Since the market value of the MEME token BOME (Book of Meme) hit a record of over 2 billion US dollars in 3 days, "Issuing MEME tokens in Solana and recharging SOL to unknown addresses" has become a new trend. The huge wealth-making effect has made users in the crypto community Completely FOMO, it is no longer novel to easily raise SOL worth millions or even tens of millions of dollars from an unknown address within a few hours.

The wealth effect of MEME currency has brought huge traffic and attention to Solana, and attracted a number of foreign applications to the Solana ecosystem.

Learn more about Weibo Tuantuan Finance here .

In fact, before the MEME hype boom, hot spots on the Solana chain had never stopped, from last year’s DePIN craze to the MEME hat dog Bonk, as well as the ecological oracle Pyth Network, DEX platform Jupiter, cross-chain protocol Wormhole and other projects airdropped one Wave after wave. In the words of community users, there is no shortage of opportunities on the Solana chain. It is a true "poor-to-rich chain."

In addition to the MEME coin, what other opportunities are there in the Solana chain ecosystem that are worth participating in and paying attention to?

DEX Big Three: Raydium, Orca, Jupiter

Raydium: DEX of choice for MEME token trading

Raydium product functions include DEX trading, AMM Swap exchange, liquidity mining, pledge mining, IDO launch Acceleraytor and other functions.

The recent popular MEME hype boom on the Solana chain, popular MEME token fund pools such as BOME and SLERF, are all created on the Raydium platform. More than 90% of the token trading volume occurs on this platform, which is the current MEME token on the Solana chain. DEX with the largest currency trading volume.

On March 17, Lanchpad platform DAOMaker announced its expansion to the Solana network and will add a $2 million SOL liquidity pool on Raydium and launch 4 Solana IDO projects. Among them, the first AI e-commerce project YOUR AI has launched the token YOURAI on Raydium on March 18.

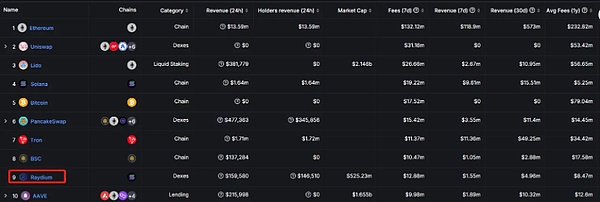

In the past seven days, the Raydium platform has captured more than $12.91 million in transaction fees, and the fees captured on the Solana chain during the same period were $19.22 million. The platform's revenue ranks among the top ten in the DeFi market.

The platform token RAY has increased by 89% in the past 30 days and is currently quoted at US$2.04, with a market value of US$530 million and an FDV of US$1.13 billion.

Trading DEX leader Orca

Orca is also the first-generation AMM (automatic market maker) DEX on the Solana chain. Unlike DEXs that integrate many functions, the platform page is very simple and only supports token exchange and liquidity pool addition.

The trading volume of the Orca platform within 24 hours was US$1.415 billion, ranking third in the entire DEX market, second only to Uniswap and Pancakeswap. It is the DEX with the largest trading volume on the Solana chain.

On March 20, the platform token ORCA was quoted at US$4.03, with a market value of US$190 million and FDV of US$4.01 billion.

Deal aggregator Jupiter

Jupiter is a transaction aggregator on the Solana chain, aiming to provide users with the best exchange rates and experience by integrating the main liquidity markets on the Solana chain.

In January this year, Jupiter announced that it would airdrop 1 billion JUP tokens to about 955,000 Solana wallet addresses. It was the project with the widest coverage of airdrop addresses to date and was a hit.

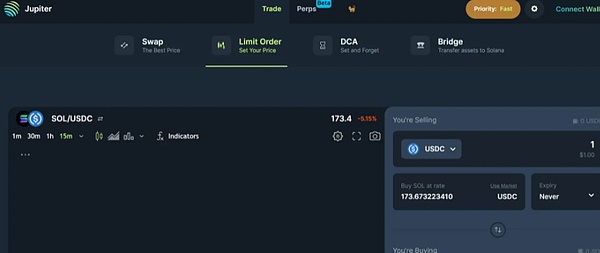

Currently, Jupiter has integrated multiple DEX paths on the Solana chain, including Orca, Raydium, Mercurial, etc. The platform not only supports SWAP, but also can provide functions such as limit orders and fixed investment.

In addition to spot trading, Jupiter will also launch contract functions, which are currently in the testing phase. Only three assets, SOL, ETH, and WBTC, are open.

In addition, Jupiter also launched LFG Launchpad, which aims to help emerging and existing cryptocurrency projects raise funds, distribute tokens, and quickly activate liquidity and launch more tokens in a decentralized and transparent manner.

On March 13, Jupiter announced that the first round of LFG Launchpad project voting had ended, and the first batch of launch projects selected were the cross-chain communication protocol Zeus Network and the NFT lending protocol SharkyFi. Among them, LFG Launchpad’s first IDO project, Zeus Network, will launch a token public offering on April 4.

On March 21, Jupiter announced that JUP DAO will inject 10 million USDC and 100 million JUP next week to accelerate Jupiverse growth and public funding.

On March 20, the platform token JUP was currently quoted at US$1.19, with an increase of more than 120% in the past 30 days, with a market value of US$1.6 billion and an FDV of US$11.8 billion.

Liquid staking track: Jito

Jito is the second largest liquid staking protocol on the Solana chain. Users can pledge SOL in exchange for the pledge certificate LSD token JitoSOL. The platform not only provides users with staking rewards income from the PoS network, but also distributes the MEV income rewards obtained to staking users.

On March 18, the number of SOL pledged on the Jito platform was approximately 9 million, worth US$1.6 billion, making it the second largest application of TVL on the Solana chain.

In November last year, Jito launched the governance token JTO, which is currently quoted at US$3.05, with a circulating market value of US$357 million and FDV of US$3.05 billion.

Oracle Pyth Network

Pyth Network is a decentralized oracle project on the Solana chain. It can transfer real-world data to the on-chain world, complete data interoperability between the blockchain and the real world, and support the construction of the next generation of DeFi. It was created by Jump Trading team members , is a star project within the Solana ecosystem.

In October last year, Pyth Network announced the economic model of the token PYTH, issued a total of 10 billion tokens, and airdropped 600 million tokens to 750 million wallets, causing a commotion in the crypto market.

On March 20, PYTH was quoted at $1.02 and FDV was $10.1 billion.

At this stage, it is not wise to cut the quilt cover. As long as there is no leverage, just hold it with peace of mind and wait for the rebound. If the position is relatively large and heavy, wait for the rebound and reduce the position a little. Just hang the pin list below.

1. SOL stocks that have fallen more can be the first choice, 2. meme sector, 3. stocks that were more popular before falling, etc. (AI, fan coins)

Take hold of your position now, it doesn't matter even if it rises directly, after Bitcoin rises, the sector will rotate. Just look for opportunities during the rotation.

Later, we will bring you analysis of leading projects on other tracks. If you are interested, please click follow. I will also compile some cutting-edge information inquiries and project reviews from time to time, and welcome like-minded people in the crypto to explore together. If you have any questions, you can comment or send a private message. All information platforms are Tuanzi Finance .