Author: @Rui, investor at SevenX Ventures.

With the growing focus on real-world applications and the rise of Solana, DePin regained huge popularity in 2024. However, DePIN is not a new concept. In my opinion, the essence of DePIN is a token economic model that turns participants into stakeholders, rather than creating new productivity.

In the previous bull market, projects such as Arweave , Filecoin , Helium and others stood out, while many others underperformed and even fell to zero. Now, as we approach the cusp of the next bull market, our challenge is to discern between fleeting fads and the truly sustainable innovations that will lead us into a new era of real-world applications.

This article aims to provide a balanced critique of DePIN’s historical shortcomings, exploring areas such as regulatory hurdles, lack of demand, token economics flaws, and carpet risks. Nonetheless, it also highlights the tremendous promise in this space, including overcoming profit margins, value anchors, token incentives, and strong community participation. I will provide a DePIN evaluation framework, as well as a detailed case study of the DePIN project. Hopefully this article will provide readers with insights and tools for building, evaluating, and investing in the DePIN landscape.

content

- introduce

- Participants: hardware, miners, protocols, operators and users

- ecosystem landscape

- DePIN projects: purpose, type and market

- Blockchain and middleware: general chain and DePin special chain

- Nature:

- Why it doesn’t work : Regulation, demand, token economics, moats and rugs

- Why there’s hope : Profits, anchors, boosters, and community

- evaluation standard:

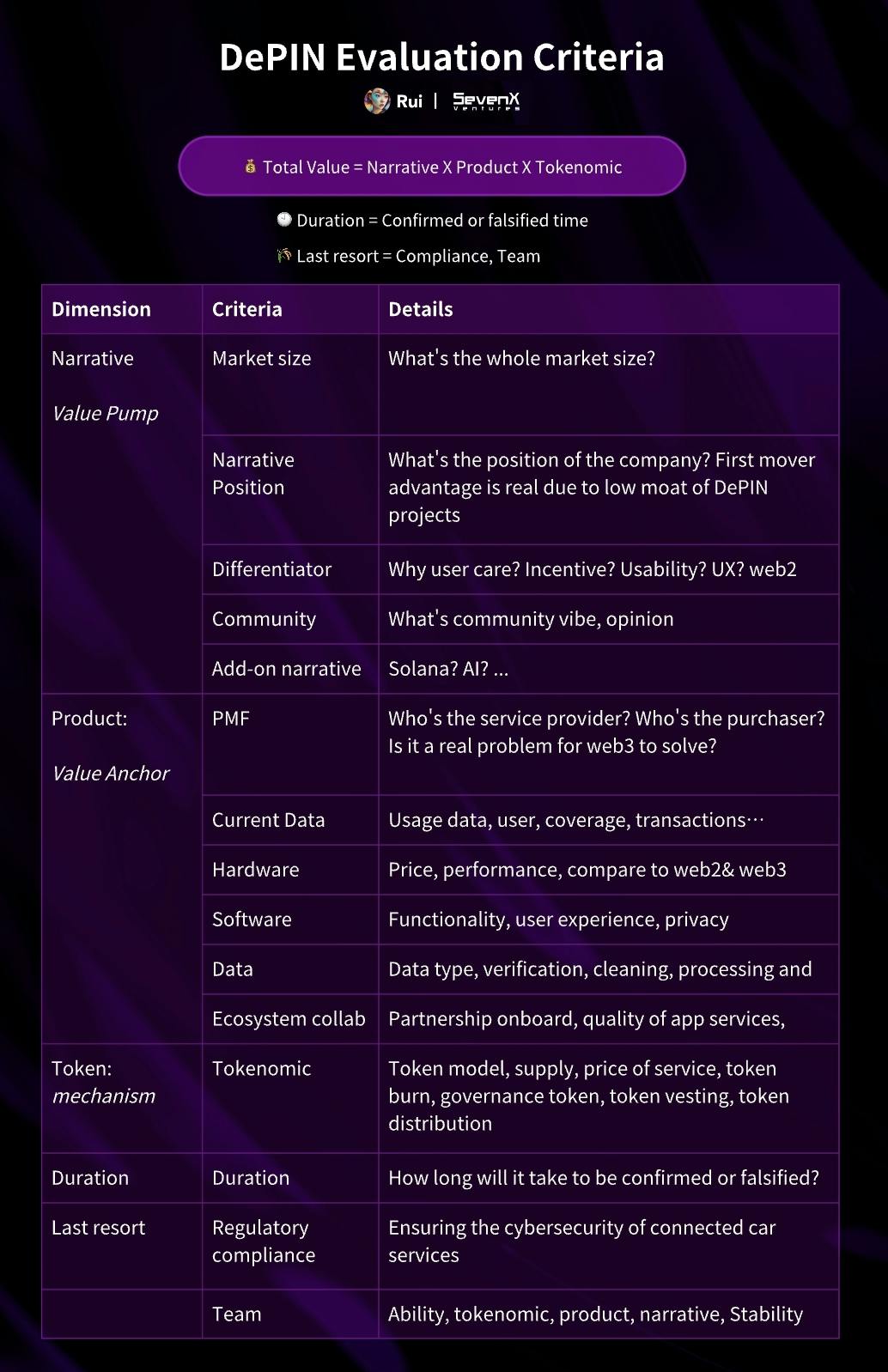

- Total Value = Product X Token Economics X Narrative

- Duration = proven or disproven

- The Last Straw = ComplianceX Team

- case analysis:

- Helium: 5G cellular network

- io.net: AI/ML shared GPU

introduce

introduce

The blockchain space has been focused on infrastructure development for years, emphasizing scaling solutions (Layer2s, data availability), privacy enhancements (zero-knowledge), and user experience improvements (account abstraction) in preparation for widespread adoption. Now, the need for real-world mass adoption is more evident than ever. Initiatives such as exchanges' commitment to compliance and ETFs' entry into traditional markets have made significant progress and paved the way for us.

DePIN is not a specific field. The term was originally proposed by Messari and is the abbreviation of Decentralized Physical Infrastructure Network. It represents a community-driven, token-incentivized decentralized hardware network. Its main goal is to replace monopolistic coordinators and turn participants into stakeholders of the network using native tokens. Since the last bull run, there has been significant expansion in high-value areas such as AI/ML, 5G, WiFi, bandwidth, vehicles, energy, and more.

So, what does DePIN bring to the table?

- Assets: Types, Distributions, Trading Methods

- When looking at successful cryptocurrency projects, they typically feature assets with common properties and continually refine the functionality and use cases of these assets. DePIN projects can integrate physical assets, converting services provided by hardware or data collected into tokenized assets. This tokenization facilitates permissionless trading and staking, paving the way for a wider range of financial activities.

- Actors: Roles, Numbers, Stickiness, and Relationships

- DePIN enhances the ecosystem through role diversification, creating a cohesive network of hardware manufacturers, miners, web applications, consumers, and more. Lowering barriers to entry and expanding geographic coverage attract a wider range of players. More importantly, DePIN converts parties into stakeholders through crypto assets, promoting labor contribution and consumption. This approach ensures ongoing engagement, increases the stickiness of the ecosystem and goes beyond the traditional, simplistic buyer-seller relationship. By facilitating complex interconnections, DePIN significantly enhances the robustness and sustainability of its ecosystem.

- Scenario: Premium value, frequency and scalability

- DePIN is based on real-life scenarios and meets existing needs. In addition to focusing on cryptocurrency investors, the general value of the network can be derived from the number of buyers, the value of each transaction, and the frequency of transactions. If any two of these parameters perform well, success can be achieved. For example, the 5G user base is huge, with more than 100 million people in the United States paying a monthly fee of $80. While deal volumes for individual AI companies may be smaller compared to 5G consumers, the high frequency and value of these deals, driven by widespread demand, highlights a significant opportunity.

Beyond the initial excitement, there are several key factors worth paying attention to: Even with sufficient supply, achieving product-market fit is still key to success; ensuring the implementation of partition-tolerant and censorship-resistant protocol designs is crucial to avoiding new forms of censorship. is critical; moreover, incentives must be carefully designed to avoid unsustainable inflation. We explore these aspects in more detail below.

participant

The department examines the roles and objectives of five key stakeholders: hardware manufacturers, custodians (called miners for the sake of memory), network providers, operators, and end users.

Hardware manufacturer : the physical device that provides services or collects data

Hardware manufacturer : the physical device that provides services or collects data

- Manufacturer evolution:

- Transitioning from a centralized whitelist maker to a permissionless system is a natural progression. Initially, it makes sense to rely on a single entity to produce reliable hardware. However, in order to prevent a single supplier from becoming a monopoly threat or a bottleneck for network growth, it is recommended to open the ecosystem to more qualified hardware manufacturers. Ultimately, an open market can promote sufficient competition to provide miners with the best products ( such as Helium HIP19 ) at fair prices.

Miner: An entity that runs hardware as a node in the network

- Cost considerations:

- Miners consider total costs, including hardware, entry, maintenance, and operating (if applicable) expenses. The time and attention costs associated with online participation are also important.

- Reward system:

- In addition to building faith in the physical network, miners prioritize rewards, often calculating payback periods. The instant incentives of the beta version are attractive, but the protocol should curb rampant inflation and incorporate a strong deflationary design and staking mechanism to ensure long-term income for miners. Many projects have adopted the Burn-Mint-Equilibrium (BME) model.

- user experience:

- The process should be straightforward and designed to lower the learning curve for participation, resulting in a low-barrier and scalable network.

Protocols: the coordinating core of the network

- Price structure:

- Prices for commoditized services are fixed at the protocol level, but decisions should be made carefully to achieve sustainability. Take the pricing model of io.net as an example: the price is affected by multi-dimensional factors such as web2 competitor prices, peak hours, hardware performance, network bandwidth, encryption revenue, etc.

- Rule transparency:

- Rules like reward mechanisms should at least be transparent and available to the public. Then, the results of the execution should be verifiable even outside the chain, and eventually the entire process is automated. On-chain automation appears to be optimal and therefore guarantees fairness, but it may sacrifice flexibility for ever-changing adjustments.

- Data Integrity and Honesty:

- Establish transparent and verifiable procedures for obtaining data from the hardware, uploading it to the database and reflecting it as rewards.

- Safety measures:

- Predict malicious behavior and implement measures such as random liveness checks and valid data verification. KYC may be involved, and reputation systems can reward honest behavior while punishing dishonest behavior.

- Privacy and Compliance:

- Collecting data from participants can improve the robustness and efficiency of the protocol, but also introduces privacy risks. While collecting only necessary data, projects should also consider implementing zero-knowledge proofs (ZKP).

Operator: An entity that packages network resources into services

- Operator entity diversity:

- Initially, a single operator, possibly from the network base, can set up cold start mode. Over time, allowing more operators to join can expand the scope of the market, maximize the use of miner resources, and allow for full competition.

- Revenue model:

- In addition to the costs operators pay miners through the network, operators typically charge higher fees for package services. Operators can use profits to increase marketing investment, subsidize users, etc.

Buyer: Internet user

- Goals and needs:

- Different users have different goals, such as cost efficiency, time savings, security, accessibility or performance. The network should meet these primary needs efficiently.

- user experience:

- A seamless onboarding and payment process is critical. Whether users need to understand cryptocurrencies depends on the service design, but the goal should be to simplify transactions and integrate fiat payment options with cryptocurrencies.

ecosystem landscape

Depin Network

DePIN projects vary widely, but for a better understanding we can classify DePIN projects by purpose, type and market.

Purpose

Purpose

- calculate:

- This includes using computing systems to process and communicate information. For example, Rollups solves the computing challenges of the blockchain, while decentralized GPU and CPU resources meet off-chain computing needs.

- storage:

- Storage projects ensure that data is retained for future retrieval and use. This broader concept includes file storage solutions such as Arweave and Filecoin , as well as databases such as KwilDB .

- network:

- Networking projects facilitate the acquisition and transmission of real-world data over networks, enabling communication between different nodes and connecting them to users. Typically, projects utilize IoT sensors and wireless networks to collect data and provide services.

type

- Service network: The core asset is service

- The core goal of a service network is to efficiently utilize unused or available resources to provide services. The protocol aggregates users’ needs, matches them with miners’ resources, and allocates tasks accordingly. Examples include io.net , which connects GPU resources with AI companies; Helium , which connects small base station hosts with 5G users; and Teleport , which connects drivers with passengers.

- Data Network: The core asset is the aggregated data set

- Data networks incentivize data contributions to accumulate large datasets. They standardize data formats, ensure data validity and quality, and may involve data cleaning and training before packaging the data into datasets, APIs, or other formats for commercial use. For example, DIMO collects vehicle data to gain insights useful to insurance or gas companies; Hivemapper captures street imagery to create map data for delivery and smart city projects.

market

- Artificial Intelligence and Machine Learning:

- The global machine learning market size is expected to grow from US$26.03 billion in 2023 to US$225.91 billion in 2030 . The AI/ML opportunities in web3 lie in data, computation, and models. For data, projects like gras allow a large number of users to share bandwidth so that artificial intelligence companies can obtain data on a large scale; for computing, projects like io.net pool data center computing power at a lower cost than web2; for models It is said that projects like Bittensor can realize the assetization of models.

- 5G/Cellular:

- The global 5G market size will reach US$84.31 billion in 2023. The transition to 5G requires more cellular networks, and web2 monopolies reap significant profit margins. DePIN 5G projects such as Helium aim to build decentralized, affordable networks by leveraging small cells, free spectrum in the United States, and eSIM cards.

- car:

- The automotive market is expected to grow fromUS$145.24 billion by 2023. The DePIN vehicle network collects data through specialized hardware and software to provide valuable insights for insurance, maintenance, gas and other operations. Projects such as DIMO use token incentive drivers to encourage data sharing.

- Online car hailing:

- The global online ride-hailing service market will reach US$176.6 billion in 2023. DePIN ride-hailing service disrupts the ride-sharing market by using tokens to fuel growth, offering fair pricing and lower transaction fees than Web2 intermediaries. Notable projects include Teleport and Drife .

- Map: 2022

- The global digital map market size is estimated to be US$18.18 billion. The DePIN Map project provides a fair data sharing model that addresses data fragmentation and over-reliance on major technology companies by rewarding community contributions with tokens. Examples include Hivemapper , 2blox and Natix .

Blockchain and middleware

At present, most DePIN projects only have tokens on the chain, and most of them are off-chain. Since April 2023, Helium has transitioned from its proprietary blockchain to Solana. This shift was motivated by the need to address maintenance costs and scalability challenges. The nature of the DePIN project, small and frequent transactions, and timely rewards determine the speed, cost-effectiveness, and scalability of the blockchain infrastructure.

At present, most DePIN projects only have tokens on the chain, and most of them are off-chain. Since April 2023, Helium has transitioned from its proprietary blockchain to Solana. This shift was motivated by the need to address maintenance costs and scalability challenges. The nature of the DePIN project, small and frequent transactions, and timely rewards determine the speed, cost-effectiveness, and scalability of the blockchain infrastructure.

For a general-purpose blockchain, performance, cost, and ecosystem are critical:

- Solana ’s DePIN has a market capitalization of approximately $2.4B and has become the most popular choice for major projects such as Helium , io.net , Teleport, Hivemappers , Render , Nosana, and more. Solana is well suited to the DePIN project's needs for fast, low-cost transactions because its unique Proof of History (PoH) mechanism reduces computational load and its high hardware requirements improve processing performance. Second, scalability is critical, for example, Helium requires millions of transactions per month and minted 900,000 NFTs for subscribers when it migrated to Solana. Solana needs to remain strong during its peak and enable rapid mass minting at a lower price. Projects can interact with other Solana ecosystem projects, and Solana is also being upgraded to better serve DePIN needs. The recently launched token extension supports advanced customization of SPL, such as threshold transactions, privacy modes, and delegation, which will provide the DePIN protocol with greater flexibility in how it builds on-chain components.

On the other hand, DePIN-specific blockchains are gaining traction. These blockchains solve key issues such as data trustworthiness, identity management, and verifiability. By providing automated and verifiable data, the DePIN project can save repetitive operational work, avoid risks, and better focus on web development.

- IoTeX , a layer 1 blockchain, launches “W3bstream”, a layer 2 solution that enables secure IoT data collection, leverages a flexible data availability layer, and aggregates large amounts of off-chain data into verifiable On-chain transactions in Zero-Knowledge Proofs (ZKP) and triggers.

- Peaq is DePIN's multi-chain Layer1 blockchain. While having low cost and high transaction speed, it also provides modular DePIN functions such as multi-chain machine ID, payment, role-based machine access, three-layer data verification, artificial intelligence agent, data storage and indexing. Peaq integrates with Wormhole for mobility and has strong relationships with relevant partners such as Bosch. Peakq will be launched in 2024.

Why doesn't it work?

- Regulatory Difficulty: Managing networks in the physical realm requires compliance with numerous regulations, with feasibility and cost varying across markets. For example, ride-hailing programs must manage trip data, comply with local governance reporting requirements, and comply with personal safety standards. Likewise, 5G projects are subject to different spectrum licensing regulations in different countries.

Helium's LoRa specification requirements fail:

Helium's LoRa specification requirements fail:- Supply-side growth does not guarantee demand-side adoption. The DePIN project uses tokens to quickly incentivize miners to expand, with onboarding fees often reinvested to increase network value. However, oversupply without corresponding usage can cause problems. To prevent this from happening, it is crucial to ensure that each project has true product-market fit. Additionally, effective marketing, sales strategies, and business development are key to competing with the large Web2 vendors.

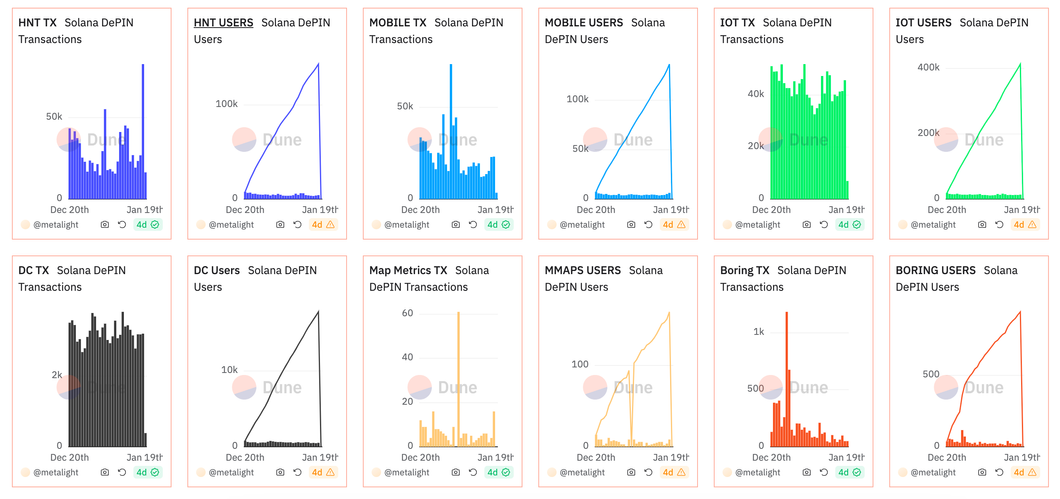

DePIN project users, https://dune.com/metalight/dewi-project-users Token economy failed:

DePIN project users, https://dune.com/metalight/dewi-project-users Token economy failed:- DePIN projects typically have their own tokens from day one, and the design of their mechanisms is a key determinant of success. However, this token economics expertise poses challenges for projects launched by Web2 makers, who often rely on precedent to shape their token strategies. Sometimes they tend to use massive incentives to attract participants, leading to unsustainable inflation. The Work Token Model (Stake for Access) is typically used for commoditized services with fixed protocol-level service fees. BME (Burn-Mint-Equilibrium) can adopt a dual-token system that combines tradable, value-seeking tokens with fiat-pegged payment tokens, allowing for fixed fiat pricing of services.

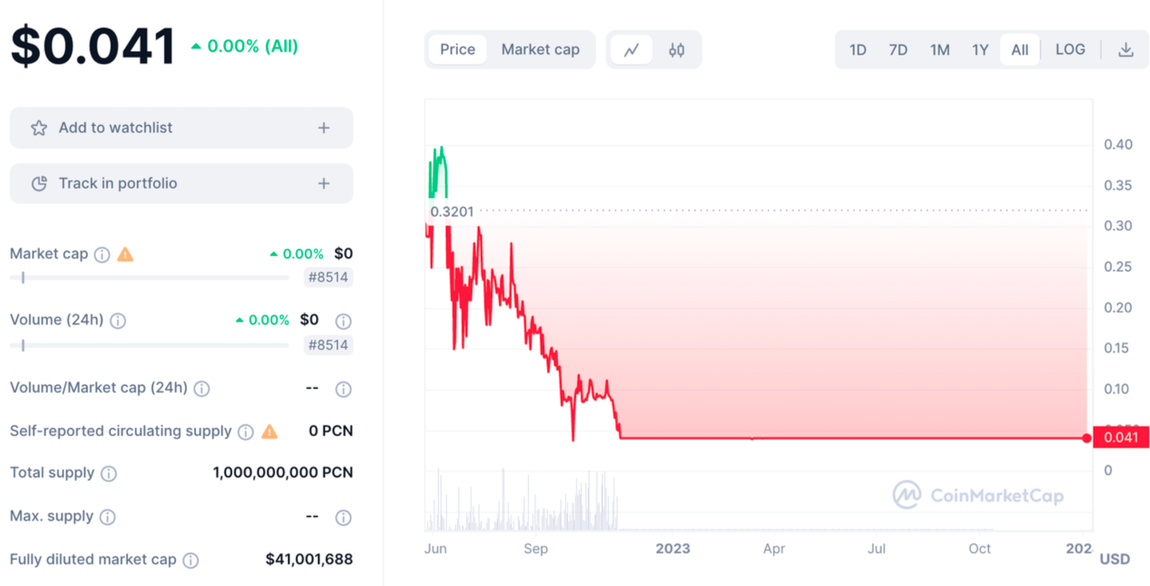

Token price performance considerations for previous famous DePIN projects:

Token price performance considerations for previous famous DePIN projects:- Centralization offers the benefits of centralized coordination, adaptive management, and high-speed performance. Although decentralized projects can attract attention with their lower fees, there is still considerable uncertainty about matching the performance of centralized services. Taking shared GPUs as an example, GPUs are distributed across locations compared to data centers, complicating the task of consolidating them into a single cluster, resulting in potential latency for intensive ML applications. If decentralized systems cannot achieve comparable performance to centralized services, then their cost advantage will not be sufficient to provide a competitive alternative.

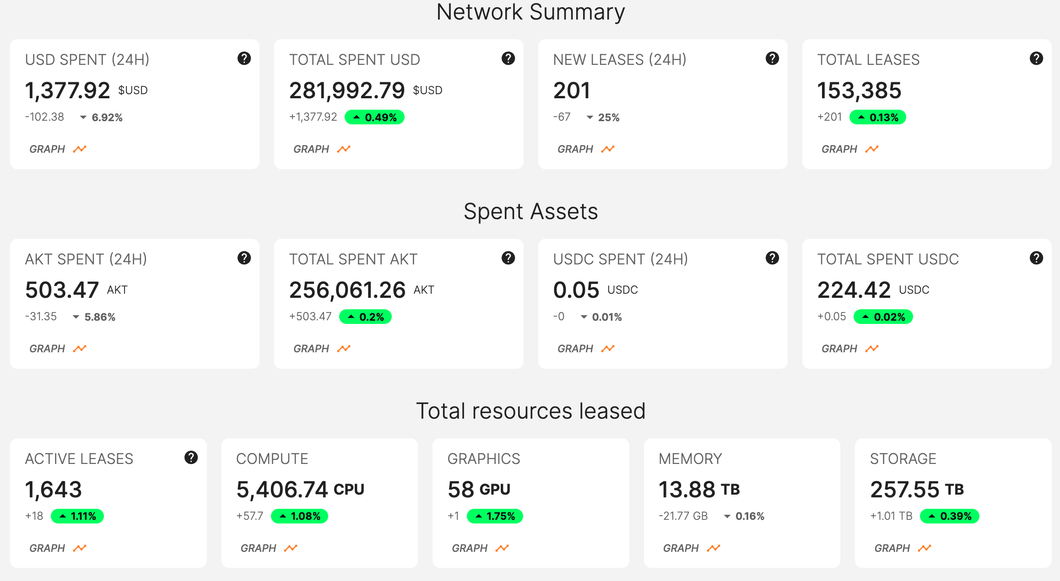

Akash Dashboard Difficulty Building a Moat:

Akash Dashboard Difficulty Building a Moat:- This challenge is particularly acute in commoditized services, where standardized and interchangeable products allow providers and customers to easily switch networks in pursuit of better revenue or lower fees. Even among Web2 enterprises, this lack of strong moats is evident. However, certain factors can create a competitive advantage: securing a first-mover position to build brand awareness, providing the best user experience, and developing proprietary, patent-protected software or hardware.

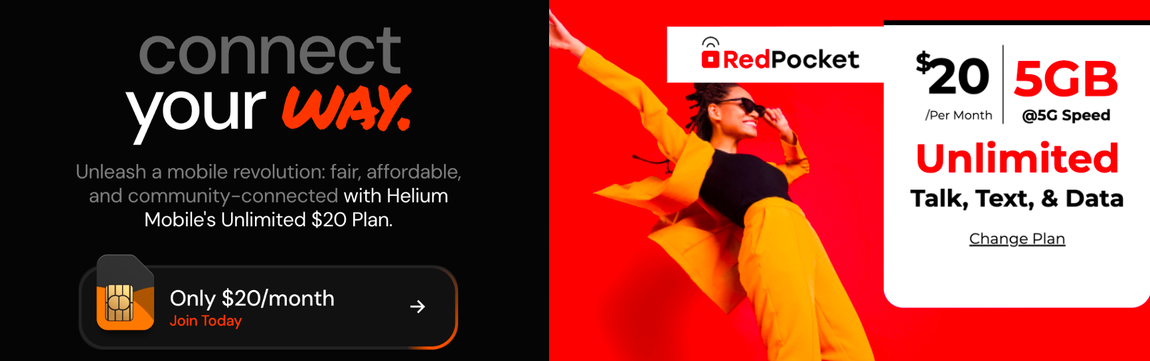

Helium 5G vs. RedPocket 5G RUG: Relaxing rug after sales narrative:

Helium 5G vs. RedPocket 5G RUG: Relaxing rug after sales narrative:- Unlike other sectors, DePIN participants (miners) typically need to first make a significant investment in hardware before they can start earning rewards, although this may vary for use cases. This brings with it the potential risk of fraud, where a foundation could publish a promising roadmap, build a narrative, ask influencers to promote and sell its hardware, and then suddenly swindle money and disappear.

Carpet Project Price

Carpet Project Price

Why there is still hope

- Your profit is my opportunity:

- Web2 is FAT. In the current Web2 landscape, large companies like Amazon and Microsoft enjoy high gross margins. DePIN can disrupt this by enabling individuals and small entities to compete with these giants. By leveraging this profit margin, DePIN can offer more cost-effective solutions, undercut the high-margin models of established players, and pass the cost savings on to users.

- Value anchors that minimize bubbles:

- DePIN provides tangible value through hardware devices, services and data . This practicality acts as a stabilizing factor, anchoring business models and mitigating the risk of speculative bubbles. By delivering real-world applications and benefits, DePIN ensures a solid and sustainable growth trajectory.

- Tokens as business boosters:

- Initial funding: DePIN can raise significant funding from venture capital, sell hardware, and launch a narrative-driven token . This initial capital launched the business.

- Growth subsidies: Using part of the raised funds to subsidize service fees and reward users , DePIN can quickly expand its network, have more nodes and users, and cultivate a strong and extensive community.

- Sustainable scaling: While hardware coverage has its limitations (for example, a certain number of hotspots are required to cover an area), a well-established network can sustain itself over the long term. Once the initial funding is leveraged, a mature network should be self-sustaining driven by its own momentum and user base.

- Community-driven, bottom-up approach:

- By leveraging a community-driven model, DePIN enables more cost-effective and agile development compared to traditional top-down approaches. This grassroots strategy not only reduces costs but also increases user engagement and investment in the platform, creating a loyal and active community.

evaluation standard

case analysis

case analysis

Helium 5G

In short, Helium Mobile is entering the vast US 5G market and has now expanded to Mexico as a pioneer and one of the largest markets in the DePIN space. It is an important undertaking for Solana, DePIN and 5G innovation. Helium Mobile offers 5G plans for $20 per month and currently serves more than 43,000 users in the United States. Its BME approach, deflationary token model and pegged coin concept have set a precedent for many projects.

- background:

- Helium is the pioneer and one of the largest DePIN networks, initially launched in 2019 to address IoT challenges. Through effective token incentives, it has become the world's largest IoT network in just two years, with more than 100,000 hotspots in 182 countries. During the last bull market, its FDV peaked at $11.7 billion , making it an outstanding project. Despite criticism of its limited IoT needs, Helium continues to explore and develop. In 2022, it entered the Internet of Things and mobile fields through two sub-DAOs, and began to focus on the 5G hotspot market. The partnership with T-Mobile enhances network accessibility and its migration to Solana in 2023 solidifies its position as the leading DePIN project on the platform. As of January 2024, Helium has deployed 8,000 5G hotspots and has more than 43,000 5G users every month.

- network:

- How are community-driven 5G services possible?

- Traditional 5G providers such as AT&T, Verizon and T-Mobile dominate the U.S. wireless market, investing heavily in spectrum licensing and infrastructure. However, DePIN 5G becomes feasible through three key opportunities: the rise of eSIM technology, allowing users to seamlessly switch to virtual providers; CBRS frequency bands becoming available to the public without expensive licenses; the availability of small cells that individuals can host appear, providing adequate coverage when deployed densely.

- What are the goals of the Helium 5G network?

- Considering the limited coverage of small base stations - which can only cover 100 yards to one mile - it is not feasible to completely replace the traditional 5G network. Instead, Helium's 5G network is intended to serve as a supplemental roaming service, especially in densely populated areas, to provide more affordable connectivity.

- How does the Helium network work?

- The network consists of five roles: hardware suppliers, miners, network, operators and users. Vendors produce and sell 5G hotspots, and miners buy and operate them for $1,000-$2,598, contributing to network coverage. Miners are rewarded for their active and efficient service. The network manages these nodes and maintains data prices at $0.5/GB. Operator Nova Labs packages this infrastructure into user-friendly services, offering users 5G plans for $20 per month.

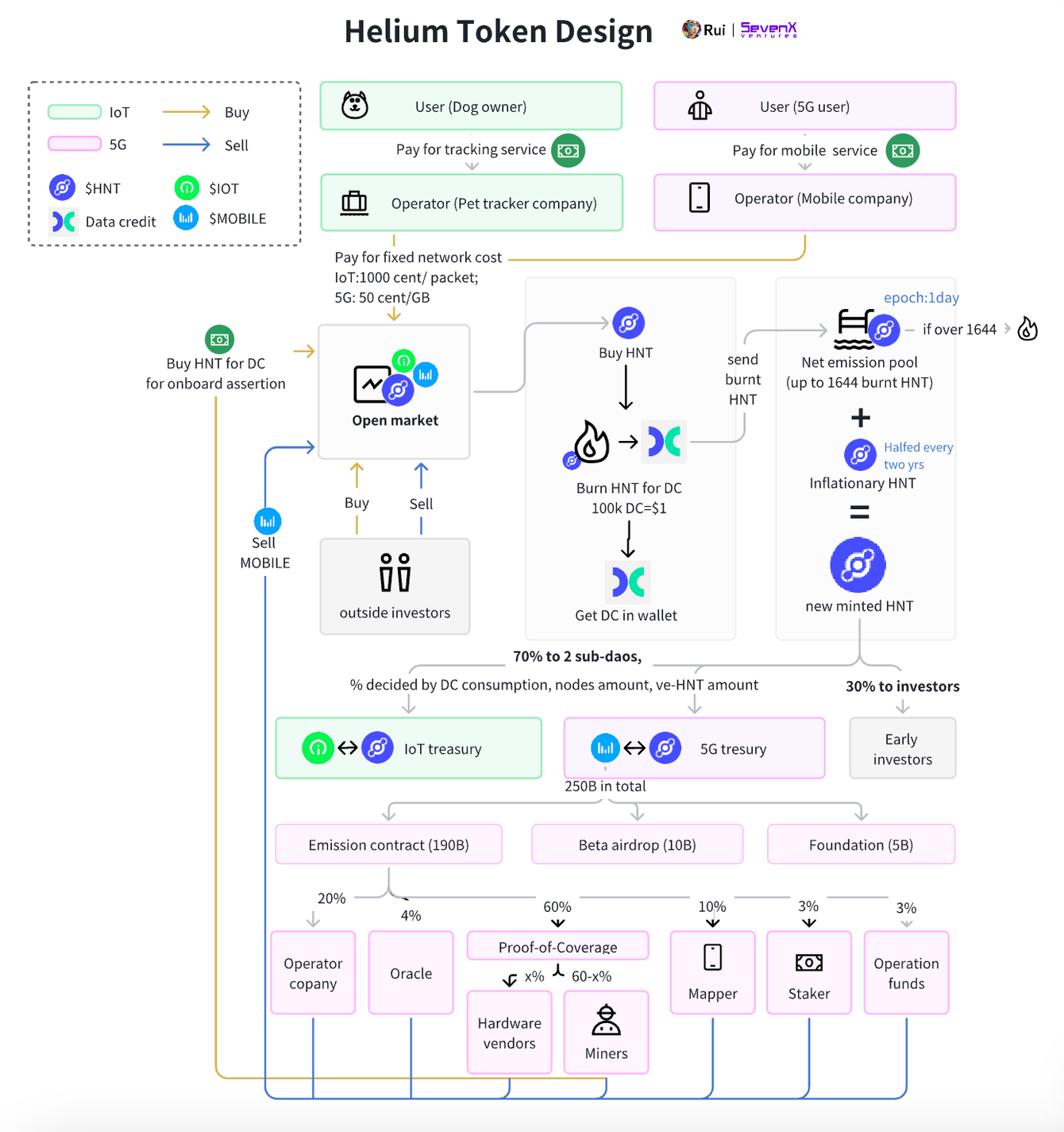

- Token:

- Token type:

- Helium utilizes $HNT to achieve utility, people need to burn $HNT to obtain Data Credits (DC), a USD-pegged token for network usage, $MOBILE and -20232023202320232023- 2- Tokens are used to reward participants of their sub-DAOs.

$HNT and BME:

$HNT and BME:- $HNT is capped at 223 million and halved every two years. By 2064, constant emissions will eventually be reduced to just 1 HNT per month. To avoid running out of rewards, Helium uses a burn and mint equivalent (BME) method without exceeding the maximum supply. Users must purchase $HNT and burn it to get Data Credits (DC) to use the network. The burned $HNT is then recycled into the net emissions pool. To apply deflationary pressure, the cap ensures that any number of tokens burned that exceed 1% of net emissions (currently 1,644 per day) will be permanently removed.

- $HNT and $MOBILE:

- The value of $MOBILE is backed by $HNT. The daily minting amount of $HNT includes recycling and new emissions from the net emissions pool, with the total amount distributed to various stakeholders. Approximately 30% goes to investors, with the remainder allocated to the two sub-DAOs based on a formula that takes into account DC consumption, number of hotspots, and ve-HNT holdings. This distribution mechanism determines the distribution of the MOBILE DAO treasury, thereby affecting the value of $MOBILE.

- $MOBILE:

- $MOBILE directly affects participants' rewards, with the maximum supply set at 250 billion, which is halved every two years. Daily emissions are allocated as follows: 20% to operators (Nova Labs), 4% to oracles, 60% to hardware vendors and miners, 10% to mappers (users share their locations), 3% to stakers , 3% to working capital.

- Theoretical flywheel effect:

- An increase in the $HNT price increases the value of $MOBILE, thus increasing the rewards for miners and mappers. This will encourage more participants to join, causing more $HNT to be burned, further pushing up the price of $HNT, creating a positive feedback loop for the growth and value of the ecosystem. xx

- Nature:

- While investor activity can significantly impact a network’s valuation, the network’s sustainable growth fundamentally relies on increasing its user base and miner participation.

- Subscriber growth: managed by operators

- Currently, Helium Mobile, as the only network operator, offers a $20 per month plan, has approximately 43,000 activated SIM cards, and projected monthly revenue of $860,000 (but this is not accurate as it does not include the $5 per month plan). Miami package) ). However, according to on-chain data , only 8%-15% of this revenue contributes to the network’s revenue. Assuming the carrier has enough money for marketing and paying for things like the T-Mobile partnership, the subscriber attraction strategy includes an attractive $20 offer for unlimited 5G. In addition, they introduced an innovative incentive that rewards users with $MOBILE for sharing their location, and the user participation rate for this program is as high as 88%. These $MOBILE tokens can directly offset subscription fees. Referral programs are another strategy being used.

- Miner growth: affected by $MOBILE volatility

- Miners' main concern is return on investment and rewards. The initial cost of a miner, including hardware purchase and setup, ranges from $1,025 to $2,624. With 7,672 active hotspots, this represents a huge amount of value created by miners. But due to the volatility of $MOBILE, rewards fluctuate; for example, the average daily income of miners in November 2023 was about $12.47, and as the value of Solana soared, the number soared to $147.63 in December 2023, but then It dropped again. Improving the value of $MOBILE, thereby attracting more miners, depends on increasing the value of $HNT, bringing greater buying pressure to investors, and exploring other strategies to stimulate buying demand.

IO.NET Artificial Intelligence/Machine Learning

In short, io.net is targeting the AI machine learning market, especially the GPU-as-a-service market. Its high-end GPUs are about 82% cheaper compared to Web2 providers like AWS and Goggle Cloud, and it has the most GPUs, especially high-end GPUs among its Web3 competitors. It introduces BME similar to helium.

- background:

- Machine learning, the basic algorithm for artificial intelligence, is experiencing significant market growth. The field of machine learning training and inference involves computing elements such as CPU and ASIC, especially GPU, which are the most basic resources. However, high-end GPUs required for large-scale machine learning are in severe short supply. As a result, many AI/ML enterprises, especially those lacking the necessary infrastructure and expertise, are increasingly turning to cloud GPU services. These services provide a cost-effective and practical rental model for running machine learning tasks.

- network:

- Why does the web3 Cloud GPU service make sense?

- "Your profit is my opportunity", io.net's prices are A100 ($0.89/hour), 522 RTX 3090 ($0.38/hour), 301 RTX3080 ($0.23/hour), 8426 photos RTX A6000 ($0.75/hour) , 1988 photos RTX, A4000K8S ($0.23/hour). Taking A100 as an example, it is 82.45% cheaper than Google Cloud and 82.62% cheaper than Amazon AWS .

- What are the goals of io.net ?

- Designed to be the world's largest and most cost-effective GPU on-demand cloud, providing unlimited scalability for AI/ML training/inference.

- How does the io.net network work?

- io.net solves this cost and availability issue by aggregating GPUs from underutilized sources such as independent data centers, crypto miners, and crypto projects such as Filecoin and Render. GPU workers can join a GPU pool, which groups GPUs based on their network speed, location, chip manufacturer, and model name, and GPUs can be rewarded not only for hours employed, but also for idle time when the GPU is used for inference. . Consumers can create clusters in 90 seconds. First, create a cluster with a custom GPU selection, use Sphere for payment, and use VSCode to deploy ML tasks and monitor progress.

Acknowledgments:

Thanks to my dearest friend for your comment:

Kuleen, Solana ’s DePIN Ecosystem Leader

0xlol, Head of Defi Research at Polygon