I spent considerable time researching the last bull run, the different narratives that were popular at the time, the profit-maximizing rotation, the top-performing coins of 2021, and the logic behind their massive gains.

This new cycle will not be exactly like the previous one, but there are many lessons we should remember because history is similar, especially in financial markets, where much of the prosperity comes from the way the human brain thinks and that will never change. Let’s get right to the point.

General experience of the 2021 bull market

New coins perform well, old coins underperform

A notable trend in the 2021 bull market is the underperformance of older coins. Almost no coins in the 2018 cycle will perform well in 2021.

Ripple (XRP), Stellar Lumens (XLM), Bitcoin Cash (BCH), NEO, XEM, IOTA, EOS, Dash, Monero (XMR), Zcash (ZEC), and Tron (TRX) never reached their previous highs again (in USD terms), and they have essentially only fallen relative to BTC since 2018.

Of course, apart from BTC and ETH, the only good performances among the major old coins came from BNB, Cardano (ADA), Ethereum Classic (ETC) and DOGE.

This is a screenshot of CoinMarketCap’s rankings in December 2017. I strongly recommend that you review these historical snapshots for several dates to help you understand how the cryptocurrency market "rotates."

Most coins underperformed BTC before the bull market really started

When we are in the middle of a bear market and think we are near the bottom, it is obviously the best time to buy BTC and ETH and hold until the next bull market.

But by the same logic, you might also be tempted to buy Altcoin because they have a high beta against BTC and should therefore perform better. Even though this is true for some Altcoin, it wasn’t entirely true during the last bull run.

Most Altcoin underperformed Bitcoin during its rally in late 2020 until early 2021, when they suddenly started taking off.

The good news is that by holding BTC and ETH until the bull market begins, you are not really missing out on excess returns.

If history repeats itself, here's what we should expect: BTC (and maybe ETH too) should have a period where it takes off on its own, while Altcoin lag, BTC market share rises, and then suddenly the rotation begins, and that's when the Altcoin start going crazy rise.

But I don’t think this is exactly what has happened or will happen: what we have seen over the past few months is that $BTC has risen simultaneously with BTC dominance, just like in 2020, but this time from June 2023 to Now, we have seen many coins outperforming BTC.

BTC market share

My interpretation is this: For long-term investors, the bottom to buy in November 2022 is $BTC (and $ETH, even if in hindsight not touching ETH in 2023 was the best idea), while buying the right Altcoin time is around June 2023.

There is a lot of variation in Altcoin performance: $ETH underperformed $BTC in 2023, some older Altcoin also underperformed $BTC over the past few months, and some Altcoin have significantly outperformed the market.

Still, we haven’t seen the Altcoin mania phase yet, which I expect will be a full-on frenzy when BTC breaks out of its past high ($69,000).

Most gains are concentrated within a few months

Most of the gains in these cryptocurrencies are concentrated in a fairly short period of time. Almost all performances occur within a few months, especially on Altcoin .

For example, in the last bull market, it was from January to May 2021, and then from August to November. The market is in a period of “all up, no down”, and your new opponents are retail investors who have given up on cryptocurrencies for 3 years.

These are the critical moments when you need to put 100% of your energy into the market. There is a famous GCR tweet that sums up what you need to do during these times:

Here are a few examples to give you an idea of how rapid and concentrated the rise has been:

- $CHZ: 30x growth in one month from February to March 2021

- $BNB: 8x growth in 20 days in February 2021

- $DOT: Grew 8x in two months from January to February 2021

- $SUSHI: Grew 6x in one month, January 2021

- $AAVE: Grew 6x in one month in January 2021

- $HOT: Grew 35x in 2 months from February to March 2021

- $JOE: 60x growth in two weeks in August 2021

Don’t let the post-traumatic stress disorder (PTSD) that comes with bear markets rob you of your chance to make crazy gains during bull and copycat seasons.

If this is your first market cycle, there's a good chance you'll enter the market too late, let your investments soar at irrational valuations without making timely profits, and then bounce back and forth between many gains. However, if you're reading this, chances are you've been through the last cycle and survived the particularly brutal bear market of 2022. In a bear market, you have to be alert to every rally and be ready to short every time an Altcoin on some catalyst. This behavior will be rewarded. However, in a bull market, this completely changes: coins rise higher than you think. You have to be ready to benefit from it.

Here are a few examples of some coins that have seen crazy gains in a fairly short period of time in 2021, and the very large valuations they have reached:

- In January 2021, $DOGE increased nearly 10x in one day, when it was already a billion-dollar token

- $THETA’s market cap rose from $1 billion to $12 billion in 3 months

- $RUNE’s market cap grew from $200 million to nearly $5 billion in 5 months

- $FIL once reached an FDV of nearly $400 billion

- $ICP launched with $250 billion in FDV

- $AXS's market capitalization rose from $200 million to $10 billion in 5 months, and its FDV was $43 billion at its peak

- $GALA’s market capitalization reached $5.4 billion at its peak in 2021, compared to a market capitalization of just $5 million at the beginning of the year

- $TEL’s market cap rose from $10 million to $30 billion (300x) in 5 months

The dominant narrative of the 2021 cycle, and the best gains

DeFi 1.0:

DeFi became the new thing in cryptocurrencies in 2020, offering new use cases and something fresh out of nothing. DeFi is the focus of the market in the summer of 2020, which is why it is called "DeFi Summer". We can describe it as the beginning (or pre-start) of the bull market.

Add a ponzinomics aspect to the whole thing and you have a recipe for huge gains. The two biggest winners in DeFi with strong fundamentals are $AAVE and $SNX. From bottom to top, these earn between 500x and 1,000x. We can also mention $SUSHI, which grew 30x between November 2020 and March 2021.

Alt L1

The L1 trade is the most persistent trade in cryptocurrencies and one of the most valuable trades of the last cycle: the main winners of this trade are $SOL, $LUNA, $AVAX, but also include $FTM, $ADA, $BNB , $EGLD.

The market places a very high premium on Alt L1s, meaning that on average, their value (market cap or FDV) is higher than other categories, such as Apps. Once you know this, you know you have to engage with this narrative. It quickly became clear that this was one of the themes of the 2021 bull run, as some of them were almost the best performing coins from the start until the Terra-Luna crash in May 2022.

The lesson here is: once you understand what the main theme of the cycle is, you simply go with the flow. The second lesson is: Alt L1 transactions will never go away. This is a dominant theme in 2021, but in fact it was already the case in 2017 and will be the case again in 2023-2024.

alt L1 Ecosystem Playbook

In cryptocurrencies, whenever a coin rises, traders look for coins that are correlated with the rising coin, or that should logically follow the rise. This is why, when an L1 network currency rises, people start looking for all the tokens in this network's "ecosystem", because these tokens have smaller market caps, so they are expected to rise more sharply, and as L1 The currency’s “beta”.

Typically, the main ecosystem currency is the network’s dominant decentralized exchange (DEX), and that’s where some crazy gains were made during the last cycle:

For example, BSC had its peak season in the first 2 months of 2021, so $BNB started a huge rise from $40 to up to $700, while $CAKE, as the main DEX on BSC, basically rose in a month 50 times. For some traders, $CAKE is their best trade of the entire 2021 bull market.

The second example is in the Avalanche ecosystem: like most coins, $AVAX had a strong start at the beginning of 2021, but fell sharply (-70%) in May and then recovered the most in August 2021. One of the strongest currencies. Naturally, people started looking for beta coins, and the Avalanche DEX coin $JOE rose 50x in two weeks. Pangolin ($PNG) is another major DEX on Avalanche, but its price has “only” quadrupled in the same time period.

In addition to DEX, you can also consider meme coins, money markets, perpetual DEX, CDP (over-collateralized stablecoins), and launch platforms. I think now in 2024, people are more inclined to "the main meme coin on the X chain" than "the main dex on the X chain".

metaverse

On October 28, 2021, Facebook announced its rebranding as Meta, and the new company's focus is "building the metaverse." This immediately triggered an extreme wave of speculation in the cryptocurrency market: Metaverse mania began.

There are 3 coins that lead this narrative: $SAND, $MANA, and $GALA.

They were both up close to 10x in a month, and the only thing you had to do was buy them after Meta announced its plans, even though they were already up 20% after the news came out.

At the time, the market was nearing the peak of its euphoria, and with the announcement of Meta came traditional financial and real-world news, so it was a very strong narrative that continued for about a month.

What’s more, the Metaverse is closely tied to gaming, and while a major crypto game, $AXS, went absolutely crazy during the summer of 2021, Gaming + the Metaverse was another powerful catalyst as people then started looking for “the next Axie Infinity” ”.

The lesson here is: Understand technology and real-world trends outside of crypto, because in a risk-on environment, if a technology trend has some relationship to crypto, it will definitely become a narrative in crypto, as we do in this dimension Seen in the metaverse and gaming fandom.

The narrative of 2024 that most resembles the Metaverse of 2021 is AI: ChatGPT’s launch didn’t happen at a time when the market was in a bull run and the overall AI narrative was concentrated in time, so there wasn’t a month of full-blown AI mania (as opposed to Metaverse mania), but AI coins performed very well during the bubble period of January-February 2023, which was the most risk-on environment of the year, then AI coins performed well again in October/November 2023, and now again in February 2024.

I think many AI coins are primarily virtual software, but I don't want to ignore a narrative that is so powerful in the technology world. Some of the wildest gains this cycle will come from the AI sector.

Meme Coin

Meme coins were some of the best performers of the last cycle. $DOGE started 2021 with a market cap of $600 million. Over the next 5 months, thanks to Elon Musk's strong promotion, the price of $DOGE increased 150 times to its peak, reaching a massive $90 billion market cap.

A few months later, a great rotation occurred, with another doge-themed meme coin $SHIB reaching a market cap of $40 billion, up from less than $5 million at the start of 2021.

Many other meme coins have reached insane valuations: $SAFEMOON ($17 billion at its peak), $ELON (over $1 billion), $AKITA ($1.5 billion), $FLOKI ($3 billion).

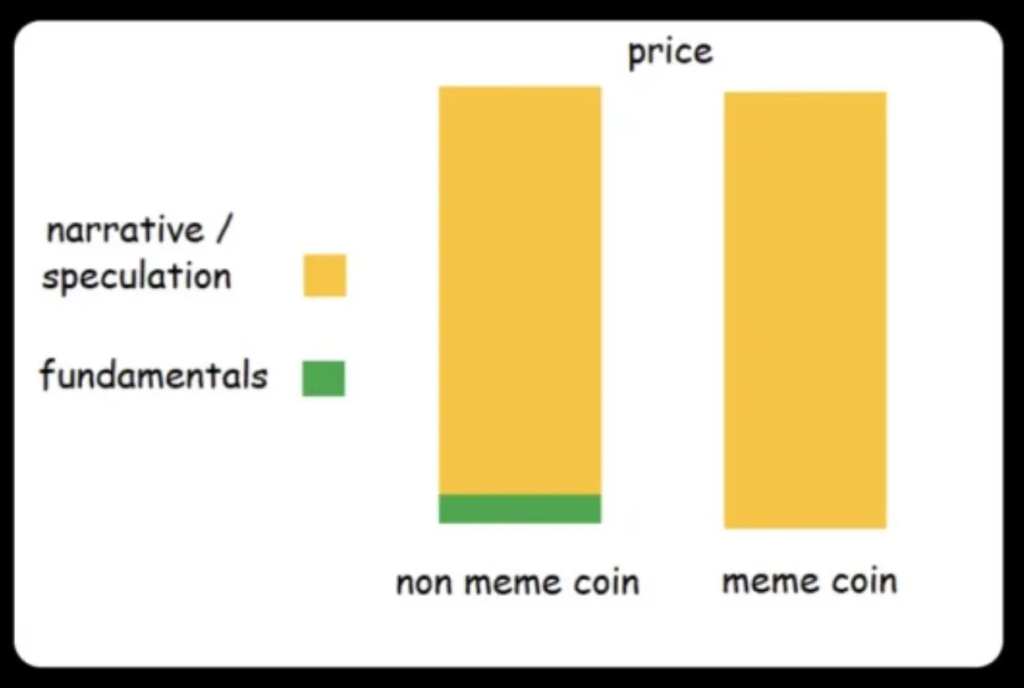

Memes are definitely here to stay, and it is likely that some meme coins will be the best performing coins in the new cycle. In cryptocurrencies, the main thing that drives prices is not fundamentals, but narrative and speculation, and meme coins take this to the extreme.

NFT

NFTs are a completely new cryptocurrency category and narrative in the 2021 bull run (technically, it’s not new, but it is new to the market), and it’s where some of the craziest gains are happening.

When we say “NFT” we mainly mean collections of avatar images, the first (and OG) to go crazy was CryptoPunks, whose floor price jumped from 5 ETH in January 2021 to 20 ETH in March, and then It rose to 100 ETH again during the summer! A year ago, in the summer of 2020, the floor price was just 1 ETH.

A large number of NFT PFP series have been launched, the most successful one besides CryptoPunks is obviously Bored Apes, but we can also mention Pudgy Penguins, Art Blocks (not the PFP series), Doodles, Cool Cats, etc.

Thoughts on cycles: How to play with narrative rotation to maximize profits?

Crypto trading is a game of rotations from one narrative to another, and while it’s nearly impossible to accurately capture all short-term rotations, there are some lessons we can remember. Some narratives remain strong throughout the bull market, such as L1 network trading never stopping, but most trends last about 1 month, which is the first thing to know.

The main part of the rally usually occurs over a period of a few weeks to a month, after which fatigue sets in and the market's attention shifts to other things. Of course, this is a very rough pattern, and some coins manage to outperform for several months in a row, but generally, if people have been talking about something for a month in a row (think Metaverse in November 2021), take note This trend may have exhausted itself.

As we go through a bull market, people tend to increase risk. This means that the dominant narrative in the early stages of a bull market may have some strong fundamentals, but as time goes on, traders will be looking for more and more that are riskier, higher rewarded, and make less and less sense.

For example, in 2020-2021, $LINK (strong fundamentals) was the best performer in the bear market, then we had DeFi Summer, which introduced a new normalization, which was DeFi (strong fundamentals), and then we had BTC Uptrend, then during the first part of the bull market, some DeFi coins were the best performers ($AAVE, $SNX, $RUNE, $UNI).

In the following months, the market became increasingly speculative, virtual items were overvalued to billions of dollars in FDV (Metaverse, Gaming), and ultra-high-yield pure Ponzi economics was regarded as French The future (Olympus DAO $OHM).

At this point, when all these top signals appear in the market, you may look to exit, or at least significantly reduce your risk. Seeing a slew of crypto games launch (e.g. via LaunchPad) with ridiculous valuations (>$1B) while they offer nothing but what they promise is a good sign that we're getting close to the top.

Of course, take all of this with a grain of salt as the crypto market continues to become degen (DeFi Summer has been Ponzi economics, new meme coins are constantly being launched and traded, etc.) and if you're looking, you can pretty much Find the "top signal" at any time in encryption.

If a coin performs best in bear markets, it cannot perform better than bear markets throughout the bull market cycle. At least, that's the case for 2021, but this is a unique bull market in that it is clearly divided into two parts (pre-May 2021 and post-July 2021). Many coins that performed strongly in the bear market peaked around May 2021 or even before: $AAVE $SNX $RUNE $THETA .

In the second half of the bull market, look for new narratives (Metaverse, NFTs in 2021) and be prepared to accept things that are increasingly irrational, introducing new Ponzi economics, and becoming religious (next section will be introduced in detail).

catalyst

Cryptocurrencies tend to amplify many human psychological biases and emotions, which are often the catalyst for more extreme rallies and the catalyst for more extreme selloffs. It seems particularly important to identify two such examples of catalysts:

"Protagonist" and the worship of some cryptographic characters

Crypto markets love “heroes” who are often idolized and will be the reason why some cryptocurrencies rise. You can easily find a central figure behind some of the rising coins in 2021:

- SBF (Sam Bankman-Fried) is viewed as a genius, which is one of the reasons for the incredible performance of $SOL (Sam is a bull and supporter of $SOL) and the reason why $FTT

- CZ is a Binance leader and this is part of $BNB

- Su Zhu, regarded as a god-like investor/trader with billions of dollars under management, was the bull on Avalanche, which was the catalyst for $AVAX

- Musk is one of the main reasons why $DOGE has risen to a market cap of nearly $100 billion

- Do Kwon is the founder of Terra Luna, and his "confidence" (to say the least) may have played a role in $LUNA

- Richard Heart, the colorful man behind $HEX, is adored by Hexicans

- Charles Hoskinson, the father of Cardano, is probably one of the main reasons why $ADA has reached its huge market capitalization

- Andre Cronje, the central figure in Fantom ($FTM) and co-founded a number of other projects, is considered a genius by some

- Daniele Setagalli leads 3 wildly rising projects: $TIME, $SPELL and $ICE

Two types of protagonists stand out: either a "genius" or a "community leader/worshiped by the community." Keep this in mind and prepare for the next bull market.

Religion x Ponzi = upcoming rally and selloff

The second and third catalysts are: religion and “Ponzi-like” token economics. Interestingly, these often appear together. Ponzi economics usually means very high returns that are ultimately unsustainable in some form. Religion is harder to explain, but a few examples will illustrate the point:

- Luna is one of the best examples: Do Kwon is the charismatic leader, there is an obvious element of Ponzi economics, which is the 20% Anchor earnings on UST, and it is somewhat like a religion because members of the community e.g. Call yourself "Lunatics" and if you challenge the sustainability of the UST model you will be opposed and attacked by them

- Olympus DAO ($OHM): The main catalyst for this is Ponzi economics, which is basically a crazy high staking yield. You may remember that Olympus has a leader who is a Twitter anonymous named "Zeus"

- Daniele Setagalli's project clearly has "degen features": Wonderland is an Olympus fork with higher yields, while Abracadabra has a "degenbox" product that allows people to rotate their UST and receive a leveraged Anchor yield ,If i remember correctly. The community gathered around Daniele Setagalli is called the "Frog Nation"...