Author: Koala Kaola Finance

For Bitcoin, it may be difficult to see supply exceeding demand in the future.

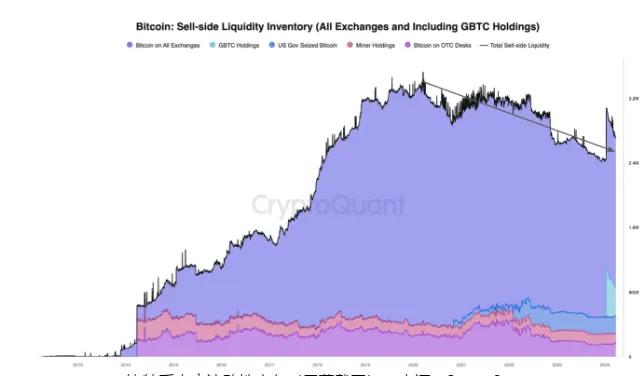

On-chain analysis platform CryptoQuant described an ongoing “seller liquidity crisis” in its latest analysis report.

Bitcoin encounters seller liquidity crisis?

Data shows that record Bitcoin demand coupled with reduced seller liquidity has caused Bitcoin’s liquidity inventory to fall to its lowest level in months. The agency estimates that if the current market growth rate is maintained, the current Bitcoin seller flow will Inventories are only sufficient to meet twelve-month demand. CryptoQuant added that it only includes “cumulative addresses” (i.e. those with no outbound transactions) in its calculations, meaning net demand may still be higher.

CryptoQuant says this continued bidding is now starting to show itself – and by the first quarter of 2025, supply dynamics could change forever. The report further pointed out: Record-breaking demand for Bitcoin coupled with reduced seller liquidity has caused Bitcoin’s liquidity inventory to fall to the lowest demand in months, and this is only considering the demand for accumulated addresses, which is subsequently regarded as Bitcoin Low-end level of coin demand.

Based on a strict assessment of the supply of Bitcoin on U.S. exchanges, the time it takes for Bitcoin supply to meet demand may be further shortened, the report explained: “Considering that the U.S. Spot Bitcoin ETF will only purchase Bitcoin from U.S. entities, if we exclude Bitcoin on exchanges outside the U.S., Bitcoin liquidity inventories will fall to six months of demand.”

Will a potential seller's liquidity crisis stimulate price increases?

Multiple industry analysts say Bitcoin’s April halving is only a small “impact” of the cryptocurrency’s potentially stunning gains this year. Investment researcher Lyn Alden said that the Bitcoin halving next month will reduce the daily production of BTC by about 450 BTC from the current daily average of 900 BTC, but that will be consistent with the daily flow in and out of cryptocurrency exchanges and Bitcoin exchange-traded funds (ETFs). The supply reduction pales in comparison to fiat traffic, Lyn Alden explained:

“The fact that inflows or outflows can easily exceed 10 times that value is a more important factor in overall demand for Bitcoin than supply tightening, and demand for Bitcoin has historically been more correlated with global liquidity indicators,” For example, global broad money supply M2 (shown in the chart below).”

So, while the halving is important, it is only one of many factors that determine the occurrence and timing of a bull market. The combination of various measures of global liquidity, HODL waves and other catalysts can play a greater role. Due to the halving, global liquidity Expectations of improving performance and the fact that so many coins turn to strong hands in a bear market, a relatively small increase in demand could push prices even higher.

Markus Thielen, CEO and chief analyst at 10x Research, said the current rally is "certainly on par with the bull markets of 2020 and 2021." Based on historical price changes and Bitcoin’s recent new highs, Bitcoin is therefore expected to reach $77,000 by early April and $99,000 by May 2024.

According to Markus Thielen, when Bitcoin hit a new high of $68,300, the market saw a wave of intraday selling, but every attempt to push the price down was met with "relentless" buying. The analyst pointed out that every time Bitcoin had a new price breakout in February 2013, February 2017 and November 2020, the price could rise by 189% after 180 days, which means that Bitcoin usually rises by 9 -It peaked around 11 months, as shown in the figure below:

Markus Thielen predicts that Bitcoin could rise to an eye-popping $146,000 within 9 to 11 months after the March 13 breakout.

eToro cryptocurrency analyst Simon Peters emphasized that the current Bitcoin rally is the first time Bitcoin has experienced a parabolic rise and reached an all-time high before the block reward halving. He said that the main reason for this breakthrough is January 11, 2024. Japan and the United States launch a spot Bitcoin exchange-traded fund (ETF):

“Demand for Bitcoin is quickly outpacing new supply, which is something we’ve never really encountered in previous cycles. Before the launch of ETFs, demand was mainly driven by retail, while the current cycle will be more institutional, This suggests that miners have sold off on the current rally in preparation for the upcoming block reward halving. If we do see spot ETF inflows slow down, this may indicate that the market has peaked and lost momentum, but it is worth noting What is clear is that while ETFs have been major contributors to the rally so far, they are not the only players in the space. Other entities such as MicroStrategy and Bitcoin whales have also continued to accumulate.”

Summarize

Liquidity refers to the ability to quickly convert an asset into cash without affecting the price. In the Bitcoin market, liquidity can be measured by the order book, which records all orders to buy and sell Bitcoin. A sell-side liquidity crisis refers to a sudden reduction in sell-side liquidity. This can lead to large price swings or even a market crash.

Currently, the Bitcoin market is in a critical period. If Bitcoins in the market continue to be bought without enough selling, then there will be fewer and fewer Bitcoins available for purchase in the market, eventually leading to a seller liquidity crisis. Generally speaking, establishing a reasonable regulatory framework can improve investor confidence, while attracting more investors into the Bitcoin market can increase seller liquidity, and improving the technical capabilities of exchanges and other platforms can reduce the probability of technical problems, thereby improving Sell-side liquidity.