The Market

It has been a volatile week for BTC as it enters the uncharted territories after hitting ATH at ~$74,000 on March 14. As we mentioned in the last weekly, BTC has experienced episodes of ~20% corrections last time it hit ATH at $40,000 at the beginning of 2021, and on its way climbing to the new high above $60,000. In fact, on an intraday level, we already saw a 17% correction last week. The price in March has formed a support level around $61,000 and a resistance level around $69,000. We expect the BTC price to bounce between these two levels and potentially break through to the upside as halving approaches.

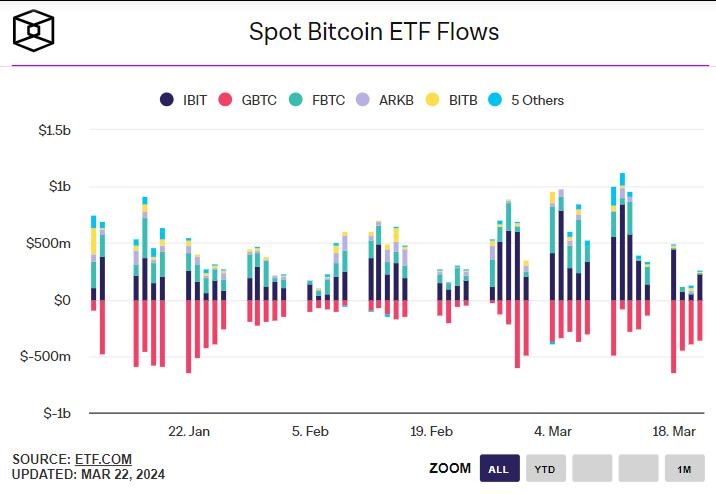

We have experienced the first week of spot ETF outflow since January, likely due to the negative price action last week. We are not particularly concerned about it as the sales effort to institutional clients have just started.

Another potential reason for BTC price weakness is the central banks’ rate decisions last week, as the dollar index DXY strengthened slightly after the FOMC meeting. The Fed decided to hold the rate steady, while Japan raised rates for the first time in 20 years and Switzerland became the first developed country to cut rates. As Noelle Archson pointed out in her “Crypto is Macro Now” newsletter, while the mean projection from the Fed Dot Plot has remained the same, the dispersion has narrowed, in an upward direction. A gradual easing policy might extend this round of the bull market, as BTC price adjusts for halving and as capital rotates down the risk curve. A correction in BTC price has flushed out some leverage in the market. The funding rate for major crypto assets have come down to a healthy level again in the last two weeks.

There is around 5% decline in long-term BTC holder supply YTD, indicating some profit taking from long-term holders as BTC hits the new ATH price. This is still small compared to the ~14% decline during late 2020 and ~25% decline during 2017-2018.

ETH is facing some headwinds as we approach the ETH spot ETFdecision date in May. The SEC has initiated a new investigation into the Ethereum Foundation, which is widely suspected as a way to delay or deny the ETH spot ETF application. The key question is whether ETH is defined as a security. This question not only applies to ETH but also to other digital assets except BTC, as well as the exchanges and custodians supporting them. We consider regulation to be the final obstacle for crypto to achieve mainstream adoption. Given that it’s an election year with potential for a change in leadership, we do not expect a clear answer in the near term.

Despite BTC finally reaching a new ATH after more than a year since the FTX debacle, other large digital assets still have some way to go before hitting their previous ATHs. Reviewing the components of the CoinDesk 20 Index, a benchmark for large cap digital assets, 16 of them are still down more than 50% from their last ATH price. This indicates we might still have some time to go before the AltSeason fully kicks in.

Source: CoinDesk, Messari

DeFi Update

While BTC and ETH are both facing setbacks, Solana is on the rise again, with its DEX trading volume surpassing ETH for a second time since last December.

Solana might have been experiencing a mini DeFi and NFT summer together, driven by Meme frenzy. There are ~$5.6B meme coins on Solana, with two of them (WIF and BONK) having a market cap above $1B. BOME, the third largest meme coin on Solana, reached a market cap of $1B within 48 hours of its launch, second only to the fundraising speed of SHIB back in May 2021. In addition to DEX volume and users, the SPL token issuance has also reached an ATH, driven largely by the meme coins issued on Solana.

Is DeFi summer arriving too quickly on Solana and should we be concerned? On the positive side, with Ethereum’s fragmented L2 ecosystems, Solana has emerged as a preferred chain for DeFi capital, offering low cost, fast speed and manageable playbook choices. Additionally, Jupiter, the leading DEX aggregator on Solana, provides a great UI that enables practical trading strategies and ample liquidity for young tokens before they get listed on CEXes. We view the rise of Solana memes as an affirmation of two things: 1. Risk appetite is back in crypto where greedy capital could pump up the market; 2. Solana has become the preferred chain in this cycle, as more activities drive more users and more adoptions. SOL and JUP could behave similarly to what ETH and UNI have done in the DeFi summer, which delivered 5-10X returns during the first half of 2021.

On the cautious side, we should be concerned about the rapid rise of meme coins and potential fraudulent fundraising activities in Solana. Solana’s founder Anatoly has publicly pleaded with the community to stop memecoin pre-sale activities. Solana’s high performance has become a double-edge sword in attracting both real users and speculators into the ecosystem. Memes have provided good PR for Solana, as its Google search trend has reached an all-time high compared to its past search history. However, it has yet to reach the level seen by ETH during the last bull cycle. The Solana ecosystem might be memed, but we have reasons to be hopeful, as more leading Solana dApps are expected to do airdrops this year, including Tensor- the leading NFT market place, MarginFi - the leading borrowing and lending protocol and Drift - the leading derivative protocol, just to name a few.

Top 7d Gainers and Losers

Top 100 MCAP Winners

Ondo (+50.56%)

Stacks (+37.72%)

Toncoin (+37.52%)

Fantom (+31.07%)

eCash (+26.73%)

Top 100 MCAP Losers

Injective (-13.94%)

Bonk (-11.10%)

Helium (-10.84%)

Jupiter (-8.68%)

Polkadot (-8.48%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.