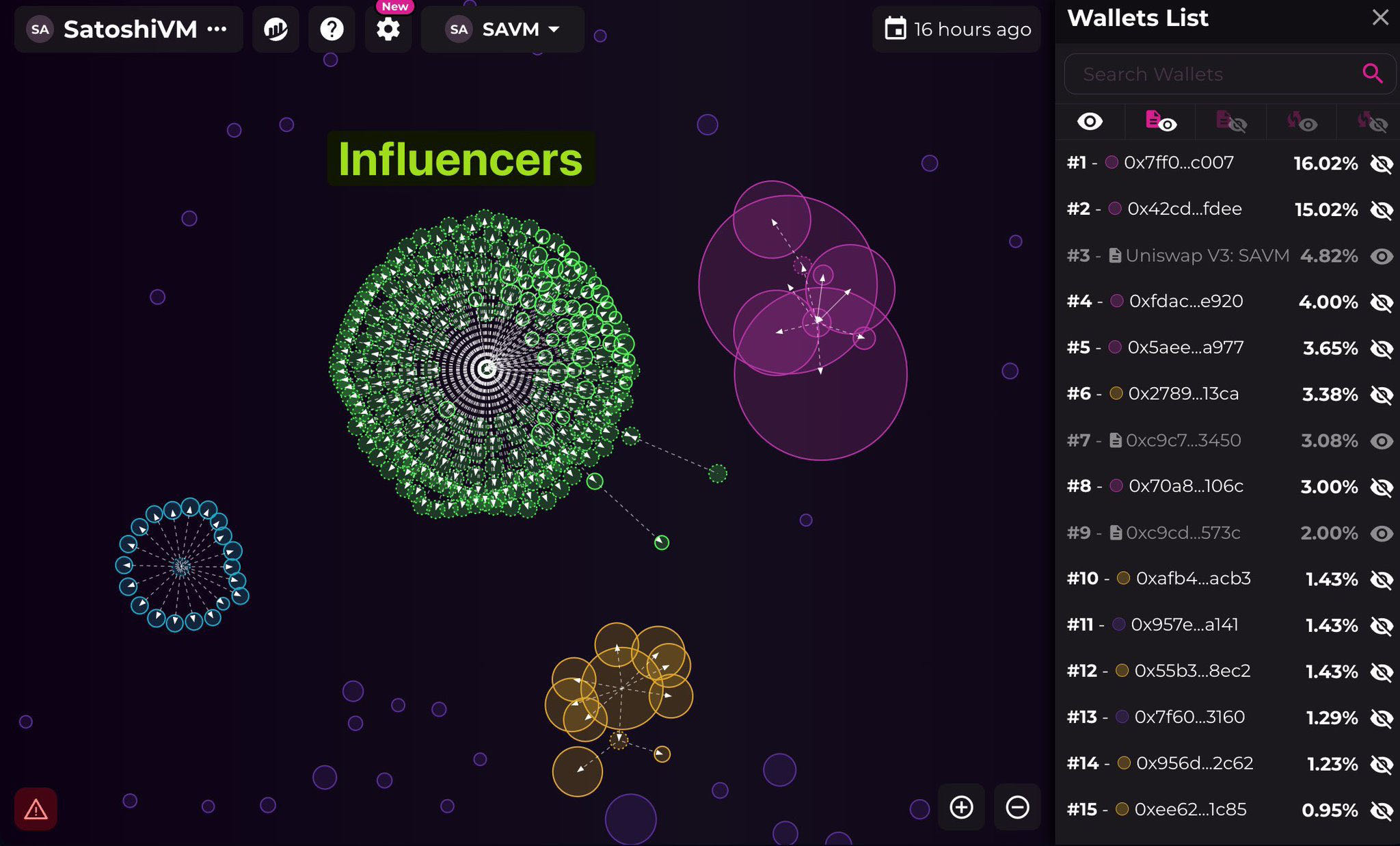

According to SatoshiVM token economics, 15% of the supply is allocated to contributors (KOL), and allocation contract 0xe77…5E00 sent more than 1.2 million SAVM (approximately $12 million) to 250 KOLs, 50% of which has been sold on Uniswap .

Someone discovered through the contract in the test network that the technical solution of the project came from Bool Network. Therefore, it was speculated that SatoshiVM was issued by the Bool Network team. However, according to the interview of TechFlow TechFlow reporter, Bool Network only provides a technical solution. Bool Network Currently focusing on the Bitcoin verification layer, it can serve all Bitcoin Layer2.

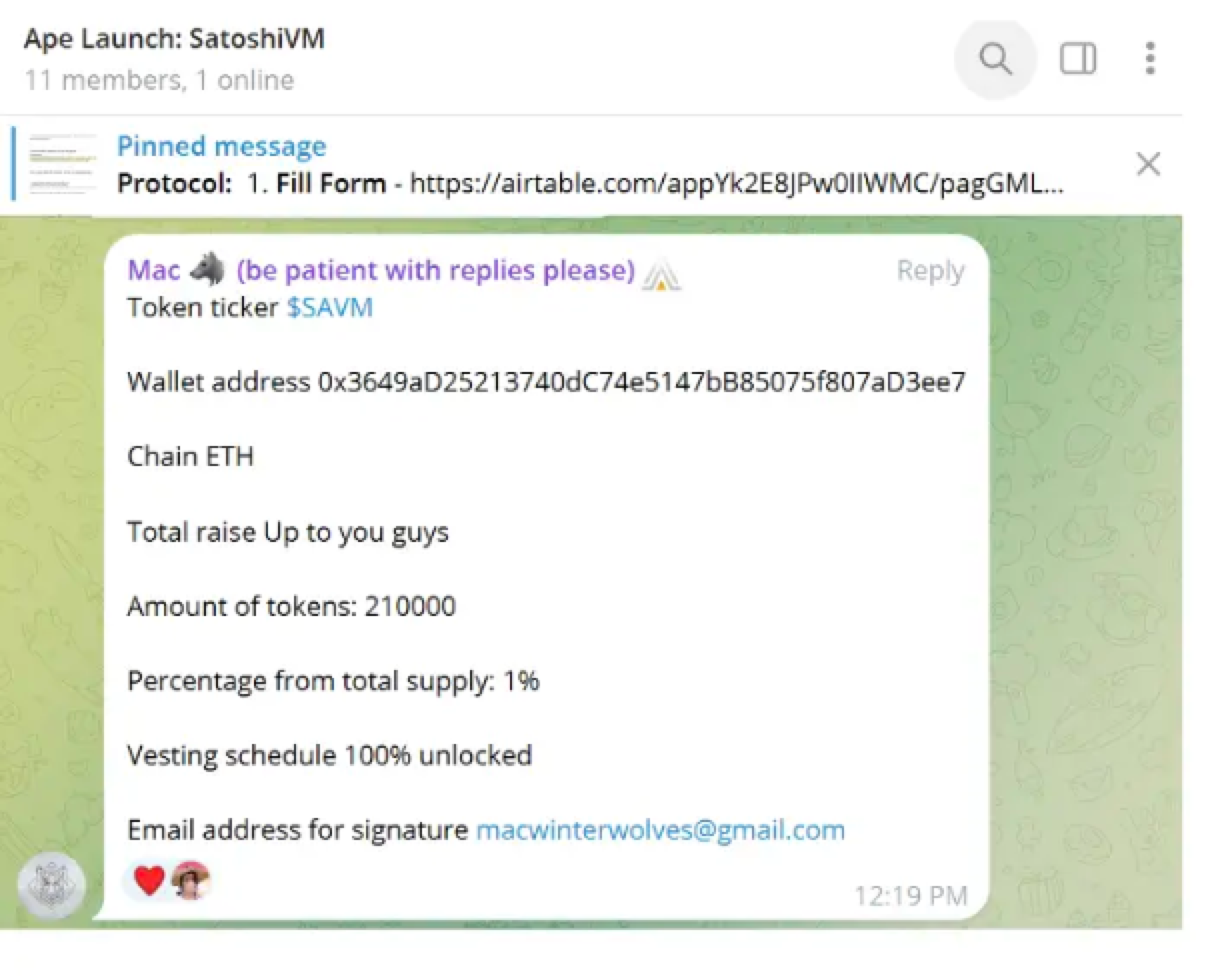

Some people also speculate that the operations behind SatoshiVM all come from the IDO platform, Ape Terminal, created by former employees of DAOMaker. SatoshiVM is issuing IDO on Ape Terminal.

On January 25, perhaps due to "interest disputes," Ape Terminal and the SatoshiVM team publicly quarreled, exposing each other's "scandals" behind them.

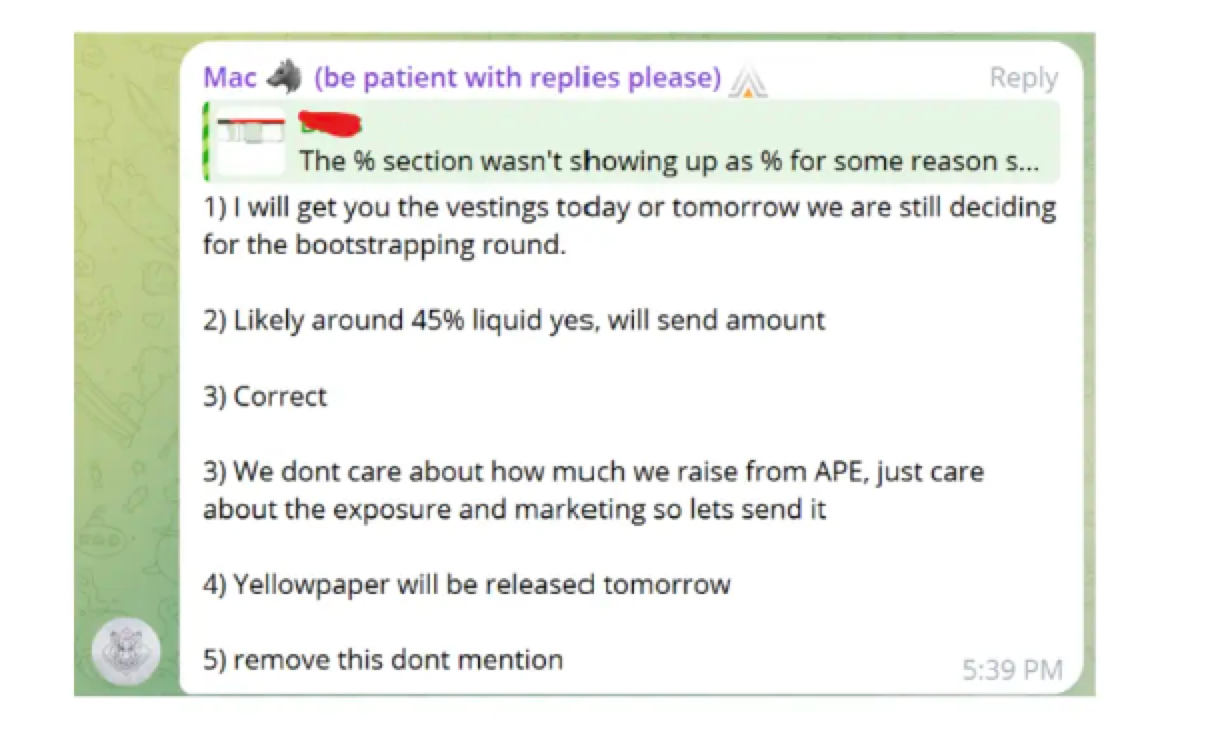

First of all, MacnBTC, a well-known KOL who has been taking the lead in promoting SatoshiVM and has 500,000 fans, launched an attack on Ape Terminal. He claimed that Ape Terminal deceived everyone and that they were not selling fairly. There were 200,000 wallets applying to participate in IDO, but only 10 of them each time. Winners, and all winners are Ape Terminal team members. In addition, Ape Terminal also charges a 25% handling fee.

Although the Ape Terminal team returned part of the IDO fee to the Satoshivm team, it made millions of dollars by selling the Rats warehouse wallet.

The official SatoshiVM Twitter confirmed that Ape Terminal has refunded 25% of its IDO fees, and a total of $52,000 in SAVM has been returned to the SatoshiVM vault.

In the face of accusations, Ape Terminal issued a statement to fight back, saying that SAVM is a project founded by the well-known KOL MacnBTC.

“SAVM is a bittersweet event for Ape Terminal, as Mac and his KOL friends made over $20 million by dumping it on their own community.”

Ape Terminal gave details of contact with Mac and records of liquidating tokens through a Google document .

In Ape Terminal's view, they have become MAC's scapegoat.

In response, MAC responded that he was a consultant to the SatoshiVM team and worked closely with them to introduce Ape Terminal to the SatoshiVM team. However, after the SatoshiVM team achieved success, he was attacked out of context and he did not rush to register liquidity. , but someone else.

Perhaps due to the quarrel, the SAVM token fell by more than 30% in 24 hours.

Everyone in the world is bustling for profit, and the world is bustling for profit. The same is true in the crypto world. Perhaps no one expected from the beginning that this project would be so "successful" that after generously giving out chips, many people I feel that my interests have been violated.

At present, KOLs, project parties and IDO platforms all hold different opinions, and perhaps only they themselves know the truth. However, in an encryption industry that emphasizes trustlessness and complicated interest disputes, trust itself appears scarce and precious.

Human nature cannot withstand the test.