Author: Jack Inabinet, Bankless; Translated by: Baishui, Jinse Finance

Bitcoin Closes March at Its Highest Level Ever! BTC fascinated traders in March, but which asset was left behind?

This record-breaking monthly close would mark Bitcoin’s seventh consecutive green month, the longest uninterrupted upward streak in history!

Although Bitcoin closed March on a strong note, the month was choppy at times, with Bitcoin’s 18% mid-month drop being a strong test for bulls.

Inflows into spot BTC ETFs were strong in the first two weeks of the month, but turned positive in the third week of March as outflows from the Grayscale Bitcoin Trust (GBTC) accelerated and falling BTC prices deterred buyers, following a rebound in BTC prices that revived demand.

The ETH/BTC ratio is also at a historic milestone, on track to post its lowest monthly close since April 2021, as more and more people believe that the spot ETH ETF application was rejected in May.

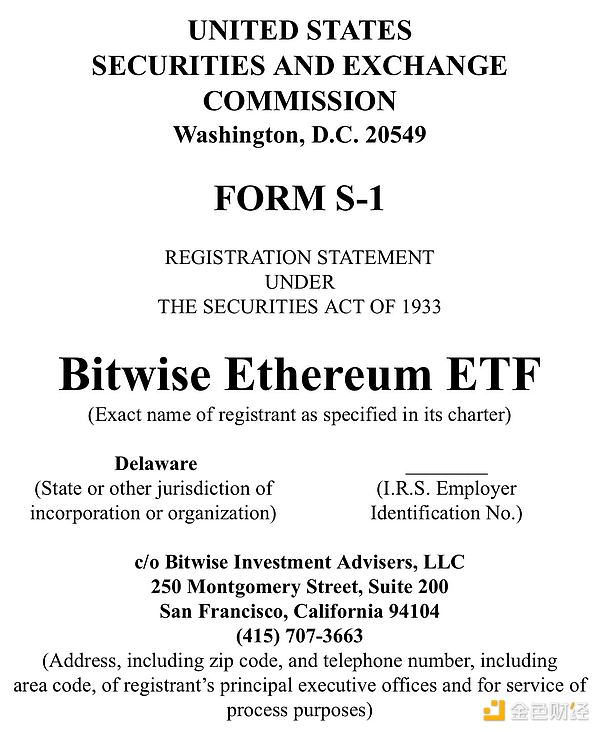

The severe lack of communication between the SEC and proposed issuers is in stark contrast to what happened during the spot BTC ETF approval process.

While Grayscale’s chief legal officer hopes that this communication is unnecessary as the nuances of spot crypto ETFs may have been worked out during the SEC spot BTC ETF approval process, others, including Bloomberg senior ETF analyst Eric Balchunas, still believe that this communication is lacking in necessity. The lack of communication is a bearish signal for the likelihood of approval.

Senior ETF analyst Eric Balchunas pointed out on social media:

Tagged in tweets about this document, Eth corr research, and other Ethereum ETF hopium. I respect all of this, but our odds of Ethereum ETF approval in May are still a bearish 25% (I’d lower that if I could). 7 weeks until the deadline, silence from the SEC = bleak. (Again, I personally hope they approve, but I also hope to get it right so we’ll be a perfect 4-for-4 in crypto ETF predictions)

Fidelity recently submitted a spot Ethereum ETF that includes a staking feature, which was not included in the Bitcoin ETF application, greatly increasing the risk of the application being rejected, which makes people more confident that the spot Ethereum ETF may be rejected.

Fidelity is unlikely to risk launching a pledge product unless they believe the application has been rejected and aim to force the court to decide whether the pledge can be included in future applications in litigation where it is inevitably rejected.

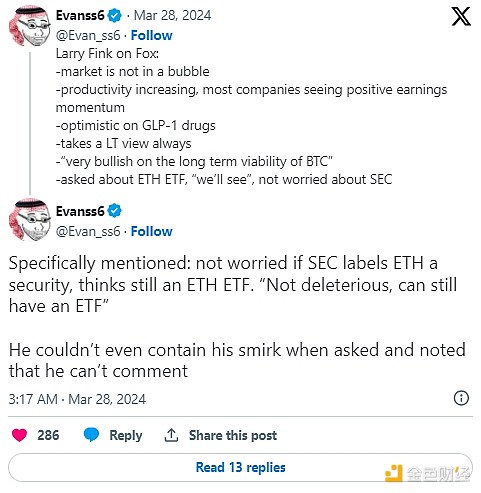

Despite growing concerns among analysts and speculators that the spot Ethereum ETF application will be rejected, Larry Fink of BlackRock seems unfazed, as he is encouraged by the success of IBIT and is maintaining his stance on the approval of the spot Ethereum ETF.

In an interview with Fox Business, Fink said that a spot Ethereum ETF would still be viable even if the SEC classified it as a security.